Japan Heavy Machinery Components Market Size, Share, Trends and Forecast by Component Type, Material Type, Machinery Type, Sales Channel, End Use Industry, and Region, 2026-2034

Japan Heavy Machinery Components Market Overview:

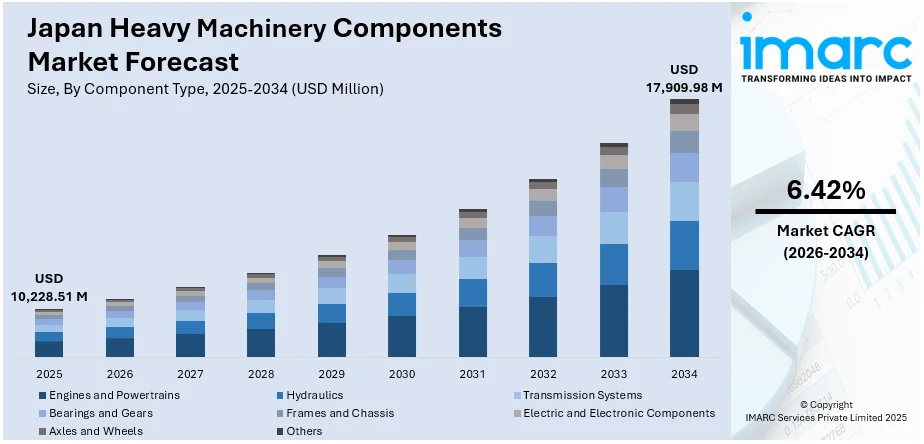

The Japan heavy machinery components market size reached USD 10,228.51 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 17,909.98 Million by 2034, exhibiting a growth rate (CAGR) of 6.42% during 2026-2034. The market is propelled by technological advancements in the form of automation and integration of Internet of Things (IoT), as well as increasing demand for eco-friendly solutions to meet stringent environmental laws. This has helped fuel the deployment of automated and remote-controlled machinery to improve operating efficiency, cut emissions, and increase productivity in construction and industrial applications, thus driving the growth of the Japan heavy machinery components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10,228.51 Million |

| Market Forecast in 2034 | USD 17,909.98 Million |

| Market Growth Rate 2026-2034 | 6.42% |

Japan Heavy Machinery Components Market Trends:

Integration of Advanced Technologies

The Japan heavy machinery components market is increasingly adopting advanced technologies like IoT, machine learning (ML), and automation. These innovations are helping to enhance efficiency by providing real-time data on machinery performance. By integrating smart sensors and predictive maintenance, companies can detect issues before they lead to costly repairs or downtime. Automation is also playing a key role, with many companies incorporating autonomous systems to improve safety and productivity. The trend toward connected machines, enabling remote monitoring and diagnostics, is also growing. This technological shift is not only making machinery smarter but is also contributing to the broader shift towards Industry 4.0, where digital tools are transforming traditional manufacturing processes.

To get more information on this market Request Sample

Shift Towards Sustainable and Decarbonized Equipment

As environmental concerns intensify, Japan’s heavy machinery industry is moving decisively toward greener, more sustainable technologies. Manufacturers are prioritizing the development of electric and hydrogen-powered machinery to meet increasingly strict emissions standards. This aligns closely with Japan’s broader national goals, including interim targets to reduce greenhouse gas emissions by 60% by 2035 and 73% by 2040, compared to 2013 levels milestones under its Nationally Determined Contributions to the Paris Agreement. These efforts support the country's overarching ambition of achieving net-zero emissions by 2050. Government incentives and international climate commitments are accelerating investment in low-carbon construction equipment. Simultaneously, innovations in battery systems and hydrogen fuel cells are boosting operational efficiency and extending machinery runtime, proving that environmental responsibility can go hand-in-hand with high performance and productivity in the heavy machinery sector.

Addressing Labor Shortages Through Automation

Japan's geriatric workforce and declining population are forcing the heavy machinery industry to embrace automation in order to overcome labor shortages. For instance, in November 2023, Yanmar showcased an electric mini-excavator prototype featuring Series Elastic Actuator (SEA) technology, developed in collaboration with JAXA, which supports force control for automated precision construction work. Moreover, demand for machinery that can run independently or be operated remotely is on the increase. This encompasses machines that are capable of carrying out duties such as excavation, lifting, and movement without ongoing human monitoring. Moreover, automation is not merely labor reduction but also enhancing safety and accuracy in building operations. The application of remote monitoring and autonomous equipment ensures that it is possible to keep working even with reduced numbers of workers, which helps fill the gap created by population challenges. This follows the trend of Japan's overall thrust towards more efficient and technologically advanced construction methods thus aiding the Japan heavy machinery components market growth.

Japan Heavy Machinery Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component type, material type, machinery type, sales channel and end use industry.

Component Type Insights:

- Engines and Powertrains

- Hydraulics

- Pumps

- Valves

- Cylinders

- Transmission Systems

- Bearings and Gears

- Frames and Chassis

- Electric and Electronic Components

- Axles and Wheels

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes engines and powertrains, hydraulics (pumps, valves., cylinders), transmission systems, bearings and gears, frames and chassis, electric and electronic components, axles and wheels, and others.

Material Type Insights:

- Steel

- Aluminum

- Cast Iron

- Composites

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes steel, aluminum, cast iron, composites, and others.

Machinery Type Insights:

- Construction Equipment

- Mining Equipment

- Agriculture Equipment

- Industrial Machinery

- Oil and Gas Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the machinery type. This includes construction equipment, mining equipment, agriculture equipment, industrial machinery, oil and gas equipment, and others.

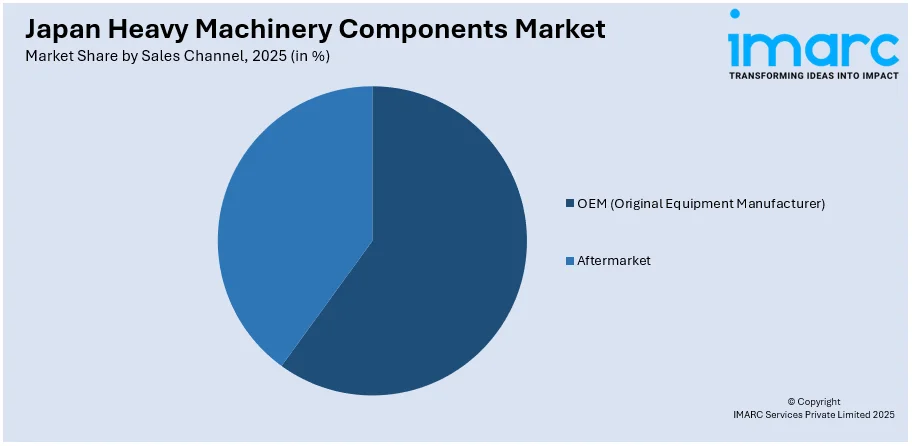

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM (Original Equipment Manufacturer)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM (original equipment manufacturer), and aftermarket.

End Use Industry Insights:

- Construction and Infrastructure

- Mining and Metallurgy

- Agriculture

- Manufacturing

- Oil and Gas

- Energy and Power

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes construction and infrastructure, mining and metallurgy, agriculture, manufacturing, oil and gas, energy and power, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Heavy Machinery Components Market News:

- In April 2024, Volvo Construction Equipment is set to launch its largest electric excavator, the EC230 Electric, in Japan at the CSPI-Expo in Tokyo. This marks the model’s Asian debut following its introduction in North America and Europe. Designed for zero emissions, the EC230 reflects growing demand in Japan for sustainable construction solutions. Volvo CE aims to support Japan’s decarbonization goals and expand its market presence with this latest electric innovation.

Japan Heavy Machinery Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Steel, Aluminum, Cast Iron, Composites, Others |

| Machinery Types Covered | Construction Equipment, Mining Equipment, Agriculture Equipment, Industrial Machinery, Oil and Gas Equipment, Others |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Construction and Infrastructure, Mining and Metallurgy, Agriculture, Manufacturing, Oil and Gas, Energy and Power, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan heavy machinery components market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan heavy machinery components market on the basis of component type?

- What is the breakup of the Japan heavy machinery components market on the basis of material type?

- What is the breakup of the Japan heavy machinery components market on the basis of machinery type?

- What is the breakup of the Japan heavy machinery components market on the basis of sales channel?

- What is the breakup of the Japan heavy machinery components market on the basis of end use industry?

- What is the breakup of the Japan heavy machinery components market on the basis of region?

- What are the various stages in the value chain of the Japan heavy machinery components market?

- What are the key driving factors and challenges in the Japan heavy machinery components market?

- What is the structure of the Japan heavy machinery components market and who are the key players?

- What is the degree of competition in the Japan heavy machinery components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan heavy machinery components market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan heavy machinery components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan heavy machinery components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)