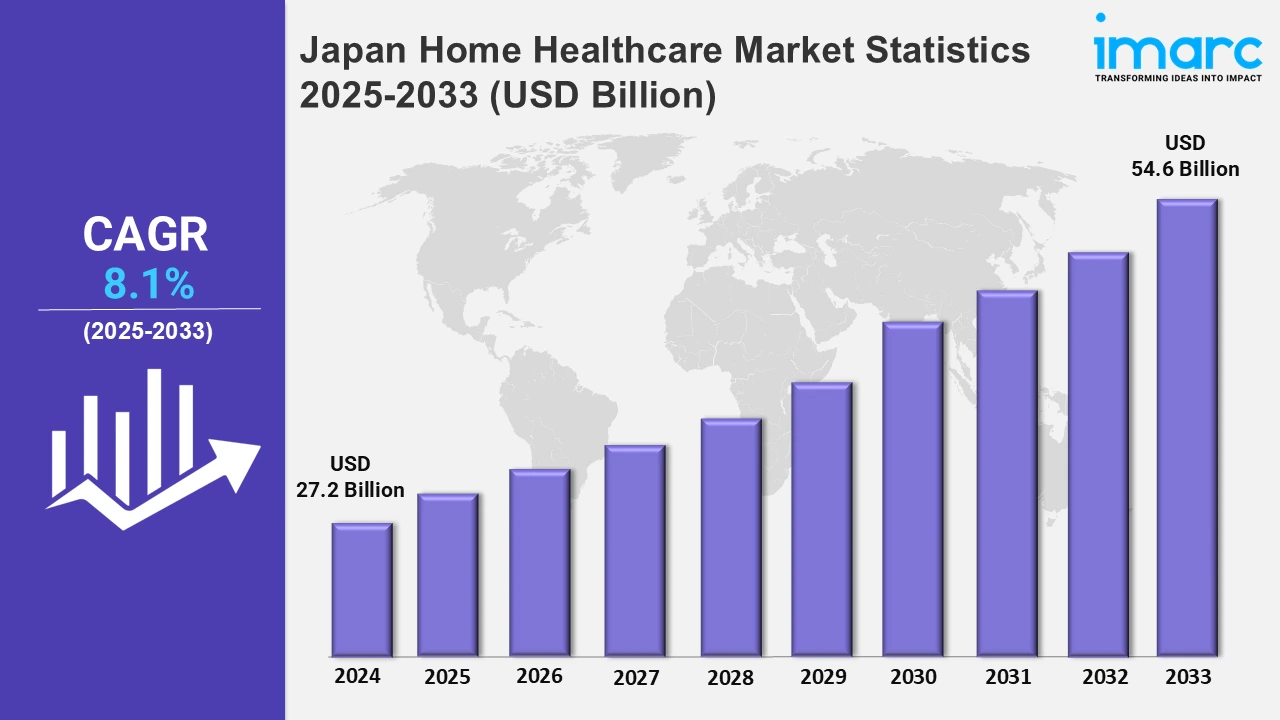

Japan Home Healthcare Market Expected to Reach USD 54.6 Billion by 2033 - IMARC Group

Japan Home Healthcare Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan home healthcare market size was valued at USD 27.2 Billion in 2024, and it is expected to reach USD 54.6 Billion by 2033, exhibiting a growth rate (CAGR) of 8.1% from 2025 to 2033.

To get more information on this market, Request Sample

The demand for innovative mobility solutions is increasing as the population ages and assistive technology advances. Companies are inventing compact and user-friendly technologies to provide freedom and accessibility for older people with mobility issues, therefore enhancing their daily lives and overall well-being. For example, in September 2024, Whill, a Japanese high-tech wheelchair firm backed by Toyota Motor's investment fund, unveiled a new scooter-style mobility gadget designed to help older people with walking difficulties.

Moreover, the digital transformation of healthcare is increasing, with an emphasis on improving accessibility and patient convenience. Advanced online drug assistance and seamless payment systems are being combined to improve pharmacy services, increase efficiency, and provide better healthcare support to people countrywide. For instance, in June 2024, Infosys formed a strategic partnership with Nihon Chouzai, a renowned Japanese dispensing pharmacy chain, to increase healthcare accessibility by adopting innovative online medication guidance and payment systems. Furthermore, the home healthcare market in Japan continues to grow to satisfy the growing need for high-quality and long-term medical services. To assist an older population, providers are creating advanced medical equipment, extending home nursing services, and improving telehealth technology. Additionally, the demand for premium home healthcare, particularly specialist nursing and rehabilitative care, has increased as Japan's older population grows. For example, companies like Nichii Gakkan and Sompo Holdings are investing in AI-powered remote monitoring and robotic caregiving solutions to enhance patient outcomes at home. These technologies address the rising need for individualized and accessible healthcare, particularly in rural regions where medical facilities are limited. The emphasis on sustainability is also encouraging projects to incorporate eco-friendly medical supplies and energy-efficient home care equipment, assuring long-term industry viability while meeting customer demands for ethical and high-quality healthcare solutions.

Japan Home Healthcare Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The Kanto region exhibits a clear dominance in the market. The growing preference for in-home medical and non-medical care for the aging population in the region is elevating the market.

Kanto Region Home Healthcare Market Trends:

The Kanto region, particularly Tokyo and Yokohama, represented the largest market in home healthcare firms that use AI and IoT for senior care. Companies such as Z-Works create smart sensors to monitor patient status remotely, decreasing hospital visits. The region's high population density and aging demography boost demand for tech-driven home healthcare solutions, with big firms such as SoftBank investing to accelerate growth in telemedicine and remote patient monitoring.

Kinki Region Home Healthcare Market Trends:

The Kinki region, which includes Osaka and Kyoto, is known for integrating traditional Japanese medicine (Kampo) with contemporary home healthcare. Hospitals such as Osaka University Hospital work with home healthcare providers to integrate herbal medicine and acupuncture into geriatric care. The region's strong pharmaceutical sector, which includes Takeda and Shionogi, is also creating specific Kampo formulations for home usage to improve patient well-being.

Central/Chubu Region Home Healthcare Market Trends:

The Central/Chubu region, including Nagoya and Shizuoka, is at the forefront of robots in-home care. Toyota and Cyberdyne have developed robotic exoskeletons (HAL) and assistive robots to help the elderly and crippled with home rehabilitation. Given the region's strong manufacturing base, smart assistive gadgets are becoming increasingly important in residential care, helping patients to recover mobility and independence while reducing caregiver burden.

Kyushu-Okinawa Region Home Healthcare Market Trends:

The Kyushu-Okinawa region, notably in Okinawa's isolated islands, is pioneering telemedicine to address restricted healthcare access. Organizations such as Okinawa Telemedicine Center provide online consultations and AI-based remote diagnostics to elderly patients who are unable to access mainland hospitals. The region's geographical constraints have prompted government measures, such as subsidized digital health programs, which promote home-based virtual care and assure timely medical intervention.

Tohoku Region Home Healthcare Market Trends:

Following the 2011 Great East Japan Earthquake, the Tohoku region established a robust home healthcare system centered on disaster preparedness. Cities such as Sendai have built mobile medical units and emergency home care networks to provide continuity of treatment during times of crisis. Collaborations with organizations such as the Japanese Red Cross allow elderly and handicapped people to obtain medications and remote consultations even during disasters.

Chugoku Region Home Healthcare Market Trends:

The Chugoku region, especially Hiroshima and Okayama, is a leader in community-based home healthcare approaches. Local governments and hospitals work together with volunteer networks to provide home visits, prescription assistance, and meal delivery to the elderly. The aging rural population and shrinking workforce have prompted municipalities to form public-private partnerships to ensure a sustainable home care ecosystem in devastated areas.

Hokkaido Region Home Healthcare Market Trends:

The Hokkaido region, known for its severe winters and rural landscape, is using AI-powered home monitoring systems to assist older citizens. Companies, including Fujitsu and NEC, have implemented sensor-based alarm systems in Sapporo and Asahikawa, which detect falls and health irregularities in real-time. These advances lower hospitalization risks and enable speedier emergency response, which is critical for older people living alone in snow-prone and isolated places.

Shikoku Region Home Healthcare Market Trends:

Shikoku, a region known for its elderly rural population, is developing mobile home healthcare clinics to reach outlying communities. Organizations such as the Shikoku Medical Center for Children and Adults (SMCCA) in Kagawa Prefecture run mobile medical units that provide on-site diagnostics, rehabilitation, and medicine distribution to senior populations in underserved regions. These mobile healthcare teams, armed with portable diagnostic gear, collaborate with local governments to provide ongoing medical treatment.

Top Companies Leading in the Japan Home Healthcare Industry

Some of the leading Japan home healthcare market companies have been included in the report. Leading players in the industry comprise both local enterprises and corporations providing cutting-edge medical devices, telehealth solutions, and home nursing care. Additionally, companies are prioritizing technological advancements, targeted acquisitions, and service expansion to enhance their market position. For example, in October 2024, MEDIROM Healthcare Technologies Inc. strategically expanded into the rehabilitation sector by acquiring all rehabilitation centers previously managed by Y’s, Inc.

Japan Home Healthcare Market Segmentation Coverage

- Based on the product, the market has been classified into therapeutic products, testing, screening and monitoring products, and mobility care products. The therapeutic products include devices and equipment used for respiratory care, pain management, and the treatment of chronic conditions such as cardiovascular disease and diabetes. Testing, screening, and monitoring tools allow for real-time health tracking and early detection of illnesses. Mobility care products meet the physical support needs of patients with restricted movement, such as the aged and disabled.

- Based on the service, the market has been categorized into skilled nursing, rehabilitation therapy, hospice and palliative care, unskilled care, respiratory therapy, infusion therapy, and pregnancy care. Skilled nursing is used for medical care, rehabilitation therapy for mobility recovery, and hospice and palliative care for terminal patients. Unskilled care provides daily living support, while respiratory therapy aids those with breathing issues. Infusion therapy delivers IV treatments at home, and pregnancy care supports mothers before and after birth.

- Based on the indication, the market has been divided into cancer, respiratory diseases, movement disorders, cardiovascular diseases and hypertension, pregnancy, wound care, diabetes, hearing disorders, and others. Cancer care focuses on providing palliative support. Respiratory disease care assists patients with COPD and asthma. Movement disorder care helps with Parkinson’s and multiple sclerosis, while cardiovascular disease care manages blood pressure and medication. Pregnancy care ensures maternal and newborn health, and wound care treats chronic and surgical wounds. Diabetes care supports blood sugar control, and hearing disorder care provides assessments and rehabilitation.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 27.2 Billion |

| Market Forecast in 2033 | USD 54.6 Billion |

| Market Growth Rate 2025-2033 | 8.1% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Therapeutic Products, Testing, Screening and Monitoring Products, Mobility Care Products |

| Services Covered | Skilled Nursing, Rehabilitation Therapy, Hospice and Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy, Pregnancy Therapy |

| Indications Covered | Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases and Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders, Others |

| Regions Covered | Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, Shikoku region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Home Healthcare Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)