Japan Home Safe Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Home Safe Market Summary:

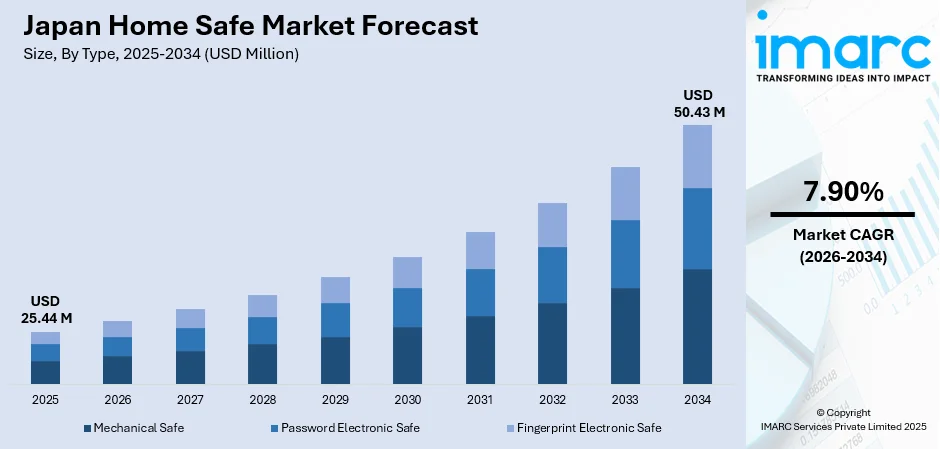

The Japan home safe market size was valued at USD 25.44 Million in 2025 and is projected to reach USD 50.43 Million by 2034, growing at a compound annual growth rate of 7.90% from 2026-2034.

The Japan home safe market is experiencing sustained expansion driven by evolving consumer priorities around personal security and asset protection. Japanese families are becoming more and more aware of the need to have secure storage systems to help them store their precious documents, jewelry, emergency funds, and even computer media. This increased consciousness is due to the increased security issues in residential places and the necessity to have disaster-resistant storage facilities that will survive during natural catastrophes that are common in the region.

Key Takeaways and Insights:

-

By Type: Mechanical safe dominates the market with a share of 42% in 2025, driven by consumer preference for reliable, battery-free security solutions that offer straightforward operation and proven durability for protecting household valuables.

-

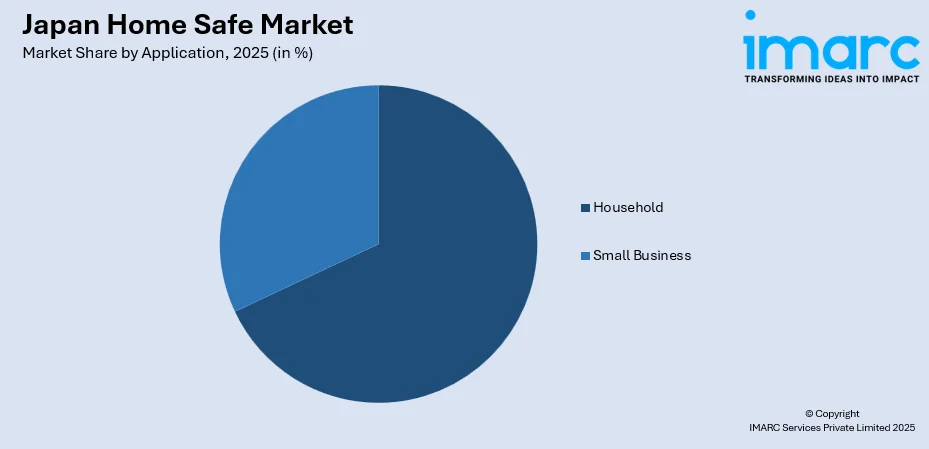

By Application: Household leads the market with a share of 68% in 2025, reflecting the growing emphasis among Japanese families on protecting personal valuables, important documents, and emergency cash reserves within residential settings.

-

Key Players: The Japan home safe market exhibits a moderately competitive landscape characterized by the presence of both established domestic manufacturers and international security solution providers. Market participants are focusing on product innovation, incorporating advanced locking mechanisms, and developing compact designs suited to urban living spaces.

To get more information on this market Request Sample

The Japan home safe market represents a significant segment within the broader residential security ecosystem, driven by the unique cultural and demographic characteristics of Japanese society. The country's position as a global leader in technological innovation has fostered consumer acceptance of both traditional mechanical safes and advanced electronic security solutions. Japanese consumers demonstrate a particular appreciation for product quality, reliability, and aesthetic integration, prompting manufacturers to develop safes that complement modern interior design while maintaining robust security features.

The market benefits from Japan's aging demographic profile, where elderly households increasingly seek secure storage solutions for important documents, medication, and valuables. Furthermore, the prevalence of natural disasters such as earthquakes and typhoons has heightened awareness regarding the importance of fireproof and water-resistant safe storage options. Urban density in major metropolitan areas like Tokyo and Osaka has created demand for compact, space-efficient, safe designs that can be seamlessly integrated into smaller living spaces without compromising security functionality.

Japan Home Safe Market Trends:

Growing Integration of Smart Security Technologies

The Japan home safe market is witnessing accelerating adoption of smart security features as consumers increasingly embrace connected home ecosystems. Advanced biometric authentication methods, including fingerprint recognition and facial scanning technologies, are gaining traction among tech-savvy Japanese households seeking enhanced convenience without compromising security. The Japan fingerprint sensor market size reached USD 501.4 Million in 2025. Looking forward, the market is expected to reach USD 1,152.7 Million by 2034, exhibiting a growth rate (CAGR) of 9.69% during 2026-2034. The integration of mobile application controls enables remote monitoring and access management, aligning with contemporary lifestyle preferences for seamless digital experiences.

Rising Emphasis on Disaster-Resilient Storage Solutions

Japanese consumers are increasingly prioritizing fireproof and earthquake-resistant safe designs in response to the country's vulnerability to natural disasters. The Japan earthquake resistant building materials market size reached USD 1,990.01 Million in 2024. Looking forward, the market is expected to reach USD 3,181.01 Million by 2033, exhibiting a growth rate (CAGR) of 5.35% during 2025-2033. Manufacturers are producing tailored safes that combine reinforced construction with fire-resistant components, ensuring valuables remain secure during seismic activity and fire hazards. This trend reflects broader societal awareness around disaster preparedness, with households seeking comprehensive protection for irreplaceable documents, digital storage media, and treasured personal items.

Expansion of Premium Compact Safe Categories

The market is witnessing strong expansion in high-end compact safes tailored for urban Japanese homes where space is limited. These advanced models blend robust security technologies with sleek, space-saving construction that fits easily into closets, cabinetry, or built-in storage units. Increasing emphasis on visual harmony has led manufacturers to introduce customizable materials, minimalist designs, and discreet installation options that align with contemporary Japanese interior preferences while maintaining strong protection for personal valuables.

Market Outlook 2026-2034:

The Japan home safe market outlook remains favorable throughout the forecast period, supported by sustained consumer demand for reliable security solutions and ongoing technological advancements in locking mechanisms. The market is positioned to benefit from demographic trends, including the aging population's increasing security consciousness and the expansion of affluent middle-class households investing in asset protection. Continued urbanization and the premium placed on disaster preparedness within Japanese society are expected to drive consistent demand for both traditional mechanical safes and innovative electronic security solutions. The market generated a revenue of USD 25.44 Million in 2025 and is projected to reach a revenue of USD 50.43 Million by 2034, growing at a compound annual growth rate of 7.90% from 2026-2034.

Japan Home Safe Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Mechanical Safe |

42% |

|

Application |

Household |

68% |

Type Insights:

- Mechanical Safe

- Password Electronic Safe

- Fingerprint Electronic Safe

The mechanical safe dominates with a market share of 42% of the total Japan home safe market in 2025.

Mechanical safes continue to command the largest share of the Japan home safe market, reflecting enduring consumer confidence in traditional dial-combination and key-operated locking systems. Japanese households particularly value the reliability and independence from power sources that mechanical safes provide, ensuring uninterrupted access during power outages or emergency situations. The absence of electronic components translates to simplified maintenance requirements and extended product lifespans, attributes highly appreciated by quality-conscious Japanese consumers.

The preference for mechanical safes among Japanese households also stems from cultural appreciation for craftsmanship and mechanical precision. Many consumers perceive dial-combination locks as providing superior tactile feedback and a sense of substantial security compared to electronic alternatives. Additionally, mechanical safes appeal to elderly consumers who may find traditional locking mechanisms more intuitive and accessible than digital interfaces, contributing to sustained demand across demographic segments.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Small Business

The household segment leads with a share of 68% of the total Japan home safe market in 2025.

The household segment dominates the Japan home safe market, driven by increasing consumer awareness regarding personal security and asset protection within residential environments. Japanese households are investing in safe storage solutions to protect diverse valuables including legal documents, jewelry, emergency cash reserves, digital storage media, and irreplaceable family heirlooms. The cultural emphasis on preparation and orderly management of personal affairs reinforces demand for dedicated secure storage within homes.

Rising property ownership rates among affluent middle-class families and the concentration of valuable assets within households continue to propel the residential segment. Japanese consumers increasingly recognize home safes as essential household investments rather than luxury items, particularly for protecting items that would be difficult or impossible to replace. The trend toward aging-in-place among elderly populations further supports demand as seniors seek secure storage solutions for important documents, medications, and treasured personal possessions.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central /Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Demand for home safes in the Kanto region is propelled by dense urban living, rising apartment ownership, and greater concern for property security. Tokyo’s high concentration of affluent households encourages adoption of fireproof and digital safes to protect valuables, documents, and electronics. Growth in home-office setups further increases the need for secure storage of sensitive work materials. Frequent seismic activity also pushes consumers toward robust, disaster-resilient safe designs.

In the Kansai/Kinki region, growing consumer awareness of burglary prevention and disaster preparedness drives steady demand for home safes. Osaka’s large urban population and Kyoto’s high proportion of culturally valuable items encourage safe installations for safeguarding jewelry, important documents, and heirlooms. Rising digital banking and personal asset management habits motivate households to seek fire-resistant, tamper-proof safes. Retail expansion and home improvement stores also support broader product accessibility.

Chubu’s home safe market expands due to a blend of high-income households, strong manufacturing presence, and rising asset preservation behaviors. Earthquake-prone prefectures like Nagano and Shizuoka heighten demand for durable, disaster-proof safes to protect vital documents during emergencies. Growth in residential construction and smart-home upgrades encourages adoption of compact, electronically controlled safes. Additionally, regional wealth linked to automotive and industrial sectors stimulates sales of premium and custom-built safe solutions.

In the Kyushu–Okinawa region, demand is supported by heightened disaster-risk awareness, especially due to frequent typhoons and heavy rainfall events. Households increasingly seek water-resistant and fire-resistant safes to secure important documents. Rising home ownership and expanding tourism-driven prosperity contribute to greater purchases of compact and high-security safes. Local retailers and e-commerce penetration also broaden access to digital lock models, appealing to younger, tech-oriented consumers.

Tohoku’s home safe market is influenced by a strong emphasis on disaster resilience following past earthquakes and tsunamis. Households prioritize safes with high fire and impact resistance to protect critical identification papers and valuables. The region’s aging population also drives demand for safes designed for medication security and organized document storage. Increasing new housing developments and government-backed disaster preparedness programs further reinforce safe adoption across urban and semi-urban communities.

In the Chugoku region, home safe demand is driven by rising disaster-preparedness awareness, especially in cities like Hiroshima, which prioritize secure storage for emergency-related documentation. Growing household incomes, coupled with expanding residential projects, stimulate interest in compact, aesthetically integrated safes. Many families seek advanced locking mechanisms that protect valuables and legal documents. Retail chains and online platforms further improve product availability, encouraging uptake of mid-range and digital safe models.

Hokkaido's home safe market growth stems from a mix of disaster-readiness needs, increasing home ownership, and rising interest in protecting personal valuables. Frequent cold-weather disruptions and occasional seismic events push households to secure vital items in fire-resistant and rugged safes. The region’s larger residential spaces support demand for bigger models, while expanding e-commerce access drives interest in modern digital and biometric safes among younger residents.

In the Shikoku region, consumer demand for home safes is shaped by disaster-risk considerations tied to earthquakes and typhoons. Families increasingly prefer compact, fireproof safes to protect important paperwork. The region’s stable elderly population drives interest in secure storage for personal records, wills, and medications. Expanded availability of digital lock products through retail chains and online marketplaces also supports market penetration across urban and rural households.

Market Dynamics:

Growth Drivers:

Why is the Japan Home Safe Market Growing?

Heightened Security Consciousness Among Japanese Households

The Japan home safe market is benefiting from growing security awareness among residential consumers who are increasingly prioritizing the protection of personal valuables and important documents. Japanese society's cultural emphasis on preparation and risk mitigation has translated into greater household investment in security infrastructure, including home safes designed for protecting emergency cash reserves, identification documents, and irreplaceable personal items. Media coverage of property crimes in urban areas has amplified public concern regarding residential security vulnerabilities, prompting households to adopt comprehensive protection measures. The psychological reassurance provided by secure storage solutions resonates strongly with Japanese consumers who value peace of mind and orderly management of personal affairs.

Expansion of the Affluent Consumer Base and Asset Accumulation

The growth of Japan's affluent middle class is driving increased demand for premium home safe solutions capable of protecting accumulated wealth and valuable possessions. Rising disposable incomes among dual-income households and successful professionals have enabled greater investment in high-value electronics, jewelry, collectibles, and financial instruments requiring secure storage. Japanese consumers within this demographic segment demonstrate willingness to invest in advanced safe features including biometric authentication, smart connectivity, and premium fire-resistant construction. The trend toward asset diversification and the accumulation of physical valuables among younger affluent consumers continues to expand the addressable market for sophisticated home security solutions.

Demographic Shifts and Aging Population Dynamics

Japan's aging demographic profile is creating sustained demand for home safe solutions tailored to elderly households seeking secure storage for important documents, medications, and treasured possessions. The country's super-aged society, characterized by a significant proportion of residents over sixty-five years of age, represents a substantial consumer base prioritizing safety and asset protection. Government data reveal that Japan’s population aged 65 and above has reached a historic peak of 36.25 million this year, highlighting the nation’s status as one of the fastest-aging societies globally. Elderly Japanese consumers particularly value safes that offer reliable protection for essential documents such as property deeds, insurance papers, and family records. The cultural practice of maintaining emergency cash reserves at home among older generations further supports demand for secure storage solutions designed with accessibility features suitable for aging users.

Market Restraints:

What Challenges the Japan Home Safe Market is Facing?

Space Constraints in Urban Living Environments

The limited living space characteristic of Japanese urban apartments and homes presents challenges for home safe adoption, as consumers must balance security needs against spatial constraints. Dense residential construction in metropolitan areas like Tokyo and Osaka restricts options for installing larger capacity safes that would otherwise be preferred for comprehensive protection. This spatial limitation influences consumer preferences toward compact models with potentially reduced storage capacity.

Premium Pricing Considerations

Advanced home safe solutions incorporating sophisticated security features, fire-resistant construction, and smart connectivity command premium price points that may exceed budget constraints for some consumer segments. The investment required for high-quality safes with comprehensive protection capabilities can present adoption barriers, particularly for younger households and budget-conscious consumers who may prioritize other household expenditures.

Consumer Perception of Low Crime Rates

Japan's relatively low crime rates compared to other developed nations may contribute to perceptions among some consumers that home safe investments are unnecessary. The historical reputation for safety within Japanese society can reduce the perceived urgency for residential security measures among certain demographic segments, potentially limiting market penetration in households that underestimate property crime risks.

Competitive Landscape:

The Japan home safe market exhibits a competitive landscape characterized by the presence of established domestic manufacturers alongside international security solution providers. Market participants differentiate through product innovation, emphasizing features such as advanced locking mechanisms, fire and water resistance ratings, and space-efficient designs optimized for Japanese living environments. Competition extends across multiple price segments, with premium offerings incorporating biometric authentication and smart connectivity features while economy-focused products emphasize fundamental security functionality. Strategic focus areas include expanding distribution channels, developing aesthetically integrated designs, and enhancing after-sales service capabilities to build consumer loyalty within this quality-conscious market.

Japan Home Safe Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical Safe, Password Electronic Safe, Fingerprint Electronic Safe |

| Applications Covered | Household, Small Business |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan home safe market size was valued at USD 25.44 Million in 2025.

The Japan home safe market is expected to grow at a compound annual growth rate of 7.90% from 2026-2034 to reach USD 50.43 Million by 2034.

Mechanical safes dominated the Japan home safe market with a share of 42% in 2025, driven by consumer preference for reliable, battery-free security solutions offering proven durability and straightforward operation.

Key factors driving the Japan home safe market include heightened security consciousness among Japanese households, expansion of the affluent consumer base with increasing asset accumulation, demographic shifts related to the aging population, and growing emphasis on disaster-resilient storage solutions.

Major challenges include space constraints in urban living environments that limit installation options, premium pricing considerations for advanced security features, consumer perceptions influenced by Japan's relatively low crime rates, and the need for products optimized for compact Japanese residential spaces.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)