Japan Hydroelectric Power Market Size, Share, Trends and Forecast by Type of Hydroelectric Plant, Component, End Use, and Region, 2026-2034

Japan Hydroelectric Power Market Summary:

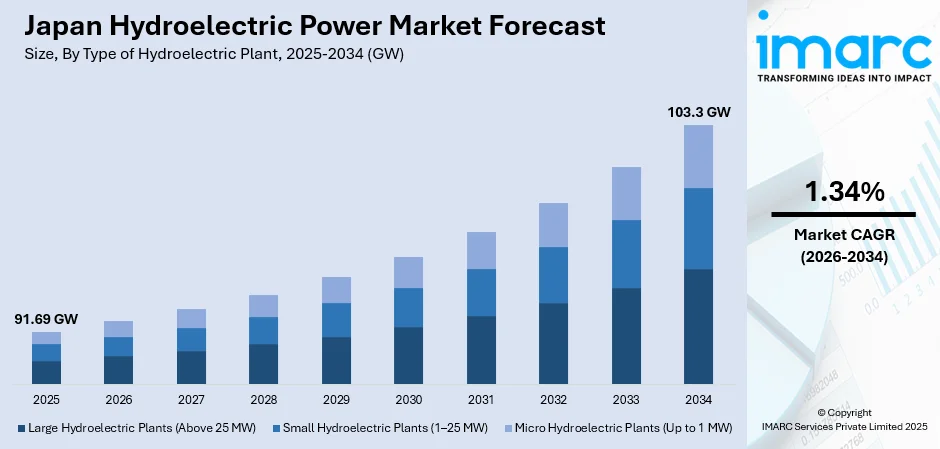

The Japan hydroelectric power market size reached 91.69 GW in 2025 and is projected to reach 103.3 GW by 2034, growing at a compound annual growth rate of 1.34% from 2026-2034.

The market is driven by government policies promoting renewable energy adoption, increasing focus on energy security, and growing environmental concerns pushing clean energy transitions. Japan's commitment to achieving carbon neutrality is accelerating investments in hydroelectric infrastructure. Technological advancements in turbine efficiency and control systems are further strengthening capacity expansion. The nation's abundant water resources and mountainous terrain provide ideal conditions for sustained development, supporting Japan hydroelectric power market share.

Key Takeaways and Insights:

- By Type of Hydroelectric Plant: Large hydroelectric plants (above 25 MW) dominate the market with a share of 75% in 2025, driven by high baseload capacity, strong regional infrastructure, government-backed grid stability efforts, and efficient fulfilment of extensive industrial electricity requirements.

- By Component: Turbines lead the market with a share of 40% in 2025, owing to central energy-conversion function, ongoing efficiency-focused technological upgrades, replacement needs in older plants, and industry emphasis on boosting output from existing hydropower resources.

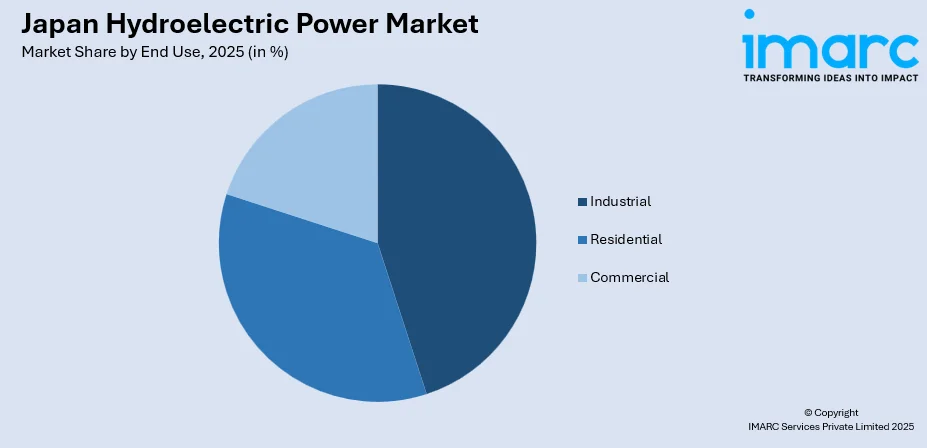

- By End Use: Industrial represents the largest segment with a market share of 38% in 2025, driven by heavy manufacturing power needs, government clean-energy incentives, corporate sustainability goals, and demand for dependable baseload electricity to support continuous operations.

- Key Players: The Japan hydroelectric power market exhibits a consolidated competitive structure, with established energy corporations holding significant operational capacity. Market participants focus on infrastructure modernization, efficiency improvements, and strategic partnerships to optimize existing facilities while expanding renewable energy portfolios.

To get more information on this market Request Sample

The Japan hydroelectric power market is experiencing sustained growth driven by the nation's comprehensive renewable energy policies and ambitious carbon neutrality targets. Government initiatives are actively promoting clean energy transitions, creating favorable regulatory frameworks for hydroelectric development. As per sources, in October 2025, MLIT selected TEPCO Renewable Power-led consortium to develop a 2.3 MW hydropower plant at Yunishigawa Dam, the first project under Japan’s “hybrid dam” initiative. Moreover, rising environmental consciousness among industries and consumers is accelerating demand for sustainable power sources. Japan's geographic advantages, including mountainous terrain and abundant water resources, provide exceptional conditions for hydroelectric generation. Energy security concerns following historical dependence on imported fossil fuels are compelling strategic investments in domestic renewable capacity. Technological innovations in turbine design and control systems are enhancing operational efficiency across existing facilities. Corporate sustainability mandates are driving industrial adoption of clean energy solutions, further strengthening market fundamentals and long-term growth prospects.

Japan Hydroelectric Power Market Trends:

Modernization of Aging Hydroelectric Infrastructure

Japan is witnessing significant efforts to modernize its aging hydroelectric infrastructure, with many facilities constructed decades ago now undergoing comprehensive upgrades. Utility providers are replacing outdated turbines and generators with advanced equipment capable of higher efficiency rates. As per sources, in 2025, J‑POWER completed modernization of the 65-year-old Nagayama Hydroelectric Power Station, with Unit 1 commencing commercial operation, increasing total output to 38,500 kW. These modernization initiatives extend operational lifespans while increasing power output from existing water resources. Digital monitoring systems and smart grid integration are being implemented to optimize performance. The focus on refurbishment rather than new construction reflects practical approaches to maximizing returns from established facilities while minimizing environmental disruption associated with new dam construction.

Integration of Pumped-Storage Hydroelectric Systems

Pumped-storage hydroelectric systems are gaining prominence as Japan expands its variable renewable energy capacity from solar and wind sources. According to sources, in September 2025, Shirokuma Electric Power launched Japan’s first corporate ‘Pumped‑Storage Plan,’ utilizing pumped-storage hydroelectric plants to provide CO₂-free electricity while reducing price risk for high-voltage customers. These facilities serve as large-scale energy storage solutions, absorbing excess electricity during low-demand periods and releasing it during peak consumption. The technology provides crucial grid balancing services, supporting overall energy system stability. Investments in pumped-storage capacity are accelerating as utilities seek flexible solutions for managing intermittent renewable generation. This trend reflects strategic planning for a diversified energy mix that maintains reliability while advancing decarbonization objectives across the national power grid.

Small-Scale and Micro Hydroelectric Development

Increasing attention is being directed toward small-scale and micro hydroelectric installations as complementary solutions to large facility operations. These distributed generation systems utilize local water resources in rural and mountainous communities, providing electricity to areas with limited grid connectivity. According to sources, Sanwa Construction began operation of the Atanogo and Nomugi small hydroelectric plants in Takayama City, Gifu Prefecture, supplying locally produced renewable electricity and supporting community revitalization. Furthermore, municipal governments and agricultural cooperatives are exploring micro-hydro opportunities using irrigation channels and natural streams. The trend supports regional energy independence while creating economic opportunities in remote areas. Simplified permitting processes and technological improvements are making smaller installations increasingly viable, contributing to overall hydroelectric capacity expansion across diverse geographic locations throughout Japan.

Market Outlook 2026-2034:

The Japan hydroelectric power market is poised for steady revenue growth throughout the forecast period, supported by sustained government investments in renewable energy infrastructure and modernization programs. Revenue generation will be driven by capacity expansion projects, equipment replacement initiatives, and increasing operational efficiency across existing facilities. The market outlook remains positive as corporate sustainability commitments strengthen industrial demand for clean energy procurement. Strategic partnerships between utilities and technology providers will enhance competitive positioning while supporting national carbon neutrality targets. Continued policy support and technological advancements will underpin long-term revenue expansion opportunities. The market size was estimated at 91.69 GW in 2025 and is expected to reach 103.3 GW by 2034, reflecting a compound annual growth rate of 1.34% over 2026-2034.

Japan Hydroelectric Power Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type of Hydroelectric Plant | Large Hydroelectric Plants (Above 25 MW) | 75% |

| Component | Turbines | 40% |

| End Use | Industrial | 38% |

Type of Hydroelectric Plant Insights:

- Large Hydroelectric Plants (Above 25 MW)

- Small Hydroelectric Plants (1–25 MW)

- Micro Hydroelectric Plants (Up to 1 MW)

Large hydroelectric plants (above 25 MW) dominate with a market share of 75% of the total Japan hydroelectric power market in 2025.

Large hydroelectric plants (above 25 MW) maintain dominant market positioning due to their exceptional capacity for generating substantial baseload electricity essential for national grid stability. These facilities leverage Japan's mountainous topography and significant water resources to produce reliable power output throughout seasonal variations. Government prioritization of large-scale infrastructure reflects strategic energy security considerations, as these plants provide consistent generation independent of weather conditions affecting solar and wind alternatives. The established network of large hydroelectric facilities across major river systems enables efficient power transmission to industrial centers and urban populations requiring dependable electricity supply.

Continued investment in this infrastructure focuses on maximizing existing facility performance through turbine upgrades and operational optimization. In December 2025, J‑POWER completed repowering Unit 3 of the Okutadami Hydroelectric Power Plant in Fukushima, increasing its maximum output from 560 MW to 566 MW through turbine efficiency upgrades. Moreover, utility operators are implementing advanced monitoring technologies to enhance efficiency and extend equipment lifecycles. The segment benefits from economies of scale, with lower per-unit generation costs compared to smaller installations. Regulatory frameworks favor large facility development given their significant contribution to renewable energy targets. Strategic importance for grid balancing and peak demand management further reinforces large hydroelectric prominence within Japan's evolving energy landscape.

Component Insights:

- Turbines

- Generators

- Transformers

- Control Systems

Turbines lead with a share of 40% of the total Japan hydroelectric power market in 2025.

Turbines represent the largest component segment, reflecting their fundamental importance in converting hydraulic energy into electrical power. Advanced turbine technologies are enabling higher efficiency rates and improved performance across varying water flow conditions. Manufacturers are developing specialized designs optimized for different facility types, from large dam installations to run-of-river applications. The replacement market for aging turbines is substantial, as operators seek performance improvements from modern equipment. According to sources, Shizen Energy installed Japan’s first GUGLER megawatt-class 2.2 MW Pelton turbine at Chubu Electric Power’s Kuroda Hydroelectric Power Plant, commencing full-scale commercial operation. Moreover, innovation in materials science and engineering is producing turbines with enhanced durability and reduced maintenance requirements, supporting long-term operational cost reductions.

Investment in turbine technology continues advancing as Japan pursues maximum energy extraction from existing water resources. Variable-speed turbines are gaining adoption for their ability to maintain efficiency across fluctuating conditions, particularly valuable in pumped-storage applications. Digital integration enables real-time performance monitoring and predictive maintenance scheduling. The component segment benefits from both new installation demand and extensive refurbishment projects across Japan's hydroelectric network. Quality improvements and extended warranties from leading manufacturers are strengthening buyer confidence while supporting market expansion.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

Industrial exhibits a clear dominance with a 38% share of the total Japan hydroelectric power market in 2025.

Industrial dominates hydroelectric power consumption, driven by manufacturing operations requiring reliable baseload electricity for continuous production processes. Heavy industries including steel, chemicals, and electronics manufacturing depend on stable power supply that hydroelectric generation provides effectively. Corporate sustainability initiatives are accelerating industrial adoption of renewable energy, with hydroelectric contracts offering predictable long-term pricing. In March 2025, Hulic signed an off-site PPA with TEPCO Renewable Power to source approximately 40 GWh annually from the Shimofunato hydroelectric plant in Niigata, starting April 2026, for its properties. Further, energy-intensive facilities benefit from hydroelectric reliability compared to variable renewable alternatives. Industrial zones located near major hydroelectric facilities enjoy competitive energy costs supporting manufacturing competitiveness.

Growing environmental regulations and stakeholder expectations are compelling industrial enterprises to increase renewable energy procurement, with hydroelectric power representing an established and dependable option. Power purchase agreements with hydroelectric generators provide industries with carbon reduction credentials essential for international market access and supply chain compliance. The industrial segment's dominance reflects both practical energy requirements and strategic sustainability positioning. Continued industrial growth and electrification trends will sustain strong demand for hydroelectric power across manufacturing sectors throughout the forecast period.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region represents significant hydroelectric activity, leveraging mountainous areas surrounding the greater Tokyo metropolitan zone. Facilities in this region supply electricity to Japan's largest population center and industrial concentration. Infrastructure investments focus on modernizing existing plants while optimizing transmission networks connecting generation facilities to high-demand urban and industrial consumers.

Kansai/Kinki Region maintains substantial hydroelectric capacity serving the Osaka-Kyoto-Kobe metropolitan corridor. River systems flowing from surrounding mountain ranges support multiple generation facilities. The region's established industrial base drives consistent electricity demand. Utility operators prioritize efficiency improvements and equipment upgrades to maximize output from existing infrastructure while meeting regional renewable energy targets.

Central/Chubu Region benefits from the Japanese Alps' abundant water resources and significant elevation differences ideal for hydroelectric generation. Multiple large facilities operate across major river systems flowing toward coastal industrial areas. The region serves as a crucial energy supply zone connecting eastern and western Japan, with hydroelectric installations providing essential baseload generation capacity.

Kyushu-Okinawa Region features diverse hydroelectric development across mountainous Kyushu terrain, though island geography limits large-scale expansion. Existing facilities contribute meaningfully to regional renewable energy portfolios. Small and micro hydroelectric installations are gaining interest for rural electrification. Regional utilities focus on optimizing current infrastructure while exploring complementary renewable integration opportunities.

Tohoku Region possesses exceptional hydroelectric resources, with numerous rivers flowing from interior mountain ranges toward Pacific and Sea of Japan coastlines. The region hosts significant installed capacity supporting both local consumption and transmission to metropolitan areas. Post-disaster energy security considerations have reinforced hydroelectric importance within regional infrastructure planning and development priorities.

Chugoku Region maintains moderate hydroelectric capacity distributed across river systems draining mountainous interior territories. Facilities in this region serve both industrial consumers and residential populations across prefectures bordering the Seto Inland Sea. Infrastructure modernization programs target efficiency improvements at existing installations while maintaining reliable power supply for regional manufacturing activities.

Hokkaido Region features substantial hydroelectric development leveraging the island's extensive river networks and significant precipitation patterns. Large facilities generate considerable renewable electricity supporting agricultural processing, manufacturing, and urban consumption. Geographic isolation from Honshu mainland emphasizes hydroelectric importance for regional energy security. Ongoing capacity optimization enhances overall contribution to renewable energy targets.

Shikoku Region operates hydroelectric facilities utilizing river systems flowing from central mountain ranges toward surrounding coastlines. Though smaller in scale compared to major regions, hydroelectric generation contributes meaningfully to island energy supply. Regional utilities are exploring small-scale development opportunities while maintaining and upgrading existing infrastructure to ensure continued operational reliability.

Market Dynamics:

Growth Drivers:

Why is the Japan Hydroelectric Power Market Growing?

Government Renewable Energy Policies and Carbon Neutrality Commitments

Japan's comprehensive renewable energy policies and carbon neutrality pledges are fundamentally driving hydroelectric power market expansion. The government has established ambitious targets for clean energy adoption, positioning hydroelectric generation as a cornerstone of national decarbonization strategies. In June 2025, J‑POWER signed a long-term agreement to sell approximately 100 million kWh annually of environmental value from its hydroelectric plants, supporting corporate decarbonization and carbon neutrality goals. Further, favorable regulatory frameworks provide incentives for infrastructure investment, capacity expansion, and technological upgrades across the hydroelectric sector. Feed-in tariff programs and renewable portfolio standards create stable revenue environments encouraging utility investments. Policy continuity and long-term planning visibility enable project financing and strategic development initiatives. These government commitments signal sustained support for hydroelectric growth throughout the forecast period.

Energy Security and Reduced Fossil Fuel Dependence

Energy security concerns stemming from Japan's historical reliance on imported fossil fuels are compelling strategic investments in domestic renewable generation, with hydroelectric power offering established and reliable capacity. The vulnerability exposed by fuel price volatility and supply disruptions has accelerated policy focus on energy independence through indigenous renewable resources. Hydroelectric generation provides baseload power unaffected by international commodity markets or geopolitical supply risks. Water resources represent perpetually renewable fuel sources eliminating import dependencies. This energy security imperative supports continued government prioritization and investment in hydroelectric infrastructure expansion and modernization programs.

Technological Advancements Enhancing Operational Efficiency

Continuous technological innovations in turbine design, generator systems, and digital controls are driving efficiency improvements across Japan's hydroelectric network. Advanced equipment enables higher energy extraction rates from existing water resources, effectively increasing generation capacity without new dam construction. Smart monitoring systems optimize operations in real-time, reducing downtime and maintenance costs while extending equipment lifecycles. As per sources, Voith commissioned Japan’s first Hydro Pocket system at Ohsawagawa Hydropower Station, enabling cloud-based monitoring and real-time operational optimization in Yamagata Prefecture. Moreover, variable-speed turbine technologies improve performance across fluctuating water flow conditions. These technological advancements make hydroelectric investments increasingly attractive while supporting environmental objectives through maximized output from established facilities and minimized ecological disruption.

Market Restraints:

What Challenges the Japan Hydroelectric Power Market is Facing?

Geographic and Environmental Constraints on New Development

Japan's mountainous terrain, while advantageous for existing facilities, presents limitations for new large-scale hydroelectric development. Most economically viable sites have been developed, leaving remaining opportunities in environmentally sensitive areas facing stringent permitting requirements. Ecological impact assessments and community consultations extend project timelines significantly. Protected watersheds and conservation priorities restrict expansion possibilities in certain regions, constraining overall capacity growth potential.

Aging Infrastructure and High Maintenance Requirements

Substantial portions of Japan's hydroelectric infrastructure were constructed decades ago, requiring significant ongoing maintenance expenditures and eventual replacement investments. Aging equipment experiences declining efficiency and increased failure risks, demanding continuous capital allocation for refurbishment. Modernization projects compete with other renewable energy investments for limited funding. Infrastructure age creates operational vulnerabilities while consuming resources that might otherwise support capacity expansion initiatives.

Competition from Alternative Renewable Energy Sources

Solar and wind energy technologies have achieved substantial cost reductions, creating competitive pressure on hydroelectric development investments. Alternative renewables offer faster deployment timelines and modular scalability attractive to investors seeking quicker returns. Government incentives increasingly favor emerging technologies, potentially diverting policy support from hydroelectric projects. This competitive landscape influences capital allocation decisions and may constrain relative hydroelectric growth compared to rapidly expanding alternative renewable sectors.

Competitive Landscape:

The Japan hydroelectric power market features a consolidated competitive structure characterized by established energy corporations maintaining significant operational portfolios. Market participants differentiate through operational excellence, technological capabilities, and strategic asset positioning across favorable geographic locations. Competition centers on efficiency optimization, cost management, and reliability performance rather than price-based rivalry given regulated market structures. Operators invest substantially in modernization programs to enhance competitive positioning while meeting evolving environmental standards. Strategic partnerships and joint ventures enable shared infrastructure development and risk distribution across major projects. The competitive landscape emphasizes technical expertise, operational experience, and financial capacity for sustained infrastructure investment and maintenance.

Recent Developments:

- In January 2025, Kyushu EPCO formally announced the repowering of four hydroelectric power plants by October 2028. Despite maintaining a combined capacity of 29.2MW, efficiency upgrades are projected to raise annual generation by 21.7GWh, increasing overall output from 133.6GWh to approximately 155.3GWh.

Japan Hydroelectric Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | GW |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Hydroelectric Plants Covered | Large Hydroelectric Plants (Above 25 MW), Small Hydroelectric Plants (1–25 MW), Micro Hydroelectric Plants (Up to 1 MW) |

| Components Covered | Turbines, Generators, Transformers, Control Systems |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan hydroelectric power market reached 91.69 GW in 2025.

The Japan hydroelectric power market is expected to grow at a compound annual growth rate of 1.34% from 2026-2034 to reach 103.3 GW by 2034.

Large hydroelectric plants (above 25 MW) held the largest market share, driven by superior baseload generation capacity, established infrastructure networks, government prioritization for grid stability, and economies of scale enabling cost-effective electricity production.

Key factors driving the Japan hydroelectric power market include government renewable energy policies, carbon neutrality commitments, energy security priorities reducing fossil fuel dependence, technological advancements improving efficiency, and corporate sustainability mandates increasing clean energy demand.

Major challenges include limited viable sites for new large-scale development, aging infrastructure requiring substantial maintenance investments, stringent environmental permitting processes, competition from alternative renewable technologies, and extended project timelines affecting investment returns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)