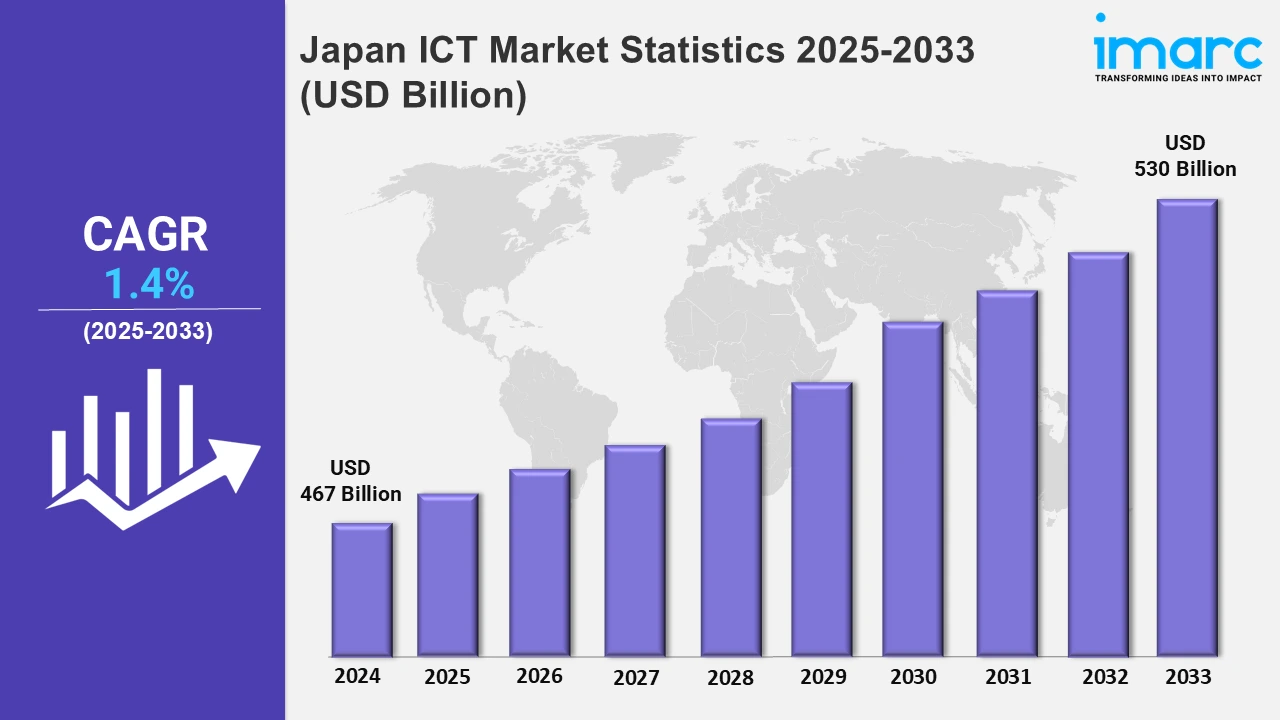

Japan ICT Market Expected to Reach USD 530 Billion by 2033 - IMARC Group

Japan ICT Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan ICT market size was valued at USD 467 Billion in 2024, and it is expected to reach USD 530 Billion by 2033, exhibiting a growth rate (CAGR) of 1.4% from 2025 to 2033.

To get more information on this market, Request Sample

Japan’s ICT market is witnessing increased investment in digital transformation within the energy sector, owing to the elevating focus on enhancing operational efficiency, sustainability, and innovation. In January 2025, FPT, Chugoku Electric Power, and Enecom partnered to drive digital transformation. These efforts align with ambitious long-term strategies aimed at reshaping the industry through advanced technologies, like ICT solutions.

Moreover, Japan’s early rollout of 5G networks is positively influencing the market growth. For example, the number of 5G subscriptions in the country surpassed 60 million by March 2023. The increased bandwidth and speed enabled by 5G are enhancing mobile connectivity and allowing new applications like augmented reality (AR) and real-time data transmission for industries such as healthcare, automotive, and entertainment. Besides this, as digital transformation accelerates, cybersecurity has become a critical concern for businesses and governments in Japan. The rise in data breaches highlights the growing need for robust safety solutions. Companies are investing heavily in advanced security systems, including cloud security, threat intelligence, encryption, and compliance management. This demand is particularly high in sectors like finance and manufacturing, where operational security is essential. The increasing reliance on digital platforms and connected devices further fuels the need for strong cybersecurity, driving the market growth in Japan.

Japan ICT Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki/Kansai region, Chubu region, Kyushu region (incl. Okinawa), Tohoku region, Chugoku region, Hokkaido, and Shikoku region. The increasing government spending on maintaining advanced infrastructure and supporting the development of various modernization and enhancement initiatives is expanding the market.

Kanto Region ICT Market Trends:

NTT Docomo, KDDI, and SoftBank are rapidly deploying 5G throughout Kanto, which includes Tokyo and Yokohama. Tokyo's 5G Smart City initiative integrates edge computing, IoT, and artificial intelligence. For instance, in November 2024, Rakuten Mobile expanded its 5G network in the Kanto region, further driving the market expansion in the Kanto region.

Kinki/Kansai Region ICT Market Trends:

Kinki/Kansai focuses on AI-driven supercomputing, led by RIKEN’s Fugaku in Kobe. Kyoto University and Osaka University drive AI, quantum computing, and deep learning research. Moreover, various companies across this region, like Panasonic and Omron, integrate AI into robotics and smart manufacturing, enhancing Japan’s industrial automation and medical AI applications.

Chubu Region ICT Market Trends:

Chubu, headquartered in Nagoya, is generally advancing smart factories with Toyota and Mitsubishi, combining AI, IoT, and digital twins. Smart production lines improve supply chain efficiency, while AI-driven automation boosts automotive production. The Robot Testing Zone in Aichi Prefecture, as well as Fujitsu's AI-powered predictive maintenance tools, are helping Japan accelerate its transition to Industry 4.0, further boosting ICT adoption.

Kyushu Region (incl. Okinawa) ICT Market Trends:

Kyushu, notably Fukuoka and Kumamoto, is Japan's semiconductor powerhouse, boosting the country's chip supply chain. Moreover, Sony and Renesas develop image sensors and automotive semiconductors with government support. Besides this, Okinawa focuses on ICT companies and digital tourism, utilizing AI-powered language translation and augmented reality vacation experiences.

Tohoku Region ICT Market Trends:

Tohoku, comprising Sendai and Fukushima, emphasizes resilient ICT infrastructure following the earthquake. The Fukushima AI & Robotics Testing Field creates disaster response technologies. Moreover, various companies across this region, like KDDI, are implementing satellite-based backup networks, while universities are researching earthquake-resistant data centers and AI-driven early warning systems to improve emergency communications in the region.

Chugoku Region ICT Market Trends:

Chugoku region improves smart logistics using AI, IoT, and blockchain. Hiroshima's ports use 5G automation, while Okayama tests AI-powered predictive shipping models. For example, Mazda utilizes real-time tracking to streamline supply chain logistics, lowering delays and operational costs while also enhancing Japan's maritime ICT infrastructure.

Hokkaido Region ICT Market Trends:

Hokkaido is becoming a popular winter sports destination. Moreover, ski resorts in the region like Niseko promote cashless payments for lift passes and accommodations, which is further propelling the adoption of ICT. Also, the increased credit card usage for ticket sales in the Sapporo show has supported the market demand.

Shikoku Region ICT Market Trends:

Shikoku, including Takamatsu and Matsuyama, is improving digital services in rural areas. This helps local communities access better technology. Moreover, Ehime also supports online healthcare and remote learning to help with worker shortages. These services make it easier for people to get medical care and education from a distance, thereby making Shikoku a model for rural ICT adoption.

Top Companies Leading in the Japan ICT Industry

Some of the key players include Fujitsu Limited, Hitachi Ltd, IBM Japan Ltd, TIS Inc, ITOCHU Techno-Solutions Corporation (ITOCHU Corporation), NEC Corporation, Nomura Research Institute Ltd., NTT Communications Corporation (Nippon Telegraph and Telephone Corporation), Panasonic Corporation, Sony Corporation, SCSK Corporation (Sumitomo Corporation). In October 2024, Japan’s NICT chose NTT, KDDI, KDDI Research, Fujitsu, NEC, and Rakuten Mobile for an ICT research project beyond 5G/6G, focusing on expansion and social implementation.

Japan ICT Market Segmentation Coverage

- On the basis of spending, the market has been bifurcated into devices, software, IT services, data center systems, and communication. Device spending includes smartphones, PCs, and specialized equipment for businesses. Moreover, software investments focus on enterprise solutions, while IT services like cloud computing and cybersecurity support digital infrastructure. Besides this, data center systems are expanding to meet storage demands, and communication services, including mobile and broadband, are essential for connectivity.

- Based on the technology, the market has been bifurcated into IOT, big data, cloud computing, content management, and security. IoT adoption drives smart devices and automation, while big data analytics enhance decision-making. Moreover, cloud computing supports scalable infrastructure, and content management optimizes data organization. Besides this, security solutions are vital to protect against cyber threats, ensuring the integrity of digital systems across industries.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 467 Billion |

| Market Forecast in 2033 | USD 530 Billion |

| Market Growth Rate 2025-2033 | 1.4% |

| Units | Billion USD |

| Segment Coverage | Spending, Technology, Region |

| Region Covered | Kanto, Hokkaido, Tohoku, Chubu, Kinki/Kansai, Chugoku, Shikoku, Kyushu (incl. Okinawa) |

| Companies Covered | Fujitsu Limited, Hitachi Ltd, IBM Japan Ltd, TIS Inc, ITOCHU Techno-Solutions Corporation (ITOCHU Corporation), NEC Corporation, Nomura Research Institute Ltd., NTT Communications Corporation (Nippon Telegraph and Telephone Corporation), Panasonic Corporation, Sony Corporation and SCSK Corporation (Sumitomo Corporation) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on ICT Market Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)