Saudi Arabia ICT Market Size, Share, Trends and Forecast by Type, Size of Enterprise, Industry Vertical, and Region, 2025-2033

Saudi Arabia ICT Market Size and Share:

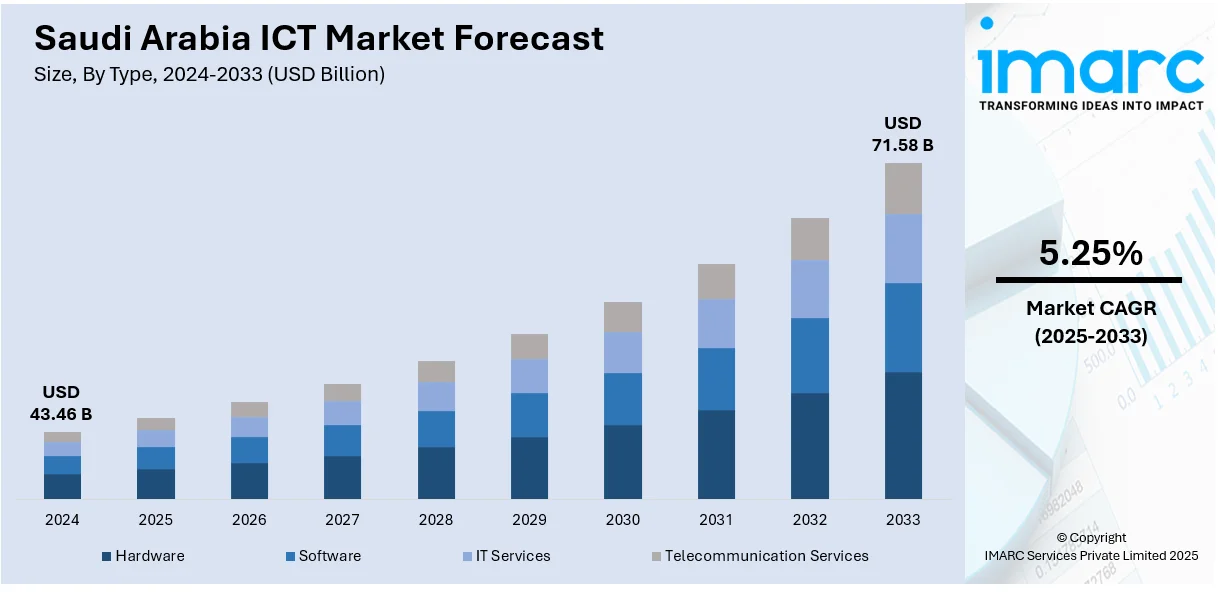

The Saudi Arabia ICT market size was valued at USD 43.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 71.58 Billion by 2033, exhibiting a CAGR of 5.25% during 2025-2033. The market is driven by Vision 2030-led digital transformation, including smart city projects and e-governance initiatives, supported by heavy government investments. Rising 5G deployment, enterprise digitalization in healthcare and finance, and a tech-savvy population are accelerating demand for advanced connectivity and IT services. Regulatory reforms, FDI inflows, and partnerships with global tech firms are fostering innovation, further augmenting the Saudi Arabia ICT market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 43.46 Billion |

| Market Forecast in 2033 | USD 71.58 Billion |

| Market Growth Rate (2025-2033) | 5.25% |

The market is primarily driven by Vision 2030, the nation’s strategic framework to diversify its economy and reduce oil dependency. Significant government investments in digital transformation, smart cities (e.g., NEOM), and e-governance initiatives are accelerating ICT adoption. The rise of 5G networks, coupled with increasing mobile and internet penetration, fuels demand for advanced connectivity solutions. Among all the GCC nations, Saudi Arabia is the frontrunner for 5G adoption, with 90 percent coverage in the major urban locations and speeds of up to 370.12 Mbps on average. It is mainly due to STC Group's rollout to over 75 cities. It depends on 45 million IoT devices and is estimated to add up to USD 12 Billion worth of market by the year 2030. The adoption falls in line with the development of the Kingdom's smart technology and ICT sectors in accordance with Vision 2030. Additionally, regulatory reforms promoting private sector participation and foreign direct investment (FDI) are stimulating innovation and competition. The growing emphasis on cybersecurity, cloud computing, and AI further underscores the need for robust ICT infrastructure, positioning the sector for sustained expansion.

To get more information on this market, Request Sample

In addition, the rapid digitalization of enterprises across sectors such as healthcare, finance, and education, influenced by post-pandemic demand for remote solutions, is also favoring the Saudi Arabia ICT market growth. Saudi businesses are adopting IoT, big data analytics, and automation to enhance efficiency, creating a rise in demand for enterprise IT services. At LEAP 2025, Saudi Arabia announced a USD 1.78 Billion investment in artificial intelligence, data centers, and the nurturing of a digital workforce. This plan is significantly sponsored by well-known companies, including Equinix, DAMAC, and Microsoft. These initiatives provide solutions within the parameters of Vision 2030 by developing the Kingdom’s GRC platform ecosystem through fostering various aspects such as regulatory sandboxes and artificial intelligence (AI) literacy and encouraging the creation of deep tech startups. Over USD 700 Million has also been set aside for venture capital, showing growing growth within the industries of AI-powered compliance and digital risk management. The young, tech-savvy population—with high smartphone usage—is also propelling consumer-driven digital services, including e-commerce and fintech. Furthermore, partnerships between local firms and global tech giants are fostering knowledge transfer and cutting-edge solutions. With the Kingdom emerging as a regional tech hub, these factors collectively reinforce the ICT market’s dynamic growth trajectory.

Saudi Arabia ICT Market Trends:

Expanding Infrastructure and Technology Integration

Strong investment in infrastructure, such as widespread implementation of high-speed broadband, 5G technology, and modern data centers, is revolutionizing the digital environment. In 2025, Zain KSA initiated its 5G Standalone (SA) network utilizing the 600 MHz spectrum, beginning operations in Riyadh and Jeddah. This deployment enhances national coverage and facilitates next-generation services such as VoNR, RedCap devices, and network slicing. Such investments are crucial for facilitating real-time communication, digital platforms, and the swift handling of substantial amounts of data. Companies in banking, healthcare, energy, and manufacturing are progressively adopting ICT solutions to boost efficiency and uphold international standards. Furthermore, the growing adoption of cloud is bolstered by both global providers and local initiatives, enhancing data sovereignty and increasing the availability of digital services. Through the establishment of a high-tech environment, Saudi Arabia enables smooth incorporation of ICT in key sectors, supporting its goals for economic modernization and global prominence.

Emphasis on Cybersecurity and Data Protection

The increasing significance of secure digital infrastructure is a major factor influencing the Saudi Arabian ICT market. Due to swift digitization in government, business, and consumer areas, protecting sensitive data is becoming essential. The creation of dedicated cybersecurity organizations and the implementation of strict regulatory measures indicate a firm national dedication to safeguarding data. Businesses functioning within the kingdom must adhere to security guidelines that promote investment in cutting-edge security measures. This need is leading to the expansion of local cybersecurity companies and collaborations with international firms providing knowledge in threat identification and deterrence. Cyber resilience is both a regulatory requirement and essential for fostering trust with clients and investors. The focus on safeguarding data integrity and guaranteeing secure transactions fosters a market setting where security-focused ICT products and services are essential. By positioning cybersecurity as a core element, Saudi Arabia bolsters ongoing ICT integration throughout all tiers of its digital economy.

Integration of ICT in Education and Workforce Training

University and vocational program curricula are progressively focused on digital fields, such as software development, artificial intelligence (AI), and data analytics. National programs highlight the importance of reskilling and upskilling efforts to equip the workforce for technology-driven sectors. Collaborations with international tech companies offer access to expert training programs, credentials, and hands-on experiences. These initiatives aim to guarantee that the job market evolves alongside swift technological progress and corresponds to the demands of both local businesses and international firms. Through integrating ICT training into the educational framework, Saudi Arabia establishes a lasting pool of skilled individuals who can lead innovation and promote adoption. The connection between educational readiness and market needs improves job prospects for graduates and bolsters the lasting durability of the ICT industry.

Saudi Arabia ICT Market Growth Drivers:

Strategic Partnerships

Collaborative alliances between international technology giants and domestic organizations are increasing knowledge transfer, bring in advanced solutions, and position the kingdom as a center for state-of-the-art innovation. By synchronizing with national initiatives like Vision 2030, partnerships promote the creation of localized technologies designed for regional requirements, encompassing AI applications and cloud infrastructure. These initiatives also lead to substantial investment in workforce development, preparing professionals with enhanced skills to address future market needs. In addition to implementing technology, these collaborations bolster the ICT ecosystem by fostering opportunities for startups, improving research capabilities, and guaranteeing regulatory compliance with global standards. For example, in 2024, PIF and Google Cloud announced a strategic partnership to establish a global AI hub in Dammam, Saudi Arabia. The collaboration aimed to enhance the country's AI capabilities, support ICT growth, and boost workforce development. The initiative aligned with Saudi Arabia's Vision 2030 and focused on Arabic language AI models and cloud services.

Large-Scale Investments

Funding initiatives supported by the governing body aim to establish globally competitive firms that foster innovation and diversify economic impacts. These investments aim not only to create corporate entities but also to enhance the wider ecosystem through research, infrastructure growth, and technological progress. Focusing on areas like AI, data-centric services, space technologies, and digital infrastructure highlights a progressive approach that establishes the kingdom as a regional frontrunner in innovative technologies. By greatly increasing the industry's portion of national production, these initiatives boost private sector involvement, attract international collaborations, and foster entrepreneurship. The allocation of resources guarantees enduring sustainability, creating a strong basis for ongoing ICT market growth aligned with national transformation objectives. In 2024, Saudi Arabia announced plans to launch two multi-billion-dollar tech companies by 2025, as part of efforts to grow its ICT sector. The Kingdom aims to increase the tech sector’s GDP contribution from 1% to 5% by 2030. This aligns with Vision 2030, fostering advancements in AI, data, space, and digital infrastructure.

Expansion of Cloud and Data Localization Policies

National policies actively promote the adoption of cloud-based platforms by organizations in Saudi Arabia to enhance scalability, improve operational efficiency, and ensure long-term cost savings. Furthermore, stringent regulations require that sensitive and strategic information be kept within the Kingdom’s borders, enhancing security and sovereignty. This integrated strategy is encouraging substantial investments in local data centers while simultaneously attracting major global cloud service providers to set up infrastructure in the region. The outcome is a rapidly expanding market for cloud solutions that serve both public and private sector requirements with increasing sophistication. Companies are increasingly moving tasks to hybrid and public cloud frameworks to speed up digital transformation efforts, supported by favorable government regulations and a well-defined strategic plan. Data localization policies protect national interests while directing significant financial investments into the local ICT ecosystem, encouraging domestic innovation. These initiatives are creating a strong foundation for cloud adoption, supporting growth in related ICT areas such as cybersecurity, sophisticated networking solutions, and managed service options.

Saudi Arabia ICT Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia ICT market, along with forecasts at the regional and country/country and regional levels from 2025-2033. The market has been categorized based on type, size of enterprise, and industry vertical.

Analysis by Type:

- Hardware

- Software

- IT Services

- Telecommunication Services

The hardware segment in Saudi Arabia’s ICT market is expanding due to rising demand for data centers, enterprise IT infrastructure, and consumer electronics. Government-led initiatives such as smart cities (NEOM, Qiddiya) and digital transformation projects are driving investments in servers, storage, and networking equipment. Additionally, the rollout of 5G and IoT adoption is fueling demand for compatible devices, including smartphones, routers, and sensors. Local manufacturing incentives under Vision 2030 are improving domestic production, reducing reliance on imports. However, supply chain disruptions and semiconductor shortages pose challenges. With increasing cloud adoption, hybrid IT infrastructure is gaining traction, positioning hardware as a critical enabler for Saudi Arabia’s digital economy.

The software segment is experiencing rapid growth, driven by enterprise digitalization, AI adoption, and cloud migration. Businesses across banking, healthcare, and retail are investing in ERP, cybersecurity, and analytics platforms to enhance efficiency. The Saudi government’s push for e-governance and smart services is accelerating demand for customized SaaS solutions. Open-source software and local tech startups are gaining prominence, supported by regulatory sandboxes and venture capital funding. However, legacy system dependencies and skill gaps hinder seamless transitions. As AI and machine learning integration rises, software will remain pivotal in shaping the Kingdom’s tech-driven economic transformation.

IT services are in high demand due to large-scale digital transformation projects and outsourcing trends. Managed services, system integration, and consulting are key growth areas, particularly for cloud migration and cybersecurity solutions. The rise of fintech and telemedicine has increased reliance on third-party IT service providers for scalable, secure infrastructure. Local firms are partnering with global tech giants to deliver cutting-edge solutions, while government initiatives such as the National Cybersecurity Authority (NCA) are driving compliance-driven services. Talent shortages and cost pressures remain challenges, but the sector’s expansion is inevitable as Saudi enterprises prioritize automation and AI-driven operational efficiency.

Telecom services are thriving, propelled by 5G deployment, rising mobile penetration, and demand for high-speed connectivity. STC, Zain, and Mobily are investing heavily in fiber-optic networks and IoT-enabled smart services. The government’s push for digital inclusion and smart city ecosystems is improving broadband and enterprise telecom solutions. OTT platforms and e-gaming are driving data consumption, while regulatory reforms encourage MVNOs and infrastructure sharing. Despite pricing pressures and competition, the sector’s growth remains robust, supported by Saudi Arabia’s vision to become a regional digital hub with ultra-low latency and next-gen telecom infrastructure.

Analysis by Size of Enterprise:

- Small and Medium Enterprises

- Large Enterprises

The SME segment is a key growth driver in Saudi Arabia’s ICT market, fueled by government initiatives including the Saudi SME Bank and Monsha’at’s digital support programs. Cloud-based solutions, affordable SaaS platforms, and fintech integrations are enabling SMEs to streamline operations and enhance competitiveness. Rising e-commerce adoption and digital payment systems further accelerate ICT demand among small businesses. However, budget constraints and limited technical expertise hinder full-scale digital transformation. To address this, local tech providers are offering scalable, pay-as-you-go models tailored to SME needs. With Vision 2030 emphasizing SME contributions to GDP, increased access to venture capital and incubator programs is expected to enhance ICT adoption, positioning SMEs as a dynamic force in the Kingdom’s digital economy.

The large enterprises segment are driven by complex digital transformation projects and automation demands. Sectors such as oil and gas, banking, and healthcare invest heavily in ERP systems, AI-driven analytics, and cybersecurity to optimize efficiency and compliance. Strategic partnerships with global tech firms enable the deployment of cutting-edge solutions, such as IoT-enabled supply chains and hybrid cloud infrastructures. Government mandates, including data localization under the Saudi Data and AI Authority (SDAIA), further propel ICT investments. While scalability and integration challenges persist, large corporations benefit from dedicated IT budgets and in-house expertise. As Vision 2030 megaprojects advance, continued ICT modernization will solidify the segment’s role in shaping the Kingdom’s tech landscape.

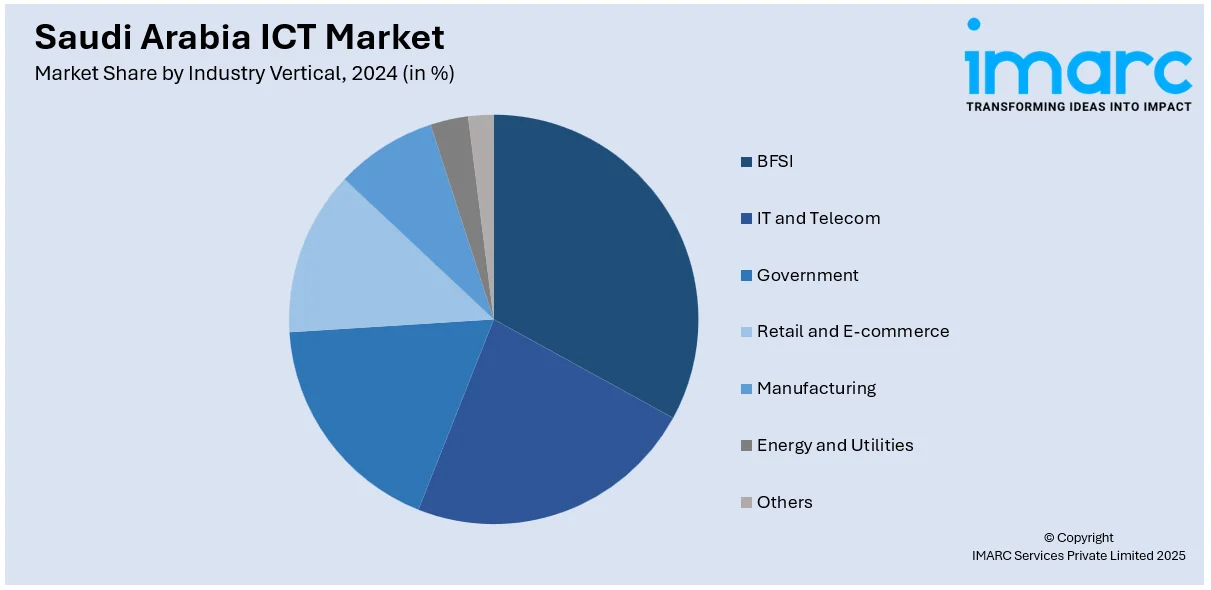

Analysis by Industry Vertical:

- BFSI

- IT and Telecom

- Government

- Retail and E-commerce

- Manufacturing

- Energy and Utilities

- Others

The BFSI sector is undergoing rapid digital transformation in Saudi Arabia, driven by open banking regulations, fintech adoption, and the Saudi Central Bank’s (SAMA) digital initiatives. Demand for cloud-based core banking systems, AI-powered fraud detection, and blockchain solutions is escalating as institutions seek operational efficiency and enhanced customer experiences. The rise of digital-only banks and InsurTech platforms is reshaping competition, while stringent cybersecurity requirements under NCA guidelines compel heavy investment in data protection. With financial inclusion as a key Vision 2030 goal, mobile payment solutions such as STC Pay and local buy-now-pay-later (BNPL) services are gaining traction. As regulatory sandboxes foster innovation, the BFSI vertical will remain a high-growth segment in Saudi Arabia’s ICT landscape.

As both a consumer and enabler of ICT solutions, Saudi Arabia’s IT and telecom sector is experiencing exponential growth, fueled by 5G rollouts, data center expansions, and edge computing deployments. Telecom giants such as STC and Mobily are investing in AI-driven network optimization and IoT ecosystems to support smart city projects. The demand for hyperscale cloud infrastructure is rising, with local data localization policies prompting global players such as AWS and Microsoft to establish in-country data centers. Additionally, the sector faces challenges in legacy system modernization and talent gaps, but government-backed upskilling programs and partnerships with global tech firms are addressing these hurdles. With digital infrastructure being a cornerstone of Vision 2030, the IT and telecom vertical will continue to drive the Kingdom’s technological advancement.

The government sector is a primary catalyst for ICT growth in Saudi Arabia, with massive investments in e-governance platforms, smart city development, and national cybersecurity frameworks. Initiatives including the Digital Government Authority’s (DGA) unified cloud-first policy and the Yesser program are accelerating public sector digitization. AI adoption is prioritized through the Saudi Data and AI Authority (SDAIA), enabling predictive analytics for urban planning and citizen services. Cybersecurity remains a top focus, with the NCA enforcing strict compliance standards across agencies. As Vision 2030 projects such as NEOM and THE LINE demand cutting-edge ICT solutions, the government vertical will sustain its position as a key driver of innovation and large-scale digital transformation in the Kingdom.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region, anchored by Riyadh, serves as Saudi Arabia's ICT nerve center, hosting government headquarters, financial institutions, and multinational tech firms. Riyadh's Smart City initiatives and the King Abdullah Financial District (KAFD) are driving demand for advanced digital infrastructure, AI solutions, and cybersecurity systems. The region benefits from concentrated investment in 5G networks and data centers, supported by regulatory incentives for cloud service providers. Qiddiya's gigaproject is further stimulating IoT and entertainment-tech adoption. While infrastructure development outpaces other regions, challenges include high competition and complex enterprise IT requirements. As the capital's digital transformation accelerates, the Northern and Central Region will continue dominating the Kingdom's ICT expenditure and innovation landscape.

The Western Region, led by Jeddah and the futuristic NEOM project, represents Saudi Arabia's most ambitious ICT testing ground. NEOM's USD 500 billion investment is catalyzing breakthroughs in AI, robotics, and smart infrastructure, attracting global tech partners. Jeddah's status as a commercial hub fuels demand for fintech, e-commerce platforms, and logistics automation solutions. The region also hosts major submarine cable landing stations, enhancing its digital connectivity. However, the scale of NEOM's technological ambitions presents unique challenges in implementation and talent acquisition. With Vision 2030 prioritizing the Red Sea development corridor, the Western Region is poised to become a global benchmark for next-generation digital ecosystems.

The Eastern Region, home to the oil and gas industry, is undergoing an ICT transformation driven by industrial automation and energy-tech innovation. Dhahran's King Abdulaziz Center for World Culture (Ithra) is fostering digital literacy, while Dammam's logistics hubs adopt blockchain for supply chain management. Aramco's digital twin initiatives and AI-powered oilfield monitoring systems set global industry standards. The region benefits from established fiber-optic networks but faces cybersecurity vulnerabilities in critical infrastructure. With the Eastern Province's economic diversification into mining and petrochemicals, demand for specialized industrial IoT and edge computing solutions is escalating, positioning the region as Saudi Arabia's energy-tech powerhouse.

The Southern Region, including Abha and Jazan, is experiencing targeted ICT growth through smart tourism and agricultural technology initiatives. The Asir region's "smart mountains" project utilizes IoT for environmental monitoring and tourism management, while Jazan's economic city drives demand for industrial automation. Limited infrastructure historically constrained development, but new data localization policies and 5G rollouts are bridging digital divides. The region presents unique opportunities in agri-tech, with AI and drone technologies transforming traditional farming practices. As Vision 2030 prioritizes regional development, the Southern Region's ICT market is emerging as a niche hub for sustainable tech solutions and digital inclusion programs.

Competitive Landscape:

The competitive landscape of the market is characterized by aggressive digital transformation strategies and strategic partnerships. Leading players are heavily investing in localized cloud infrastructure and AI-driven solutions to align with Vision 2030 objectives, while forming alliances with global tech giants to enhance their service offerings. Telecom providers are expanding 5G networks and IoT ecosystems to support smart city projects, coupled with cybersecurity enhancements to address growing data protection needs. Domestic firms are focusing on niche segments including fintech and e-government solutions, leveraging regulatory sandboxes to innovate. Meanwhile, international competitors are establishing in-country data centers to comply with localization policies. The market is witnessing intensified competition in pricing and service differentiation, with players racing to capture opportunities in emerging sectors such as industrial automation and edge computing.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia ICT market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: BICSI, in partnership with Pro Skills Training, launched its Saudi Arabia affiliate to support digital growth and workforce development in the country. The initiative aligns with Saudi Arabia's Vision 2030, offering ICT training and certifications to bridge the skills gap in the tech sector.

- February 2025: Huawei, in partnership with the Ministry of Communications and Information Technology, launched the Huawei Skills Development Center in Riyadh. The center aims to train 25,000 local talents by 2030 in key technologies such as AI, cloud computing, and cybersecurity. This initiative supports Saudi Arabia's digital transformation and ICT development goals.

- April 2025: KAFD DMC and Huawei launched Saudi Arabia’s first Smart WiFi-7 service, enhancing digital infrastructure across Riyadh’s financial district. The ICT-powered network enhances seamless, secure connectivity supports AI-driven services, and empowers businesses with data analytics, aligning with Saudi Vision 2030 and global smart city transformation goals.

- April 2025: Expleo launched Expleo Solutions Arabia Ltd. in Riyadh, reinforcing its commitment to Saudi Arabia’s Vision 2030. The new entity will deliver advanced ICT services, including AI, cybersecurity, and cloud computing, to BFSI and other sectors, supporting digital transformation and strengthening Expleo’s presence across the GCC region.

- February 2025: Microsoft and the National IT Academy launched the Middle East’s first Microsoft Datacenter Academy in Saudi Arabia. The program is designed to develop student expertise in data center operations, AI, cloud technologies, and cybersecurity.

- February 2025: Happiest Minds acquired Gavs Technologies' Middle East operations for USD 1.7 million, covering entities in the UAE, Oman, and Saudi Arabia. The ICT-focused deal enhances Happiest Minds’ regional presence, consolidating application development, infrastructure support, and BFSI services.

- January 2025: Elm acquired Thiqah Business Services from Saudi Arabia’s PIF for USD 907 million. The ICT-driven agreement seeks to enhance innovation, streamline operations, and advance national smart services through the integration of advanced digital technologies. It supports local tech localization, sector growth, and aligns with the Kingdom’s broader digital transformation strategy.

Saudi Arabia ICT Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hardware, Software, IT Services, Telecommunication Services |

| Size of Enterprises Covered | Small and Medium Enterprises, Large Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia ICT market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia ICT market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia ICT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ICT market in Saudi Arabia was valued at USD 43.46 Billion in 2024.

The Saudi Arabia ICT market is projected to exhibit a CAGR of 5.25% during 2025-2033, reaching a value of USD 71.58 Billion by 2033.

The growth of Saudi Arabia ICT market is driven by government initiatives focused on digital transformation, increasing adoption of cloud computing, and advancements in 5G technology. Additionally, the rise in demand for cybersecurity solutions, along with investments in smart technologies and innovation, is bolstering the market growth, positioning Saudi Arabia as a regional ICT hub.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)