Japan Industrial Exhaust Systems Market Size, Share, Trends and Forecast by Type, End-Use Industry, and Region, 2026-2034

Japan Industrial Exhaust Systems Market Summary:

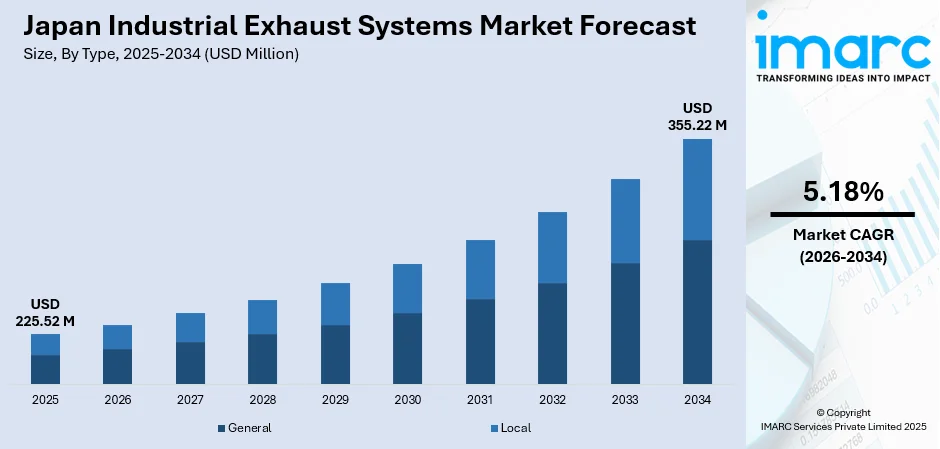

The Japan industrial exhaust systems market size was valued at USD 225.52 Million in 2025 and is projected to reach USD 355.22 Million by 2034, growing at a compound annual growth rate of 5.18% from 2026-2034.

The market is driven by stringent environmental regulations, rising energy costs, and the growing adoption of energy-efficient ventilation solutions across manufacturing sectors. Japan's commitment to carbon neutrality by 2050 is accelerating investments in advanced exhaust technologies with heat recovery capabilities. The increasing emphasis on workplace safety standards and air quality compliance in industrial facilities is compelling sectors such as automotive, chemical, and electronics to modernize their ventilation infrastructure, thereby expanding the Japan industrial exhaust systems market share.

Key Takeaways and Insights:

- By Type: General dominates the market with a share of 59.8% in 2025, driven by wide industrial applicability, simple installation, cost-effective ventilation performance, and strong compatibility with existing infrastructures across large manufacturing environments seeking efficient air quality control.

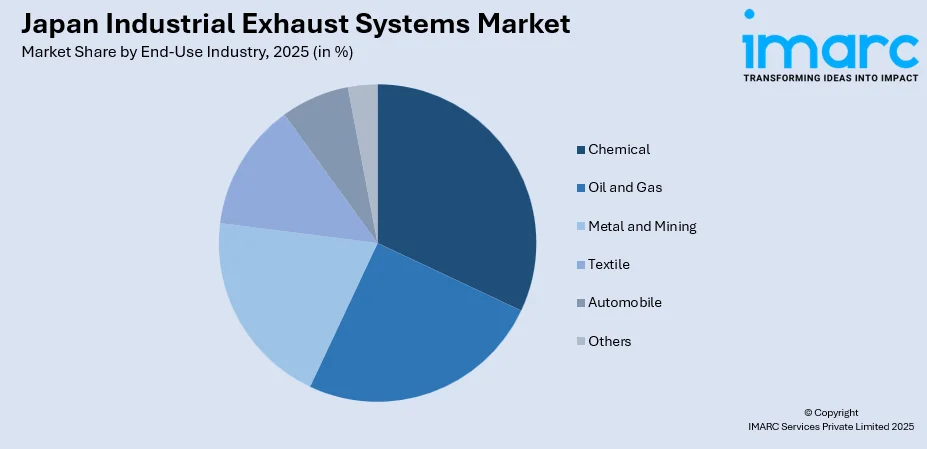

- By End-Use Industry: Chemical leads the market with a share of 24.9% in 2025, supported by strict regulatory compliance needs, extensive management of hazardous fumes and VOCs, and sustained investments in facilities prioritizing advanced ventilation systems to enhance worker protection and operational safety.

- By Region: Kanto Region dominates the market with a share of 35.9% in 2025, driven by dense industrial clusters around Tokyo and Yokohama, superior infrastructure, major manufacturing hubs, and higher corporate investments in technologically advanced exhaust and ventilation solutions.

- Key Players: The competitive landscape is defined by established domestic manufacturers and specialized ventilation solution providers offering customised, high-efficiency systems. Companies compete through engineering capabilities, product reliability, energy-efficient designs, and strong OEM relationships, while international suppliers add pressure through broader portfolios and advanced technological integration.

To get more information on this market Request Sample

The Japan industrial exhaust systems market is experiencing robust growth driven by multiple converging factors reshaping the industrial landscape. Stringent environmental regulations enforced by governmental bodies mandate industries to implement effective air pollution control measures, compelling manufacturers to invest in advanced exhaust solutions. Rising energy costs across Japan's industrial sector are driving demand for energy-efficient ventilation systems incorporating variable frequency drives and heat recovery technologies. The nation's ambitious carbon neutrality goals are accelerating the transition toward sustainable manufacturing practices, with exhaust systems playing a critical role in emissions management. As per sources, in May 2025, Japan enacted a law requiring companies producing over 100,000 tonnes of carbon emissions to join a carbon trading system starting April 2026, covering firms responsible for 60% of national emissions. Moreover, workplace safety standards continue to tighten, particularly in sectors handling hazardous materials, necessitating sophisticated fume extraction capabilities. Additionally, Japan's aging industrial infrastructure requires modernization, creating replacement demand for outdated ventilation equipment with technologically advanced alternatives that offer superior performance and regulatory compliance.

Japan Industrial Exhaust Systems Market Trends:

Integration of Smart Monitoring and IoT-Enabled Systems

The Japanese industrial sector is increasingly adopting intelligent exhaust systems equipped with Internet of Things (IoT) sensors and real-time monitoring capabilities. These advanced solutions enable continuous air quality assessment, automated ventilation adjustments, and predictive maintenance alerts that minimize operational disruptions. Manufacturing facilities are leveraging cloud-based analytics platforms to track emissions data, optimize airflow patterns, and ensure regulatory compliance without manual intervention. In 2025, a Japanese metal processing company implemented Advantech’s IoTSuite, ECU-1051, and ADAM-6051 modules to automate data collection, eliminating over 1,000 manual work hours and enabling real-time monitoring. Further, the integration of artificial intelligence (AI) algorithms allows exhaust systems to learn operational patterns and automatically adjust performance parameters based on production schedules and environmental conditions, significantly enhancing energy efficiency and operational effectiveness across industrial applications.

Adoption of Heat Recovery and Energy Reclamation Technologies

Japanese manufacturers are increasingly implementing exhaust systems featuring integrated heat recovery mechanisms that capture thermal energy from expelled air streams. This recovered energy is redirected for facility heating, process preheating, or conversion into usable power, substantially reducing overall energy consumption. The technology aligns with Japan's national energy conservation objectives and helps industries offset rising utility expenses. In April 2025, Japan launched a subsidy program supporting installation of renewable heat and industrial waste‑heat recovery systems, promoting energy-efficient factory upgrades and reducing emissions. Moreover, advanced heat exchangers and energy reclamation units are becoming standard components in new exhaust system installations, particularly within energy-intensive sectors seeking to maximize operational efficiency while minimizing environmental footprints and achieving sustainability certifications.

Modular and Customizable Exhaust System Configurations

The market is witnessing growing preference for modular exhaust system designs that offer flexibility in configuration and scalability for evolving industrial requirements. In October 2023, Zehnder, Honeywell, and Panasonic advanced modular ventilation systems, enabling flexible, scalable exhaust solutions with customizable configurations for industrial and commercial facilities. Furthermore, manufacturers are developing adaptable solutions that can be easily reconfigured, expanded, or upgraded without complete system replacement, addressing the dynamic needs of modern production facilities. This trend responds to industries requiring versatile ventilation solutions capable of accommodating changing production processes, facility expansions, and evolving regulatory requirements. Modular designs also facilitate faster installation timelines, reduced maintenance complexity, and lower lifecycle costs compared to traditional fixed-configuration alternatives.

Market Outlook 2026-2034:

The Japan industrial exhaust systems market demonstrates strong growth potential, with revenue projected to expand significantly through the forecast period. Market revenue is expected to witness substantial appreciation driven by increasing industrialization, stringent environmental compliance requirements, and technological advancements in exhaust system efficiency. The automotive, chemical, and electronics manufacturing sectors will remain primary revenue contributors as they continue upgrading ventilation infrastructure. Government incentives supporting clean manufacturing technologies and workplace safety investments will further accelerate market revenue growth, positioning the industry for sustained expansion throughout the decade. The market generated a revenue of USD 225.52 Million in 2025 and is projected to reach a revenue of USD 355.22 Million by 2034, growing at a compound annual growth rate of 5.18% from 2026-2034.

Japan Industrial Exhaust Systems Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | General | 59.8% |

| End-Use Industry | Chemical | 24.9% |

| Region | Kanto Region | 35.9% |

Type Insights:

- General

- Local

The general dominates with a market share of 59.8% of the total Japan industrial exhaust systems market in 2025.

General exhaust systems represent the dominant segment within Japan's industrial ventilation market, commanding the largest revenue share due to their widespread applicability across diverse manufacturing environments. These systems effectively manage ambient air quality by extracting contaminated air from broad production areas, providing comprehensive ventilation coverage essential for maintaining safe working conditions. Their design flexibility accommodates various industrial configurations, from automotive assembly plants to food processing facilities. The segment benefits from relatively straightforward installation requirements and lower capital expenditure compared to specialized alternatives, making them attractive for facilities seeking cost-effective compliance solutions.

General exhaust systems continue gaining traction among small and medium-sized enterprises seeking efficient yet affordable ventilation solutions without specialized requirements. The technology's maturity ensures reliable performance with established maintenance protocols and readily available replacement components. Manufacturers are enhancing general exhaust offerings with improved energy efficiency features, variable speed controls, and enhanced filtration capabilities to meet evolving regulatory standards while maintaining competitive pricing structures that appeal to budget-conscious industrial operators across multiple sectors. In October 2025, Daikin Industries announced it would exhibit at the Japan Pavilion during COP30 to showcase its HVAC solution combining ventilation and air conditioning, achieving significant energy savings.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Chemical

- Metal and Mining

- Textile

- Automobile

- Others

The chemical leads with a share of 24.9% of the total Japan industrial exhaust systems market in 2025.

The chemical sector represents the leading end-use industry for industrial exhaust systems in Japan, driven by stringent regulatory requirements governing hazardous substance handling and worker exposure limits. Chemical manufacturing processes generate diverse airborne contaminants including volatile organic compounds, toxic fumes, and particulate matter requiring sophisticated extraction and treatment capabilities. Facilities must maintain rigorous air quality standards to prevent worker health hazards, environmental violations, and potential process contamination that could compromise product quality. For instance, in March 2025, Japan added 157 new chemical substances to the Industrial Safety and Health Act’s regulated list, strengthening workplace safety requirements and increasing demand for advanced industrial exhaust systems.

Chemical manufacturers continuously invest in advanced exhaust technologies featuring specialized filtration, scrubbing systems, and containment solutions designed for handling corrosive and reactive substances. The sector's growth trajectory, driven by expanding pharmaceutical, petrochemical, and specialty chemical production, sustains strong demand for customized ventilation solutions. Exhaust system suppliers serving this segment must demonstrate expertise in managing complex chemical atmospheres while ensuring compliance with Japan's comprehensive occupational health and environmental protection frameworks.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates with a market share of 35.9% of the total Japan industrial exhaust systems market in 2025.

The Kanto Region dominates Japan's industrial exhaust systems market, capturing the largest revenue share driven by its position as the nation's primary industrial and economic hub. The region encompasses Tokyo, Yokohama, Kawasaki, and surrounding prefectures hosting Japan's highest concentration of manufacturing facilities, corporate headquarters, and industrial infrastructure. This industrial density creates substantial demand for ventilation solutions across automotive, electronics, chemical, and food processing sectors.

Kanto's advanced infrastructure supports rapid adoption of sophisticated exhaust technologies, with facilities accessing superior technical support, installation services, and maintenance capabilities. The region's stringent local environmental regulations often exceed national standards, compelling industries to implement premium ventilation solutions ensuring comprehensive compliance. Corporate sustainability initiatives among Kanto-based manufacturers further accelerate investments in energy-efficient exhaust systems aligned with environmental stewardship objectives. According to sources, in 2025, Kyocera’s Kanto-based sites in Hachioji, Tokyo, and Kawasaki, Kanagawa, reported zero environmental law violations and reduced VOC emissions to 429 tons, showcasing advanced exhaust system compliance.

Market Dynamics:

Growth Drivers:

Why is the Japan Industrial Exhaust Systems Market Growing?

Stringent Environmental Regulations and Emission Standards

Japan maintains comprehensive environmental regulatory frameworks governing industrial air emissions, compelling manufacturers across sectors to implement effective exhaust and ventilation systems ensuring compliance. Governmental agencies continuously strengthen emission standards, particularly concerning particulate matter, volatile organic compounds, and hazardous air pollutants, requiring industries to upgrade existing ventilation infrastructure or install advanced solutions meeting tightened requirements. In January 2025, Japan revised its Air Pollution Control Act, expanding VOC and dust regulations to small and medium facilities, increasing mandatory monitoring and accelerating adoption of advanced industrial exhaust systems. Furthermore, regulatory enforcement mechanisms including facility inspections, emission monitoring requirements, and substantial penalties for violations create strong compliance incentives driving exhaust system investments. Industries operating in environmentally sensitive locations face additional local regulations often exceeding national standards, further accelerating adoption of premium ventilation technologies. The regulatory trajectory indicates continued tightening of emission limits aligned with Japan's international environmental commitments, sustaining long-term demand for advanced industrial exhaust systems.

National Carbon Neutrality Objectives and Sustainability Initiatives

Japan's commitment to achieving carbon neutrality by 2050 is fundamentally reshaping industrial operations, including ventilation and exhaust system requirements. According to sources, in May 2025, Japan’s Ministry of the Environment selected new JCM subsidy projects supporting advanced decarbonization technologies, reinforcing industrial pressure to upgrade energy-efficient systems. Further, government policies supporting this objective include incentives for energy-efficient industrial equipment, carbon pricing mechanisms, and sustainability reporting requirements influencing corporate investment decisions. Manufacturers increasingly recognize exhaust systems as opportunities for energy conservation through heat recovery technologies, variable frequency drives, and optimized airflow management reducing overall facility energy consumption. Corporate sustainability initiatives, driven by investor expectations, customer requirements, and competitive positioning, further accelerate adoption of environmentally advanced exhaust solutions. Green building certifications and environmental management system standards increasingly factor ventilation system efficiency into compliance assessments, creating additional drivers for market growth.

Workplace Safety Standards and Occupational Health Requirements

Japan's stringent occupational health and safety regulations mandate effective ventilation in workplaces where employees face exposure to airborne contaminants, hazardous substances, or uncomfortable thermal conditions. Regulatory agencies specify exposure limits for numerous substances, requiring employers to implement engineering controls including exhaust systems maintaining compliant atmospheric conditions. Industries handling particularly hazardous materials face enhanced requirements including continuous monitoring, specialized extraction equipment, and documented compliance programs. As per sources, in May 2025, Japan’s MHLW expanded ISHA requirements to 2,316 chemicals, tightening mandatory labelling and SDS delivery rules and increasing workplace ventilation and exhaust system obligations for compliance. Moreover, growing awareness of occupational respiratory diseases and long-term health impacts from workplace exposures drives proactive investment in ventilation improvements beyond minimum regulatory requirements. Corporate responsibility considerations and potential liability concerns further motivate comprehensive exhaust system implementations protecting worker health while demonstrating organizational commitment to employee wellbeing.

Market Restraints:

What Challenges the Japan Industrial Exhaust Systems Market is Facing?

High Initial Capital Investment Requirements

Industrial exhaust systems, particularly advanced configurations incorporating energy recovery, smart controls, and specialized filtration, require substantial upfront capital investments that challenge budget-constrained organizations. Small and medium-sized enterprises often face difficulties financing comprehensive ventilation upgrades, potentially delaying necessary improvements or selecting lower-capability alternatives. The total installation cost encompasses equipment procurement, ductwork fabrication, electrical infrastructure, and commissioning expenses that collectively represent significant capital outlays.

Complex Installation and Integration Challenges

Implementing industrial exhaust systems within existing manufacturing facilities presents considerable installation complexity, particularly when integrating new equipment with established production infrastructure. Retrofit projects often require operational disruptions, facility modifications, and coordination across multiple trades extending project timelines and increasing implementation costs. Facilities with space constraints, structural limitations, or complex existing systems face heightened integration challenges potentially compromising optimal exhaust system performance.

Ongoing Maintenance and Operational Expenses

Industrial exhaust systems require continuous maintenance including filter replacement, ductwork cleaning, motor servicing, and periodic system inspections to maintain operational effectiveness and regulatory compliance. These recurring expenses represent significant operational cost burdens, particularly for facilities operating multiple exhaust systems across extensive production areas. Specialized maintenance requirements for advanced systems may necessitate external service contracts adding further to lifecycle costs.

Competitive Landscape:

The Japan industrial exhaust systems market exhibits a moderately competitive structure characterized by the presence of established domestic manufacturers alongside international ventilation technology providers competing across various industrial segments. Market participants differentiate through technological capabilities, energy efficiency performance, customization flexibility, and comprehensive service offerings addressing diverse customer requirements. Domestic manufacturers leverage strong customer relationships, local market understanding, and established service networks, while international competitors bring advanced technologies and global best practices. Competition increasingly centers on integrated solutions combining exhaust systems with monitoring technologies, energy recovery systems, and smart controls delivering enhanced value propositions. Suppliers are expanding service capabilities including system design, installation, maintenance, and performance optimization to strengthen customer relationships and capture recurring revenue streams beyond initial equipment sales.

Recent Developments:

- In September 2025, Sahara Co., Ltd. launched its redesigned “New Flat Fan” 24-hour ventilation system, developed with Tohoku University. The next-generation model blends minimalist aesthetics with improved energy efficiency, quiet performance, and easier maintenance, offering a ventilation fan that harmonizes seamlessly with modern residential interiors.

- In July 2024, Asahi Kogyosha Co., Ltd. launched the energy-saving ventilation system AUX JET, enhancing factory safety by efficiently capturing VOCs and other hazardous substances. The system improves air quality, supports worker health, and optimizes energy use in industrial settings, including paint, printing, pharmaceutical, and food factories.

Japan Industrial Exhaust Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | General, Local |

| End-Use Industries Covered | Oil and Gas, Chemical, Metal and Mining, Textile, Automobile, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan industrial exhaust systems market size was valued at USD 225.52 Million in 2025.

The Japan industrial exhaust systems market is expected to grow at a compound annual growth rate of 5.18% from 2026-2034 to reach USD 355.22 Million by 2034.

General held the largest share in the market, supported by their broad suitability for multiple industrial environments, straightforward installation requirements, cost-effective performance, and strong compatibility with existing facility layouts, making them the preferred choice for comprehensive air quality and ventilation management.

Key factors driving the Japan industrial exhaust systems market include stringent environmental regulations, national carbon neutrality objectives, rising energy costs compelling adoption of efficient systems, workplace safety requirements, and increasing industrial automation integration.

Major challenges include high initial capital investment requirements, complex installation and integration processes in existing facilities, ongoing maintenance expenses, shortage of specialized technical personnel, and lengthy procurement cycles in regulated industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)