Japan Industrial Gas Cylinders Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Industrial Gas Cylinders Market Summary:

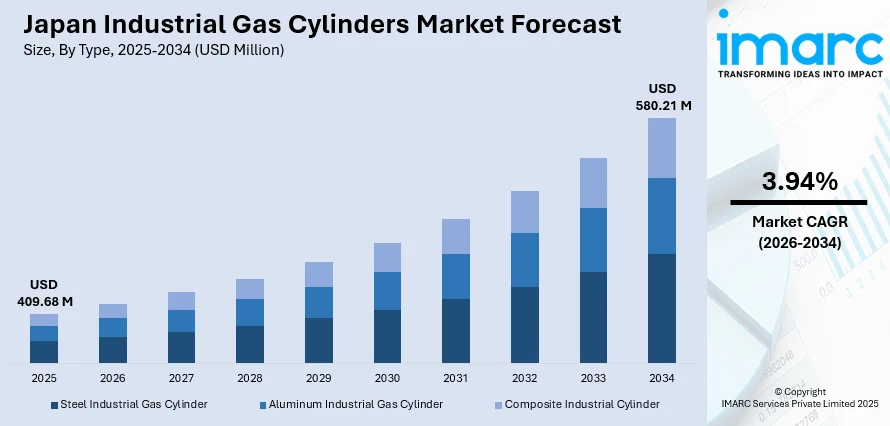

The Japan industrial gas cylinders market size was valued at USD 409.68 Million in 2025 and is projected to reach USD 580.21 Million by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034.

The Japan industrial gas cylinders market is experiencing robust growth driven by the country's extensive manufacturing capabilities, advanced technological infrastructure, and strategic investments in key industrial sectors. The market benefits from strong demand across steel production, automotive manufacturing, semiconductor fabrication, and healthcare applications. Japan's commitment to technological innovation and stringent safety standards has positioned the nation as a significant player in the regional industrial gas cylinders landscape, with domestic manufacturers continuously enhancing product quality and expanding distribution networks to meet evolving industrial requirements.

Key Takeaways and Insights:

- By Type: Steel industrial gas cylinder dominates the market with a share of 62% in 2025, owing to its superior durability, cost-effectiveness, and widespread application in heavy industries including steel manufacturing, chemical processing, and welding operations across Japan's industrial corridors.

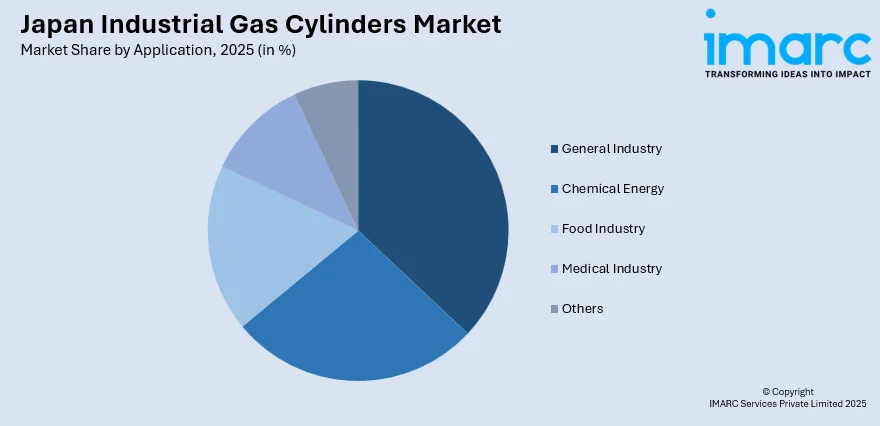

- By Application: General industry leads the market with a share of 37% in 2025, driven by extensive utilization in metal fabrication, welding applications, construction activities, and diverse manufacturing processes requiring reliable gas storage and transportation solutions.

- By Region: Kanto Region represents the largest segment with a market share of 35% in 2025, supported by a dense concentration of electronics, manufacturing, and healthcare industries in Tokyo, Kanagawa, and Saitama, benefiting from advanced infrastructure and strong distribution networks.

- Key Players: The Japan industrial gas cylinders market exhibits moderate competitive intensity, with established domestic manufacturers and multinational corporations competing through technological innovation, strategic partnerships, and comprehensive service networks to capture market share across diverse industrial applications and regional territories.

To get more information on this market Request Sample

The Japan industrial gas cylinders market is propelled by the nation's robust industrial ecosystem and technological advancement priorities. The market is vital to Japan's automobile sector, which is still one of the biggest in the world and heavily relies on industrial gas cylinders for heat treatment, cutting, and welding. Additionally, the semiconductor sector's expansion, particularly with initiatives like Rapidus achieving prototyping of advanced 2nm transistors, accelerates demand for ultra-high-purity gas storage solutions. Japan's healthcare sector, characterized by an aging population and increasing respiratory care requirements, further strengthens demand for medical-grade cylinders. The market benefits from continuous innovation in lightweight composite materials and smart cylinder technologies featuring IoT-enabled monitoring systems, reflecting Japan's commitment to integrating advanced technologies across industrial applications.

Japan Industrial Gas Cylinders Market Trends:

Hydrogen Infrastructure Development and Clean Energy Transition

Japan's commitment to achieving carbon neutrality by 2050 is driving substantial investments in hydrogen infrastructure, significantly impacting the industrial gas cylinders market. The government's strategic initiatives support the development of hydrogen refueling stations and fuel cell applications, necessitating specialized high-pressure composite cylinders capable of operating above 350 bars. Companies like Kawasaki Heavy Industries commenced operations of Japan's first 30%-hydrogen co-firing gas engine in September 2025, demonstrating the increasing integration of hydrogen technologies across industrial applications and creating new demand avenues for advanced cylinder solutions.

Advanced Manufacturing and Semiconductor Sector Expansion

The semiconductor industry's growth significantly influences the industrial gas cylinders market, with ultra-high-purity gases essential for wafer fabrication processes. Precision gas storage and distribution systems are in high demand due to Japan's emphasis on domestic chip fabrication, which is demonstrated by the Rapidus foundry's development of cutting-edge transistor technology. Industry collaborations are forming to enhance local supply chain resilience, with increased investments in photolithography and etching processes accelerating demand for specialty gas cylinders. This trend supports consistent revenue growth and technological upgrades in precision gas systems serving electronics manufacturing applications.

Smart Cylinder Technologies and IoT Integration

The adoption of smart gas cylinders equipped with IoT-enabled monitoring systems represents a transformative trend in the Japanese market. These advanced cylinders offer real-time tracking, automated leak detection, and enhanced safety features, with approximately twelve percent of new products incorporating such technologies. Industrial facilities increasingly integrate smart monitoring systems to reduce operational risks and optimize gas usage efficiency. This technological evolution aligns with Japan's broader Industry 4.0 initiatives, supporting the development of connected industrial ecosystems and driving demand for digitally-enhanced gas storage solutions.

Market Outlook 2026-2034:

The Japan industrial gas cylinders market outlook remains positive, underpinned by sustained industrial demand, government support for clean energy initiatives, and ongoing infrastructure development projects. The healthcare sector's expansion, driven by an aging population requiring increased respiratory care, coupled with the automotive industry's steady demand for welding and fabrication applications, ensures continued market momentum. Japan's strategic investments in hydrogen energy infrastructure and semiconductor manufacturing capacity are expected to create substantial growth opportunities. The market generated a revenue of USD 409.68 Million in 2025 and is projected to reach a revenue of USD 580.21 Million by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034.

Japan Industrial Gas Cylinders Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Steel Industrial Gas Cylinder | 62% |

| Application | General Industry | 37% |

| Region | Kanto Region | 35% |

Type Insights:

- Steel Industrial Gas Cylinder

- Aluminum Industrial Gas Cylinder

- Composite Industrial Cylinder

The steel industrial gas cylinder dominates with a market share of 62% of the total Japan industrial gas cylinders market in 2025.

Steel industrial gas cylinders maintain their dominant position in the Japanese market owing to their exceptional durability, superior pressure resistance, and cost-effectiveness for high-volume industrial applications. These cylinders serve as the backbone of Japan's heavy industries, including steel manufacturing, chemical processing, and large-scale welding operations. The robust construction of steel cylinders enables them to withstand demanding operational environments while meeting stringent safety regulations established by Japanese authorities. Manufacturers continue to invest in corrosion-resistant coatings and advanced surface treatments to extend cylinder lifespan and maintain gas purity standards required by precision industries.

Japanese manufacturers leverage advanced metallurgical technologies and precision engineering capabilities to produce steel cylinders meeting stringent international quality standards while optimizing production efficiency and maintaining competitive pricing structures. The segment benefits significantly from well-established supply chains, mature recycling infrastructure supporting sustainability initiatives, and widespread technical expertise in handling steel-based gas storage solutions. These factors collectively reinforce the dominant market position of steel cylinders across Japan's comprehensive industrial ecosystem and manufacturing landscape.

Application Insights:

Access the comprehensive market breakdown Request Sample

- General Industry

- Chemical Energy

- Food Industry

- Medical Industry

- Others

The general industry leads with a share of 37% of the total Japan industrial gas cylinders market in 2025.

The general industry segment encompasses diverse manufacturing applications including metal fabrication, welding operations, heat treatment processes, and various industrial processes requiring reliable gas storage and delivery solutions. Japan's extensive manufacturing sector, particularly automotive components, machinery production, and construction materials, drives substantial demand for industrial gas cylinders supporting cutting, brazing, and surface treatment operations. The segment benefits from Japan's reputation for precision manufacturing, with industries requiring consistent gas quality and reliable supply chains to maintain production efficiency and product quality standards.

Japan's industrial gases market is expected to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033, with rising applications in steel, electronics, and chemical sectors driving cylinder demand. The general industry segment continues to evolve with increasing adoption of automated gas handling systems and integrated supply solutions. Manufacturers are investing in advanced cylinder management technologies to optimize gas consumption, reduce operational costs, and enhance workplace safety. The segment's growth trajectory aligns with Japan's broader industrial modernization initiatives and commitment to maintaining global competitiveness in manufacturing excellence.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 35% share of the total Japan industrial gas cylinders market in 2025.

The Kanto Region maintains its leading position as Japan's industrial heartland, encompassing Tokyo, Kanagawa, Saitama, Chiba, Ibaraki, Tochigi, and Gunma prefectures. This region benefits from the highest concentration of manufacturing, electronics, and healthcare industries in Japan, creating substantial demand for industrial gas cylinders across diverse applications. The presence of major industrial clusters, research facilities, and advanced infrastructure supports large-scale gas consumption, while semiconductor fabrication and precision manufacturing industries drive continuous demand for high-purity gas storage solutions.

Government initiatives actively promoting hydrogen energy adoption and renewable energy projects further enhance the region's industrial gas production capacity and infrastructure development capabilities. The region's well-established distribution networks, advanced logistics infrastructure, strategic proximity to major international ports, and comprehensive transportation connectivity facilitate efficient cylinder supply chain management operations. These advantages collectively support diverse industries requiring reliable, consistent, and timely gas delivery services across manufacturing, healthcare, and emerging clean technology sectors.

Market Dynamics:

Growth Drivers:

Why is the Japan Industrial Gas Cylinders Market Growing?

Expanding Healthcare Infrastructure and Aging Population Demographics

Japan's rapidly aging population represents a significant driver for the industrial gas cylinders market, particularly in medical and healthcare applications. As one of the world's countries with the highest percentage of elderly population, the demand for respiratory care services, oxygen therapy equipment, and medical gas infrastructure continues to expand substantially. Healthcare facilities across Japan are increasing their capacity for treating chronic respiratory conditions, post-surgical care, and home healthcare services requiring portable oxygen delivery systems. The Japan medical gas market is anticipated to reach USD 1,533.75 Million by 2033, exhibiting a growth rate (CAGR) of 5.81% during 2025-2033, driven by rising demand for advanced respiratory support and diagnostic applications. This demographic trend ensures sustained demand growth for medical-grade cylinders while encouraging innovation in lightweight, portable gas delivery technologies designed for home healthcare settings and emergency medical services.

Strategic Investments in Hydrogen Energy and Clean Technology Infrastructure

Japan's commitment to achieving carbon neutrality by 2050 has catalyzed substantial investments in hydrogen infrastructure, creating significant opportunities for industrial gas cylinder manufacturers. Government-backed initiatives support the development of hydrogen refueling stations, fuel cell vehicle adoption, and industrial hydrogen applications requiring specialized high-pressure storage solutions. The growing hydrogen ecosystem encompasses transportation, power generation, and industrial processes, each requiring specific cylinder technologies. Japanese companies are pioneering hydrogen co-firing technologies and developing comprehensive hydrogen supply chains, including receiving bases and distribution networks. These strategic investments position the industrial gas cylinders market for sustained growth as hydrogen transitions from demonstration projects to commercial-scale deployment across industrial and transportation sectors.

Advanced Manufacturing and Semiconductor Industry Expansion Requirements

Japan's strategic focus on strengthening domestic semiconductor manufacturing capabilities drives substantial demand for industrial gas cylinders designed for electronics fabrication applications. Ultra-high-purity gases essential for wafer processing, including nitrogen, argon, hydrogen, and specialty gases, require precision storage and delivery systems meeting stringent purity standards. The establishment of advanced semiconductor facilities, exemplified by initiatives achieving leading-edge transistor prototyping, accelerates investments in gas infrastructure supporting photolithography, etching, and deposition processes. Additionally, Japan's broader advanced manufacturing sector, including precision machinery, aerospace components, and specialized electronics, maintains consistent demand for industrial gas cylinders supporting diverse fabrication and treatment processes. The convergence of semiconductor expansion and general manufacturing modernization ensures sustained market growth across multiple industrial gas cylinder categories.

Market Restraints:

What Challenges the Japan Industrial Gas Cylinders Market is Facing?

Stringent Regulatory Compliance and Safety Certification Requirements

Japan's comprehensive regulatory framework governing industrial gas cylinder manufacturing, testing, and maintenance creates substantial compliance burdens for market participants. Manufacturers must navigate complex certification processes, periodic inspection requirements, and stringent quality control standards that increase operational costs and market entry barriers for new competitors.

Raw Material Price Volatility and Supply Chain Disruptions

Fluctuations in steel, aluminum, and composite material prices directly impact manufacturing costs for industrial gas cylinders. Global supply chain disruptions, currency fluctuations, and raw material availability constraints create pricing pressures and inventory management challenges for manufacturers operating in Japan's competitive market environment.

Competition from Alternative Gas Delivery Technologies

The industrial gas cylinders market faces increasing competition from alternative delivery methods including bulk liquid storage, on-site gas generation systems, and pipeline supply solutions. Large industrial consumers increasingly evaluate total cost of ownership, favoring integrated gas supply solutions that may reduce dependence on traditional cylinder-based delivery systems.

Competitive Landscape:

The Japan industrial gas cylinders market exhibits a moderately consolidated competitive structure characterized by established domestic manufacturers and multinational industrial gas corporations operating comprehensive supply networks. Market participants compete through technological innovation, product quality differentiation, and extensive service capabilities spanning manufacturing, distribution, maintenance, and technical support. Leading companies leverage their established customer relationships, manufacturing expertise, and distribution infrastructure to maintain market positions across diverse industrial applications. Strategic partnerships between cylinder manufacturers and industrial gas suppliers facilitate integrated solution offerings addressing complex customer requirements. The competitive landscape continues to evolve with increasing emphasis on sustainable technologies, smart cylinder solutions, and specialized products serving emerging applications in hydrogen infrastructure, semiconductor manufacturing, and healthcare sectors. Market leaders invest substantially in research and development to enhance cylinder performance, safety features, and operational efficiency while expanding production capacities to meet growing demand across Japan's industrial ecosystem.

Recent Developments:

- In January 2024, GE Vernova's gas power business and IHI Corporation signed an agreement for building a gas turbine combustor capable of utilizing ammonia as a viable fuel option, supporting Japan's clean energy transition initiatives and creating demand for specialized gas storage solutions.

Japan Industrial Gas Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steel Industrial Gas Cylinder, Aluminum Industrial Gas Cylinder, Composite Industrial Cylinder |

| Applications Covered | General Industry, Chemical Energy, Food Industry, Medical Industry, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan industrial gas cylinders market size was valued at USD 409.68 Million in 2025.

The Japan industrial gas cylinders market is expected to grow at a compound annual growth rate of 3.94% from 2026-2034 to reach USD 580.21 Million by 2034.

Steel industrial gas cylinders dominated the market with 62% share in 2025, owing to superior durability, cost-effectiveness, and extensive applications in heavy industries including steel manufacturing and chemical processing across Japan's industrial corridors.

Key factors driving the Japan industrial gas cylinders market include expanding healthcare infrastructure serving an aging population, strategic investments in hydrogen energy and clean technology, and advanced manufacturing requirements from semiconductor and automotive industries.

Major challenges include stringent regulatory compliance requirements, raw material price volatility affecting manufacturing costs, competition from alternative gas delivery technologies, supply chain disruptions, and increasing operational costs associated with safety certifications and quality standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)