Japan Industrial Ovens and Furnaces Market Size, Share, Trends and Forecast by Product, Power Type, Application, and Region, 2026-2034

Japan Industrial Ovens and Furnaces Market Summary:

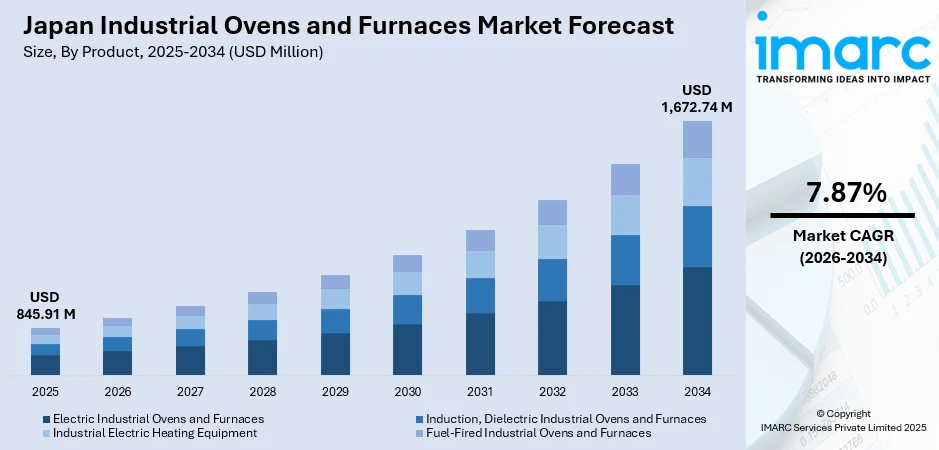

The Japan industrial ovens and furnaces market size was valued at USD 845.91 Million in 2025 and is projected to reach USD 1,672.74 Million by 2034, growing at a compound annual growth rate of 7.87% from 2026-2034.

The Japan industrial ovens and furnaces market is experiencing robust growth, propelled by the nation's advanced manufacturing ecosystem and commitment to carbon neutrality. The market benefits from Japan's leadership in precision engineering across automotive, electronics, and semiconductor industries. Government-backed green transformation initiatives are accelerating investments in energy-efficient thermal processing solutions, while the shift toward electric arc furnaces in the steel sector reflects broader decarbonization trends. These developments, combined with technological integration of IoT and AI capabilities, are driving substantial demand for advanced thermal equipment, reinforcing Japan's industrial ovens and furnaces market share.

Key Takeaways and Insights:

- By Product: Electric industrial ovens and furnaces dominate the market with a share of 44.2% in 2025, driven by superior energy efficiency, precise temperature control, and alignment with Japan's decarbonization goals for industrial manufacturing processes.

- By Power Type: Electric type leads the market with a share of 65.7% in 2025, supported by government incentives for clean energy adoption and the growing preference for pollution-free heating solutions across precision manufacturing sectors.

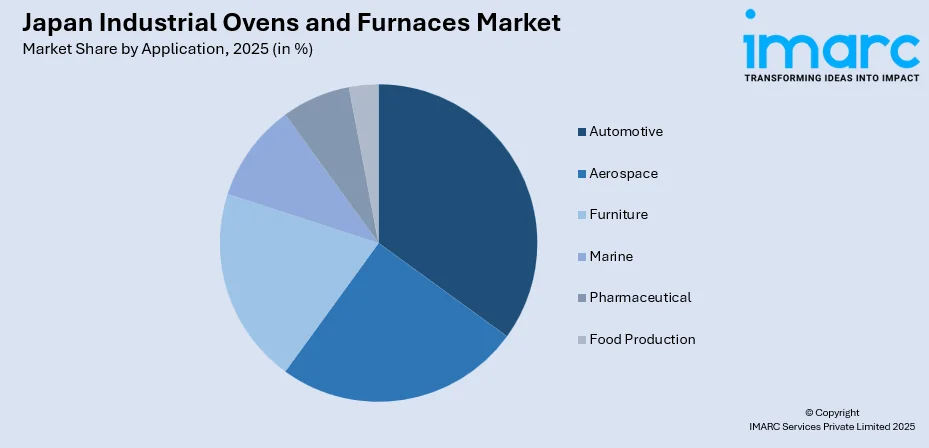

- By Application: Automotive represents the largest segment with a market share of 34.3% in 2025, fueled by Japan's position as a global automotive manufacturing hub and increasing demand for heat treatment in electric vehicle component production.

- By Region: Kanto Region dominates the market with a share of 33.8% in 2025, owing to the concentration of major manufacturing facilities, advanced technology infrastructure, and proximity to key automotive and electronics production centers.

- Key Players: The Japan industrial ovens and furnaces market exhibits a moderately consolidated competitive structure, with domestic manufacturers leveraging technological expertise in precision thermal equipment alongside international players. Competition centers on energy efficiency innovations, automation capabilities, and customized solutions for diverse industrial applications.

To get more information on this market Request Sample

The Japan industrial ovens and furnaces market exhibits a moderately consolidated competitive landscape characterized by a blend of established domestic manufacturers and international participants. Leading market players leverage decades of thermal processing expertise, advanced research and development capabilities, and strong relationships with key industrial sectors. Domestic manufacturers benefit from deep understanding of local industry requirements, proximity to major customers, and established service networks across the country. Competition centers on technological innovation, energy efficiency improvements, precision control capabilities, and after-sales service quality. Companies differentiate through specialized solutions tailored to specific applications including semiconductor processing, automotive heat treatment, and aerospace component manufacturing. Strategic partnerships between equipment manufacturers and end-user industries drive product development and customization. Market participants increasingly focus on developing environmentally sustainable thermal solutions aligned with national decarbonization objectives, while investing in smart manufacturing integration and predictive maintenance capabilities to enhance customer value propositions.

Japan Industrial Ovens and Furnaces Market Trends:

Accelerated Transition to Electric Arc Furnace Technology

Japanese manufacturers are rapidly transitioning from conventional blast furnaces to electric arc furnaces as part of comprehensive decarbonization strategies. This shift reflects the industry's commitment to reducing carbon emissions while maintaining high-quality production standards essential for automotive, electronics, and precision manufacturing applications. Electric arc furnaces offer significant environmental advantages through lower greenhouse gas emissions and greater compatibility with renewable energy sources. The transformation aligns with national climate objectives and positions Japanese manufacturers competitively in global markets increasingly focused on sustainable production practices.

Integration of Smart Manufacturing and IoT Technologies

The integration of Industry 4.0 technologies into thermal processing equipment is revolutionizing manufacturing operations across Japan. Smart ovens and furnaces equipped with IoT sensors, AI-powered monitoring systems, and predictive maintenance capabilities are becoming increasingly prevalent. In November 2024, Sony Semiconductor Solutions Corporation unveiled the IMX925 stacked CMOS image sensor, designed for industrial imaging applications including furnace monitoring, offering 24.55 effective megapixels and enhanced precision for factory automation. These technological integrations enable real-time process optimization, reduced energy consumption, and enhanced product quality.

Growing Demand for Energy-Efficient Thermal Solutions

Energy efficiency has emerged as a paramount consideration in thermal equipment selection, driven by Japan's high energy import dependency and stringent environmental regulations. Induction heating systems and vacuum heat treatment technologies are gaining significant traction, offering superior energy savings compared to conventional heating methods. In June 2024, Toyo Glass announced plans to transition from air combustion to oxygen combustion in its glass-melting furnace at its Chiba facility during refurbishment scheduled for December 2025, representing the industry's broader shift toward environmentally friendly furnace technologies. This trend aligns with Japan's commitment to reducing greenhouse gas emissions by 2030 compared to 2013 levels.

Market Outlook 2026-2034:

The Japan industrial ovens and furnaces market is positioned for sustained expansion through the forecast period, driven by the convergence of government policy support, technological innovation, and industrial modernization. The Green Transformation strategy, with substantial investments through transition bonds, provides a robust foundation for equipment upgrades across hard-to-abate sectors. The semiconductor industry's continued growth will generate substantial demand for precision thermal processing systems as fabrication facilities expand across the country. Additionally, the automotive sector's electrification trajectory, supported by government subsidies for electric vehicle purchases, creates new requirements for specialized heat treatment equipment in battery and motor component manufacturing. The market generated a revenue of USD 845.91 Million in 2025 and is projected to reach a revenue of USD 1,672.74 Million by 2034, growing at a compound annual growth rate of 7.87% from 2026-2034.

Japan Industrial Ovens and Furnaces Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Electric Industrial Ovens and Furnaces | 44.2% |

| Power Type | Electric Type | 65.7% |

| Application | Automotive | 34.3% |

| Region | Kanto Region | 33.8% |

Product Insights:

- Electric Industrial Ovens and Furnaces

- Induction, Dielectric Industrial Ovens and Furnaces

- Industrial Electric Heating Equipment

- Fuel-Fired Industrial Ovens and Furnaces

The electric industrial ovens and furnaces segment dominates with a market share of 44.2% of the total Japan industrial ovens and furnaces market in 2025.

Electric industrial ovens and furnaces have established clear market leadership in Japan, driven by their superior precision, energy efficiency, and environmental compatibility. These systems offer precise temperature control essential for manufacturing high-quality components in the automotive, electronics, and aerospace sectors. The growing emphasis on carbon neutrality has accelerated adoption, as electric systems produce no direct emissions during operation. Tokyo Electron, Japan's premier semiconductor equipment manufacturer, offers comprehensive thermal processing equipment portfolios including electric heating systems, contributing to the segment's technological advancement.

The segment's growth is further reinforced by Japan's steel industry transformation, where major producers are investing significantly in electric arc furnace technology. Tokyo Electron recently completed a major production facility in Oshu City specifically for thermal processing and single-wafer deposition systems, underscoring the strategic importance of electric thermal equipment in advanced manufacturing. The convergence of government policy support through the Green Transformation initiative and sustained industry investment creates a favorable environment for continued electric furnace adoption across multiple industrial sectors.

Power Type Insights:

- Combustion Type

- Electric Type

The electric type leads with a share of 65.7% of the total Japan industrial ovens and furnaces market in 2025.

Electric-powered thermal processing equipment dominates Japan's industrial landscape, reflecting the nation's strategic commitment to decarbonization and energy efficiency. This segment benefits from Japan's advanced electrical infrastructure and government promotion of clean energy adoption across industrial applications. Electric systems offer distinct advantages including precise temperature control, uniform heating, reduced maintenance requirements, and elimination of on-site combustion emissions, making them ideal for industries requiring stringent environmental compliance and operational consistency.

The steel industry's transition from blast furnaces to electric arc furnaces exemplifies this segment's evolution toward sustainable manufacturing. In February 2025, the Japanese Cabinet approved the Seventh Strategic Energy Plan establishing a target to reduce greenhouse gas emissions by 73% by fiscal year 2040 compared to 2013 levels. This policy framework accelerates industrial electrification and drives demand for advanced electric thermal processing systems across manufacturing sectors.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace

- Furniture

- Marine

- Automotive

- Pharmaceutical

- Food Production

The automotive segment holds the largest share at 34.3% of the total Japan industrial ovens and furnaces market in 2025.

Japan's automotive industry, the world's third-largest vehicle producer, drives substantial demand for industrial ovens and furnaces across manufacturing operations. Heat treatment processes are essential for producing high-quality automotive components, from engine parts to body panels, requiring precise thermal processing capabilities. The industry's accelerating transition to electric vehicles has created new demand for specialized thermal equipment in battery manufacturing, motor production, and power electronics component fabrication for next-generation mobility solutions.

Japanese automotive manufacturers are investing significantly in electrification infrastructure, with corresponding requirements for advanced thermal processing equipment. In fiscal year 2024, the Japanese government expanded the Clean Energy Vehicle subsidy budget to 129.1 Billion Yen, supporting electric vehicles, plug-in hybrids, and fuel cell vehicles. This policy framework stimulates electric vehicle production and drives demand for industrial ovens used in battery cell manufacturing, thermal management systems, and electric drivetrain component production.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits clear dominance with a 33.8% share of the total Japan industrial ovens and furnaces market in 2025.

The Kanto Region, encompassing Tokyo and surrounding prefectures, leads Japan's industrial ovens and furnaces market through its concentration of manufacturing facilities, technology headquarters, and research institutions. The region hosts Japan's largest electronics and automotive manufacturing clusters, generating substantial demand for precision thermal processing equipment. Tokyo's position as the nation's economic hub attracts major equipment manufacturers and facilitates technology transfer, while the region's robust infrastructure supports advanced manufacturing operations.

The semiconductor industry presence in Kanto creates ongoing demand for thermal processing systems. The region's leadership in Industry 4.0 adoption allows manufacturers to cut operating costs and streamline production processes, enhancing Japan's worldwide competitiveness in advanced manufacturing. In 2025, the EU-Japan Centre's Smart Factory and Robotics Business Mission was held during Factory Innovation Week in Japan, fostering collaboration between SMEs and clusters specializing in AI, robotics, and sustainable manufacturing technologies.

Market Dynamics:

Growth Drivers:

Why is the Japan Industrial Ovens and Furnaces Market Growing?

Government-Led Green Transformation Initiatives Accelerating Industrial Modernization

Japan's comprehensive Green Transformation strategy represents a fundamental catalyst for industrial ovens and furnaces market expansion. The government's commitment to achieving carbon neutrality by 2050 has generated unprecedented policy support for clean industrial equipment adoption. The Ministry of Economy, Trade and Industry has designated industrial process conversion in hard-to-abate sectors as a priority area, allocating substantial funding through the Green Innovation Fund at 2 Trillion Yen. This policy framework provides manufacturers with financial incentives and regulatory clarity to invest in advanced thermal processing equipment. This unprecedented government backing creates a favorable investment environment that directly accelerates market growth.

Expansion of Semiconductor and Electronics Manufacturing Requiring Precision Thermal Equipment

Japan's resurgent semiconductor industry is generating substantial demand for advanced thermal processing equipment. The establishment of new semiconductor fabrication facilities, including TSMC's operations in Kumamoto and Rapidus's 2-nanometer chip facility in Hokkaido, creates concentrated demand for precision thermal equipment. Rapidus Corporation has received government support totaling 330 billion yen for its Chitose facility, where pilot production commences in April 2025 with mass production targeted for 2027. These facilities require extensive thermal processing capabilities for wafer fabrication, including diffusion furnaces and thermal oxidation systems. The semiconductor equipment market is projected to exceed 5 trillion yen annually by 2026, ensuring sustained demand for thermal processing solutions.

Automotive Industry Electrification Driving New Thermal Processing Requirements

Japan's automotive sector transformation toward electrification is creating significant new demand for industrial thermal equipment. The shift from internal combustion engines to electric vehicles requires different manufacturing processes and specialized heat treatment for battery components, electric motors, and power electronics. Major Japanese automakers are investing heavily in electrification infrastructure, generating corresponding demand for thermal processing equipment. Toyota's battery development and production plans received certification from METI in September 2024 as part of Japan's battery supply assurance program. The company is constructing new lithium-ion battery plants alongside Nissan and Subaru, with government subsidies covering approximately one-third of costs. These investments in electric vehicle production capacity translate directly into demand for specialized ovens and furnaces capable of battery cell processing, electrode drying, and component heat treatment.

Market Restraints:

What Challenges the Japan Industrial Ovens and Furnaces Market is Facing?

High Capital Investment Requirements for Advanced Thermal Equipment

The substantial capital expenditure required for modern industrial ovens and furnaces presents a significant barrier, particularly for small and medium-sized enterprises. Electric arc furnaces and advanced thermal processing systems demand investments of hundreds of billions of yen, limiting adoption to larger manufacturers with access to significant financing. Additionally, the transition from conventional to electric systems incurs increased operational costs including raw materials and electricity expenses.

High Energy Import Dependency Affecting Operational Costs

Japan's substantial reliance on imported energy creates cost uncertainties for thermal equipment operations. The country imports nearly all of its oil, liquefied natural gas, and coal requirements from foreign sources. This dependency subjects manufacturers to price volatility and supply disruptions, complicating operational planning and potentially reducing the cost-effectiveness of certain thermal processing technologies that rely heavily on fossil fuel inputs.

Skilled Labor Shortage in Advanced Manufacturing Operations

The increasing sophistication of industrial thermal equipment requires specialized technical expertise that is becoming scarce in Japan's aging workforce. Operating and maintaining advanced electric furnaces, IoT-integrated systems, and automated thermal processing equipment demands specialized training that fewer workers possess. This skills gap creates challenges for manufacturers seeking to adopt next-generation thermal technologies, potentially slowing modernization efforts and limiting the operational efficiency gains that advanced equipment could otherwise deliver across industrial applications.

Competitive Landscape:

The Japan industrial ovens and furnaces market exhibits a moderately consolidated competitive structure characterized by the presence of established domestic manufacturers with deep expertise in precision thermal engineering alongside international equipment suppliers. Competition is primarily driven by technological innovation, energy efficiency performance, and the ability to provide customized solutions for diverse industrial applications. Japanese manufacturers leverage their legacy of manufacturing excellence and close relationships with major end-users in automotive, semiconductor, and steel industries to maintain market positions. The market is witnessing increased collaboration between equipment manufacturers and end users for developing application-specific thermal solutions that meet stringent quality and environmental standards. Strategic partnerships with technology providers for IoT integration and automation capabilities have become essential competitive differentiators.

Recent Developments:

- May 2025: Nippon Steel announced investment of JPY 870 Billion (approximately $6.05 Billion) to introduce electric arc furnaces at three facilities across Japan, expecting up to 251.4 billion yen in government subsidies under the Green Transformation Promotion Act, with combined annual production capacity of 2.9 million tons scheduled for fiscal year 2029.

- April 2025: JFE Steel Corporation announced construction of a large-scale, high-efficiency electric arc furnace at its West Japan Works facility in Kurashiki, with total investment of 329.4 Billion Yen and government grant support of up to 104.5 Billion Yen, featuring annual production capacity of approximately 2 Million Tons with operation scheduled from fiscal year 2028.

Japan Industrial Ovens and Furnaces Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electric Industrial Ovens and Furnaces, Induction, Dielectric Industrial Ovens and Furnaces, Industrial Electric Heating Equipment, Fuel-Fired Industrial Ovens and Furnaces |

| Power Types Covered | Combustion Type, Electric Type |

| Applications Covered | Aerospace, Furniture, Marine, Automotive, Pharmaceutical, Food Production |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan industrial ovens and furnaces market size was valued at USD 845.91 Million in 2025.

The Japan industrial ovens and furnaces market is expected to grow at a compound annual growth rate of 7.87% from 2026-2034 to reach USD 1,672.74 Million by 2034.

Electric industrial ovens and furnaces dominated the market with a 44.2% share in 2025, driven by superior energy efficiency, precise temperature control capabilities, and alignment with Japan's comprehensive decarbonization initiatives across manufacturing sectors.

Key factors driving the Japan industrial ovens and furnaces market include government-led Green Transformation initiatives with substantial financial support, expansion of semiconductor manufacturing requiring precision thermal equipment, automotive industry electrification creating new heat treatment requirements, and technological integration of IoT and smart manufacturing capabilities.

Major challenges include high capital investment requirements for advanced thermal equipment, Japan's significant energy import dependency affecting operational costs, skilled labor shortages in advanced manufacturing operations, and the complexity of transitioning existing facilities from conventional to electric systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)