Japan Industrial Safety Equipment Market Size, Share, Trends and Forecast by Product Type, End-Use Industry, and Region, 2026-2034

Japan Industrial Safety Equipment Market Summary:

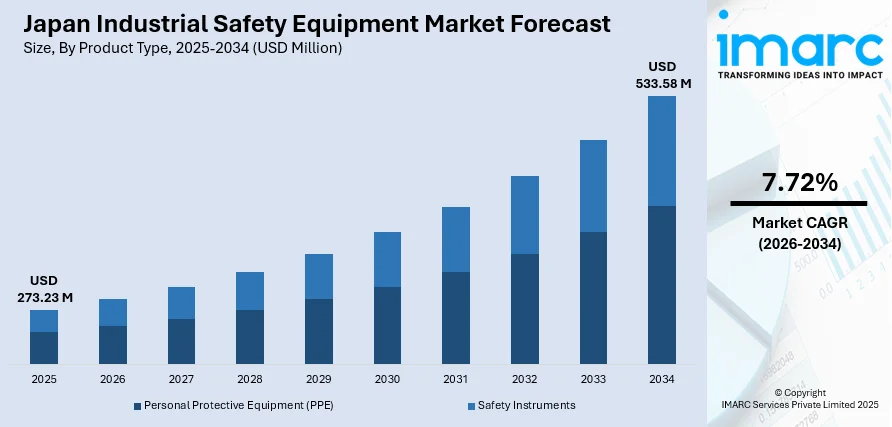

The Japan industrial safety equipment market size was valued at USD 273.23 Million in 2025 and is projected to reach USD 533.58 Million by 2034, growing at a compound annual growth rate of 7.72% from 2026-2034.

Japan's industrial safety equipment market is experiencing robust growth driven by stringent workplace safety regulations and evolving occupational health standards. The nation's advanced manufacturing sector, coupled with its commitment to worker welfare, continues to fuel demand for innovative protective solutions. The market benefits from technological advancements, smart safety systems integration, and heightened awareness regarding industrial hazard prevention across diverse sectors.

Key Takeaways and Insights:

- By Product Type: Personal Protective Equipment (PPE) dominates the market with a share of 59% in 2025, driven by comprehensive regulatory mandates and widespread adoption across manufacturing, construction, and chemical industries requiring head, eye, respiratory, and hand protection solutions.

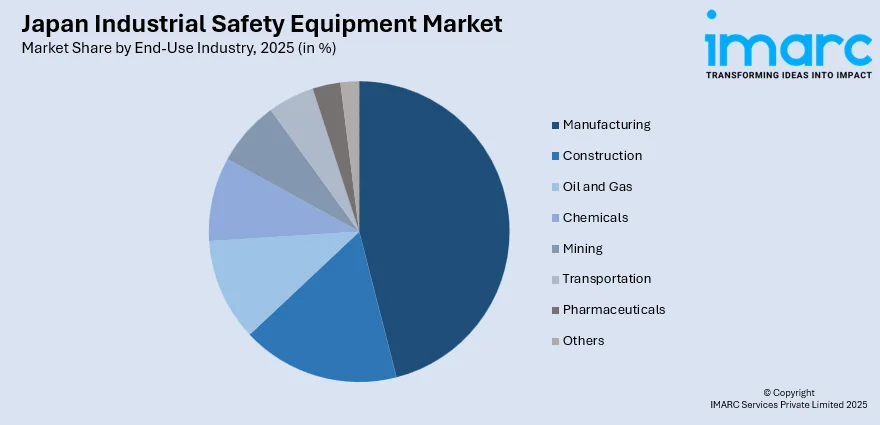

- By End-Use Industry: Manufacturing leads the market with a share of 46% in 2025, owing to Japan's position as a global manufacturing powerhouse with extensive automotive, electronics, and precision machinery production facilities requiring comprehensive worker protection systems.

- Key Players: The Japan industrial safety equipment market exhibits a moderately consolidated competitive landscape with established domestic manufacturers competing alongside global multinational corporations. Market participants focus on technological innovation, product differentiation, and strategic partnerships to strengthen their market positioning.

To get more information on this market Request Sample

Japan's industrial safety equipment market is propelled by the government's continuous reinforcement of workplace safety regulations and occupational health standards. The Ministry of Health, Labour and Welfare, alongside the Japan Industrial Safety and Health Association, establishes rigorous compliance frameworks that mandate safety equipment adoption across industrial sectors. In 2025, Japan amended the Industrial Safety and Health Act, expanding mandatory chemical labeling and SDS requirements, increasing employer obligations, and boosting demand for protective equipment and workplace safety compliance systems. The nation's aging workforce demographics necessitate ergonomic safety solutions and enhanced protective technologies to accommodate physical limitations while maintaining productivity. Furthermore, Japan's leadership in industrial automation and robotics integration creates demand for advanced safety instrumentation systems including sensors, controllers, and emergency shutdown mechanisms. The convergence of traditional manufacturing excellence with digital transformation initiatives is accelerating smart safety technology deployment, incorporating artificial intelligence and Internet of Things (IoT) capabilities for real-time hazard monitoring and predictive risk assessment.

Japan Industrial Safety Equipment Market Trends:

Integration of Smart and Connected Safety Technologies

Japanese manufacturers are increasingly incorporating intelligent sensors, wearable devices, and Internet of Things enabled safety equipment into industrial operations. In 2025, Murata Manufacturing and Toda Corporation deployed over 10,000 sensors across 100+ companies, tracking biometric and environmental data to reduce heat-stress and enhance real-time worker safety. These connected solutions enable real-time monitoring of worker conditions, environmental hazards, and equipment status, facilitating proactive risk management. Smart helmets with integrated communication systems, biometric monitoring wearables, and AI-powered gas detection systems represent the evolution toward predictive safety management in modern industrial facilities.

Ergonomic Design Innovations for Aging Workforce

Japan's demographic landscape, characterized by an aging population and declining birth rates, is driving innovations in ergonomic safety equipment design. In 2025, Dia Industry Co., Ltd. showcased its assist‑suit exoskeleton at NSC Safety Congress & Expo in the U.S., emphasizing global interest in ergonomically supportive gear for aging workforces. Manufacturers are developing lightweight protective gear, powered exoskeletons for physical support, and adaptive personal protective equipment that accommodates physical limitations while ensuring comprehensive protection. This trend addresses workforce sustainability concerns while maintaining stringent safety standards across labor-intensive industrial sectors.

Sustainability and Eco-Friendly Safety Solutions

Environmental consciousness is reshaping Japan's industrial safety equipment landscape, with manufacturers developing sustainable and recyclable protective products. In 2024, Espec Corporation established a “Sustainable Procurement Guideline” promoting environmentally responsible sourcing, human rights, safety, and eco-friendly supply chain practices, reinforcing sustainable approaches across product lifecycles. Companies are adopting eco-friendly materials, implementing circular economy principles in product design, and reducing carbon footprints throughout manufacturing processes. This shift aligns with Japan's broader sustainability commitments and corporate environmental responsibility initiatives, creating demand for green safety solutions across industrial applications.

Market Outlook 2026-2034:

The Japan industrial safety equipment market demonstrates promising growth prospects throughout the forecast period, supported by strengthening regulatory frameworks, technological advancements, and evolving workplace safety cultures. Continued investments in manufacturing modernization, infrastructure development, and industrial automation will sustain demand for protective equipment and safety instrumentation systems. The market generated a revenue of USD 273.23 Million in 2025 and is projected to reach a revenue of USD 533.58 Million by 2034, growing at a compound annual growth rate of 7.72% from 2026-2034.

Japan Industrial Safety Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Personal Protective Equipment (PPE) | 59% |

| End-Use Industry | Manufacturing | 46% |

Product Type Insights:

- Personal Protective Equipment (PPE)

- Head Protection

- Eye and Face Protection

- Hearing Protection

- Respiratory Protection

- Hand Protection

- Protective Clothing

- Foot Protection

- Safety Instruments

- Safety Sensors

- Safety Controllers/Relays

- Safety Valves

- Emergency Shutdown Systems (ESD)

- Fire and Gas Monitoring Systems

- High Integrity Pressure Protection Systems (HIPPS)

- Burner Management Systems (BMS)

The Personal Protective Equipment (PPE) dominates with a market share of 59% of the total Japan industrial safety equipment market in 2025.

Personal Protective Equipment (PPE) constitutes the largest product segment in Japan's industrial safety equipment market, encompassing head protection, eye and face protection, hearing protection, respiratory protection, hand protection, protective clothing, and foot protection categories. The segment's dominance reflects Japan's comprehensive regulatory framework mandating worker protection across all industrial sectors. Manufacturing facilities, construction sites, chemical processing plants, and transportation operations require extensive PPE deployment to ensure worker safety and regulatory compliance. In 2025, at Japan’s Green Cross Exhibition in Osaka, Ansell Healthcare showcased its “Ansell Guardian Chemical” glove tool and new protective gloves, highlighting PPE innovation for Japan’s industrial safety needs.

Japanese PPE manufacturers emphasize technological innovation, integrating advanced materials and ergonomic designs to enhance user comfort and protection effectiveness. The segment benefits from continuous product development initiatives addressing specific industry requirements, climate considerations, and workforce demographic characteristics. Growing awareness regarding occupational health hazards and employer liability concerns further drives PPE adoption, with companies investing in premium protective solutions to safeguard their workforce and maintain operational continuity.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Construction

- Oil and Gas

- Chemicals

- Mining

- Transportation

- Pharmaceuticals

- Others

The manufacturing leads with a share of 46% of the total Japan industrial safety equipment market in 2025.

Japan's manufacturing sector represents the primary consumer of industrial safety equipment, driven by the nation's extensive industrial base spanning automotive, electronics, precision machinery, chemicals, and heavy industries. Manufacturing facilities operate under stringent safety protocols requiring comprehensive protective equipment deployment for workforce protection. The sector's emphasis on operational excellence and quality management extends to worker safety, with manufacturers implementing robust safety programs incorporating advanced equipment and systematic training initiatives.

The manufacturing industry's safety equipment requirements encompass personal protective gear, safety instrumentation systems, emergency response equipment, and environmental monitoring solutions. Japan's manufacturing modernization initiatives, including Industry 4.0 adoption and smart factory development, create additional demand for integrated safety technologies capable of interfacing with automated production systems. The sector's global competitiveness depends on maintaining exemplary safety records, driving continuous investment in protective equipment upgrades and safety system enhancements.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates Japan's industrial safety equipment market, anchored by Tokyo and the Keihin Industrial Zone encompassing Yokohama and Kawasaki. This economic powerhouse serves as the nation's largest hub and hosts extensive manufacturing, petrochemical, and heavy industrial facilities requiring comprehensive safety solutions and advanced protective equipment systems.

The Kansai/Kinki Region represents Japan's second-largest industrial hub, centered around Osaka, Kobe, and Kyoto metropolitan areas. The Keihanshin Industrial Zone supports diverse manufacturing operations including electronics, pharmaceuticals, and machinery production. Strong industrial heritage combined with modern manufacturing facilities generates substantial demand for personal protective equipment and safety instrumentation systems.

The Central/Chubu Region serves as Japan's automotive manufacturing heartland, with Nagoya and surrounding prefectures hosting major vehicle production facilities. This region represents a significant share of national manufactured goods shipments and demonstrates exceptional demand for industrial safety equipment supporting automotive assembly operations, parts manufacturing, and related supply chain industries.

The Kyushu-Okinawa Region emerges as a leading economic zone in southern Japan, distinguished by semiconductor manufacturing, integrated circuit production, and automotive assembly operations. The region accounts for significant shares of national electronics and vehicle production, driving demand for specialized safety equipment in high-technology manufacturing environments and precision component facilities.

The Tohoku Region specializes in electrical machinery manufacturing and food processing industries, with growing electronics production capabilities following industrial development initiatives. Regional manufacturing facilities require comprehensive safety equipment portfolios addressing electrical hazards, food safety compliance, and general industrial protection needs across diverse operational environments.

The Chugoku Region features advanced research and development activities in electronics, biotechnology, and new materials sectors. The Setouchi Industrial Zone along the Inland Sea hosts heavy industries including shipbuilding, steel production, and petrochemical processing. These industrial operations generate consistent demand for specialized protective equipment and advanced safety monitoring systems.

Hokkaido Region's industrial safety equipment market is shaped by food processing, agricultural machinery, and chemical manufacturing operations concentrated in major industrial cities. The region's harsh climate conditions necessitate specialized protective equipment designed for cold weather operations, while food processing facilities require hygiene-compliant safety solutions meeting stringent regulatory standards.

The Shikoku Region maintains industrial activities in chemicals, paper manufacturing, and heavy machinery production along northern coastal areas connected to the Setouchi Industrial Zone. Regional facilities require safety equipment supporting chemical handling operations, paper mill environments, and machinery manufacturing processes, with emphasis on respiratory protection and hazardous material handling solutions.

Market Dynamics:

Growth Drivers:

Why is the Japan Industrial Safety Equipment Market Growing?

Stringent Regulatory Framework and Compliance Requirements

Japan maintains one of the world's most comprehensive occupational safety and health regulatory frameworks, administered by the Ministry of Health, Labour and Welfare and enforced through the Industrial Safety and Health Act. These regulations mandate specific safety equipment requirements across industrial sectors, establishing minimum standards for protective gear, safety instrumentation, and workplace hazard mitigation systems. In 2025, Japan revised the Labour Safety and Health Law and Industrial Environment Measurement Law, expanding stress checks and chemical risk assessments, reinforcing employer responsibilities for proactive hazard prevention and safety equipment use. Regulatory authorities conduct regular inspections and impose penalties for non-compliance, compelling industrial operators to invest in appropriate safety equipment. The continuous strengthening of these requirements, driven by evolving workplace hazard understanding and international best practices adoption, sustains market demand for compliant safety solutions across Japan's industrial landscape.

Industrial Automation and Smart Manufacturing Expansion

Japan's leadership in industrial automation and robotics deployment creates substantial demand for advanced safety instrumentation systems designed to protect workers operating alongside automated equipment. In 2024, Japan’s automotive industry installed around 13,000 industrial robots, an 11 % increase from 2023, marking a five-year high and highlighting rapid automation adoption in manufacturing. Smart factory initiatives incorporating artificial intelligence, machine learning, and Internet of Things technologies require sophisticated safety sensors, controllers, and monitoring systems capable of real-time hazard detection and response. The integration of collaborative robots in manufacturing environments necessitates enhanced safety protocols and specialized protective equipment ensuring safe human-machine interaction. This technological transformation drives continuous investment in cutting-edge safety solutions, positioning the industrial safety equipment market for sustained growth throughout the forecast period.

Aging Workforce and Ergonomic Safety Considerations

Japan's demographic landscape, characterized by an aging population and declining workforce participation, significantly influences industrial safety equipment demand. In 2024, Japan employed a record 9.3 million people aged 65 and older for the 21st consecutive year, reflecting growing reliance on senior workers amid demographic changes. Employers increasingly recognize the need for ergonomically designed protective equipment accommodating age-related physical limitations while maintaining comprehensive protection standards. This demographic shift drives innovation in lightweight materials, adaptive fit technologies, and powered assistance devices including industrial exoskeletons. Companies invest in premium safety solutions that reduce physical strain and prevent age-related workplace injuries, supporting workforce sustainability and productivity maintenance. The convergence of demographic pressures and safety requirements creates favorable conditions for market expansion as manufacturers develop specialized solutions addressing Japan's unique workforce characteristics.

Market Restraints:

What Challenges the Japan Industrial Safety Equipment Market is Facing?

High Implementation Costs for Advanced Safety Technologies

The deployment of advanced safety technologies, including artificial intelligence-driven systems, Internet of Things-enabled monitoring, and integrated safety platforms, requires substantial capital investment. Small and medium enterprises, which constitute the majority of Japan's industrial base, often face financial constraints limiting their ability to adopt premium safety solutions. High upfront costs combined with ongoing maintenance and system upgrade expenses create adoption barriers, particularly for companies operating with tight margins.

Skilled Labor Shortages for Safety System Implementation

The successful deployment and operation of sophisticated safety equipment and instrumentation systems requires trained personnel capable of installation, maintenance, and optimization. Japan's broader labor shortage extends to specialized technical roles, creating challenges for companies seeking qualified safety professionals. This workforce constraint can delay safety system implementations and limit the effectiveness of advanced protective technologies requiring specialized operational knowledge.

Integration Challenges with Legacy Industrial Systems

Many Japanese manufacturing facilities operate with established production systems and legacy equipment requiring careful consideration when implementing modern safety technologies. Compatibility issues between new safety instrumentation and existing industrial control systems can complicate deployment efforts. The need for customized integration solutions and potential production disruptions during implementation creates hesitation among facility operators considering safety system upgrades.

Competitive Landscape:

The Japan industrial safety equipment market exhibits a moderately consolidated competitive structure characterized by the presence of established domestic manufacturers alongside global multinational corporations. Market participants compete across multiple dimensions including product quality, technological innovation, pricing strategies, and customer service capabilities. Domestic companies leverage deep understanding of local regulatory requirements and customer preferences, while international players bring global technological expertise and comprehensive product portfolios. Strategic partnerships, mergers and acquisitions, and research and development investments characterize competitive dynamics as companies seek to strengthen market positioning. Manufacturers increasingly focus on integrated safety solutions combining hardware, software, and service components to differentiate offerings and capture greater customer value.

Recent Developments:

- In July 2025, Ansell has launched its KIMTECH™ PPE range in Japan, targeting laboratory and cleanroom safety for pharma, semiconductor, and manufacturing sectors. The product line was showcased at Interphex Tokyo, offering compliance support and advisory services to meet evolving chemical and contamination control safety regulations.

Japan Industrial Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End-Use Industries Covered | Manufacturing, Construction, Oil and Gas, Chemicals, Mining, Transportation, Pharmaceuticals, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan industrial safety equipment market size was valued at USD 273.23 Million in 2025.

The Japan industrial safety equipment market is expected to grow at a compound annual growth rate of 7.72% from 2026-2034 to reach USD 533.58 Million by 2034.

Personal Protective Equipment (PPE) dominated the market with a 59% share, driven by comprehensive regulatory mandates across manufacturing, construction, and chemical industries.

Key factors driving the Japan industrial safety equipment market include stringent workplace safety regulations, industrial automation expansion, technological innovations in protective equipment, and growing emphasis on worker health and wellness across manufacturing sectors.

Major challenges include high implementation costs for advanced safety technologies, skilled labor shortages for system deployment and maintenance, integration difficulties with legacy industrial systems, and budget constraints among small and medium enterprises limiting premium solution adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)