Japan Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2026-2034

Japan Inflight Catering Market Overview:

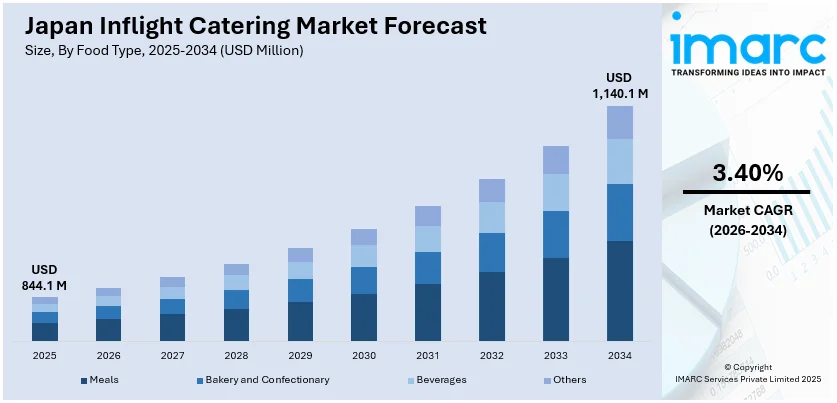

The Japan inflight catering market size reached USD 844.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,140.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.40% during 2026-2034. Rising international passenger traffic, escalating demand for premium and culturally authentic inflight meals, advancements in sustainable packaging, and strategic collaborations with renowned chefs and local food producers are among the key factors driving the Japan inflight catering market, as airlines aim to enhance passenger satisfaction and differentiate their services in a competitive landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 844.1 Million |

| Market Forecast in 2034 | USD 1,140.1 Million |

| Market Growth Rate 2026-2034 | 3.40% |

Japan Inflight Catering Market Trends:

Rising International Tourism and Passenger Traffic

Japan has recorded a consistent stream of overseas visitors, especially following the relaxation of travel restrictions related to the pandemic. The tourism resurgence initiatives of the government - such as visa relaxations, improved airport facilities, and targeted promotion campaigns - have made Japan one of the leading tourism destinations globally. Now, with Japan hosting the Osaka Expo 2025 and the global popularity of Japanese culture, natural sights, and cuisine, inbound tourism is poised to expand strongly in the near-term. Growing international passenger volume is directly linked to rising demand for inflight meals, especially those custom-designed to satisfy multiple dietary restrictions and cultural considerations. Airlines engaged in long-distance and medium-haul international services out of Japan have to make heavy investments in top-quality and diverse catering operations in order to serve global travelers' expectations. Furthermore, flight volume has accelerated significantly, with airlines being driven to acquire longer-range and guaranteed inflight catering facilities. Airports such as Narita and Haneda are key international terminals, and as a result, catering companies need to increase production, logistics, and customization capacity.

To get more information on this market Request Sample

Technological Advancements and Automation in Food Logistics

Another force behind Japan's inflight catering industry is its quick embrace of cutting-edge food logistics and automation technologies. As a world leader in robotics, artificial intelligence, and precision manufacturing, the incorporation of these technologies into inflight catering processes has facilitated unprecedented levels of efficiency, consistency, and safety. From robotic kitchens that employ precision cooking and portioning to AI-based inventory systems that streamline ingredient sourcing and minimize food waste, the whole value chain is being revolutionized. These technologies enable catering suppliers to prepare huge quantities of meals to exacting standards of hygiene and presentation, while also reacting to real-time information from airline partners about passenger preferences, dietary requirements, and flight schedules. Also, automated cold storage and rapid conveyor systems enhance the efficiency and dependability of food handling, so that meals are delivered to aircraft in prime condition, even during rush hours. This technological advantage not only saves labor costs in a nation with demographic challenges such as workforce aging, but also facilitates scalability—enabling providers to cope with both peak international demand and unexpected logistical issues such as flight delays or rescheduling.

Japan Inflight Catering Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on food type, flight service type, and aircraft seating class.

Food Type Insights:

- Meals

- Bakery and Confectionary

- Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the food type. This includes meals, bakery and confectionary, beverages, and others.

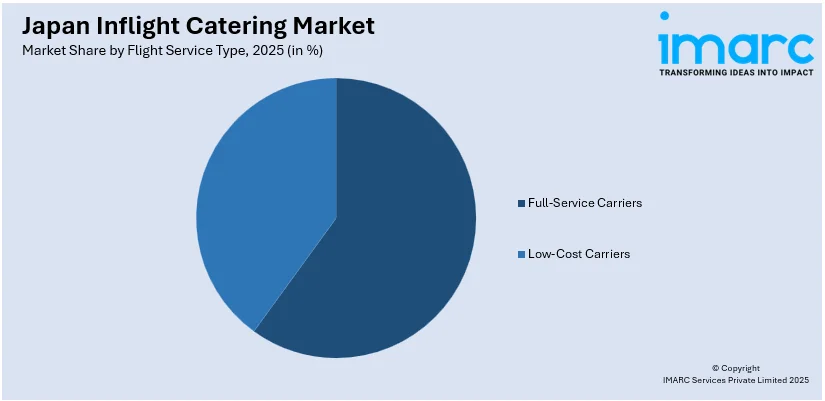

Flight Service Type Insights:

Access the comprehensive market breakdown Request Sample

- Full-Service Carriers

- Low-Cost Carriers

A detailed breakup and analysis of the market based on the flight service type have also been provided in the report. This includes full-service carriers and low-cost carriers.

Aircraft Seating Class Insights:

- Economy Class

- Business Class

- First Class

The report has provided a detailed breakup and analysis of the market based on the aircraft seating class. This includes economy class, business class, and first class.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Inflight Catering Market News:

- April 2025: Air India enhanced India-Japan connectivity by increasing its Delhi–Tokyo Haneda service from four weekly flights to daily operations. This expansion follows the airline's recent shift from Narita to the more centrally located Haneda Airport. The airline also highlighted its comprehensive inflight catering services, which offer a diverse selection of Indian and international cuisines across all classes.

- February 2025: ANA announced that it would expand its inflight and lounge beverage offerings by introducing 53 curated Japanese sake options, catering to both enthusiasts and newcomers. This initiative aims to enhance the passenger experience, showcasing Japan's cultural heritage through a diverse saké selection.

- January 2025: Japan Airlines (JAL) expanded its North American network by introducing a new daily flight between Chicago O’Hare and Tokyo Narita, complementing its existing service to Haneda. To elevate the passenger experience, JAL emphasizes its inflight catering services, offering chef-curated Japanese and Western meals across all classes. Passengers can pre-select meals, including express options for quicker service, and special dietary accommodations are available upon request.

- January 2023: Japan Airlines (JAL) partnered with renowned chef Daisuke Hayashi to offer a limited-time gluten-free rice flour noodle dish, "Rice Flour Noodle with Seafood in Starchy Sauce" on select flights between London Heathrow and Tokyo Haneda. This initiative, in collaboration with Japan's Ministry of Agriculture, Forestry and Fisheries and the All Japan Rice and Rice Related Foods Export Promotion Council, aims to promote Japanese rice flour products internationally.

Japan Inflight Catering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Food Types Covered | Meals, Bakery and Confectionary, Beverages, Others |

| Flight Service Types Covered | Full-Service Carriers, Low-Cost Carriers |

| Aircraft Seating Classes Covered | Economy Class, Business Class, First Class |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan inflight catering market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan inflight catering market on the basis of food type?

- What is the breakup of the Japan inflight catering market on the basis of flight service type?

- What is the breakup of the Japan inflight catering market on the basis of aircraft seating class?

- What are the various stages in the value chain of the Japan inflight catering market?

- What are the key driving factors and challenges in the Japan inflight catering market?

- What is the structure of the Japan inflight catering market and who are the key players?

- What is the degree of competition in the Japan inflight catering market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan inflight catering market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan inflight catering market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan inflight catering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)