Japan Inland Cargo Shipping Market Size, Share, Trends and Forecast by Cargo Type, Mode of Transport, Service Type, End-Use Industry, and Region, 2026-2034

Japan Inland Cargo Shipping Market Summary:

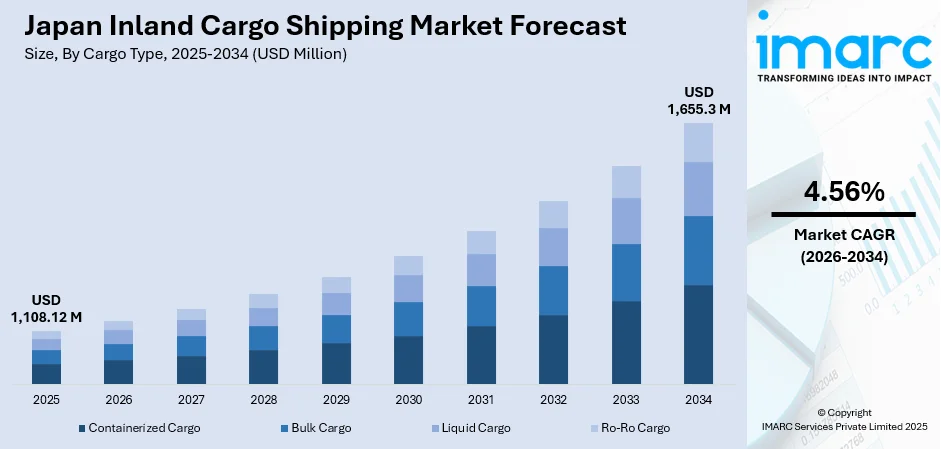

The Japan inland cargo shipping market size was valued at USD 1,108.12 Million in 2025 and is projected to reach USD 1,655.3 Million by 2034, growing at a compound annual growth rate of 4.56% from 2026-2034.

The Japan inland cargo shipping market is experiencing steady expansion driven by the country's strategic geographic positioning as an island nation dependent on maritime transport for domestic trade. The growing emphasis on modal shift initiatives, coupled with government investments in port modernization and automated logistics infrastructure, is catalyzing market growth. Increasing adoption of coastal shipping as a cost-effective alternative to road transport, combined with rising e-commerce demand and advanced supply chain integration, continues to reinforce the sector's development trajectory.

Key Takeaways and Insights:

-

By Cargo Type: Containerized cargo dominates the market with a share of 49% in 2025, driven by standardized intermodal transport efficiency enabling seamless integration across maritime, rail, and road networks for Japan's export-oriented manufacturing sector.

-

By Mode of Transport: Coastal shipping leads the market with a share of 54% in 2025, owing to its cost-effectiveness for domestic freight movement, reduced carbon footprint compared to trucking, and extensive port infrastructure connecting major industrial hubs.

-

By Service Type: Freight forwarding represents the largest segment with a market share of 49% in 2025, fueled by increasing demand for end-to-end logistics solutions, multimodal transport coordination, and digital booking platforms enhancing supply chain visibility.

-

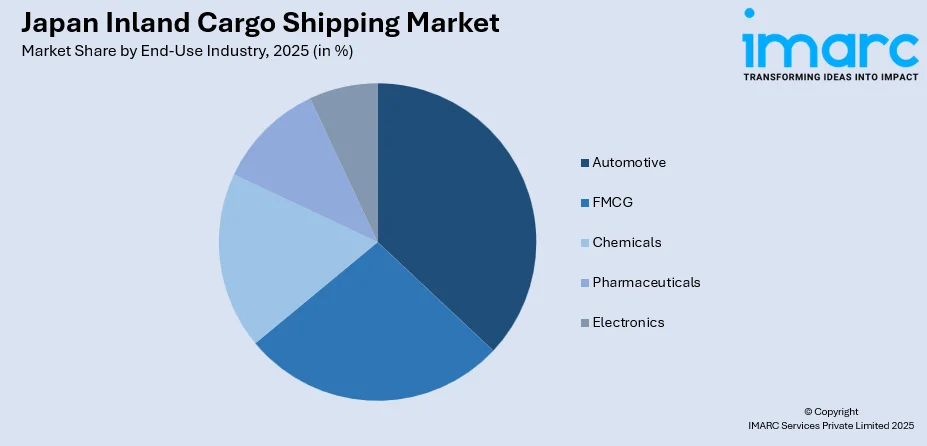

By End-Use Industry: Automotive dominates with a 32% share in 2025, reflecting Japan's position as a global automotive manufacturing powerhouse requiring robust logistics networks for component procurement and vehicle exports.

-

By Region: Kanto Region leads the market with approximately 36% share in 2025, attributed to the concentration of major ports including Tokyo and Yokohama, serving as the primary gateway for the Greater Tokyo Metropolitan Area's commercial activities.

-

Key Players: The Japan inland cargo shipping market exhibits a moderately consolidated competitive landscape, with established domestic carriers and integrated logistics providers competing alongside international freight forwarding companies. Major players are focusing on fleet modernization, digital transformation initiatives, and sustainable shipping solutions to strengthen market positioning.

To get more information on this market Request Sample

The Japan inland cargo shipping sector is witnessing transformative developments as the country addresses its logistics challenges through innovative solutions. The government's announcement of the Autoflow-Road project, a proposed automated conveyor belt network spanning over 500 kilometers between Tokyo and Osaka, exemplifies the nation's commitment to revolutionizing freight transport infrastructure. The integration of coastal shipping with advanced port automation technologies is creating operational synergies, while the adoption of IoT-enabled tracking systems and AI-powered route optimization platforms is enhancing overall supply chain efficiency across the maritime logistics ecosystem.

Japan Inland Cargo Shipping Market Trends:

Autonomous Vessel Development and Maritime Digitalization

Japan is accelerating efforts toward autonomous shipping through the MEGURI2040 initiative, aiming to deploy fully autonomous vessels in the coming decades supported by The Nippon Foundation. A consortium of Japanese companies specializing in container ships, passenger ferries, AI, and telecommunications is collaborating on advanced navigation systems, IoT integration, and remote operation technologies. The initiative addresses workforce shortages in the maritime sector while enhancing navigational safety by reducing human error, positioning Japan as a global leader in smart shipping innovation.

Modal Shift from Road to Coastal Shipping

The logistics industry is actively promoting modal shift strategies to address driver shortages and environmental concerns. Coastal shipping provides a sustainable alternative for long-haul freight, offering reduced carbon emissions and significant cost advantages over road transport. Companies are increasingly utilizing roll-on/roll-off vessels for efficient cargo transfer, with collaborative initiatives enabling shared marine transportation between major manufacturers. Coordinated route planning helps reduce empty vessel returns, maximizing load efficiency while supporting the government's sustainability goals.

Multimodal Integration and Green Logistics Initiatives

Japan's freight sector is embracing integrated multimodal transport solutions combining sea, road, and rail connectivity for seamless cargo movement. The launch of specialized services linking ocean freight with scheduled truck convoys is reducing delivery times for key industries including electronics and automotive. Sustainability initiatives are gaining momentum with shipping companies investing in fuel-efficient vessels, LNG-powered ships, and carbon-neutral logistics operations aligned with Japan's environmental commitment goals and international maritime decarbonization frameworks.

Market Outlook 2026-2034:

The Japan inland cargo shipping market is positioned for sustained growth as infrastructure modernization and technological integration reshape logistics operations. Government investments in port automation, smart terminal development, and green shipping corridors are creating favorable conditions for market expansion. The debut of cargo-dedicated bullet trains and the development of automated cargo transport systems between major metropolitan centers demonstrate Japan's innovative approach to addressing logistics challenges. The market generated a revenue of USD 1,108.12 Million in 2025 and is projected to reach a revenue of USD 1,655.3 Million by 2034, growing at a compound annual growth rate of 4.56% from 2026-2034.

Japan Inland Cargo Shipping Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Cargo Type |

Containerized Cargo |

49% |

|

Mode of Transport |

Coastal Shipping |

54% |

|

Service Type |

Freight Forwarding |

49% |

|

End-Use Industry |

Automotive |

32% |

|

Region |

Kanto Region |

36% |

Cargo Type Insights:

- Containerized Cargo

- Bulk Cargo

- Liquid Cargo

- Ro-Ro Cargo

The containerized cargo dominates with a market share of 49% of the total Japan inland cargo shipping market in 2025.

The containerized cargo segment maintains its leading position in Japan's inland cargo shipping market, driven by standardization advantages that enable efficient intermodal transport across maritime, rail, and road networks. The segment benefits from advanced automated terminal operations, streamlined customs procedures, and integrated digital tracking systems that enhance supply chain visibility for manufacturers and retailers. Growing export-oriented manufacturing activities further reinforce containerized shipping as the preferred method for transporting goods domestically and internationally.

The growth of containerized shipping is further supported by Japan's export-oriented manufacturing sector, particularly in electronics, machinery, and automotive components requiring reliable and time-sensitive delivery schedules. Port modernization initiatives are enhancing container handling efficiency, with investments in AI-based cargo management systems and real-time tracking technologies. The integration of blockchain platforms for secure documentation and the adoption of smart container solutions equipped with IoT sensors are revolutionizing cargo monitoring and logistics planning capabilities.

Mode of Transport Insights:

- Inland Waterways

- Coastal Shipping

- Transoceanic Shipping

The coastal shipping segment leads with a share of 54% of the total Japan inland cargo shipping market in 2025.

Coastal shipping represents the dominant mode of transport within Japan's inland cargo shipping landscape, offering a sustainable and cost-effective solution for domestic freight movement along the country's extensive coastline encompassing numerous ports. The segment handles substantial cargo volumes, with steel products, coal, and automotive shipments contributing significantly to overall throughput. Industry associations report continued investment in vessel modernization and route optimization to enhance operational efficiency while addressing environmental sustainability objectives.

The segment's dominance is reinforced by government policies promoting modal shift from road transport to coastal shipping, addressing driver shortages and environmental sustainability goals. Collaborative shipping arrangements between major manufacturers, such as joint marine transportation using RORO vessels, are maximizing load efficiency and reducing empty vessel returns. The industry is advancing toward autonomous vessel operations, with Japan targeting half of all coastal ships to operate autonomously, positioning the segment for enhanced competitiveness and operational reliability.

Service Type Insights:

- Freight Forwarding

- Warehousing and Distribution

- Customs Brokerage

The freight forwarding exhibits clear dominance with a 49% share of the total Japan inland cargo shipping market in 2025.

The freight forwarding segment commands nearly half of the market, driven by increasing demand for integrated logistics solutions that coordinate multimodal transport operations seamlessly. The Japan freight forwarding market is reflecting the shift toward digitized booking platforms, multimodal agility, and data-backed customs clearance. Major players are investing in AI-powered route optimization and IoT-enabled cargo tracking to enhance service quality and supply chain transparency.

The segment benefits from Japan's robust industrial and manufacturing base, which contributes over half of the country's logistics demand. Companies are introducing specialized multimodal forwarding solutions, such as the Sea and Road Smart Link program combining ocean freight with scheduled truck convoys, reducing delivery times significantly for electronics and apparel sectors. Strategic partnerships between domestic and global freight forwarders are expanding service capabilities, particularly in healthcare, semiconductor, and e-commerce logistics segments.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- FMCG

- Chemicals

- Pharmaceuticals

- Electronics

The automotive dominates with a market share of 32% of the total Japan inland cargo shipping market in 2025.

The automotive industry drives nearly one-third of Japan's inland cargo shipping demand, reflecting the nation's position as the fourth largest automotive market globally. Japan's automotive sector encompasses manufacturing, sales, maintenance, and freight operations employing approximately 5.58 million people, representing 8.3% of the working population. The increasing automotive exports, with vehicles and parts accounting for substantial share of Japan's shipments to the United States are further highlighting the critical role of shipping logistics in supporting this export-oriented industry.

The Port of Nagoya serves as Japan's largest trade port and primary automotive export hub, facilitating vehicle and component shipments for manufacturers including Toyota, with facilities headquartered nearby. The segment's logistics requirements extend beyond finished vehicle transport to include precision timing for just-in-time component delivery, specialized handling for sensitive parts, and temperature-controlled environments for certain materials. Investment in automated cargo handling and dedicated automotive terminals continues to enhance shipping efficiency for this vital industry.

Region Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates with a market share of 36% of the total Japan inland cargo shipping market in 2025.

The Kanto Region maintains market leadership as Japan's primary economic hub, encompassing Tokyo with its population estimated at 37,036,200 in 2025. The region houses major ports including Tokyo and Yokohama, which together processed record container volumes, handling diverse cargo from consumer goods imports to automotive exports and high-value electronics. Government initiatives, including plans to construct a automated freight tunnel between Tokyo and Osaka, are enhancing the region's logistics infrastructure.

Advanced logistics facilities in the Kanto Region support high-volume freight traffic from manufacturing, retail, and rapidly expanding e-commerce sectors. The presence of Narita Airport and comprehensive port connectivity positions the region as pivotal for Japan's supply chain and economic activities. Companies are establishing micro-fulfillment centers and automated warehousing facilities in urban areas, with warehouse vacancy rates near zero for Grade A logistics sheds, reflecting strong demand for distribution infrastructure.

Market Dynamics:

Growth Drivers

Why is the Japan Inland Cargo Shipping Market Growing?

Government Infrastructure Investments and Port Modernization

The Japanese government is actively investing in port infrastructure modernization and innovative transportation solutions to enhance logistics efficiency across the supply chain. Large-scale initiatives include the development of automated cargo transport corridors, port expansions, and road network improvements designed to streamline freight movement. The proposed Autoflow-Road conveyor system between Tokyo and Osaka exemplifies the nation's commitment to revolutionary logistics infrastructure. Port digitization programs are promoting the integration of advanced technologies including IoT sensors, AI-powered cargo handling systems, and real-time tracking platforms that optimize operations and reduce turnaround times. These infrastructure investments are creating a more connected and efficient maritime ecosystem capable of meeting growing trade demands.

Rising E-commerce Demand and Supply Chain Optimization Requirements

The rapid expansion of e-commerce activities in Japan is driving unprecedented demand for efficient and reliable freight services throughout the inland cargo shipping market. Companies are establishing distributed fulfillment nodes, micro-logistics hubs, and urban warehousing facilities to meet consumer expectations for rapid delivery. The integration of digital freight platforms enabling real-time booking, payment processing, and shipment tracking is transforming traditional logistics operations. This e-commerce boom is encouraging the development of more advanced and widespread logistics networks connecting regional distribution centers with final-mile delivery capabilities.

Modal Shift Initiatives Addressing Labor Shortages and Environmental Sustainability

Japan's logistics industry is confronting critical workforce challenges as the aging population creates driver shortages projected to reduce transport capacity significantly by the end of the decade. Regulatory changes capping annual overtime work hours for truck drivers are accelerating the shift toward alternative transportation modes, particularly coastal shipping and rail freight. Government policies actively promote modal shift strategies, encouraging manufacturers and logistics providers to transition long-haul freight from road to maritime transport. This transition offers multiple advantages including reduced carbon emissions aligned with environmental sustainability goals, lower transportation costs for bulk shipments, and decreased highway congestion. Collaborative shipping arrangements between major manufacturers are maximizing vessel utilization and reducing empty returns, creating operational efficiencies that strengthen the economic viability of maritime logistics solutions.

Market Restraints:

What Challenges is the Japan Inland Cargo Shipping Market Facing?

Aging Infrastructure and Limited Capacity Constraints

Japan faces significant challenges with aging warehousing infrastructure, as a substantial portion of domestic warehouses have been operational for several decades, creating concerns about replacement capabilities and expansion limitations. High construction costs and limited land availability, particularly in metropolitan areas, constrain the development of modern logistics facilities required to meet growing demand.

Workforce Shortages and Regulatory Compliance Pressures

The shipping industry faces severe labor shortages as more than half of domestic coastal vessel crews are older than fifty years, with younger workers showing limited interest in maritime careers. New overtime regulations and compliance requirements are constraining operational flexibility, while the need for specialized training in autonomous vessel technologies adds complexity to workforce development.

High Technology Implementation Costs and Cybersecurity Risks

The substantial capital investment required for implementing digital technologies, automation systems, and autonomous vessel capabilities poses financial barriers for smaller operators. Additionally, increased digitalization exposes maritime operations to cybersecurity vulnerabilities, requiring continuous investment in protective systems and protocols to safeguard vessel navigation and cargo management systems.

Competitive Landscape:

The Japan inland cargo shipping market exhibits a moderately consolidated competitive structure characterized by the presence of established domestic carriers, integrated logistics providers, and international freight forwarding companies. Industry participants are actively pursuing strategic initiatives including fleet modernization, digital transformation, and sustainable shipping solutions to strengthen competitive positioning. Leading players are investing in cutting-edge technologies such as IoT-enabled real-time tracking, AI-powered route optimization, and warehouse automation to enhance operational efficiency and reduce costs. Consolidation activities, including mergers among shipping and ship-management companies, are creating larger entities with enhanced scale advantages and diversified service offerings. Partnerships between domestic carriers and global logistics providers are expanding service capabilities, particularly in specialized segments including healthcare logistics, semiconductor supply chains, and e-commerce fulfillment.

Recent Developments:

-

In November 2024, Japan announced plans to develop an automated cargo transport corridor between Tokyo and Osaka, leveraging advanced technology to optimize logistics operations and address the projected 34% decline in transport capacity by 2030.

-

In October 2025, three NYK Group shipping companies, including Asahi Shipping, Hachiuma Steamship, and Mitsubishi Ore Transport, entered into a merger agreement to form NYK Bulkship Partners Co., Ltd., with operations launching in April 2026.

-

In August 2024, Yamato Group launched cargo aircraft services between Tokyo's Haneda, Sapporo's New Chitose, and Kitakyushu airports, expanding its logistics network to address rising demand for efficient regional distribution capabilities.

Japan Inland Cargo Shipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cargo Types Covered | Containerized Cargo, Bulk Cargo, Liquid Cargo, Ro-Ro Cargo |

| Modes of Transport Covered | Inland Waterways, Coastal Shipping, Transoceanic Shipping |

| Service Types Covered | Freight Forwarding, Warehousing and Distribution, Customs Brokerage |

| End-Use Industries Covered | Automotive, FMCG, Chemicals, Pharmaceuticals, Electronics |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan inland cargo shipping market size was valued at USD 1,108.12 Million in 2025.

The Japan inland cargo shipping market is expected to grow at a compound annual growth rate of 4.56% from 2026-2034 to reach USD 1,655.3 Million by 2034.

Containerized cargo dominated the market with approximately 49% share in 2025, driven by standardized intermodal transport efficiency and Japan's strong export-oriented manufacturing sector.

Key factors driving the Japan inland cargo shipping market include government infrastructure investments in port modernization and automated transport corridors, rising e-commerce demand requiring efficient logistics networks, modal shift initiatives addressing driver shortages, and digital transformation enhancing supply chain visibility.

Major challenges include aging warehousing infrastructure with over 30% of facilities exceeding 40 years, severe workforce shortages as coastal vessel crews age, high technology implementation costs for automation and autonomous systems, regulatory compliance pressures from overtime restrictions, and cybersecurity vulnerabilities in digitalized maritime operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)