Japan Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2026-2034

Japan Instant Soups Market Summary:

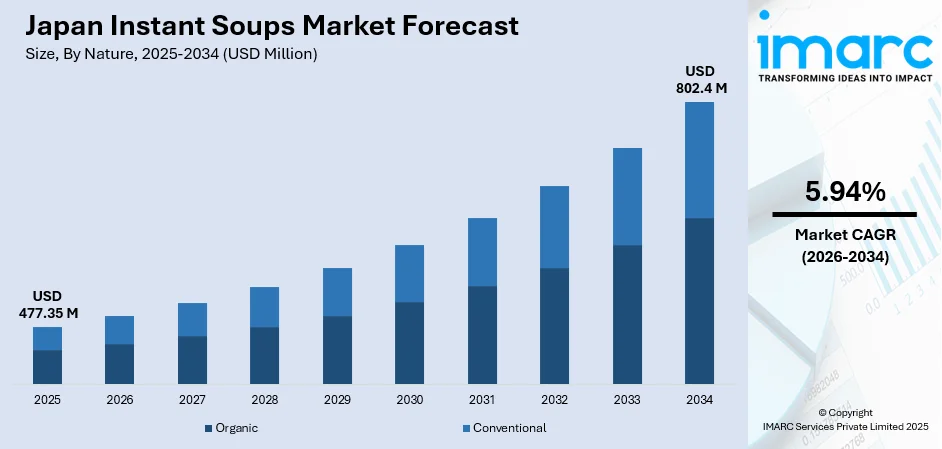

The Japan instant soups market size was valued at USD 477.35 Million in 2025 and is projected to reach USD 802.4 Million by 2034, growing at a compound annual growth rate of 5.94% from 2026-2034.

The market is driven by increasing demand for convenient meal solutions among Japan's time-constrained urban population, coupled with evolving dietary preferences favoring quick-preparation food options. Rising single-person households and the growing geriatric demographic seeking easy-to-prepare nutritious meals further propel consumption. Additionally, product innovation incorporating traditional Japanese flavors and health-conscious formulations strengthens consumer appeal. The expanding retail infrastructure and e-commerce penetration enhance product accessibility, contributing to the Japan instant soups market share.

Key Takeaways and Insights:

- By Nature: Conventional dominates the market with a share of 92% in 2025, driven by consumer acceptance, established manufacturing, competitive pricing, and loyalty to familiar instant soup flavors.

- By Form: Dry leads the market with a share of 84% in 2025, owing to long shelf life, lightweight packaging, cost-effective production, and preference for quick hot-water preparation.

- By Source: Plant-based represents the largest segment with a market share of 68% in 2025, driven by cultural alignment, health consciousness, and preference for lighter, nutrient-rich vegetable broths.

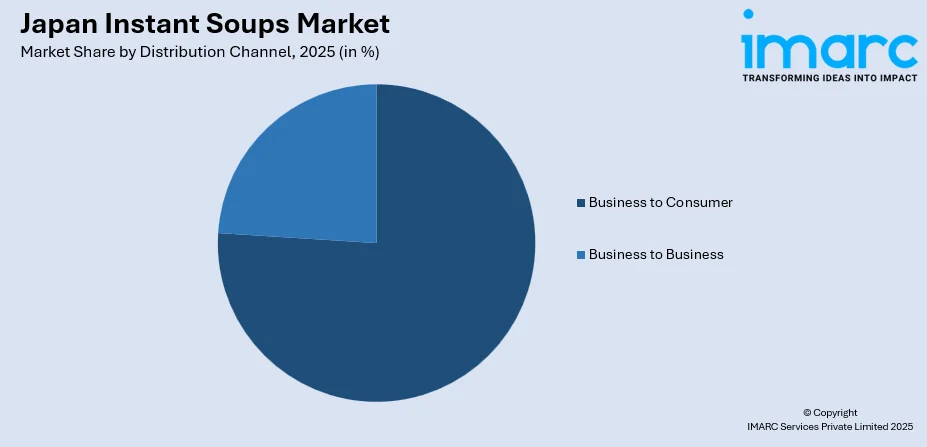

- By Distribution Channel: Business to consumer leads the market with a share of 76% in 2025, owing to retail penetration, supermarket access, online adoption, and direct consumer promotional engagement.

- By End Use: Retail/household represents the market with a share of 72% in 2025, driven by in-home meal culture, cost savings, home preparation preference, and stockpiling habits.

- By Region: Kanto region dominates the market with a share of 38% in 2025, owing to dense population, high income, urban lifestyle, convenience demand, and superior retail infrastructure.

- Key Players: The Japan instant soups market exhibits a moderately consolidated competitive landscape, with established domestic manufacturers leveraging strong brand recognition and distribution networks while competing through continuous product innovation, premiumization strategies, and expansion into health-focused formulations.

To get more information on this market Request Sample

The Japan instant soups market continues to experience steady growth, propelled by fundamental shifts in consumer lifestyles and dietary preferences across the nation. The accelerating pace of urban life, coupled with increasing participation of women in the workforce, has significantly elevated demand for quick, convenient meal solutions that require minimal preparation time. As per sources, in 2025, ITOCHU Corporation announced the acquisition of import and domestic marketing rights for Campbell's soups in Japan, targeting convenience-focused consumers. Moreover, consumers increasingly seek products that align with their health-conscious mindset while offering authentic flavors and nutritional benefits. The expanding geriatric population, many of whom live independently, further contributes to market expansion as instant soups provide warm, easy-to-prepare meals suited to their needs. Additionally, the growing prevalence of single-person households and nuclear families has shifted consumption patterns toward individually portioned, ready-to-eat (RTE) food products that minimize waste while maximizing convenience.

Japan Instant Soups Market Trends:

Rising Demand for Functional and Wellness-Oriented Formulations

Japanese consumers increasingly prioritize health and wellness when selecting food products, driving manufacturers to develop instant soups with enhanced nutritional profiles. The market is witnessing growing interest in soups fortified with beneficial ingredients such as collagen, dietary fiber, vitamins, and minerals that support overall well-being. In March 2025, Ajinomoto Co., Inc. launched "Ajinomoto KK Protein Miso Soup" online, delivering 20 g protein per cup with soy protein and collagen, promoting health, wellness, and convenient meal pairing in Japan. Traditional ingredients including miso, seaweed, shiitake mushrooms, and tofu are being prominently featured in product formulations due to their perceived health benefits and alignment with clean-label expectations. Manufacturers are reformulating recipes to reduce sodium content and eliminate artificial additives, responding to consumer demand for cleaner, more natural food options. This wellness-oriented approach extends to packaging, with clear ingredient labeling and nutritional information becoming essential differentiators in the competitive marketplace.

Expansion of Premium and Gourmet Instant Soup Varieties

The Japan instant soups market is experiencing a notable shift toward premiumization as consumers demonstrate willingness to pay higher prices for superior quality and authentic taste experiences. Manufacturers are introducing restaurant-quality soup varieties that replicate regional specialties and traditional recipes, elevating instant soups beyond their convenience-food positioning. Gourmet offerings featuring high-quality ingredients, artisanal preparation methods, and sophisticated flavor profiles are gaining traction among discerning consumers seeking elevated dining experiences at home. In November 2025, Nongshim Japan launched the premium "Shin Ramen Black Cup," a microwave-safe instant noodle with rich pork bone and spicy soups, upgraded packaging, and enhanced convenience, appealing to gourmet-focused consumers. Limited-edition and seasonal varieties create excitement and encourage repeat purchases, with flavors inspired by regional cuisines and festive occasions generating strong consumer interest. This premiumization trend enables manufacturers to improve profit margins while meeting evolving consumer expectations for quality and authenticity.

Sustainable Packaging and Environmental Consciousness

Environmental sustainability has emerged as a significant consideration influencing product development and consumer purchasing decisions in Japan instant soups market. Manufacturers are actively transitioning toward eco-friendly packaging materials, including biodegradable containers, recyclable wrappers, and reduced-plastic alternatives that align with Japan's commitment to environmental protection. The development of concentrated soup formats requiring smaller packaging volumes represents another sustainability-driven innovation gaining market acceptance. Consumers increasingly favor brands demonstrating environmental responsibility through their packaging choices and manufacturing practices. As per sources, in April 2025, Nissin Foods advanced its EARTH FOOD CHALLENGE 2030 by reducing CO₂ emissions, promoting renewable energy use, and implementing sustainable practices across production, supporting environmental stewardship in Japan. Moreover, this sustainability focus extends beyond packaging to encompass ingredient sourcing, with growing emphasis on responsibly sourced materials and reduced environmental footprint throughout the supply chain. These initiatives resonate strongly with environmentally conscious Japanese consumers who consider sustainability when making purchasing decisions.

Market Outlook 2026-2034:

The Japan instant soups market is positioned for sustained revenue growth throughout the forecast period, supported by evolving consumer preferences toward convenient, health-conscious meal solutions. Market revenue expansion will be driven by continued product innovation, premiumization trends, and increasing penetration across diverse demographic segments. The growing geriatric population and prevalence of single-person households will sustain demand, while health-oriented formulations and sustainable packaging initiatives will attract environmentally and health-conscious consumers. Strategic investments in flavor diversification and distribution channel expansion will further strengthen revenue generation opportunities. The market generated a revenue of USD 477.35 Million in 2025 and is projected to reach a revenue of USD 802.4 Million by 2034, growing at a compound annual growth rate of 5.94% from 2026-2034.

Japan Instant Soups Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Nature | Conventional | 92% |

| Form | Dry | 84% |

| Source | Plant-based | 68% |

| Distribution Channel | Business to Consumer | 76% |

| End Use | Retail/Household | 72% |

| Region | Kanto Region | 38% |

Nature Insights:

- Organic

- Conventional

Conventional dominates with a market share of 92% of the total Japan instant soups market in 2025.

Conventional maintains commanding dominance in the Japan instant soups market, reflecting established consumer preferences for traditional, affordably priced instant soup products. Japanese consumers demonstrate strong loyalty toward conventional instant soups due to their consistent quality, familiar taste profiles, and widespread availability across retail channels. The extensive distribution infrastructure supporting conventional products ensures accessibility in convenience stores, supermarkets, and neighborhood retailers throughout urban and rural areas alike. Manufacturers have developed sophisticated production capabilities for conventional instant soups, achieving economies of scale that translate into competitive pricing attractive to cost-conscious consumers. In June 2025, Ajinomoto Co., Inc. highlighted Knorr® Cup Soup’s enduring popularity in Japan, launched in 1964, maintaining No. 1 market share and widespread consumer support for conventional instant soups. Further, this segment benefits from decades of product refinement and consumer trust built through consistent delivery of satisfying, convenient meal solutions.

Conventional continue attracting mainstream consumers who prioritize value, convenience, and reliable taste over premium or specialty attributes. The segment's dominance reflects Japan's practical consumer culture where functional products meeting everyday needs maintain strong market positions. Manufacturers invest continuously in improving conventional product formulations, enhancing flavor authenticity and nutritional profiles while maintaining accessible price points. The mature supply chain infrastructure supporting conventional instant soups enables efficient distribution and inventory management, ensuring product freshness and availability. This segment's stability provides manufacturers with reliable revenue streams while supporting ongoing investment in product development and market expansion initiatives.

Form Insights:

- Dry

- Liquid

Dry leads with a share of 84% of the total Japan instant soups market in 2025.

Dry commands the largest share in Japan instant soups market, driven by inherent advantages in storage, transportation, and preparation convenience. Dry instant soups offer significantly extended shelf life compared to liquid alternatives, reducing waste and enabling consumers to maintain pantry supplies without concerns about spoilage. As per sources, in 2024, Hikari Miso Co., Ltd. launched “Mainichi Miso Soup Mild Sodium Freeze-Dried Miso” in 8- and 20-serving packs across Japan, offering 25% reduced salt while preserving authentic miso flavor. Moreover, the lightweight nature of dry soup products facilitates efficient distribution while minimizing transportation costs and environmental impact. Japanese consumers appreciate the simplicity of dry instant soup preparation, requiring only hot water addition for quick meal assembly. The compact packaging format appeals to space-conscious Japanese households where efficient storage solutions are valued. Retailers benefit from the favorable shelf-life characteristics and space-efficient packaging of dry instant soups.

Dry demonstrate remarkable versatility, available in diverse formats including powder sachets, dehydrated ingredient mixes, and compressed soup blocks suited to various consumption occasions. The segment's technological maturity enables manufacturers to achieve authentic flavor replication and satisfying texture characteristics despite the dehydrated format. Innovations in drying technologies have enhanced product quality, preserving nutritional content and flavor intensity throughout extended storage periods. The dry format particularly suits Japan's extensive convenience store network, where space efficiency and extended product viability are essential operational requirements. Consumer confidence in dry instant soup quality and convenience sustains strong demand across demographic segments, from busy professionals to geriatric individuals seeking practical meal solutions.

Source Insights:

- Animal-based

- Plant-based

Plant-based exhibits a clear dominance with a 68% share of the total Japan instant soups market in 2025.

Plant-based leads the Japan instant soups market, reflecting traditional Japanese dietary preferences that emphasize vegetables, legumes, and sea vegetables. Japanese cuisine historically incorporates substantial plant-based ingredients, creating natural consumer acceptance for vegetable-forward instant soup varieties. The segment benefits from growing health consciousness among Japanese consumers who associate plant-based foods with lighter, more digestible meal options. Traditional ingredients including miso, tofu, seaweed, and various vegetables feature prominently in popular instant soup formulations aligned with Japanese culinary heritage. The perception of plant-based soups as healthier alternatives supports strong demand among wellness-oriented consumers seeking nutritious convenience food options.

These instant soups align well with emerging environmental sustainability concerns influencing consumer food choices in Japan. In November 2025, FamilyMart launched a plant-based “Egg-style” cup soup under its “Blue Green Project” at 16,400 stores nationwide, offering a vegan-friendly, environmentally conscious alternative to traditional instant soups. Moreover, the lower environmental footprint associated with plant-based food production resonates with environmentally conscious consumers considering sustainability in purchasing decisions. Manufacturers have expanded plant-based product portfolios, introducing innovative formulations featuring diverse vegetable combinations and traditional Japanese ingredients. The segment attracts consumers across age groups, from younger individuals embracing plant-forward diets to geriatric consumers preferring lighter, easily digestible meal options. Continued innovation in plant-based instant soup development, incorporating functional ingredients and authentic regional flavors, will sustain segment growth and market leadership.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business to Business

- Business to Consumer

Business to consumer leads with a share of 76% of the total Japan instant soups market in 2025.

Business to consumer dominates Japan instant soups market, reflecting the nation's highly developed retail infrastructure and consumer-direct purchasing patterns. Japan's extensive convenience store network, comprising numerous outlets operating around the clock, provides unparalleled consumer access to instant soup products. In December 2025, FamilyMart launched Marugen Ramen’s signature “Nikusoba” at approximately 3,200 Tokai-region stores, providing convenient access to a popular restaurant-style instant soup for Japanese consumers. Further, supermarkets and hypermarkets offer comprehensive instant soup selections, enabling consumers to compare varieties and make informed purchasing decisions. The segment benefits from Japan's sophisticated e-commerce infrastructure, with online grocery platforms expanding consumer access to diverse instant soup products including specialty and regional varieties. Direct consumer sales channels enable manufacturers to gather market intelligence and respond rapidly to evolving preferences.

The segment's dominance reflects Japanese consumer preferences for direct product selection and immediate availability characteristic of the nation's retail culture. Convenience stores serve as essential distribution points for instant soups, catering to time-constrained consumers seeking quick meal solutions during work breaks or commutes. The segment's strength is reinforced by promotional activities, product sampling, and marketing communications targeting end consumers directly. Manufacturers invest substantially in consumer-facing marketing initiatives, brand building, and retail partnerships to strengthen positioning within this dominant channel. The continued evolution of omnichannel retail strategies, integrating physical stores with digital platforms, will further solidify business to consumer segment leadership.

End Use Insights:

- Foodservice

- Retail/Household

Retail/household exhibits a clear dominance with a 72% share of the total Japan instant soups market in 2025.

The retail/household captures the largest share of Japan instant soups market, driven by increasing home consumption patterns and preferences for convenient meal preparation. As per sources, in 2025, Ajinomoto Co., Inc. announced nine new household instant soup products and 39 renewed varieties, launching nationwide, enhancing convenience-focused home meal options. Japanese households maintain instant soup inventories as practical pantry staples, providing quick meal solutions for busy weekday evenings or satisfying light meals. The segment benefits from demographic trends including growing single-person households and nuclear families who favor individually portioned products minimizing waste. Instant soups serve diverse household consumption occasions, from quick breakfasts to late-night snacks, supporting consistent demand across daily meal periods. The segment's dominance reflects the fundamental positioning of instant soups as convenient home-meal solutions.

Retail/household consumption patterns align with Japanese preferences for comfortable, satisfying meals enjoyed in domestic settings. The segment attracts diverse consumer demographics, including working professionals seeking convenient dinner options, geriatric individuals preferring easy-to-prepare meals, and families appreciating quick supplementary dishes. Manufacturers develop products specifically addressing household consumption needs, including family-sized packages and variety packs encouraging repeat purchases. The segment's stability provides manufacturers with reliable demand forecasting capabilities and efficient production planning. Continued focus on household-appropriate packaging formats, flavor varieties appealing to family consumption, and value-oriented offerings will sustain retail/household segment dominance.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region dominates with a market share of 38% of the total Japan instant soups market in 2025.

Kanto region maintains leading market position in Japan's instant soups sector, driven by concentration of population and economic activity in the Tokyo metropolitan area. The region's demographic characteristics, including high urbanization rates and substantial working populations, create strong demand for convenient meal solutions addressing time-constrained lifestyles. Higher disposable incomes in the Kanto Region support premium product adoption and willingness to explore innovative instant soup varieties. The region's sophisticated retail infrastructure, featuring dense convenience store networks and modern supermarket formats, ensures widespread product availability and consumer access. The Kanto Region serves as the primary testing ground for new product launches and marketing initiatives.

The region's market leadership reflects Tokyo's role as Japan's commercial and cultural center, influencing consumption trends that subsequently spread nationwide. The concentration of corporate headquarters and business districts generates substantial demand for convenient lunch options, with instant soups serving office workers seeking quick, affordable midday meals. The region's diverse population, including significant numbers of young professionals and geriatric residents, creates demand across product categories and price segments. Manufacturers prioritize Kanto Region distribution and marketing investments, recognizing the area's influence on broader national consumption patterns. The region's continued economic vitality and population concentration will sustain its dominant market position throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Japan Instant Soups Market Growing?

Accelerating Urbanization and Evolving Lifestyle Patterns

Japan's ongoing urbanization and transformation of traditional lifestyle patterns continue driving substantial growth in the instant soups market. The concentration of population in major metropolitan areas, particularly Tokyo, Osaka, and other urban centers, creates environments where convenient food solutions become essential components of daily life. Working professionals facing extended commutes and demanding schedules increasingly rely on quick-preparation meals that minimize time spent on food preparation without sacrificing nutritional intake or taste satisfaction. The acceleration of work culture intensity has reduced time available for traditional cooking, positioning instant soups as practical alternatives meeting contemporary lifestyle requirements. Urban apartment living, characterized by compact kitchen spaces, favors convenient food products requiring minimal preparation equipment and cooking infrastructure. In April 2025, Pokka Sapporo’s powdered soup brand “Ouchi Soup” launched a campaign in collaboration with the popular picture book The Bread Thief, offering 300 customers a chance to win an original mug and spoon set. Moreover, this urbanization-driven demand creates sustained growth momentum as more Japanese residents adopt metropolitan lifestyles emphasizing convenience and efficiency.

Expanding Geriatric Population and Demographic Shifts

Japan's demographic transformation, characterized by one of the world's most rapidly aging populations, generates significant market growth opportunities for instant soups. Geriatric individuals frequently prefer instant soups due to their easy preparation, digestible nature, and warm, comforting characteristics suited to senior dietary preferences. The growing population of geriatric persons living independently creates substantial demand for convenient, nutritious meal solutions that do not require extensive cooking skills or physical capability. Instant soups offer portion-controlled servings appropriate for individual consumption, reducing food waste concerns common among geriatric single-person households. Manufacturers are developing products specifically addressing senior nutritional needs, incorporating easily digestible ingredients and softer textures suited to geriatric consumption. The demographic momentum of Japan's aging society ensures sustained long-term demand growth for convenient food products including instant soups.

Health-Conscious Consumer Preferences and Product Innovation

Growing health consciousness among Japanese consumers drives market growth through demand for nutritionally enhanced instant soup products. Contemporary Japanese consumers increasingly scrutinize food product ingredients, seeking options featuring natural components, reduced sodium content, and beneficial nutritional profiles. As per sources, in February 2025, Hanamaruki announced that its “Sugumami Cup Miso Soup with Healthy Low-Sodium Vegetables,” launching March 1, contains 2.5 g dietary fiber (half a lettuce) and 25 % less salt per serving. Further, this health orientation stimulates manufacturer investment in product reformulation, introducing instant soups fortified with vitamins, minerals, collagen, and other functional ingredients addressing wellness trends. Traditional Japanese ingredients associated with health benefits, including miso, seaweed, and various vegetables, feature prominently in product development aligned with consumer expectations. The perception of soups as inherently healthier meal options compared to other convenience foods supports category growth among wellness-oriented consumer segments. Manufacturers responding effectively to health-conscious preferences through transparent labeling, clean ingredients, and functional formulations capture growing market share, driving overall market expansion.

Market Restraints:

What Challenges the Japan Instant Soups Market is Facing?

Competition from Fresh and Alternative Convenience Foods

The Japan instant soups market faces competitive pressure from expanding fresh food offerings and alternative convenience meal solutions available across retail channels. Japanese convenience stores have significantly enhanced fresh food selections, including prepared salads, rice balls, and ready-to-eat meals competing directly for consumer convenience food spending. The growing availability of freshly prepared options challenges instant soup positioning, as consumers may perceive fresh alternatives as healthier or more satisfying. Restaurant delivery services and meal kit subscriptions offer additional convenient meal solutions competing for consumer attention and spending. This competitive intensity requires instant soup manufacturers to continuously innovate and differentiate products to maintain consumer interest.

Perception Concerns Regarding Processed Food Products

Consumer perceptions associating instant soups with processed food characteristics present restraining factors for market growth among health-conscious segments. Some Japanese consumers harbor reservations about instant food products, questioning nutritional adequacy and ingredient quality compared to freshly prepared alternatives. Concerns regarding sodium content, artificial additives, and preservatives commonly associated with processed foods influence purchasing decisions among wellness-oriented consumers. Despite manufacturer efforts to reformulate products with cleaner ingredients, negative perceptions persist among certain consumer segments. Addressing these perception challenges requires sustained investment in product quality improvement, transparent communication, and marketing initiatives emphasizing health-conscious formulations.

Market Maturity and Limited Growth Potential

Japan's instant soups market demonstrates characteristics of relative maturity, with established product categories and consumer patterns limiting expansion opportunities. High household penetration rates for instant soup products reduce potential for significant new consumer acquisition. The mature competitive landscape features well-established brands with strong consumer loyalty, creating barriers for market share growth through traditional competitive strategies. Market maturity necessitates manufacturer focus on product innovation, premiumization, and value-added offerings to generate growth within existing consumer bases. This maturity dynamic requires creative approaches to stimulate demand beyond established consumption patterns.

Competitive Landscape:

The Japan instant soups market features a well-established competitive environment characterized by the presence of major domestic food manufacturers alongside international food corporations. Market participants compete across multiple dimensions including product quality, flavor innovation, nutritional profiles, packaging convenience, and price positioning. Established manufacturers leverage extensive distribution networks, brand recognition, and consumer loyalty developed through decades of market presence. Competition intensifies through continuous product innovation, with manufacturers introducing new flavors, health-oriented formulations, and premium varieties to capture consumer interest. Strategic investments in marketing communications, retail partnerships, and promotional activities influence market positioning. Manufacturers increasingly emphasize sustainability initiatives and clean-label credentials as competitive differentiators responding to evolving consumer expectations regarding environmental responsibility and ingredient transparency.

Recent Developments:

- In August 2024, Riken Vitamin introduced its “Just Dilute Soup” series, a new liquid concentrated soup range featuring Corn Soup, Scallop Chowder, and Onion Consommé. The soups dissolve quickly and allow consumers to easily adjust thickness, temperature, and portion size, targeting busy adults seeking convenient, customizable, and time-saving meal solutions.

Japan Instant Soups Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Organic, Conventional |

| Forms Covered | Dry, Liquid |

| Sources Covered | Animal-based, Plant-based |

| Distribution Channels Covered | Business to Business, Business to Consumer |

| End Uses Covered | Foodservice, Retail/Household |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan instant soups market size was valued at USD 477.35 Million in 2025.

The Japan instant soups market is expected to grow at a compound annual growth rate of 5.94% from 2026-2034 to reach USD 802.4 Million by 2034.

Conventional held the largest share of the Japan instant soups market, driven by long-established consumer preferences, consistent taste quality, optimized manufacturing processes, extensive distribution networks, and strong brand loyalty favoring familiar, time-tested formulations.

Key factors driving the Japan instant soups market include accelerating urbanization, evolving lifestyle patterns favoring convenience, expanding geriatric population requiring easy-to-prepare meals, growing health consciousness stimulating product innovation, and increasing single-person households demanding individually portioned food solutions.

Major challenges include intensifying competition from fresh convenience foods and alternative meal solutions, consumer perception concerns regarding processed food products, market maturity limiting new consumer acquisition opportunities, and evolving regulatory requirements regarding ingredient disclosure and nutritional labeling standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)