Japan Leak Detection Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2026-2034

Japan Leak Detection Market Overview:

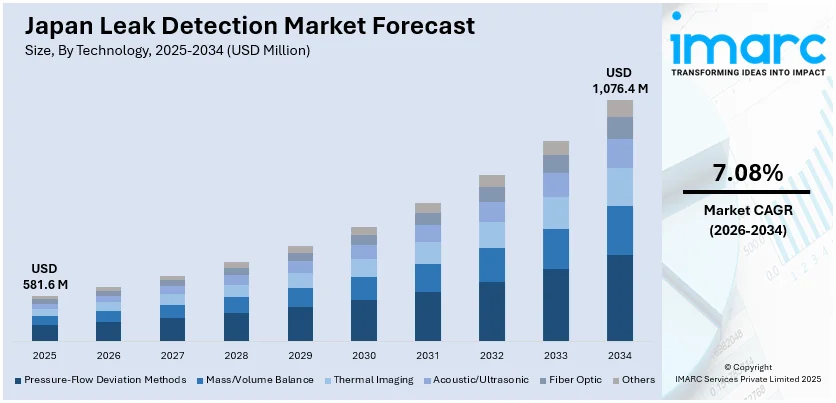

The Japan leak detection market size reached USD 581.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,076.4 Million by 2034, exhibiting a growth rate (CAGR) of 7.08% during 2026-2034. The market is driven by stringent environmental regulations and the need for efficient resource management, accelerating the adoption of IoT-enabled sensors and AI-powered leak detection systems across oil and gas, water utilities, and manufacturing sectors. Aging infrastructure and government safety mandates are further increasing demand for non-destructive testing methods. Rising emphasis on sustainability and preventive maintenance will continue to spur technological advancements, further augmenting the Japan leak detection market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 581.6 Million |

| Market Forecast in 2034 | USD 1,076.4 Million |

| Market Growth Rate 2026-2034 | 7.08% |

Japan Leak Detection Market Trends:

Increasing Adoption of Advanced Leak Detection Technologies

The market is experiencing a significant shift toward advanced technologies, driven by stringent environmental regulations and the need for efficient resource management. Traditional methods, such as visual inspections and manual pressure testing, are being replaced by smart sensors, IoT-enabled devices, and AI-powered analytics. These technologies provide real-time monitoring, early leak detection, and predictive maintenance, reducing operational costs and minimizing environmental risks. Industries such as oil and gas, water utilities, and manufacturing are increasingly investing in ultrasonic, acoustic, and infrared-based leak detection systems. Additionally, the accelerating emphasis on sustainability and energy efficiency is accelerating the demand for automated solutions that prevent wastage. Japan has been successful in reducing environmental pressures; nevertheless, it still faces significant challenges, particularly in resource circularity, as recycling of municipal waste remains at only a 20% level. The country's energy mix remains carbon-based, and water wastage remains an issue that calls for urgent intervention through advanced leak detection technologies. As Japan accelerates its transition to a greener future, the need for efficient water management solutions will be crucial to meeting climate targets and improving sustainability in both urban and rural areas. As Japan continues to prioritize infrastructure modernization, the integration of AI and IoT in leak detection systems is expected to expand, creating new growth opportunities for technology providers in the market.

To get more information on this market Request Sample

Rising Demand for Non-Destructive Testing (NDT) Methods

Non-destructive testing (NDT) methods are also propelling the Japan leak detection market growth due to their ability to inspect infrastructure without causing damage. Techniques such as ultrasonic testing, radiography, and thermography are being widely adopted across industries, including construction, automotive, and chemical processing. The aging infrastructure in Japan, including pipelines and storage tanks, necessitates regular inspections to prevent leaks and ensure safety. Japan's aging infrastructure includes more than 730,000 bridges and 11,000 tunnels, many of which have been in place for over 50 years, leading to fatal accidents and substantial repair costs, thereby creating an acute need for advanced diagnostic technologies. The Ministry of Land, Infrastructure, and Transportation (MLIT) estimates that early detection would save USD 46 Billion by the year 2048. This case presents significant opportunities for leak detection technology to collaborate with Japan's infrastructure managers in leveraging cutting-edge solutions, such as drones, artificial intelligence, and 5G, to enhance the effectiveness of inspections and maintenance. NDT methods offer high accuracy, cost-efficiency, and reduced downtime compared to traditional destructive testing. Furthermore, government initiatives promoting industrial safety and environmental protection are encouraging companies to adopt these advanced inspection techniques. With the increasing focus on preventive maintenance and risk mitigation, the demand for NDT-based leak detection solutions is expected to grow, driving innovation and competition among service providers in the Japanese market.

Japan Leak Detection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology and end user.

Technology Insights:

- Pressure-Flow Deviation Methods

- Mass/Volume Balance

- Thermal Imaging

- Acoustic/Ultrasonic

- Fiber Optic

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pressure-flow deviation methods, mass/volume balance, thermal imaging, acoustic/ultrasonic, fiber optic, and others.

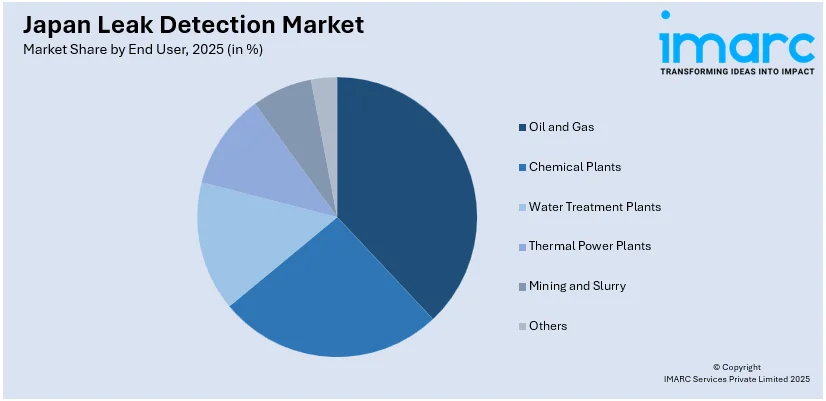

End User Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Chemical Plants

- Water Treatment Plants

- Thermal Power Plants

- Mining and Slurry

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, chemical plants, water treatment plants, thermal power plants, mining and slurry, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Leak Detection Market News:

- May 13, 2025: Tenchijin Inc., a leading figure in Japanese space technology, partnered with PWS to launch the KnoWaterleak satellite water leak detection system in major regions of Malaysia, namely Johor, Selangor, and Penang. The collaboration leverages Tenchijin's satellite technology to enhance leak detection and promote water conservation as part of Malaysia's efforts to modernize its infrastructure. The partnership serves as a model for Japan's leak detection sector, leveraging the high-tech capabilities of satellites to revolutionize water management and enhance infrastructure efficiency.

- April 28, 2025: Carrier Japan launched Abound HVAC Performance, a digital lifecycle solution with high-end leak detection, real-time monitoring, and proactive maintenance for HVAC systems. The platform is compatible with both water- and air-cooled heat sources and offers real-time diagnostics, resulting in reduced downtime, which is particularly valuable for commercial HVAC operators across Japan. The platform, supported by a 24/365 Command Center, delivers enhanced leak detection capabilities and increased energy efficiency to address critical infrastructure issues.

Japan Leak Detection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pressure-Flow Deviation Methods, Mass/Volume Balance, Thermal Imaging, Acoustic/Ultrasonic, Fiber Optic, Others |

| End Users Covered | Oil and Gas, Chemical Plants, Water Treatment Plants, Thermal Power Plants, Mining and Slurry, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan leak detection market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan leak detection market on the basis of technology?

- What is the breakup of the Japan leak detection market on the basis of end user?

- What is the breakup of the Japan leak detection market on the basis of region?

- What are the various stages in the value chain of the Japan leak detection market?

- What are the key driving factors and challenges in the Japan leak detection market?

- What is the structure of the Japan leak detection market and who are the key players?

- What is the degree of competition in the Japan leak detection market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan leak detection market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan leak detection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan leak detection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)