Japan LiDAR Market Size, Share, Trends and Forecast by Installation Type, Component, Application, and Region, 2025-2033

Japan LiDAR Market Size and Share:

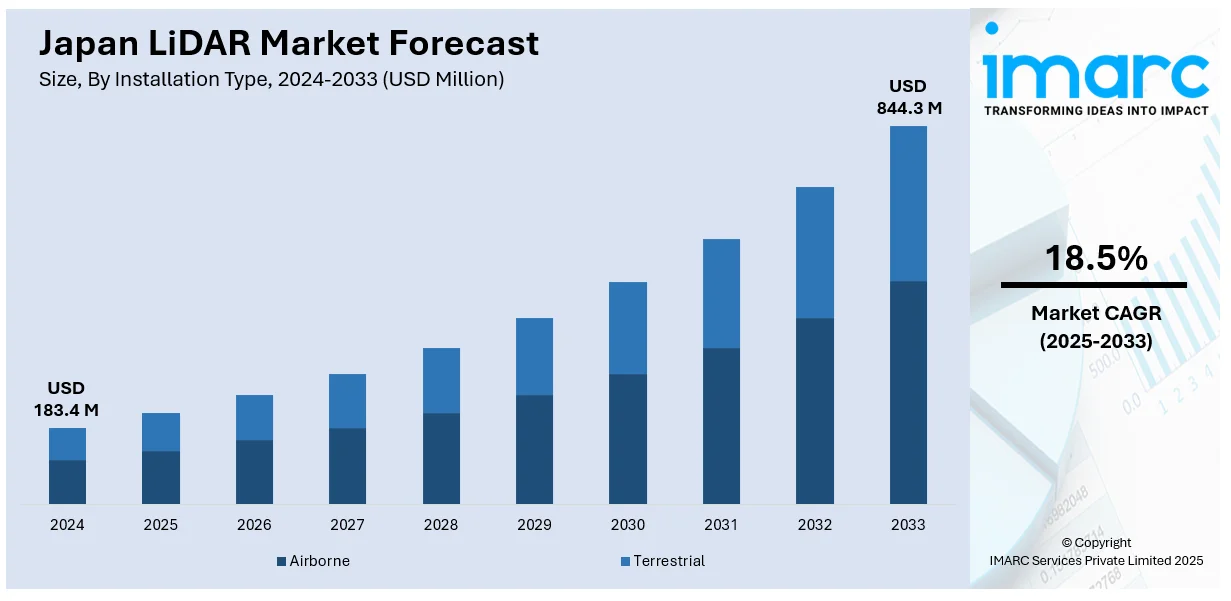

The Japan LiDAR market size was valued at USD 183.4 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 844.3 Million by 2033, exhibiting a CAGR of 18.5% from 2025-2033. The market is witnessing significant growth due to the advancements in autonomous vehicle technology and the escalating demand for precision mapping in infrastructure and urban planning. Moreover, the integration of LiDAR with artificial intelligence and machine learning, increased use of LiDAR for environment monitoring and disaster management, and miniaturization and cost reductions are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 183.4 Million |

| Market Forecast in 2033 | USD 844.3 Million |

| Market Growth Rate (2025-2033) | 18.5% |

in Japan. LiDAR technology is essential for enabling precise and accurate mapping of the vehicle's surroundings, allowing for real-time 3D scanning and obstacle detection. For instance, in 2024, KOITO Manufacturing developed a short-range LiDAR, co-created with Cepton, for ADAS and autonomous vehicles. It has secured an order from a global OEM for use in Level 4 autonomous vehicles. The autonomous vehicle capabilities are thriving in the spotlight of Japan's automotive industry; thus, the demand for LiDAR systems is also on the rise. Japanese automobile manufacturers such as Toyota, Honda, and Nissan strongly invest in the autonomous vehicle technology arena, thereby furthering the acceptance of LiDAR for navigation, safety, and driver assistance systems. The dynamic automotive industry of Japan, together with rapidly accelerating autonomous vehicle development programs, will ensure that LiDAR will continue to play a key role in the future of mobility solutions.

Another significant driver for the Japan LiDAR market is the growing demand for precision mapping technologies in infrastructure development and urban planning. LiDAR systems provide highly accurate and detailed 3D mapping, which is crucial for city planning, environmental monitoring, and construction projects. For instance, in 2024, RIEGL, LiDAR solution providing company in Japan, presented the VZ-600i 3D terrestrial laser scanner for BIM and AEC applications, offering fast, accurate surveying with a 1,000-meter range, ideal for documenting structures and ensuring quality during construction. With Japan's urban areas facing challenges like space optimization and natural disaster management, LiDAR technology supports effective infrastructure planning and environmental monitoring. This demand, particularly in sectors such as construction, surveying, and disaster management, is fueling market growth.

Japan LiDAR Market Trends:

Integration of LiDAR with Artificial Intelligence (AI) and Machine Learning (ML)

Another important trend in the Japan LiDAR market is the synergy of LiDAR and artificial intelligence (AI)/machine learning (ML). AI and ML have, due to the advancement of LiDAR technology, been integrated into the LiDAR for efficient processing and analysis of the data. This real-time integration allows decision-making with improved object detection accuracy and application automation in areas such as autonomous vehicles, smart cities, and industrial inspections. For instance, instance, in 2024, advanced LiDAR systems might benefit from the 500 billion yen investment by Toyota and NTT in AI software for self-driving vehicles for enhanced vehicle safety through accident prediction and control. AI and ML algorithms sift through vast volumes of LiDAR data to discern patterns and predict outcomes, proffering additional functionality and value to the LiDAR system. This trend benefits in the construction, agricultural, and city planning fields, as it helps them optimize operational workflows and save costs.

Increased use of LiDAR for environmental monitoring and disaster management.

Another key trend observed is the increased use of LiDAR for environmental monitoring and disaster management. With Japan facing natural disasters such as earthquakes, tsunamis, and typhoons, the country heavily invests in technologies that give an edge in disaster preparedness and response. LiDAR is an important tool for monitoring environmental change and disaster-prone sites, as it has highly accurate mapping capabilities for terrain, infrastructure, and coastal areas through high-resolution, 3D scanning technology. For example, in 2024, Cesium launched Japan 3D Buildings, a countrywide open-source dataset from the MLIT Plateau Platform merging over 200 CityGML datasets into an extensive tileset meant for digital twin visualizations and simulations. The technology supports flood prediction, landslide simulation, and post-disaster evaluation and response. Some projects facing challenges from climate change continue to spur forward the use of LiDAR for disaster risk reduction in Japan under both government and private initiatives concerning environmental safety.

Miniaturization and Cost Reduction

The miniaturization of LiDAR sensors and the corresponding reduction in costs are significant trends influencing Japan’s LiDAR market. Traditional LiDAR systems have been expensive and bulky, limiting their use in certain applications. However, recent advancements in sensor technology have led to the development of smaller, more affordable LiDAR sensors that maintain high levels of accuracy. For instance, in 2024, Lumotive and Hokuyo Automatic launched the YLM-10LX 3D LiDAR sensor, utilizing Lumotive’s Light Control Metasurface technology, revolutionizing 3D sensing for industrial automation and service robotics applications.

This trend is opening up new opportunities for LiDAR adoption across a wider range of industries, including drones, robotics, and handheld devices. The affordability and compactness of these sensors are expected to further drive the market, especially in applications requiring real-time data capture and analysis.

Japan LiDAR Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan LiDAR market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on installation type, component, and application.

Analysis by Installation Type:

- Airborne

- Terrestrial

Airborne LiDAR systems, typically mounted on aircraft, provide high-resolution topographic data for large-scale mapping projects. In Japan, these systems are instrumental in surveying remote or hard-to-reach areas, aiding in disaster management, infrastructure planning, and environmental monitoring.

Ground-based terrestrial LiDAR is used for precise, detailed scans of specific structures or terrain. It supports urban planning, construction, and heritage preservation in Japan, offering high accuracy in densely populated regions.

Analysis by Component:

- Laser Scanners

- Navigation Systems

- Global Positioning Systems

- Others

Laser scanners are critical in LiDAR systems, providing high-resolution data by emitting laser pulses to capture precise 3D measurements. In Japan, they support applications like infrastructure development, disaster management, and environmental monitoring, delivering accurate data for urban planning and the assessment of topography and structures.

Navigation systems integrated with LiDAR help guide the equipment during data collection. In Japan, they enhance autonomous vehicles, robotics, and mobile mapping, ensuring precise positioning and efficient data acquisition in urban and rural environments.

GPS technology is integral to LiDAR systems, ensuring accurate georeferencing of collected data. In Japan, it aids in large-scale surveys for mapping, monitoring natural disasters, and supporting construction projects by providing precise location data, crucial for planning and real-time analysis.

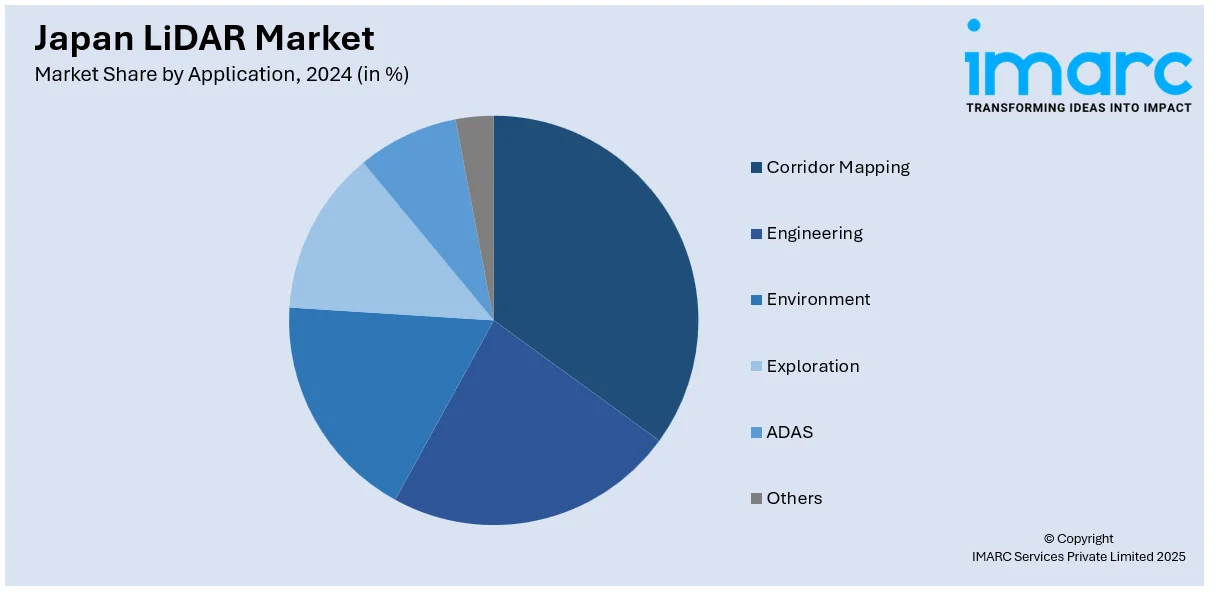

Analysis by Application:

- Corridor Mapping

- Engineering

- Environment

- Exploration

- ADAS

- Others

LiDAR-based corridor mapping in Japan is vital for infrastructure projects, including transportation and utilities. It provides detailed 3D models of linear corridors, helping with the planning of railways, highways, and power lines while improving accuracy, reducing costs, and ensuring minimal disruption to surrounding environments.

LiDAR assists in engineering by offering precise topographic data for designing complex infrastructure projects. In Japan, it supports the construction of bridges, tunnels, and urban developments, improving project efficiency and accuracy while minimizing risks during the design and construction phases.

LiDAR is used for environmental monitoring in Japan, mapping forests, rivers, and coastal areas with high precision. It aids in disaster preparedness, flood modeling, and ecosystem assessments, enabling better management of natural resources and more informed decision-making for conservation efforts and environmental protection.

LiDAR technology is used in Japan for geological and archaeological exploration. By providing detailed 3D data of terrain, it helps in discovering mineral deposits, assessing landforms, and uncovering hidden archaeological sites, supporting both scientific research and resource extraction industries.

LiDAR plays a key role in ADAS in Japan, enabling autonomous vehicles to navigate safely through complex environments. By providing real-time 3D scanning, it enhances vehicle perception for collision avoidance, lane-keeping, and navigation, contributing to the development of Japan's autonomous driving technology and improving road safety.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, home to Tokyo, is a major hub for LiDAR technology in Japan. LiDAR supports urban planning, transportation infrastructure, and environmental monitoring, helping with projects such as city development, earthquake preparedness, and flood modeling. The region also sees significant use of LiDAR in autonomous vehicle testing and smart city initiatives.

In the Kinki region, LiDAR is crucial for mapping infrastructure and natural resources. It supports projects like railway expansion, coastal protection, and urban redevelopment, particularly in Osaka and Kyoto. LiDAR data aids in disaster management, such as earthquake and flood risk analysis, enhancing regional resilience.

The Chubu region benefits from LiDAR technology in areas like industrial infrastructure and environmental monitoring. LiDAR is applied in mapping mountainous terrain, managing forestry resources, and supporting the development of high-speed rail systems. Its use also extends to disaster risk management, especially in seismic activity zones.

In Kyushu and Okinawa, LiDAR helps with topographic mapping, disaster preparedness, and agricultural monitoring. LiDAR supports the development of transportation infrastructure, including airports and ports, while also aiding in volcanic risk management and coastal erosion studies. It plays a key role in environmental conservation and sustainable development in these regions.

The Tohoku region uses LiDAR for post-disaster recovery, particularly following the 2011 earthquake and tsunami. LiDAR aids in mapping damaged infrastructure, coastal areas, and landforms. Additionally, it supports flood modeling, forest management, and environmental research, contributing to the region's reconstruction efforts and natural resource management.

In Chugoku, LiDAR is employed in infrastructure mapping, disaster risk assessment, and agricultural monitoring. The technology is essential for surveying mountainous and coastal areas, improving flood prediction, and assisting in the development of transportation networks. LiDAR data helps in regional planning for sustainable development and environmental protection.

Hokkaido relies on LiDAR for managing its diverse and challenging landscapes, from mountainous areas to forests and coastlines. LiDAR helps with forestry management, disaster risk modeling, and environmental monitoring, particularly in relation to snow and seismic activity. It also supports infrastructure projects, such as road and railway construction, in remote regions.

Shikoku benefits from LiDAR in surveying mountainous terrain, coastal areas, and infrastructure projects. The technology is widely used for flood risk modeling, landslide prediction, and environmental monitoring. It also supports the development of transportation networks and contributes to the region's efforts in disaster preparedness and sustainable resource management

Competitive Landscape:

The competitive landscape of Japan's LiDAR market is characterized by the presence of both established players and emerging startups. Key global companies have a strong foothold, offering advanced LiDAR solutions for automotive, surveying, and industrial applications. For instance, in 2024, Dexerials Technologies announced advancements in miniaturizing high-performance LiDAR through precision adhesives, anti-reflection film, black adhesives, inorganic diffusers, and ACF technology for enhanced LiDAR performance and miniaturization. Japanese companies, including are also prominent in the market, focusing on integrating LiDAR technology into automotive and geospatial applications. The market is highly competitive, with continuous innovation in sensor technology, software integration, and cost-efficiency, positioning LiDAR as a critical technology for autonomous systems and precision mapping in Japan.

The report provides a comprehensive analysis of the competitive landscape in the Japan LiDAR market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Japan's Tier IV will launch its first Level 4 self-driving EV taxi service in Tokyo, utilizing advanced LiDAR sensors for precise autonomous navigation between Tokyo Teleport Station, Kokusai Tenjijo, and Miraikan Museum.

- In September 2023, Toshiba Corporation announced groundbreaking advancements in LiDAR technology, achieving 99.9% accuracy in object tracking and 98.9% recognition using only LiDAR data. These innovations significantly enhance environmental robustness, expanding LiDAR’s potential for diverse applications, making it more reliable for various industries.

Japan LiDAR Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Installation Types Covered | Airborne, Terrestrial |

| Components Covered | Laser Scanners, Navigation Systems, Global Positioning Systems, Others |

| Applications Covered | Corridor Mapping, Engineering, Environment, Exploration, ADAS, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu/Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan LiDAR market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan LiDAR market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan LiDAR industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The LiDAR market in the Japan was valued at USD 183.4 Million in 2024.

The growth of Japan’s LiDAR market is driven by advancements in sensor miniaturization, increased adoption in autonomous vehicles, demand for precise 3D mapping in construction and urban planning, and rising environmental concerns prompting applications in agriculture and disaster management. Government investments in smart city initiatives also contribute to market expansion.

The Japan LiDAR market is projected to exhibit a CAGR of 18.5% during 2025-2033, reaching a value of USD 844.3 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)