Japan Load Break Switch Market Size, Share, Trends and Forecast by Type, Voltage, Installation, End Use, and Region, 2026-2034

Japan Load Break Switch Market Overview:

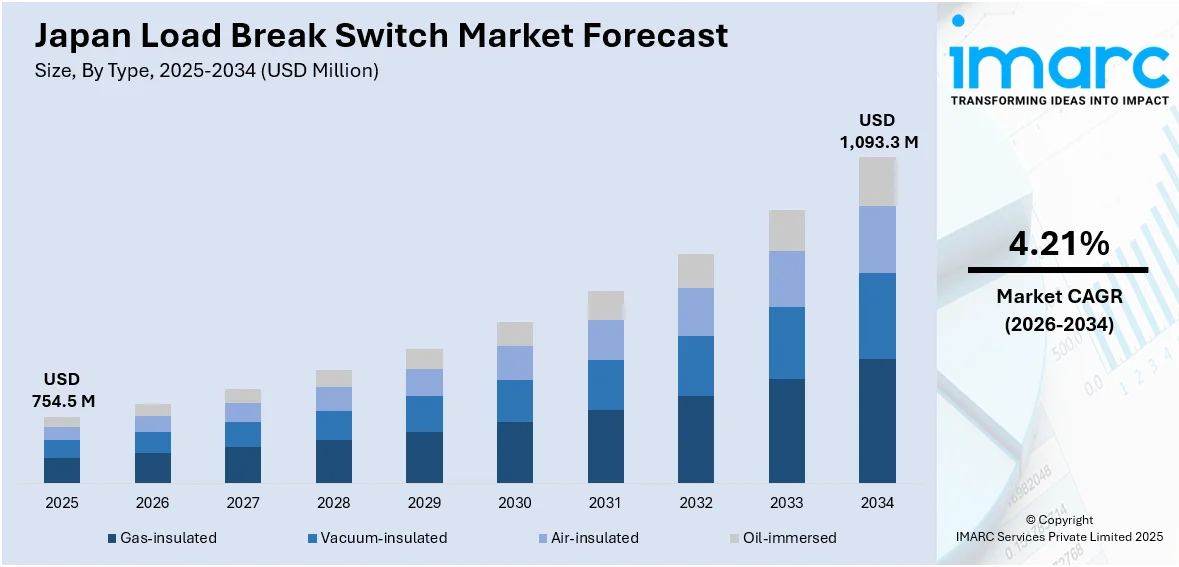

The Japan load break switch market size reached USD 754.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,093.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.21% during 2026-2034. At present, the broadening of renewable energy projects is creating the need for reliable and safe electrical distribution systems like load break switches. Besides this, rising adoption of the Internet of Things (IoT), which aids in enhancing efficiency, is contributing to the expansion of the Japan load break switch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 754.5 Million |

| Market Forecast in 2034 | USD 1,093.3 Million |

| Market Growth Rate 2026-2034 | 4.21% |

Japan Load Break Switch Market Trends:

Expansion of renewable energy projects

The broadening of renewable energy projects is positively influencing the market in Japan. As the country is investing in solar and wind energy projects, the power grid is becoming more decentralized and complex, requiring reliable switching solutions to manage the flow of electricity. In January 2025, Amazon revealed its investment in four new large-scale solar initiatives in Japan. Through this funding, the firm increased its renewable energy capacity in the country more than twofold within a year, rising from 101 megawatts (MW) in 2023 to 211 MW in 2024. Load break switches play a critical role in isolating and controlling power within these renewable systems, ensuring safety during maintenance and preventing electrical faults. Renewable energy sites, such as solar farms and wind installations, often require compact and weather-resistant switchgear to function reliably in varied environmental conditions, driving the demand for advanced load break switches. In addition, the integration of distributed energy resources into local grids needs precise load management, which these switches aid in achieving. With Japan’s strong commitment to reducing carbon emissions and increasing energy independence, renewable projects are being launched, especially in rural and coastal areas. The ability of load break switches to support smooth grid operation and protect systems from overloads makes them a key component in sustainable energy development.

To get more information on this market Request Sample

Rising infrastructure development

As the country continues to upgrade its transportation networks, commercial complexes, and residential projects, the need for reliable electrical infrastructure is becoming more critical. Load break switches play an essential role in managing and isolating power flows, making them vital in newly built electrical networks. Large-scale construction projects, including railways, smart buildings, and industrial zones, require modern switchgear to ensure smooth and secure electricity supply. The emphasis on energy efficiency and system protection in new infrastructure is further boosting the adoption of advanced load break switches. Moreover, as infrastructure projects often involve high-voltage and distributed power systems, load break switches help maintain grid stability and operational safety. These rising construction activities across urban and rural regions are directly supporting the steady growth of the market in Japan. According to the IMARC Group, the Japan construction market size reached USD 625.4 Billion in 2024. Looking forward, IMARC Group expects the market to attain USD 937.4 Billion by 2033, showing a growth rate (CAGR) of 4.37% during 2025-2033.

Increasing adoption of IoT

Rising adoption of IoT is impelling the Japan load break switch market growth. With IoT integration, load break switches can be monitored and controlled from a distance, enabling immediate data gathering, predictive maintenance, and faster fault detection. This enhances grid reliability and reduces downtime, which is especially important in Japan's dense urban and industrial environments. IoT-enabled switches also support automation in smart grids, making energy management more efficient. Utilities and infrastructure developers increasingly prefer smart switchgear to meet modern energy demands and regulatory standards. As IoT continues to transform energy infrastructure, the demand for intelligent and connected load break switches is increasing steadily. This shift towards the employment of the IoT not only improves operational efficiency but also aligns with Japan’s broader goals for digital transformation and sustainable energy management, further strengthening the market. As per industry reports, the Japan IoT market had a valuation of USD 19.10 Billion in 2024 and is projected to attain USD 47.34 Billion by 2030, reflecting a CAGR of 16.16%.

Japan Load Break Switch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, voltage, installation, and end use.

Type Insights:

- Gas-insulated

- Vacuum-insulated

- Air-insulated

- Oil-immersed

The report has provided a detailed breakup and analysis of the market based on the type. This includes gas-insulated, vacuum-insulated, air-insulated, and oil-immersed.

Voltage Insights:

- Below 11 kV

- 11-33 kV

- 33-60 kV

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes below 11 kV, 11-33 kV, and 33-60 kV.

Installation Insights:

- Outdoor

- Indoor

The report has provided a detailed breakup and analysis of the market based on the installation. This includes outdoor and indoor.

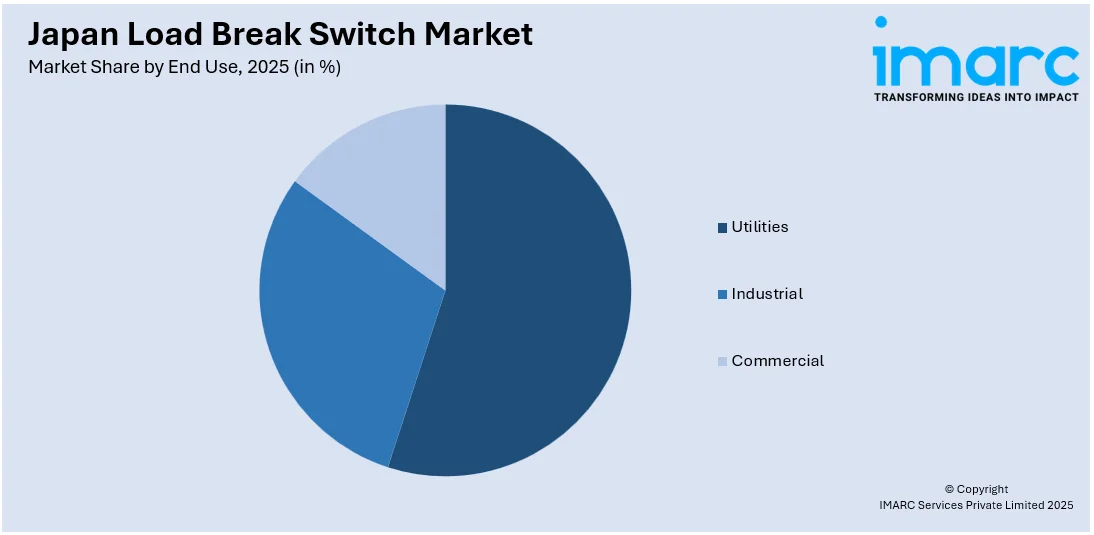

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Utilities

- Industrial

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes utilities, industrial, and commercial.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Load Break Switch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gas-insulated, Vacuum-insulated, Air-insulated, Oil-immersed |

| Voltages Covered | Below 11 kV, 11-33 kV, 33-60 kV |

| Installations Covered | Outdoor, Indoor |

| End Uses Covered | Utilities, Industrial, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan load break switch market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan load break switch market on the basis of type?

- What is the breakup of the Japan load break switch market on the basis of voltage?

- What is the breakup of the Japan load break switch market on the basis of installation?

- What is the breakup of the Japan load break switch market on the basis of end use?

- What is the breakup of the Japan load break switch market on the basis of region?

- What are the various stages in the value chain of the Japan load break switch market?

- What are the key driving factors and challenges in the Japan load break switch market?

- What is the structure of the Japan load break switch market and who are the key players?

- What is the degree of competition in the Japan load break switch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan load break switch market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan load break switch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan load break switch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)