Japan Loaders Market Size, Share, Trends and Forecast by Type, Engine, Fuel, and Region, 2026-2034

Japan Loaders Market Summary:

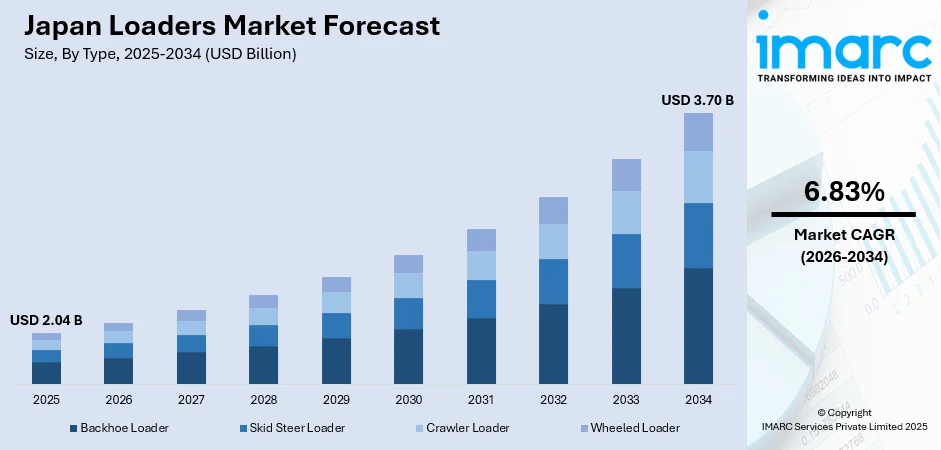

The Japan loaders market size was valued at USD 2.04 Billion in 2025 and is projected to reach USD 3.70 Billion by 2034, growing at a compound annual growth rate of 6.83% from 2026-2034.

The market growth is primarily driven by Japan's substantial investments in infrastructure modernization, the government's accelerated efforts to address aging roadways and bridges, and the robust demand from the construction and mining sectors. The convergence of automation technologies, electrification initiatives, and the upcoming Expo 2025 Osaka is creating significant demand for advanced loading equipment across commercial, industrial, and infrastructure applications, driving Japan loaders market share.

Key Takeaways and Insights:

- By Type: Wheeled loader dominates the market with a share of 36.8% in 2025, driven by its superior mobility and versatility across diverse construction applications, widespread adoption in urban infrastructure projects, and operational efficiency advantages in material handling operations throughout Japan's major metropolitan areas.

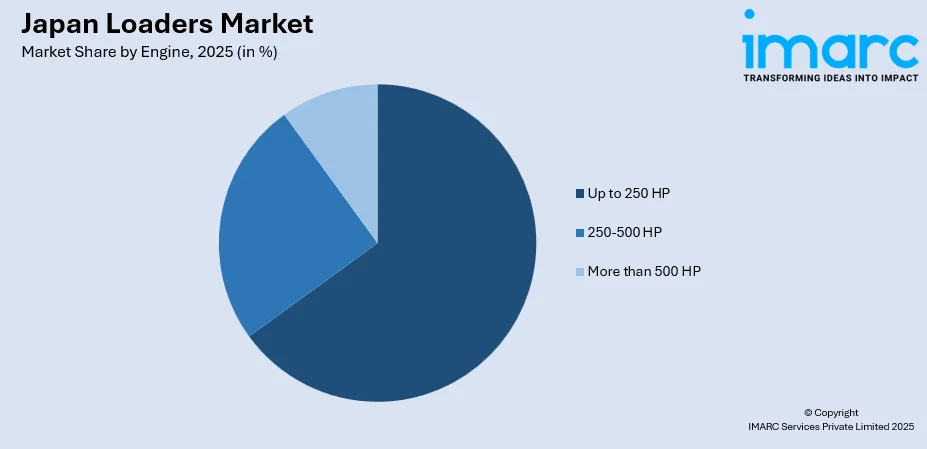

- By Engine: Up to 250 HP leads the market with a share of 65.0% in 2025, due to the predominance of medium-duty construction applications, optimal power-to-weight ratios for urban projects, and cost-effectiveness for general earthmoving tasks requiring balanced performance characteristics across multiple worksites.

- By Fuel: ICE represents the largest segment with a market share of 93.2% in 2025. This dominance reflects the established infrastructure for diesel refueling, proven reliability in demanding construction environments, and the mature supply chain supporting conventional powertrains across Japan's construction and mining sectors.

- By Region: Kanto Region dominates the market with a share of 43.2% in 2025, owing to the concentration of megaprojects in Tokyo and surrounding prefectures, substantial government investments in rail extensions and high-rise developments, and the region's early adoption of advanced construction technologies.

- Key Players: The Japan loaders market exhibits highly competitive intensity, with established domestic manufacturers leveraging technological expertise and global distribution networks while competing alongside international equipment suppliers across diverse application segments.

To get more information on this market Request Sample

The Japan loaders market is being propelled by a combination of infrastructure development, industrial expansion, and ongoing technological advancements in loader machinery. Increasing construction and civil engineering activities demand efficient earthmoving and material handling solutions, thereby raising the need for versatile, high-performance loaders. In 2025, Tokyo’s major redevelopment projects, including Shinagawa’s Takanawa Gateway City and Toranomon’s Azabudai Hills, are set to transform the city’s skyline with multi-functional skyscrapers, smart city features, and enhanced commercial and residential hubs, significantly catalyzing the demand for modern construction equipment. Rising emphasis on operational efficiency, operator safety, and comfort is encouraging the deployment of advanced loaders with ergonomic designs, intelligent control systems, and enhanced hydraulics. Furthermore, environmental sustainability initiatives, regulatory compliance, and fleet modernization requirements are promoting energy-efficient, low-emission machinery. These factors collectively sustain consistent demand and drive the adoption of technologically sophisticated loaders across Japan’s construction and industrial sectors.

Japan Loaders Market Trends:

Rising Demand for Sustainable Construction Equipment

The growing emphasis on environmental sustainability is driving the adoption of electric and low-emission construction equipment. Companies are increasingly prioritizing machinery that reduces carbon footprints, lowers noise pollution, and complies with stricter emissions regulations. This shift encourages manufacturers to develop eco-friendly solutions, creating new market opportunities, boosting demand for innovative green technologies, and promoting investments in energy-efficient, electrically powered construction machinery. In 2025, Volvo introduced its L120 Electric, a 20-ton, battery-powered wheel loader designed for various industrial applications in Japan. The loader offers improved environmental performance, low noise, and reduced CO2 emissions compared to diesel-powered machines. Its release emphasizes Volvo's commitment to sustainability and efficiency in construction and recycling operations.

Infrastructure Development

The increasing number of large-scale infrastructure projects in Japan is catalyzing the demand for versatile and high-capacity loaders across construction and civil engineering sectors. In 2025, Tokyo’s major redevelopment initiatives, including the Shinagawa Takanawa Gateway City and Toranomon-Azabudai Hills projects, are transforming the urban landscape with multi-functional complexes that integrate offices, retail, residential, and cultural spaces. These developments require efficient earthmoving and material handling equipment to maintain project timelines and cost-effectiveness. As urban expansion continues and government-led initiatives focus on modernizing transportation networks and smart city infrastructure, the adoption of technologically advanced, reliable loader machinery is increasingly critical.

Expansion of Mining and Resource Extraction Activities

Japan’s mining and resource extraction sectors are driving the demand for high-capacity loaders capable of handling heavy-duty material movement and transporting aggregates efficiently. In 2025, the government announced plans to begin rare-earth mud seabed mining trials off Minamitori Island in January 2026, aiming to secure domestic supplies of critical minerals such as dysprosium and neodymium for electric vehicle motors and high-tech applications. As mining operations modernize and expand, the adoption of robust, technologically advanced loaders that can operate under challenging environmental conditions becomes essential, supporting continuous operations while enhancing efficiency, safety, and overall productivity.

Market Outlook 2026-2034:

The Japan loaders market is positioned for notable growth, driven by ongoing infrastructure modernization, rising construction investments, and expanding industrial activity across the country. The market generated a revenue of USD 2.04 Billion in 2025 and is projected to reach a revenue of USD 3.70 Billion by 2034, growing at a compound annual growth rate of 6.83% from 2026-2034. This upward trajectory highlights increasing equipment demand, technological advancements, and sustained public and private sector development initiatives supporting long-term market growth.

Japan Loaders Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Wheeled Loader | 36.8% |

| Engine | Up to 250 HP | 65.0% |

| Fuel | ICE | 93.2% |

| Region | Kanto Region | 43.2% |

Type Insights:

- Backhoe Loader

- Skid Steer Loader

- Crawler Loader

- Wheeled Loader

The wheeled loader dominates with a market share of 36.8% of the total Japan loaders market in 2025.

Wheeled loader leads the market due to its superior mobility, versatility, and efficiency across construction, industrial, and municipal applications. Its ability to operate effectively on paved and semi-paved surfaces makes it highly suitable for Japan’s urban and infrastructure-focused development landscape.

Additionally, wheeled loader offers lower operating costs, easier maintenance, and faster cycle times compared to tracked alternatives. Its adaptability for tasks such as material handling, excavation, and waste management further strengthens its market leadership, supporting widespread adoption across Japan’s expanding construction and industrial sectors. In 2024, Komatsu launched the WA700-8 wheel loader, designed for quarry operations and aggregate producers. This model boasted up to 8% more power, 15% more torque, and a 6% increase in lifting force compared to its predecessor. With advanced automation, improved fuel efficiency, and enhanced operator comfort, the WA700-8 was built to optimize productivity in demanding work environments.

Engine Insights:

Access the comprehensive market breakdown Request Sample

- Up to 250 HP

- 250-500 HP

- More than 500 HP

Up to 250 HP leads with a market share of 65.0% of the total Japan loaders market in 2025.

Up to 250 HP represents the largest segment owing to its suitability for medium-scale construction, urban development, and industrial operations. Its balanced power, fuel efficiency, and compact maneuverability align well with Japan’s space-constrained job sites and diverse project requirements.

Moreover, this engine segment offers lower operating costs, easier maintenance, and greater versatility compared to higher-horsepower models. Its broad applicability, ranging from material handling to roadwork and municipal services, supports widespread adoption, solidifying its leading position in the market.

Fuel Insights:

- Electric

- ICE

ICE exhibits a clear dominance with a 93.2% share of the total Japan loaders market in 2025.

ICE holds the biggest market share, driven by its proven reliability, high power output, and ability to perform demanding tasks across construction, mining, and industrial applications. It is especially crucial in massive urban renewal initiatives, such as Shibuya's $13 billion redevelopment project in 2025, which is actively reshaping Tokyo's iconic district.

Additionally, ICE loader offers extended operating hours and fast refueling, making it well-suited for continuous or heavy-duty use. Its established market presence, wide availability of service support, and cost-effectiveness reinforce its market dominance.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region leads with a market share of 43.2% of the total Japan loaders market in 2025.

The Kanto Region dominates the market, driven by its concentration of large-scale construction projects, dense urban development, and ongoing infrastructure upgrades. The rise of large-scale construction projects and ongoing infrastructure upgrades, is clearly demonstrated by developments like NEXCO EAST's 2025 announcement of the official name for the new Tsukubamirai Smart Interchange on the Joban Expressway, which will improve regional access. Such projects drive the demand for loaders in roadworks, commercial construction, and municipal activities supports the region’s strong market share.

Additionally, Kanto Region hosts a significant number of industrial facilities, logistics hubs, and equipment rental companies, further driving loader utilization. Its strong economic activity and continuous urban expansion create sustained equipment requirements, solidifying Kanto’s position as the leading region in the market.

Market Dynamics:

Growth Drivers:

Why is the Japan Loaders Market Growing?

Increasing Demand from Logistics and Material Handling Sectors

The rapid growth of logistics, warehousing, and material handling operations in Japan is driving the demand for versatile loaders that ensure efficient loading, unloading, and transportation of bulk goods. In 2025, the Ministry of Economy, Trade and Industry (METI) reported that Japan’s B2C e-commerce market reached 26.1 trillion yen in 2024, while the B2B segment totaled 514.4 trillion yen, underscoring the expanding need for reliable material handling equipment. Companies are increasingly adopting advanced loaders with enhanced capacity, maneuverability, and durability to reduce labor dependency, minimize handling errors, and maintain consistent productivity across complex supply chain networks.

Government Policies and Regulatory Support

Government policies promoting infrastructure development, industrial expansion, and environmental sustainability are key factors impelling the Japan loaders market growth. In FY2025, Japan’s Cabinet Office allocated $225 million to advance smart city technologies, alongside significant investments at prefectural, municipal, and private-sector levels, highlighting the emphasis on modern urban development. Regulations encouraging mechanization in construction and mining, coupled with subsidies, tax incentives, and modernization support programs, foster the adoption of efficient, technologically advanced loaders. Additionally, stringent safety and emission standards promote the use of low-impact machinery, ensuring consistent demand and creating a favorable regulatory environment for loader manufacturers and suppliers nationwide.

Growing Applications in Energy and Utilities

Loaders play a critical role in transporting construction materials, equipment, and debris for energy infrastructure projects, including power plants, solar farms, and utility installations, ensuring operational efficiency and timely project execution. In 2025, Japan commissioned its first osmotic power plant in Fukuoka City, generating 880,000 kWh annually, sufficient to power the local desalination facility, underscoring the nation’s growing investment in renewable energy infrastructure. As energy projects expand, the demand for versatile, high-capacity loaders capable of handling heavy materials in challenging environments rises, reinforcing market growth and supporting the adoption of advanced machinery across Japan’s energy sector.

Market Restraints:

What Challenges the Japan Loaders Market is Facing?

Skilled Equipment Operator Shortage Constraining Productivity

The aging workforce of the construction industry' creates significant operational challenges as experienced equipment operators retire faster than new talent enters the sector. Strict immigration policies limit foreign labor availability while training programs struggle to attract younger generations to construction careers. This operator shortage constrains equipment utilization rates and project completion timelines despite available machinery.

High Equipment Acquisition and Ownership Costs

Advanced loaders that integrate automation, electrification, and connectivity technologies require substantial capital outlays, posing significant challenges for smaller contractors. Added pressures from import tariffs, currency volatility, and specialized maintenance needs further inflate overall ownership expenses. Together, these financial hurdles constrain the ability of small and medium enterprises to acquire and benefit from technologically sophisticated equipment solutions in their daily operations.

Supply Chain Disruptions Affecting Equipment Availability

Global supply chain constraints continue to affect construction equipment availability through persistent component shortages and prolonged delivery timelines. Ongoing semiconductor supply limitations disrupt production schedules, while difficulties in sourcing specialized parts intensify inventory pressures for manufacturers and distributors. Collectively, these disruptions hinder market growth by delaying new equipment deployments, restricting fleet expansion efforts, and increasing operational uncertainty for industry stakeholders.

Competitive Landscape:

The Japan loaders market exhibits highly competitive intensity characterized by the presence of established domestic manufacturers alongside international equipment suppliers competing across diverse application segments. Market dynamics reflect strategic positioning ranging from premium, technology-driven offerings emphasizing autonomous capabilities and fuel efficiency to value-oriented products targeting cost-conscious contractors. The competitive landscape is increasingly shaped by electrification initiatives, digital fleet management capabilities, and after-sales service excellence. Domestic manufacturers leverage deep distribution networks and local service infrastructure while global competitors emphasize technological innovation and product breadth to capture market opportunities across construction, mining, and industrial applications.

Recent Developments:

- In October 2025, Volvo CE launched its New Generation wheel loaders in Asia, offering improved productivity, safety, and operator comfort. The new models, including the L150, L180, L200 High Lift, L220, and L260, feature faster cycle times, intelligent systems, and enhanced fuel efficiency. Tailored to meet regional needs, the machines support demanding applications like material handling, quarrying, and waste management.

- In September 2025, Fujisaka Co. unveiled the CAT995-12, one of the world's largest wheel loaders, in Tochigi Prefecture, Japan. Weighing 250 tons and measuring 19.5 meters in length, this super-large machine was specially ordered and assembled in Japan. The loader is designed for heavy-duty applications and aims to enhance productivity in Japan's construction industry.

Japan Loaders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Backhoe Loader, Skid Steer Loader, Crawler Loader, Wheeled Loader |

| Engines Covered | Up to 250 HP, 250-500 HP, More than 500 HP |

| Fuels Covered | Electric, ICE |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan loaders market size was valued at USD 2.04 Billion in 2025.

The Japan loaders market is expected to grow at a compound annual growth rate of 6.83% from 2026-2034 to reach USD 3.70 Billion by 2034.

Wheeled loader dominates the Japan loaders market with a share of 36.8% in 2025, driven by superior mobility, operational versatility, and widespread adoption across urban construction and material handling applications.

Key factors driving the Japan loaders market include the growing focus on sustainability, which is driving the demand for low-emission construction equipment. In 2025, Volvo launched its 20-ton L120 Electric wheel loader in Japan, offering reduced CO2 emissions, low noise, and improved efficiency, highlighting the shift toward eco-friendly machinery.

Major challenges include skilled equipment operator shortages constraining productivity, high acquisition costs for advanced automated and electrified equipment, supply chain disruptions affecting component availability, and extended delivery timelines impacting fleet expansion capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)