Japan Low Calorie Sweeteners Market Size, Share, Trends and Forecast by Source, Type, Application, and Region, 2025-2033

Japan Low Calorie Sweeteners Market Overview:

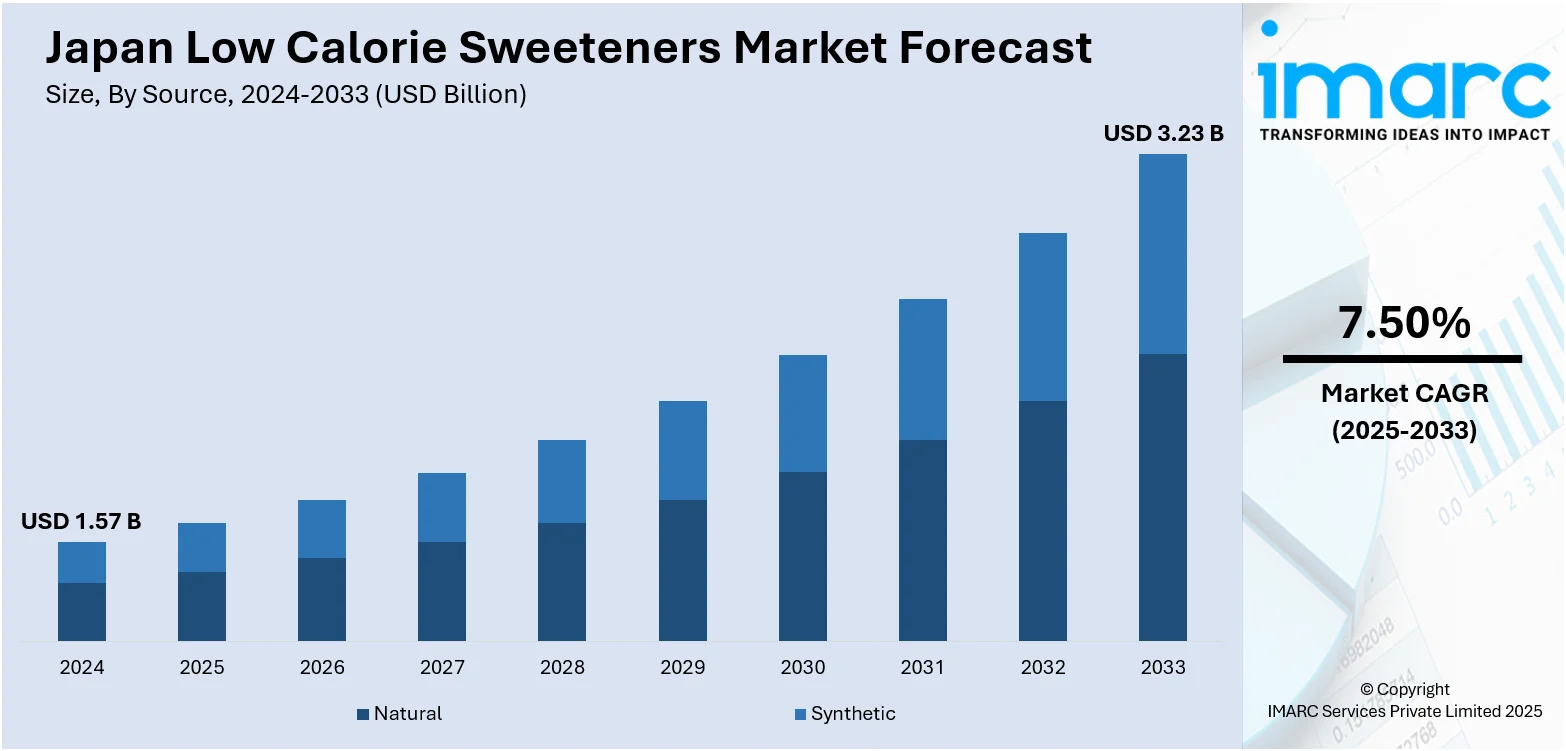

The Japan low calorie sweeteners market size reached USD 1.57 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.23 Billion by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The market is expanding due to increasing health consciousness and shifting toward sugar alternatives. Rising concerns over obesity and diabetes have encouraged consumers to prefer natural sweeteners like stevia and monk fruit. Innovations in product formulations and broader applications in food and beverages further influence the Japan low calorie sweeteners market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.57 Billion |

| Market Forecast in 2033 | USD 3.23 Billion |

| Market Growth Rate 2025-2033 | 7.50% |

Japan Low Calorie Sweeteners Market Trends:

Health Awareness and Rise in Lifestyle Diseases

Japanese consumers are increasingly prioritizing health due to high rates of obesity, diabetes, and other lifestyle diseases. Data reveals that millions face blood sugar issues, prompting demand for low-calorie sweeteners that help regulate sugar intake. Government health surveys and nutritional guidance from the Ministry of Health consistently emphasize reducing sugar consumption, fueling interest in sugar-free and reduced-calorie alternatives. As more individuals seek dietary options to support weight management and overall wellness, products like stevia, erythritol, and monk fruit are preferred over regular sugar. This collective mindset shift is foundational to the market’s growth, as manufacturers and retailers respond by offering an expanding range of sweeteners aligned with health and disease prevention priorities in Japan.

To get more information on this market, Request Sample

Innovation in Formulation, Taste and Applications

Food technology innovations are enhancing the taste and versatility of low-calorie sweeteners, addressing earlier issues like off‑flavors. Producers are blending sweeteners (e.g., stevia with erythritol) and launching novel alternatives like brazzein to mimic sugar’s profile closely. These improved formulations support wider use in beverages, dairy, bakery, confectioneries, and ready-to-eat foods. Additionally, companies focus on natural-origin, plant-based, sustainable sweeteners, appealing to clean-label and eco-conscious consumers. Ongoing research and development (R&D) partnerships between domestic and global firms fuel better sensory experiences and functional blends—e.g., sweetness without aftertaste. Such product innovation helps overcome taste barriers, drives adoption in diverse food categories, and reinforces Japan low calorie sweeteners market growth.

Aging Population & Diabetes Management

Japan’s aging demographic includes a substantial proportion of individuals over 65, with many diagnosed with diabetes or pre-diabetes conditions. This segment often pays close attention to glycemic impact, prompting demand for low-glycemic, low-calorie sweeteners suited for blood sugar control. Health experts recommend sugar alternatives as a dietary strategy to reduce glucose spikes and manage calorie intake. As a result, natural sweeteners such as stevia and monk fruit, along with sugar alcohols, have gained preference given their minimal effect on blood glucose. This demand from older adults and diabetics strongly shapes product development, market positioning, and sustained growth in Japan’s low-calorie sweeteners landscape.

Japan Low Calorie Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, type, and application.

Source Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the source. This includes natural and synthetic.

Type Insights:

- Sucralose

- Saccharin

- Aspartame

- Neotame

- Advantame

- Acesulfame Potassium

- Stevia

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes sucralose, saccharin, aspartame, neotame, advantame, acesulfame potassium, stevia, and others.

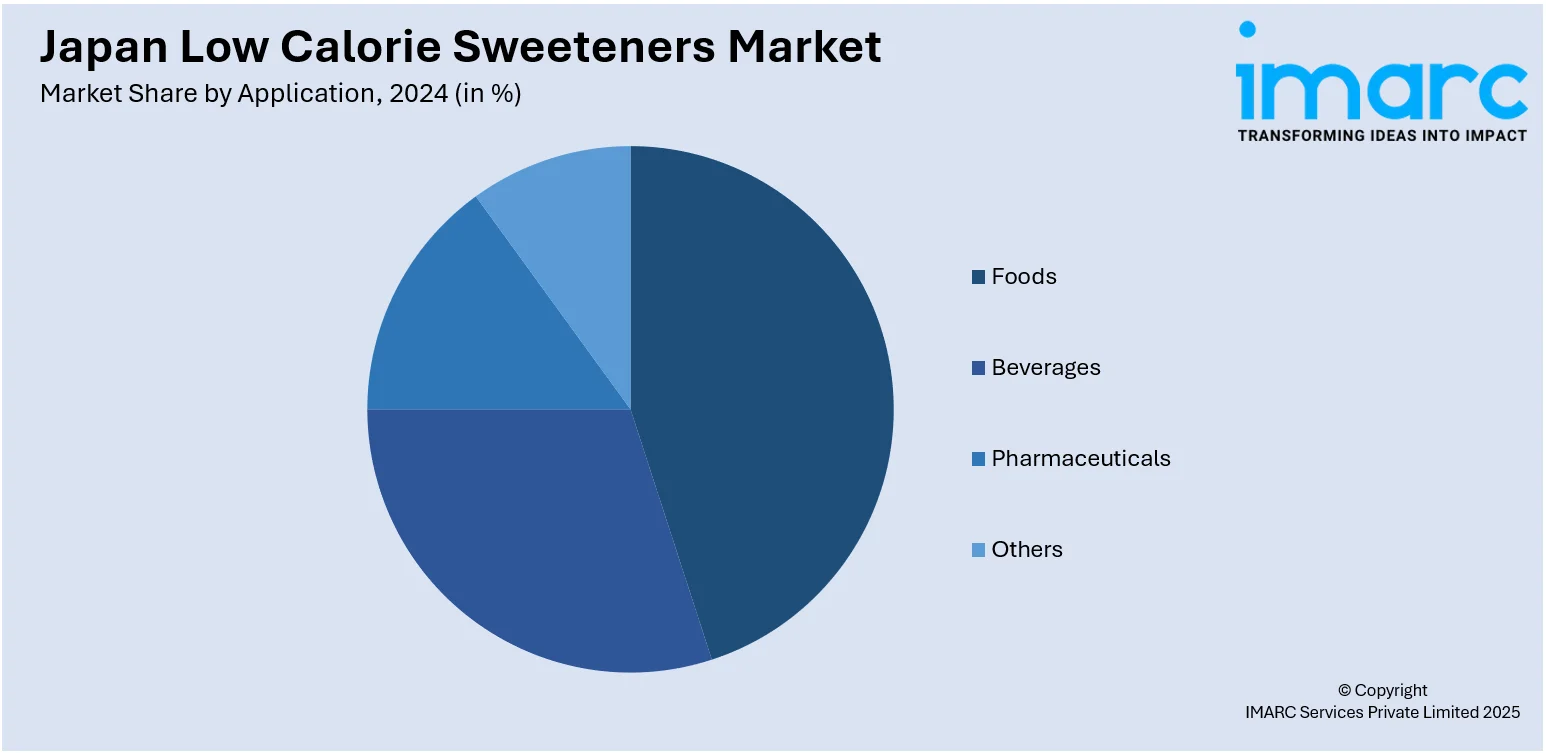

Application Insights:

- Foods

- Bakery

- Frozen Food and Dairy

- Confectionery

- Others

- Beverages

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes foods (bakery, frozen food and dairy, confectionery, and others), beverages, pharmaceuticals, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Low Calorie Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Natural, Synthetic |

| Types Covered | Sucralose, Saccharin, Aspartame, Neotame, Advantam, Acesulfame Potassium, Stevia, Others |

| Applications Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan low calorie sweeteners market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan low calorie sweeteners market on the basis of source?

- What is the breakup of the Japan low calorie sweeteners market on the basis of type?

- What is the breakup of the Japan low calorie sweeteners market on the basis of application?

- What is the breakup of the Japan low calorie sweeteners market on the basis of region?

- What are the various stages in the value chain of the Japan low calorie sweeteners market?

- What are the key driving factors and challenges in the Japan low calorie sweeteners market?

- What is the structure of the Japan low calorie sweeteners market and who are the key players?

- What is the degree of competition in the Japan low calorie sweeteners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan low calorie sweeteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan low calorie sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan low calorie sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)