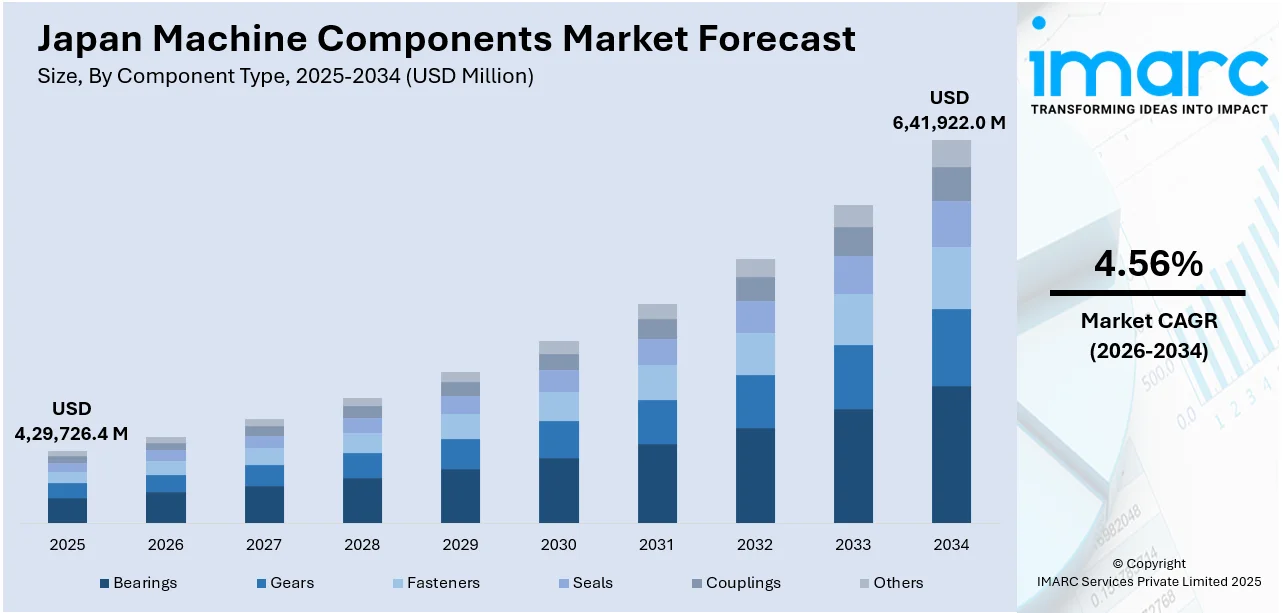

Japan Machine Components Market Size, Share, Trends and Forecast by Component Type, Material, End Use Industry, and Region, 2026-2034

Japan Machine Components Market Overview:

The Japan machine components market size reached USD 4,29,726.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,41,922.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.56% during 2026-2034.The market is driven by rapid automation and Industry 4.0 adoption, aging industrial infrastructure requiring modernization, and a strong push toward green manufacturing. As labor shortages intensify, smart components that enable predictive maintenance and efficiency are in high demand. Simultaneously, older equipment across industries is being upgraded with advanced, compatible components. Additionally, government-led sustainability initiatives are boosting the need for energy-efficient and eco-friendly components, making green innovation a critical factor for rising Japan machine components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4,29,726.4 Million |

|

Market Forecast in 2034

|

USD 6,41,922.0 Million |

| Market Growth Rate 2026-2034 | 4.56% |

Japan Machine Components Market Trends:

Automation and Industry 4.0 Integration

Japan's machine components industry is more and more being driven by the introduction of smart manufacturing and Industry 4.0 technologies. Organizations are embedding Internet of Things (IoT)-ready components, sensors, and control systems to improve productivity, minimize downtime, and facilitate predictive maintenance. This trend is particularly high in industries such as automotive, electronics, and precision machinery, where efficiency in operations and real-time information matter the most. As their workforce becomes increasingly scarce due to Japan's aging population, automation becomes not only helpful but imperative. Government incentives towards digitalization, like the "Society 5.0" program, accelerate investment in smart components and systems even more. Japanese companies are world leaders in robotics as well, and the demand for high-performance, modular, and low-energy components matches trends worldwide. This drive for cutting-edge automation is essentially reframing design, procurement, and maintenance standards within the machine components industry.

To get more information on this market Request Sample

Green Manufacturing and Energy Efficiency Initiatives

Sustainability is becoming a top priority in Japan’s manufacturing sector, deeply influencing the machine components market. Japan generated 25.7% of its electricity from renewable sources in 2023, up from 22.7% the year before, with solar and wind power playing important roles. This shift supports national carbon neutrality goals and rising energy costs, prompting manufacturers to adopt greener components such as energy-efficient motors, lightweight materials, and low-friction bearings. Government decarbonization initiatives and subsidies for green technologies further accelerate this transition. Manufacturers face growing pressure to reduce their carbon footprint and meet global Environmental, Social, and Governance (ESG) standards. As a result, demand is rising for components that enable smarter energy use like regenerative drives and high-efficiency actuators. Suppliers emphasizing sustainable production and recyclable materials gain a competitive edge. This green transformation is both a regulatory necessity and a critical market differentiator further impelling the Japan machine components market growth.

Aging Infrastructure and Equipment Modernization

Japan's strong industrial foundation features a massive inventory of older equipment that more and more needs to be replaced or retrofitted. Most factories, particularly in central industries such as automobiles, manufacturing, and heavy industry, have equipment that is decades old. As standards of performance, efficiency, and safety change, mounting pressure exists to upgrade these systems with second-generation machine components. This drives strong demand for both original equipment manufacturer parts and aftermarket alternatives. Japan machine components market trends reflect how component makers are taking advantage of this trend with higher but backward-compatible upgrades that plug into existing systems. The wave of modernization is also driven by more stringent laws on emissions, power use, and occupational safety. Also, Japanese businesses are renowned for emphasizing precision and reliability, and therefore, the market is ready for high-quality, long-lasting components. This long-cycle replacement business underpins consistent growth and development in materials, miniaturization, and component life.

Japan Machine Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component type, material, and end use industry.

Component Type Insights:

- Bearings

- Gears

- Fasteners

- Seals

- Couplings

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes bearings, gears, fasteners, seals, couplings, and others.

Material Insights:

- Metals

- Plastics

- Composites

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metals, plastics, and composites.

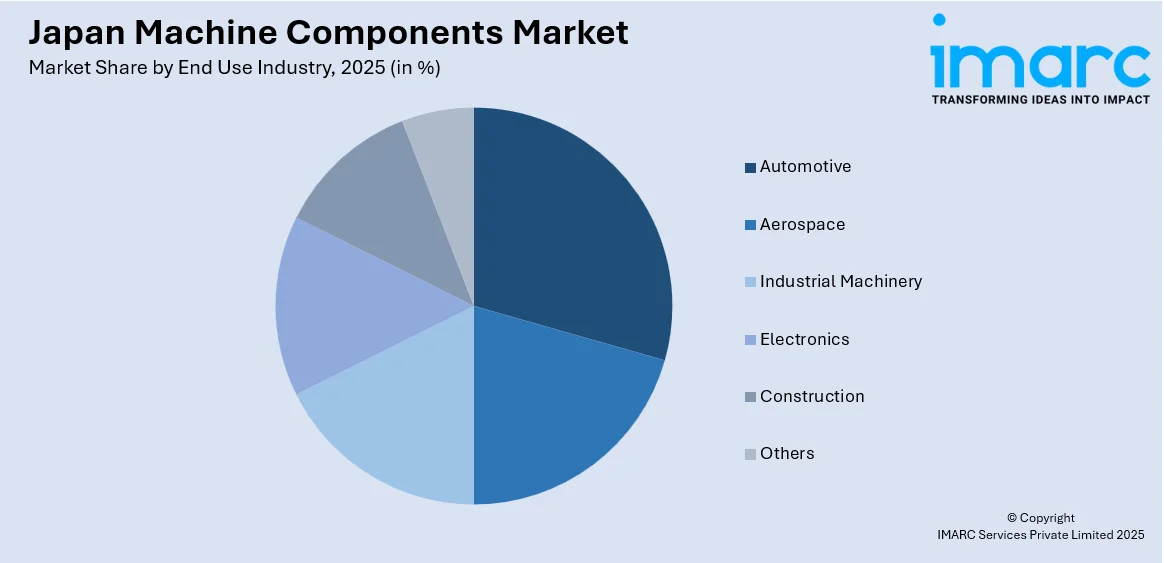

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace

- Industrial Machinery

- Electronics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, aerospace, industrial machinery, electronics, construction, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Machine Components Market News:

- In December 2024, HKS Co., Ltd. and Nippon Seiki Co., Ltd. (Defi brand) partnered to launch cutting-edge meter systems and precision instruments for EVs, blending HKS’s aftermarket expertise with Defi’s instrumentation innovation. Debuting at January’s Tokyo Auto Salon, this collaboration marks a major milestone in Japan’s automotive aftermarket, aiming to deliver advanced, high-performance solutions to the global market through their combined engineering and design strengths.

- In December 2024, Japan launched a US$670 million subsidy scheme to boost domestic production of semiconductors, advanced electronic components, and batteries. Aimed at enhancing economic security and reinforcing supply chains, the initiative reflects the government’s strategic push to strengthen key tech industries. This move supports innovation, reduces reliance on imports, and positions Japan as a resilient player in the global high-tech manufacturing landscape.

Japan Machine Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Bearings, Gears, Fasteners, Seals, Couplings, Others |

| Materials Covered | Metals, Plastics, Composites |

| End Use Industries Covered | Automotive, Aerospace, Industrial Machinery, Electronics, Construction, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan machine components market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan machine components market on the basis of component type?

- What is the breakup of the Japan machine components market on the basis of material?

- What is the breakup of the Japan machine components market on the basis of end use industry?

- What is the breakup of the Japan machine components market on the basis of region?

- What are the various stages in the value chain of the Japan machine components market?

- What are the key driving factors and challenges in the Japan machine components market?

- What is the structure of the Japan machine components market and who are the key players?

- What is the degree of competition in the Japan machine components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan machine components market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan machine components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan machine components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)