Japan Maintenance Repair and Operations Market Size, Share, Trends and Forecast by Provider, MRO Type, and Region, 2026-2034

Japan Maintenance Repair and Operations Market Overview:

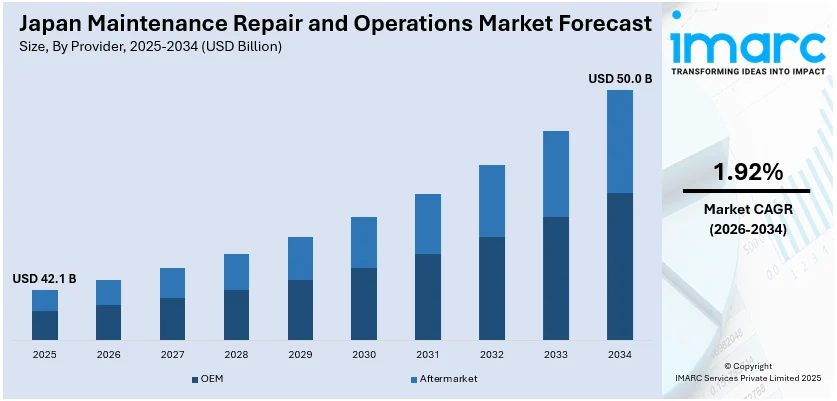

The Japan maintenance repair and operations market size reached USD 42.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 50.0 Billion by 2034, exhibiting a growth rate (CAGR) of 1.92% during 2026-2034. The rising industrial automation, aging infrastructure, stringent safety regulations, increasing focus on operational efficiency, and the expansion of manufacturing facilities, technological advancements and the growing need for predictive maintenance across key sectors are some of the major factors augmenting Japan maintenance repair and operations market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 42.1 Billion |

| Market Forecast in 2034 | USD 50.0 Billion |

| Market Growth Rate 2026-2034 | 1.92% |

Japan Maintenance Repair and Operations Market Trends:

Emphasis on Sustainability and Circular Maintenance Practices

Environmental sustainability is increasingly shaping MRO strategies across Japanese industries, which is facilitating Japan maintenance repair and operations market growth. There is growing pressure to reduce resource consumption, minimize emissions, and extend the usable life of industrial equipment. Maintenance departments are adopting circular economy principles, thereby emphasizing reuse, refurbishment, and recycling rather than replacement. In addition to this, Japanese firms are also incorporating energy audits and emission monitoring into regular maintenance routines, especially in energy-intensive sectors such as chemicals, metallurgy, and manufacturing. According to an industry report, Japan's industry and environment ministries have a comprehensive plan to reduce greenhouse gas emissions by 60% from 2013 levels by 2035, an increase from its previous 2030 target of a 46% reduction. This move signals a stronger regulatory push toward sustainability, reinforced by frameworks such as the Act on Rational Use of Energy and evolving sustainability disclosure standards. In response to these regulations, industries across Japan, including the MRO market, are adapting their strategies to align with stricter environmental goals. MRO suppliers are increasingly offering green-certified products, energy-efficient equipment, and environmentally conscious service solutions to support decarbonization efforts. Companies are also integrating sustainable practices into their supply chains, reducing waste, and optimizing energy use in operations.

To get more information on this market Request Sample

Aging Infrastructure and Industrial Equipment

Japan faces a growing challenge due to the age of its infrastructure and industrial assets, which is positively impacting Japan maintenance repair and operations market outlook. Industry reports indicates that much of the country's infrastructure, such as bridges, tunnels, factories, and public facilities, was developed during the high-growth post-war era of the 1950s through the 1970s. As these assets exceed 50 years of service, their structural integrity and functional reliability decline, driving increased demand for preventive and corrective maintenance. In industrial settings, legacy machinery still accounts for a significant share of installed equipment, especially in manufacturing sectors such as automotive, electronics, and heavy engineering. This is leading to a greater focus on condition-based monitoring, retrofitting, and component replacements. Firms are investing in diagnostics and lifecycle extension technologies, including ultrasonic sensors, vibration analysis, and thermal imaging. In the public sector, government agencies are enforcing stricter inspection schedules and incentivizing the adoption of smart maintenance systems. These requirements are stimulating steady growth in specialized MRO services, components, and tools across sectors. This trend is particularly significant for contractors and suppliers that specialize in retrofitting, refurbishment, and aging infrastructure assessment.

Japan Maintenance Repair and Operations Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on provider and MRO type.

Provider Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the provider. This includes OEM and aftermarket.

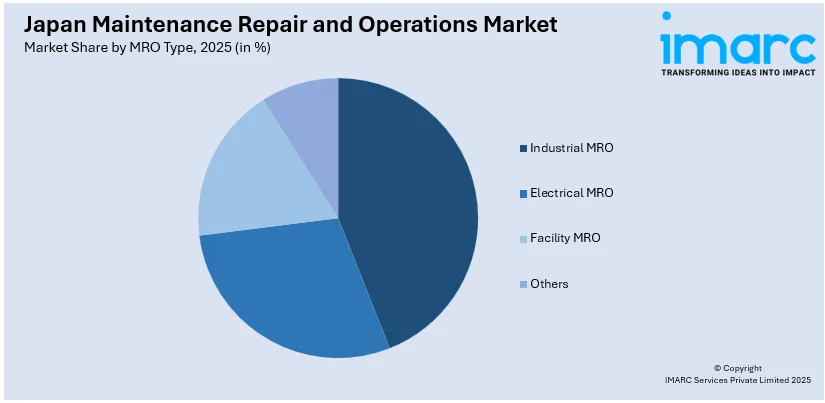

MRO Type Insights:

Access the comprehensive market breakdown Request Sample

- Industrial MRO

- Electrical MRO

- Facility MRO

- Others

A detailed breakup and analysis of the market based on the MRO type have also been provided in the report. This includes industrial MRO, electrical MRO, facility MRO, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Maintenance Repair and Operations Market News:

- On September 2, 2024, Mitsubishi Heavy Industries (MHI) and Japan Airlines (JAL) established a pact to explore partnership in the aircraft aftermarket industry, focusing on services such as repairs, maintenance, parts supply, and refurbishment. This initiative aims to address the increasing demand for maintenance services amid a global resurgence in aircraft demand, leveraging JAL's operational and maintenance expertise alongside MHI's capabilities in aircraft design, development, manufacturing, certification, and maintenance, repair, and overhaul (MRO) services, particularly in North America.

- On November 20, 2024, Kawasaki Heavy Industries announced its entry into the civil aircraft engine maintenance sector, focusing on the PW1100G-JM engines. With an investment of approximately 7 Billion yen (about USD 47.44 Million), the company aims to service at least 50 engines annually by fiscal year 2031. This initiative leverages Kawasaki's extensive experience in engine development and maintenance to address the growing global demand for aircraft engine services.

Japan Maintenance Repair and Operations Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | OEM, Aftermarket |

| MRO Types Covered | Industrial MRO, Electrical MRO, Facility MRO, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan maintenance repair and operations market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan maintenance repair and operations market on the basis of provider?

- What is the breakup of the Japan maintenance repair and operations market on the basis of MRO type?

- What is the breakup of the Japan maintenance repair and operations market on the basis of region?

- What are the various stages in the value chain of the Japan maintenance repair and operations market?

- What are the key driving factors and challenges in the Japan maintenance repair and operations market?

- What is the structure of the Japan maintenance repair and operations market and who are the key players?

- What is the degree of competition in the Japan maintenance repair and operations market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan maintenance repair and operations market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan maintenance repair and operations market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan maintenance repair and operations industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)