Japan Material Testing Equipment Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Japan Material Testing Equipment Market Overview:

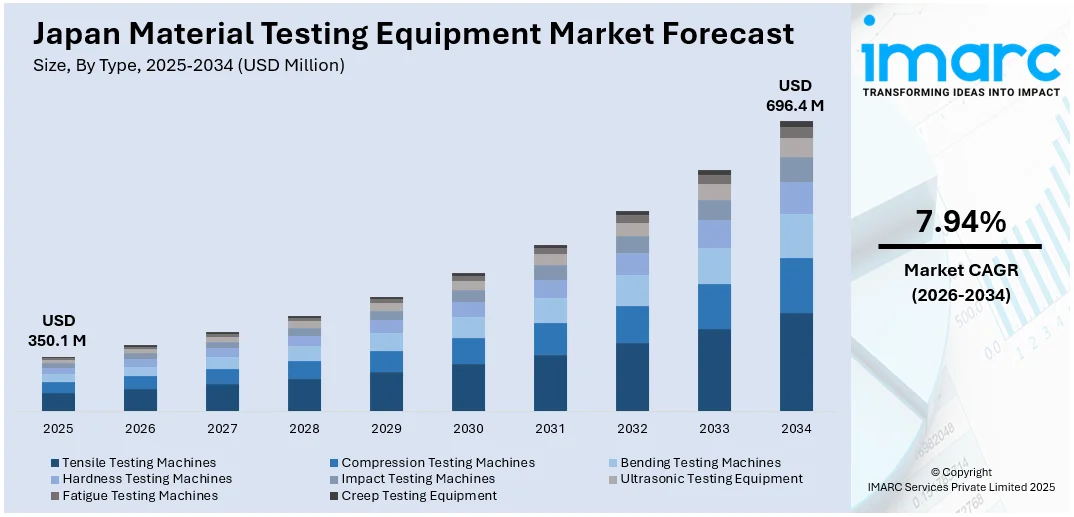

The Japan material testing equipment market size reached USD 350.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 696.4 Million by 2034, exhibiting a growth rate (CAGR) of 7.94% during 2026-2034. The market is driven by stringent material compliance requirements in precision manufacturing sectors such as automotive, semiconductors, and robotics. The need to assess aging infrastructure and ensure earthquake-resistant construction further supports material testing demand, thereby fueling the market. Sustainability mandates and rapid material innovation require advanced, multi-functional testing technologies, reinforcing the Japan material testing equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 350.1 Million |

| Market Forecast in 2034 | USD 696.4 Million |

| Market Growth Rate 2026-2034 | 7.94% |

Japan Material Testing Equipment Market Trends:

Advanced Manufacturing and Precision Engineering Standards

Japan’s reputation for precision manufacturing spanning automotive, robotics, semiconductors, and optics necessitates strict material compliance protocols. Industrial firms require high-resolution testing equipment to measure mechanical, thermal, and fatigue properties of alloys, ceramics, polymers, and composites used in component manufacturing. The country’s dense R&D ecosystem demands custom test conditions to validate materials under extreme stress, vibration, or temperature. Automotive leaders, such as Toyota and Honda, conduct extensive fatigue and impact testing to ensure long-term part performance, especially for hybrid and EV components. Meanwhile, semiconductor and electronics firms require nano-indentation and micro-mechanical testing to meet next-generation product standards. On April 25, 2025, OKI Circuit Technology announced the development of 124-layer printed circuit board (PCB) technology designed for next-generation AI semiconductor testing equipment. This new PCB design represents a 15% increase in layer density compared to conventional 108-layer designs and will be used for wafer inspection of high bandwidth memory (HBM) semiconductors. Material testing laboratories are equipped with automated, digitally networked machines that comply with both Japanese Industrial Standards (JIS) and global norms like ASTM and ISO. Furthermore, strong interlinkages between academia and industry have led to collaborative testing facilities that validate new materials before commercialization. The integration of smart metrology systems into production lines enhances traceability and precision. These practices position quality control as a central competitive strategy for Japanese manufacturers and drive long-term procurement cycles of high-performance material testing systems supporting Japan material testing equipment market growth.

To get more information on this market Request Sample

Rapid AI Data Center Expansion in Japan

The rapid expansion of AI data centers in Japan is driving a significant demand for advanced material testing solutions, particularly in the optical communications and semiconductor industries. As these data centers require high-speed data processing, there is an increasing need for optical components such as laser diodes, optical transceivers, and amplifiers, which must meet stringent performance and reliability standards. To support the manufacturing of these complex components, precision material testing equipment like optical spectrum analyzers has become essential. These instruments enable accurate and efficient evaluation of critical materials, ensuring that the optical devices used in AI data centers can handle high data loads with minimal errors. On February 17, 2025, Yokogawa Test & Measurement Corporation announced the release of the AQ6361 Optical Spectrum Analyzer, designed for production testing of optical components used in AI data centers. The AQ6361 offers up to 20 times faster measurement speeds compared to its predecessor, enhancing production efficiency for optical device manufacturers. As Japan solidifies its position as a global leader in AI and semiconductor industries, the need for high-performance testing technologies is set to grow, bolstering the demand for state-of-the-art material testing equipment. The combination of cutting-edge technologies and rigorous testing standards is essential for ensuring that Japan’s AI infrastructure can support the future of data processing, pushing the material testing equipment market to new heights in both demand and innovation.

Japan Material Testing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Tensile Testing Machines

- Compression Testing Machines

- Bending Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Ultrasonic Testing Equipment

- Fatigue Testing Machines

- Creep Testing Equipment

The report has provided a detailed breakup and analysis of the market based on the type. This includes tensile testing machines, compression testing machines, bending testing machines, hardness testing machines, impact testing machines, ultrasonic testing equipment, fatigue testing machines, and creep testing equipment.

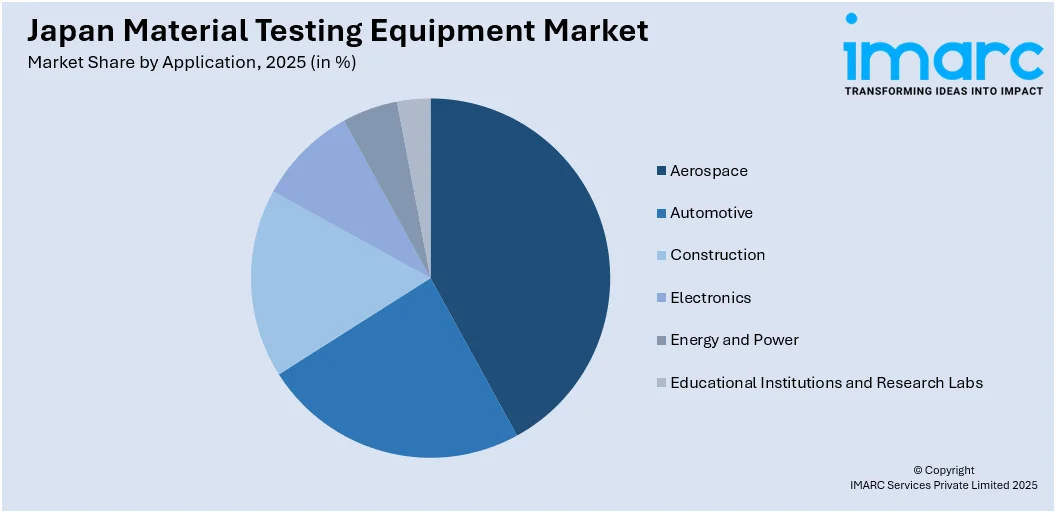

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace

- Automotive

- Construction

- Electronics

- Energy and Power

- Educational Institutions and Research Labs

The report has provided a detailed breakup and analysis of the market based on the application. This includes aerospace, automotive, construction, electronics, energy and power, and educational institutions and research labs.

End User Insights:

- Manufacturers

- Research and Development Laboratories

- Quality Control and Assurance Departments

- Academic Institutions

- Governmental Regulatory Bodies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes manufacturers, research and development laboratories, quality control and assurance departments, academic institutions, and governmental regulatory bodies.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Material Testing Equipment Market News:

- On September 3, 2024, ABB announced that Kami Shoji Co., Ltd., a Japanese paper manufacturer, has successfully implemented the ABB L&W Fiber Tester Plus to optimize its cellulose nanofiber (CNF) paper production. This advanced testing solution allows for the rapid analysis of fiber quality, enabling Kami Shoji to improve the defibration process and enhance the strength and elasticity of CNF paper, which is used in soundproofing and insulation materials. The integration of ABB’s technology into the production process highlights the increasing demand for precision material testing solutions in the paper and advanced material sectors in Japan.

Japan Material Testing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tensile Testing Machines, Compression Testing Machines, Bending Testing Machines, Hardness Testing Machines, Impact Testing Machines, Ultrasonic Testing Equipment, Fatigue Testing Machines, Creep Testing Equipment |

| Applications Covered | Aerospace, Automotive, Construction, Electronics, Energy and Power, Educational Institutions and Research Labs |

| End Users Covered | Manufacturers, Research and Development Laboratories, Quality Control and Assurance Departments, Academic Institutions, Governmental Regulatory Bodies |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan material testing equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan material testing equipment market on the basis of type?

- What is the breakup of the Japan material testing equipment market on the basis of application?

- What is the breakup of the Japan material testing equipment market on the basis of end user?

- What is the breakup of the Japan material testing equipment market on the basis of region?

- What are the various stages in the value chain of the Japan material testing equipment market?

- What are the key driving factors and challenges in the Japan material testing equipment market?

- What is the structure of the Japan material testing equipment market and who are the key players?

- What is the degree of competition in the Japan material testing equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan material testing equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan material testing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan material testing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)