Japan Medical Waste Management Market Size, Share, Trends and Forecast by Treatment Site, Treatment, and Region, 2026-2034

Japan Medical Waste Management Market Overview:

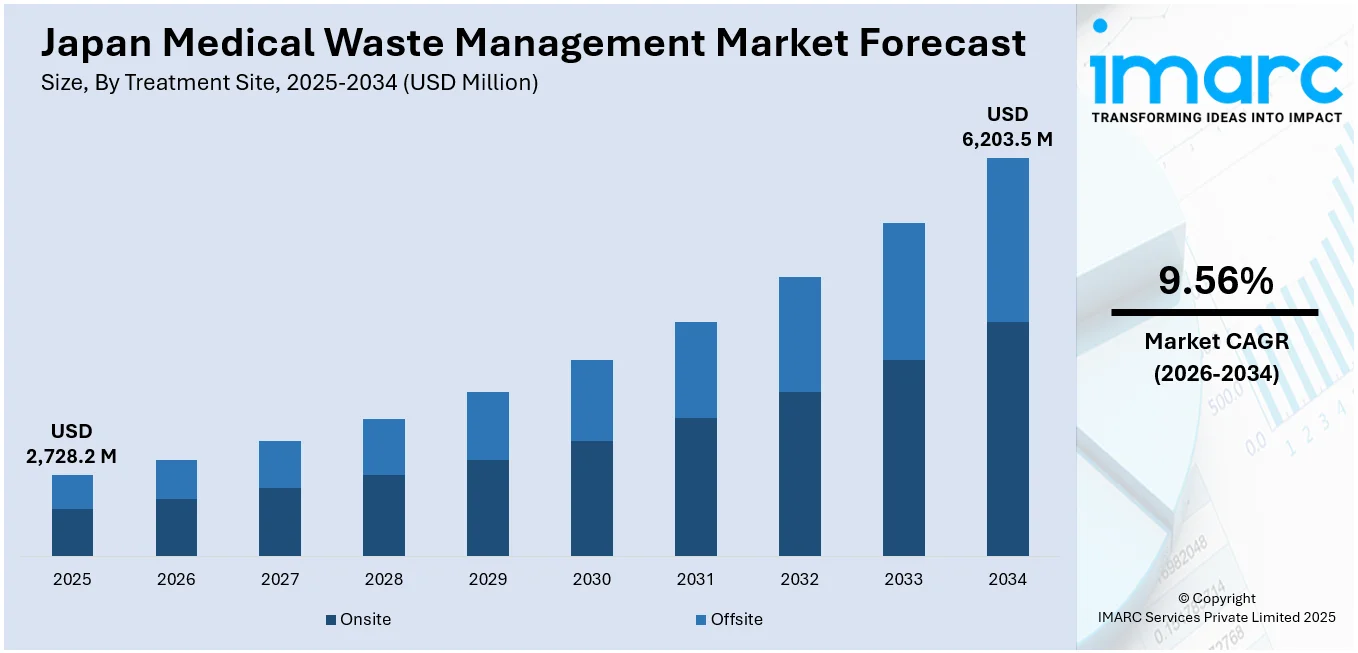

The Japan medical waste management market size reached USD 2,728.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,203.5 Million by 2034, exhibiting a growth rate (CAGR) of 9.56% during 2026-2034. The market is driven by stringent waste legislation and classification protocols that mandate traceable, compliant medical waste disposal. Rising healthcare usage from Japan’s aging population and institutional expansion contributes to consistent demand across hospitals and clinics, thereby fueling the market. Sustainability mandates and digital innovations in waste tracking are reshaping procurement decisions, further augmenting the Japan medical waste management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,728.2 Million |

| Market Forecast in 2034 | USD 6,203.5 Million |

| Market Growth Rate 2026-2034 | 9.56% |

Japan Medical Waste Management Market Trends:

Regulatory Enforcement and Advanced Waste Classification Standards

Japan enforces one of the most rigorous frameworks for medical waste handling under the Waste Management and Public Cleansing Law, which mandates strict categorization and treatment of infectious and hazardous waste, due to rising concerns regarding improper medical waste disposal. A recent study investigates improper discharge of regulated medical waste (RMW) from small-scale medical institutions in the Tokyo metropolitan area. The research highlights that 37.7% of the inspected containers had improper discharges, with improper sealing (67%), container deformation (24.6%), as well as overweight (6.31%) being the most common issues. Hospitals, clinics, and laboratories must segregate waste into burnable, sharps, pharmaceutical, and cytotoxic categories, ensuring traceability from generation to disposal. Non-compliance results in legal penalties, prompting institutions to rely on licensed firms with certified treatment infrastructure. Prefectural governments conduct regular audits, increasing the need for documented waste tracking, barcoding, and safety labeling. These regulatory expectations have advanced industry standards and stimulated demand for automated systems that ensure real-time monitoring of disposal activities. With Japan’s aging population and growing number of long-term care facilities, the volume of biohazardous materials is rising, creating a consistent need for compliant solutions. Facilities must also manage fluctuating waste volumes driven by seasonal illnesses and surgical procedures. As these trends mature, demand for legally compliant, scalable, and technology-backed waste solutions continues to rise, contributing directly to Japan medical waste management market growth.

To get more information on this market Request Sample

Emphasis on Circular Waste Economy and Digital Innovation

Japan’s national strategy to minimize environmental impact underpins its growing preference for sustainable waste management. A 2023 article discusses Japan’s waste management system, highlighting key data from FY2020, including 40.95 million tons of municipal waste and 373.82 million tons of industrial waste generated. The recycling rate for municipal waste was 47%, while industrial waste recycling stood at 40%. The total final disposal amount was 13 million tons for both municipal and industrial waste, with remaining landfill capacity of 400 million cubic meters for municipal waste and 200 million cubic meters for industrial waste. Hospitals are adopting closed-loop systems and non-incineration technologies that align with Japan’s carbon neutrality goals. Innovations such as microwave disinfection, compact autoclave units, and reusable container logistics are gaining traction, especially in urban regions. Moreover, facilities are implementing digital manifest systems and barcoded tagging to track waste lifecycle and ensure compliance with government-issued disposal quotas. Prefectures with high population densities, like Tokyo, Osaka, and Kanagawa, are encouraging the use of low-emission treatment systems to reduce pollution. ESG mandates and corporate social responsibility standards have further incentivized private hospitals to work with service providers offering environmental reporting and carbon impact metrics. This shift has also catalyzed investments in AI-powered waste tracking tools and route-optimized collection logistics. By aligning waste practices with environmental policy, medical institutions are not only complying with law but also pursuing operational efficiency and social accountability.

Japan Medical Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on treatment site and treatment.

Treatment Site Insights:

- Onsite

- Collection

- Treatment and Disposal

- Recycling

- Others

- Offsite

- Collection

- Treatment and Disposal

- Recycling

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment site. This includes onsite (collection, treatment and disposal, recycling, and others) and offsite (collection, treatment and disposal, recycling, and others).

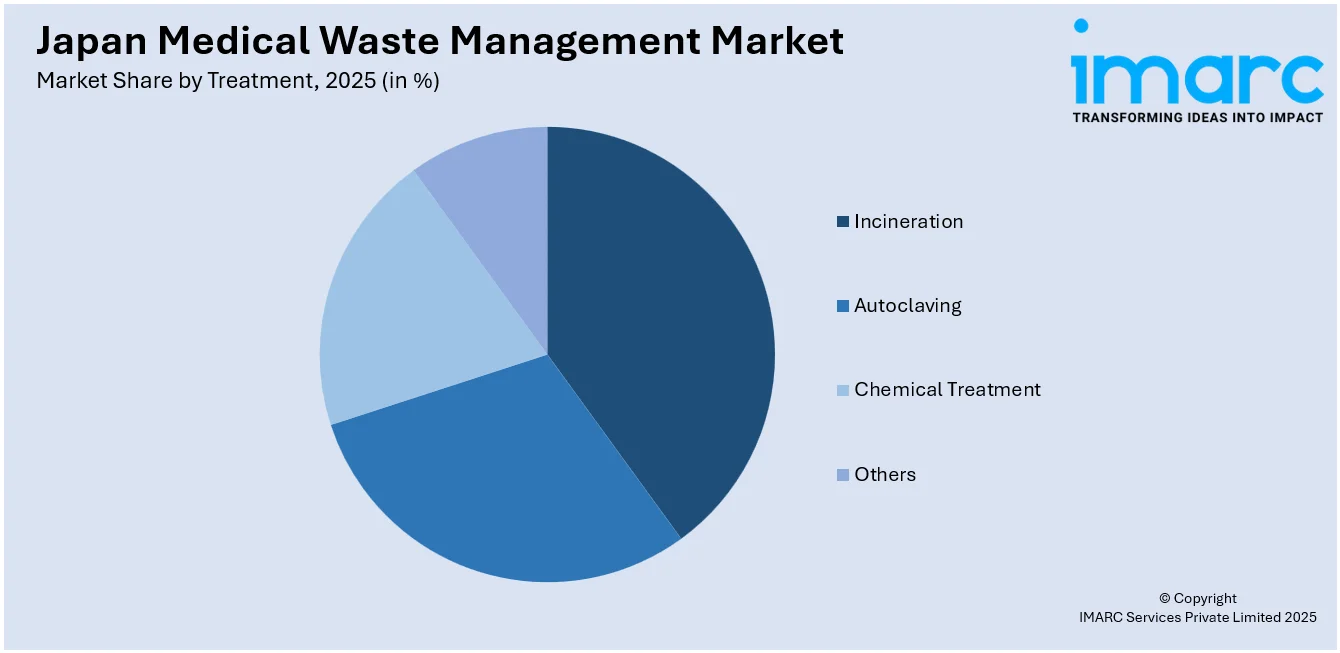

Treatment Insights:

Access the comprehensive market breakdown Request Sample

- Incineration

- Autoclaving

- Chemical Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment. This includes incineration, autoclaving, chemical treatment, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Medical Waste Management Market News:

- On June 2, 2025, the Government of Japan announced its support for establishing a Medical Waste Management Centre in Kushtia District, Bangladesh, under the Grant Assistance for Grass-roots Human Security Projects (GGHSP). The project, implemented by PRISM Bangladesh Foundation, aims to improve health and sanitation for approximately 1.94 million residents and 245 waste workers across Kushtia and surrounding districts.

Japan Medical Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatment Sites Covered |

|

| Treatments Covered | Incineration, Autoclaving, Chemical Treatment, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan medical waste management market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan medical waste management market on the basis of treatment site?

- What is the breakup of the Japan medical waste management market on the basis of treatment?

- What is the breakup of the Japan medical waste management market on the basis of region?

- What are the various stages in the value chain of the Japan medical waste management market?

- What are the key driving factors and challenges in the Japan medical waste management market?

- What is the structure of the Japan medical waste management market and who are the key players?

- What is the degree of competition in the Japan medical waste management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan medical waste management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan medical waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan medical waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)