Japan Medium Density Fiberboard Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2026-2034

Japan Medium Density Fiberboard Market Summary:

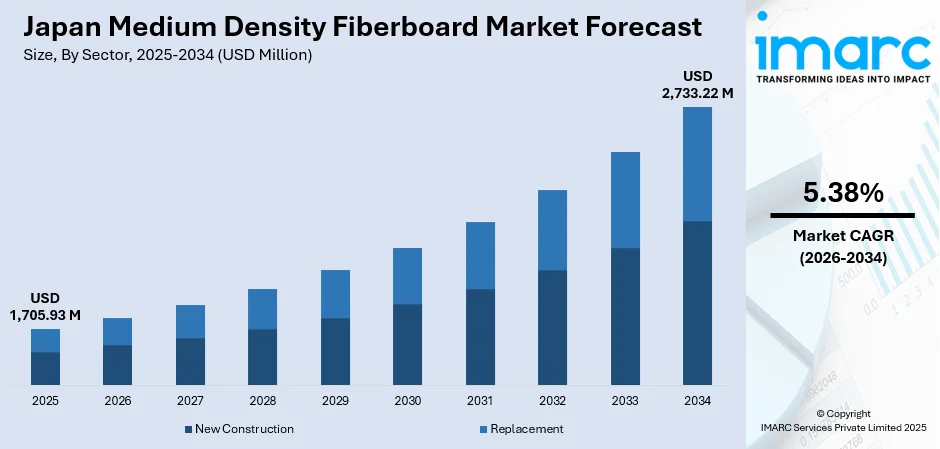

The Japan medium density fiberboard market size was valued at USD 1,705.93 Million in 2025 and is projected to reach USD 2,733.22 Million by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034.

The Japan medium density fiberboard market is experiencing notable growth driven by the nation's thriving residential construction sector and ongoing infrastructure redevelopment initiatives across major metropolitan areas. Rising demand for high-quality interior finishing materials, combined with Japan's stringent building codes emphasizing safety and sustainability, is accelerating product adoption. Technological advancements in moisture-resistant and fire-retardant medium density fiberboard formulations are reshaping competitive dynamics and creating substantial opportunities for manufacturers seeking to capitalize on Japan's evolving construction landscape and the growing emphasis on eco-friendly building materials for residential and commercial applications.

Key Takeaways and Insights:

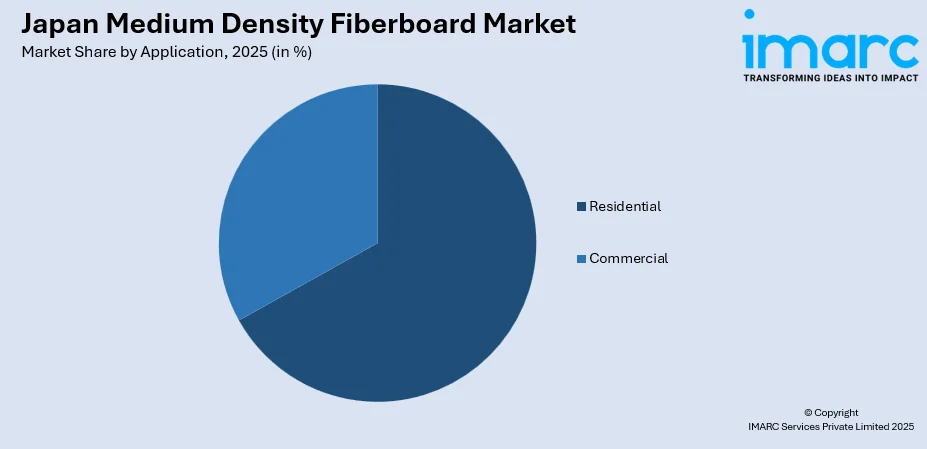

- By Application: Residential dominates the market with a share of 66.7% in 2025, driven by Japan's sustained focus on compact urban housing development, space-efficient interior solutions, and the growing preference for customizable cabinetry and built-in storage systems that maximize limited living spaces in metropolitan areas.

- By Sector: New construction leads the market with a share of 59.8% in 2025, owing to ongoing urban redevelopment projects, high-rise condominium developments, and infrastructure investments associated with major events.

- By Region: Kanto Region represents the largest segment with a market share of 35% in 2025, underpinned by Tokyo's concentrated population density, superior retail and commercial infrastructure, advanced building code adoption, and the region's position as Japan's economic and construction hub with numerous megaprojects underway.

- Key Players: The Japan medium density fiberboard market exhibits a moderately competitive landscape characterized by established domestic manufacturers alongside international suppliers, with companies focusing on product innovation, sustainability initiatives, and specialized formulations to address Japan's unique construction requirements and safety standards.

To get more information on this market Request Sample

The Japan medium density fiberboard market is primarily driven by increasing demand across various sectors, particularly construction and furniture manufacturing. The need for affordable, durable materials is driving the demand for medium density fiberboard. This rise in demand is attributed to the cost-effectiveness, ease of use, and versatility of medium density fiberboard, making it a material of choice for both residential and commercial projects. This sustained demand is underscored by major corporate real estate developments. For example, in 2025, Toyota announced the start of construction for its new Tokyo Head Office at Shinagawa Station, with the office scheduled to open in FY2030. This large-scale, long-term project exemplifies the ongoing requirement for durable and easily finished materials in high-profile infrastructure. Moreover, technological advancements are enhancing the quality of medium density fiberboard, making it suitable for high-end applications.

Japan Medium Density Fiberboard Market Trends:

Growing Demand in the Construction Sector

There is an increase in the demand for medium density fiberboard in Japan’s construction sector, as the need for affordable, durable, and versatile building materials rises. Medium density fiberboard adaptability in flooring, cabinetry, and interior design applications makes it a preferred choice for both residential and commercial projects. This trend is exemplified by major developments, such as the 2025 completion of TOYOTA ARENA TOKYO in the Odaiba Aomi area. The arena, set to open on October 3, 2025, with a capacity of 10,000, demonstrates the continued need for materials that combine aesthetics, durability, and easy installation, further contributing to the market growth.

Rise in Automotive Industry

The automotive sector in is adopting medium density fiberboard, driven by the industry's need for lightweight durable and eco-friendly materials. Medium density fiberboard is utilized in various interior components, including door panels dashboards and seating frames. Its versatility and ease of processing allow manufacturers to create components that are both functional and aesthetically appealing. This robust application is supported by the considerable scale of vehicle production. For instance, in 2024, Japan sold 4,421,494 new passenger vehicles, according to the ITA, highlighting the vast production volume that necessitates a stable supply of materials like medium density fiberboard. As the automotive industry continues to prioritize sustainability and innovation, the demand for medium density fiberboard in mass vehicle production is rising, further impelling the market growth.

Increasing Applications in Home Decor and Interior Design

Medium density fiberboard is highly favored in home decor and interior design due to its versatility and ease of customization. It is extensively utilized for creating decorative moldings, baseboards, wainscoting, and custom furniture pieces like entertainment centers. Its smooth, paintable surface enables designers to achieve a polished, high-end aesthetic without the high cost of solid wood, making it an attractive option for homeowners. This substantial usage is directly linked to the robust size of the user segment. For instance, according to the IMARC Group, the Japan home decor market size reached USD 46,118 Million in 2024. This immense market value underscores the sustained demand for cost-effective and aesthetically versatile materials, thereby cementing medium density fiberboard essential role in both residential and commercial interior projects across Japan.

Market Outlook 2026-2034:

The Japan medium density fiberboard market is expected to experience strong growth throughout the forecast period, driven by sustained residential construction activity and shifting preferences toward versatile, sustainable building materials. As the demand for cost-effective and eco-friendly solutions rises in the construction sector, medium density fiberboard’s popularity continues to increase. The market generated a revenue of USD 1,705.93 Million in 2025 and is projected to reach a revenue of USD 2,733.22 Million by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034.

Japan Medium Density Fiberboard Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Residential | 66.7% |

| Sector | New Construction | 59.8% |

| Regional | Kanto Region | 35% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential dominates with a market share of 66.7% of the total Japan medium density fiberboard market in 2025.

Residential holds the biggest market share due to the growing demand for affordable, durable, and aesthetically appealing building materials in homes. Medium density fiberboard is commonly used in furniture, cabinetry, and interior décor, making it highly favored in residential construction.

Furthermore, the versatility and ease of customization of medium density fiberboard make it an ideal choice for homeowners looking for sustainable and cost-effective solutions. Its ability to be easily painted or veneered allows for endless design possibilities, driving its dominance in the market.

Sector Insights:

- New Construction

- Replacement

New construction leads with a market share of 59.8% of the total Japan medium density fiberboard market in 2025.

New construction represents the largest segment owing to the increasing demand for affordable, high-quality materials in building projects. Medium density fiberboard is widely used in residential and commercial structures for applications like partitions, cabinetry, and flooring, supporting its strong market position.

Additionally, the rise of infrastructure development in Japan is driving the need for modern construction materials. As new buildings and housing projects continue to rise, the demand for versatile, cost-effective materials like medium density fiberboard remains high, ensuring its dominance in the market.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region exhibits a clear dominance with a 35% share of the total Japan medium density fiberboard market in 2025.

Kanto Region dominates the market due to its significant economic strength. As the hub of Japan’s manufacturing, construction, and furniture industries, the region drives high demand for medium density fiberboard in residential and commercial applications.

Additionally, the presence of major industries and manufacturers in the Kanto Region drives the demand for medium density fiberboard. The concentration of suppliers, distributors, and construction projects in this area ensures easy access to raw materials, making it the leading region for medium density fiberboard market growth in Japan.

Market Dynamics:

Growth Drivers:

Why is the Japan Medium Density Fiberboard Market Growing?

Increasing Urban Population and Housing Projects

The continued growth of Japan’s urban population is leading to a steady rise in housing projects and necessary infrastructure development. This demographic shift generates significant demand for cost-effective and durable building materials for housing construction. Medium density fiberboard, valued for its affordability, strength, and design flexibility, is extensively utilized in producing essential components like walls, ceilings, doors, and interior fittings. his need is further supported by government initiatives. For instance, in 2025, the Tokyo Metropolitan Government selected four operators, including Nomura Real Estate and Mitsubishi UFJ Trust, to manage public-private funds worth approximately $20$ billion yen for an affordable housing initiative. This substantial investment into new residential projects directly contributes to an increase in the demand for affordable building solutions, cementing medium density fiberboard’s role as an integral component of Japan’s housing sector.

Expanding Use in Furniture Manufacturing

The growing demand for high-quality furniture in Japan is significantly influencing the medium density fiberboard market. Medium density fiberboard is favored in the furniture manufacturing industry for its cost-effectiveness, ease of shaping, and ability to produce smooth, high-quality finishes. As user preferences shift toward modern, stylish, and durable furniture, medium density fiberboard serves as an ideal material, enabling manufacturers to create diverse designs without compromising on functionality. This expanding application within the furniture sector contributes substantially to overall market growth. This trend is quantitatively underpinned by the market's considerable size, with the Japan furniture market size reaching USD 23.2 Billion in 2025, as reported by the IMARC Group. As a result, the sustained need for versatile and economical materials in a high-value industry solidifies medium density fiberboard’s position in the market.

Rising Disposable Incomes

Japan’s growing disposable incomes and evolving consumer spending patterns are catalyzing the demand for premium consumer goods, particularly in sectors like furniture, home décor, and construction materials. With increased purchasing power, people are prioritizing durable, well-designed products crafted from materials such as medium density fiberboard. The expanding middle-class population plays a pivotal role in driving this demand for both stylish and affordable home improvement solutions. Notably, the yearly average of monthly income per household reached 636,155 yen, according to Japan’s Statistics Bureau, underscoring the financial capability driving the ongoing rise in demand for high-quality medium density fiberboard products.

Market Restraints:

What Challenges the Japan Medium Density Fiberboard Market is Facing?

Rising Raw Material and Production Costs

Rising raw material and production costs are becoming significant challenges for manufacturers in Japan, particularly within industries reliant on pulpwood for medium density fiberboard production. As demand for pulpwood increases, especially from biomass energy plants, the supply of logs has become tighter, pushing up the cost of delivered fiber. Additionally, the depreciation of the yen against major currencies has heightened the cost of importing essential materials like resins and production equipment.

Competition from Alternative Building Materials

The rise of alternative building materials like wood plastic composites (WPC) and cross-laminated timber (CLT) is intensifying competition for the medium density fiberboard market in Japan. As these materials gain acceptance for their sustainability and performance benefits, particularly in outdoor and moisture-exposed applications, they present a direct challenge to traditional medium density fiberboard. These factors are pressuring medium density fiberboard manufacturers to innovate and find ways to retain market share in segments where these alternatives offer superior performance and environmental benefits.

Labor Shortages in Manufacturing and Construction

Labor shortages in Japan’s construction and manufacturing sectors are becoming more acute, posing challenges for production capacity and project completion timelines. With the workforce aging and fewer younger workers entering these industries, companies are struggling to meet labor demands. As a result, demand for building materials, including medium density fiberboard, faces constraints, as delayed or reduced construction activities hinder the need for new materials. This labor shortage is exacerbating supply chain issues and potentially slowing overall market growth.

Competitive Landscape:

The Japan medium density fiberboard market exhibits a moderately competitive landscape characterized by established domestic manufacturers operating alongside international suppliers. Market dynamics reflect strategic positioning across product segments, ranging from premium, innovation-driven offerings emphasizing advanced moisture resistance and fire retardancy to value-oriented products targeting cost-sensitive applications. The competitive environment is increasingly shaped by sustainability initiatives, technological capabilities in specialized product development, and the ability to meet Japan's stringent certification requirements. Manufacturers are focusing on vertical integration, product differentiation through enhanced performance characteristics, and strategic partnerships to strengthen market positions in this sophisticated market environment.

Japan Medium Density Fiberboard Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan medium density fiberboard market size was valued at USD 1,705.93 Million in 2025.

The Japan medium density fiberboard market is expected to grow at a compound annual growth rate of 5.38% from 2026-2034 to reach USD 2,733.22 Million by 2034.

Residential dominates the market with 66.7% revenue share in 2025, driven by Japan's compact urban housing requirements, demand for space-efficient interior solutions, and preference for customizable cabinetry and storage systems across metropolitan areas.

Key factors driving the Japan medium density fiberboard market include the automotive sector's adoption of medium density fiberboard for lightweight, durable, and eco-friendly interior components such as door panels, dashboards, and seating frames. In 2024, Japan sold 4,421,494 new passenger vehicles, highlighting the growing demand for medium density fiberboard in vehicle production.

Major challenges include rising raw material and production costs due to tightening log supply from competing biomass energy demand, competition from alternative materials including wood plastic composites and cross-laminated timber, labor shortages affecting manufacturing and construction sectors, and currency fluctuations impacting import costs for production inputs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)