Japan Metal Recycling Market Size, Share, Trends and Forecast by Metal, Sector, and Region, 2026-2034

Japan Metal Recycling Market Overview:

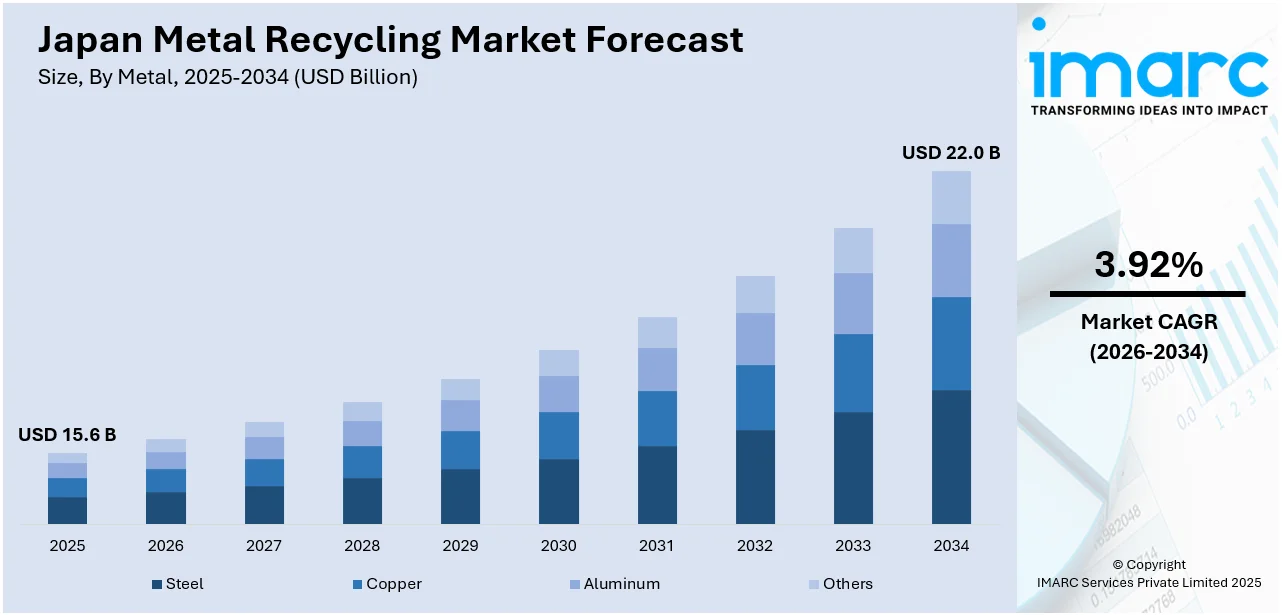

The Japan metal recycling market size reached USD 15.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 22.0 Billion by 2034, exhibiting a growth rate (CAGR) of 3.92% during 2026-2034. The market is driven by stringent environmental regulations and national sustainability goals that promote resource efficiency and circular economy practices. The country’s advanced manufacturing sector, particularly in automotive and electronics, generates a consistent demand for high-quality recycled metals to reduce production costs and carbon emissions. Additionally, the country's limited natural metal resources further incentivize the recovery and reuse of scrap metals, supported by government-led initiatives and technological advancements are augmenting the Japan metal recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.6 Billion |

| Market Forecast in 2034 | USD 22.0 Billion |

| Market Growth Rate 2026-2034 | 3.92% |

Japan Metal Recycling Market Trends:

Growth of the Advanced Manufacturing Sector

The market is significantly influenced by its highly developed manufacturing sector, which generates a continuous and diverse stream of industrial metal scrap. Industries such as automotive, electronics, and precision machinery rely heavily on metals like steel, aluminum, and copper, and their production processes inherently produce substantial scrap volumes. As manufacturers prioritize lean production and resource efficiency, many are integrating in-house scrap recovery and recycling loops to reduce costs and environmental impact. According to industry reports, Japan’s auto production from January to September 2024 stood at only 6.01 million units, reflecting subdued manufacturing activity compared to pre-pandemic levels. However, the ongoing transition toward electric vehicles and next-generation consumer electronics is driving a notable increase in the demand for specialized metals such as lithium, copper, and rare earth elements. This shift underscores the growing importance of efficient metal recovery processes to support evolving industry requirements. Many large manufacturers are adopting closed-loop systems where production scrap is systematically collected, refined, and reused, minimizing waste and optimizing material use. The advanced nature of Japan’s industrial base provides a strong foundation for technologically integrated recycling solutions, ensuring a steady supply of high-quality secondary raw materials for domestic reuse.

To get more information on this market Request Sample

Government-led Initiatives Supporting Recycling Infrastructure and Policy Reform

Government involvement is a significant factor contributing to the Japan metal recycling market growth. The long-standing policies designed to promote sustainability, waste minimization, and circular economy practices are positively impacting the market. Additionally, laws like the Home Appliance Recycling Law and End-of-Life Vehicle Recycling Law require the organized recovery and treatment of consumer product scrap metal and automobile scrap metal through systematic processes. The national and local governments provide funding for recycling facilities, enforcement processes, and public education campaigns. The government also actively encourages extended producer responsibility (EPR), wherein manufacturers are made to take charge of the post-consumer phase of their products. Aside from this, incentive programs have been launched to favor the use of leading-edge recycling technologies and the upgrading of facilities. For instance, on February 20, 2025, Japan's Ministry of Economy, Trade and Industry (METI) introduced a JPY 50,000 (about USD 350.50) subsidy for clean energy vehicles (CEVs) manufactured using low-carbon emission steel, aiming to promote the adoption of green steel in the automotive sector. This initiative complements existing consumer subsidies of up to JPY 850,000 (about USD 5,958.50) for electric vehicles and JPY 550,000 (about USD 3,855.5) for hybrid vehicles. Municipalities are equipped with standardized collection systems, contributing to the high rates of metal recovery across urban and rural regions alike. These initiatives foster cooperation among government bodies, industry players, and consumers, ensuring a robust and compliant recycling ecosystem that underpins the country’s environmental and economic sustainability goals.

Japan Metal Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on metal and sector.

Metal Insights:

- Steel

- Copper

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the metal. This includes steel, copper, aluminum, and others.

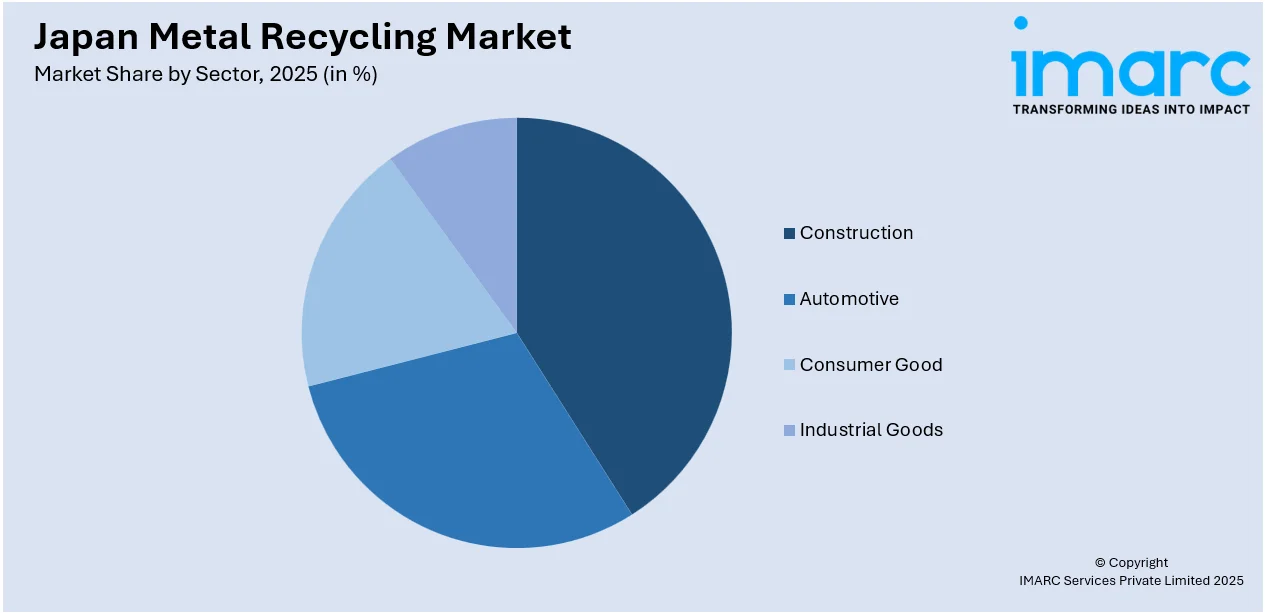

Sector Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Automotive

- Consumer Good

- Industrial Goods

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes construction, automotive, consumer good, and industrial goods.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Metal Recycling Market News:

- On June 2, 2025, Nippon Steel Corporation announced plans to invest approximately USD 6 Billion in expanding its electric arc furnace (EAF) steelmaking capacity across three domestic facilities. The Japanese government will support this initiative with about USD 1.75 Billion in funding under the Green Transformation (GX) Promotion Act, aiming to boost recycled-content steel production by 2.9 million tons annually. This strategic move aligns with Japan's broader decarbonization goals and underscores the nation's commitment to transitioning towards low-carbon steel manufacturing.

Japan Metal Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metals Covered | Steel, Copper, Aluminum, Others |

| Sectors Covered | Construction, Automotive, Consumer Goods, Industrial Goods |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan metal recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan metal recycling market on the basis of metal?

- What is the breakup of the Japan metal recycling market on the basis of sector?

- What is the breakup of the Japan metal recycling market on the basis of region?

- What are the various stages in the value chain of the Japan metal recycling market?

- What are the key driving factors and challenges in the Japan metal recycling market?

- What is the structure of the Japan metal recycling market and who are the key players?

- What is the degree of competition in the Japan metal recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan metal recycling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan metal recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan metal recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)