Japan Metallurgical Equipment Market Size, Share, Trends and Forecast by Type, Equipment, Application, and Region, 2026-2034

Japan Metallurgical Equipment Market Summary:

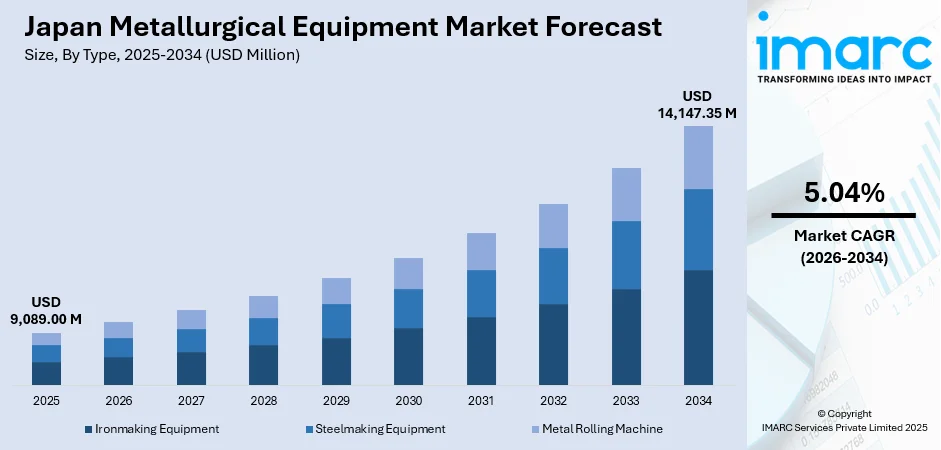

The Japan metallurgical equipment market size was valued at USD 9,089.00 Million in 2025 and is projected to reach USD 14,147.35 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034.

In the Japan metallurgical equipment market, the continuous investment in the modernization of steel making and automation in manufacturing is driving the market toward continued growth. It is a strategic transition of the nation toward carbon-neutral steel production that drives the market, along with increasing demand from the automotive sector for high-precision metal components, and continuous infrastructure development across major industrial regions. This segment is expected to gain pace with increased adoptions of advanced machinery as manufacturers strive for higher levels of operational efficiency and product quality, ultimately strengthening the position of the Japan metallurgical equipment market.

Key Takeaways and Insights:

-

By Type: Steelmaking equipment dominates the market with a share of 42% in 2025, driven by substantial capital investments in electric arc furnace technology and blast furnace modernization programs aimed at achieving carbon neutrality targets by 2050.

-

By Equipment: Milling machines lead the market with a share of 36% in 2025, owing to robust demand from automotive and aerospace sectors requiring high-precision multi-axis CNC machining capabilities for complex component manufacturing.

-

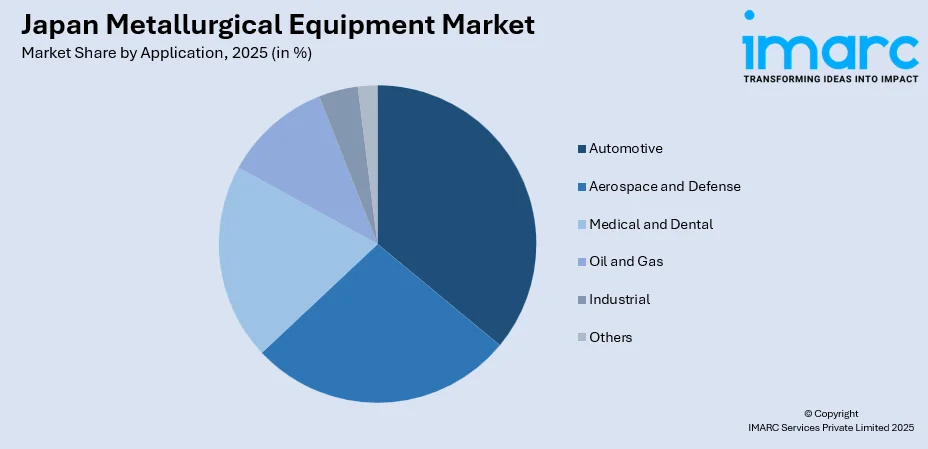

By Application: Automotive sector represents the largest segment with a market share of 33% in 2025, supported by Japan's position as a global automotive manufacturing hub with over 7.8 million vehicles produced annually requiring extensive metallurgical processing.

-

By Region: Kanto Region holds the largest share of 36% in 2025, attributed to the concentration of electronics, machinery, and manufacturing industries in the Tokyo metropolitan area and surrounding prefectures.

-

Key Players: The Japan metallurgical equipment market exhibits a competitive landscape with established domestic manufacturers maintaining strong positions through technological innovation, precision engineering expertise, and comprehensive after-sales service networks catering to diverse industrial applications.

To get more information on this market Request Sample

The Japan metallurgical equipment market is characterized by sophisticated manufacturing capabilities and a robust industrial base. The sector benefits from Japan's global leadership in precision engineering, with companies investing heavily in research and development to meet evolving industry requirements. The automotive industry remains the primary demand driver, with manufacturers requiring advanced metallurgical equipment for producing lightweight, high-strength steel components essential for electric vehicle production. In May 2025, Nippon Steel announced a significant investment of approximately JPY870 Billion ($6.05 Billion) to expand electric arc furnace capacity across three domestic facilities, demonstrating the industry's commitment to equipment modernization and sustainable manufacturing practices. This investment underscores the growing demand for advanced steelmaking equipment that supports carbon-neutral production objectives.

Japan Metallurgical Equipment Market Trends:

Transition to Electric Arc Furnace Technology

Japanese steelmakers are accelerating investments in electric arc furnace technology as part of decarbonization strategies. This shift is driving demand for advanced steelmaking equipment capable of producing high-quality steel products traditionally manufactured through blast furnace processes. In April 2025, JFE Steel announced a 329.4 Billion Yen investment to construct a large-scale advanced electric arc furnace at its Kurashiki facility, incorporating proprietary high-efficiency melting technologies developed under Japan's Green Innovation Fund projects, targeting commissioning by fiscal year 2028.

Integration of Digital Technologies and Smart Manufacturing

Various artificial intelligence, Internet of Things connectivity, and digital twin technologies have been increasingly integrated into the product offerings of manufacturers of metallurgical equipment. This advancement in technology offers real-time monitoring, predictive maintenance, and optimizing of production processes across facilities involved in steelmaking and metal fabrication. Smart manufacturing solutions enable operators to analyze data from operations to locate inefficiencies and introduce remedial measures before equipment failure. The integration of advanced sensors and cloud-based analytics platforms supports continuous process improvement, reduced downtime, and enhanced product quality throughout metallurgical operations.

Growing Demand for High-Precision Multi-Axis Machining Centers

The need for complicated elements with superior accuracy has increased because of the transition to electric vehicles and advancements in manufacturing technologies. Five-axis computer numerical control machining centers are rapidly growing in popularity as these can do complex operations in one setup, thereby increasing production time and enhancing dimensional accuracy. These advanced systems enable manufacturers to process lightweight high-strength materials and specialized alloys required for automotive, aerospace, and electronics applications, supporting the production of battery housings, motor components, and precision structural parts.

Market Outlook 2026-2034:

The Japan metallurgical equipment market is positioned for steady growth throughout the forecast period, supported by sustained industrial modernization initiatives and decarbonization investments across the steelmaking sector. Government support under the Green Transformation Promotion Act is catalyzing equipment upgrades, with substantial subsidies allocated for manufacturing process transformation. The automotive sector's evolution toward electric vehicle production will continue driving demand for precision metallurgical machinery, advanced machining centers, and specialized steelmaking equipment capable of producing high-grade electromagnetic steel sheets and lightweight structural components. The market generated a revenue of USD 9,089.00 Million in 2025 and is projected to reach a revenue of USD 14,147.35 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034.

Japan Metallurgical Equipment Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Steelmaking Equipment |

42% |

|

Equipment |

Milling Machines |

36% |

|

Application |

Automotive |

33% |

|

Region |

Kanto Region |

36% |

Type Insights:

- Ironmaking Equipment

- Steelmaking Equipment

- Metal Rolling Machine

Steelmaking equipment dominates the market with a 42% share of the total Japan metallurgical equipment market in 2025.

The steelmaking equipment segment maintains its leading position due to substantial capital investments by Japanese steel manufacturers transitioning toward low-carbon production methods. This segment encompasses electric arc furnaces, basic oxygen furnaces, and continuous casting equipment essential for modern steel production. Government initiatives supporting green transformation are driving equipment upgrades across integrated steel facilities. These installations incorporate innovative high-efficiency melting technologies designed to produce high-quality specialty steel products including electromagnetic steel sheets for electric vehicle motors.

Integrated steelmakers are implementing comprehensive modernization programs to enhance production efficiency while reducing carbon emissions in alignment with national decarbonization objectives. The steelmaking equipment market benefits from Japan's established position as a global technology leader, with domestic manufacturers developing proprietary solutions for hydrogen utilization and carbon capture integration. These advanced technological capabilities command premium valuations and attract sustained investment, driving continued segment growth and reinforcing Japan's competitive advantages in metallurgical equipment manufacturing.

Equipment Insights:

- Milling Machines

- Broaching Machines

- Grinding Machines

- Drilling Machines

Milling machines lead the equipment segment with a 36% share of the total Japan metallurgical equipment market in 2025.

The milling machines segment holds the largest equipment share driven by widespread applications across automotive, aerospace, and precision manufacturing industries. Japanese manufacturers are global leaders in CNC milling technology, offering advanced multi-axis machining centers capable of achieving precise tolerances as much as possible. The transition to electric vehicle manufacturing has intensified demand for five-axis machining centers that can complete complex battery housing and motor component operations in single setups, reducing production time and improving dimensional accuracy.

The segment benefits from continuous technological innovation, with manufacturers integrating artificial intelligence and advanced control systems to enhance machining precision and productivity. Japan's machine tools market is projected to reach USD 8,808.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.95% during 2025-2033, with metal cutting operations accounting for over 84 percent of revenue. Domestic producers maintain competitive advantages through superior engineering quality, comprehensive service networks, and ongoing development of smart manufacturing capabilities that address evolving customer requirements for automated, high-efficiency production solutions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace and Defense

- Automotive

- Medical and Dental

- Oil and Gas

- Industrial

- Others

The automotive sector holds the highest revenue with a 33% share of the total Japan metallurgical equipment market in 2025.

The automotive sector's dominance reflects Japan's position as a global automotive manufacturing powerhouse. Each vehicle requires substantial quantities of steel and associated metal components, creating significant demand for metallurgical processing equipment. The transition toward electric vehicles is transforming equipment requirements, with manufacturers demanding advanced machinery for producing lightweight high-strength steel components, battery casings, and precision motor parts. Tool steels used in automotive stamping and mold making must now demonstrate exceptional durability to meet evolving electric vehicle production demands.

Major Japanese automakers drive continuous innovation in metallurgical equipment specifications, requiring machinery capable of processing advanced high-strength steels and specialized alloys for safety-critical applications. The electrification trend accelerates demand for precision machining equipment and specialized steelmaking facilities capable of producing electromagnetic steel sheets essential for electric motor manufacturing. This ongoing transformation creates sustained growth opportunities for metallurgical equipment manufacturers serving automotive supply chains across body panel fabrication, powertrain component production, and chassis assembly applications.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region represents the largest share with 36% of the total Japan metallurgical equipment market in 2025.

The Kanto Region dominates the market as Japan's primary industrial and economic hub, encompassing Tokyo and surrounding prefectures including Kanagawa, Saitama, and Chiba. The region serves as a center for electronics manufacturing, information technology equipment production, and precision machinery industries requiring advanced metallurgical processing capabilities and sophisticated machine tools. Major manufacturing facilities in the greater Tokyo metropolitan area drive substantial demand for high-precision CNC machining centers, metal fabrication equipment, and specialized processing machinery.

The concentration of corporate headquarters, research institutions, and advanced manufacturing facilities in the Kanto Region creates a robust ecosystem supporting metallurgical equipment demand. The region's well-developed infrastructure, skilled workforce availability, and proximity to major ports facilitate efficient supply chain operations for equipment manufacturers and end-users. Ongoing urban redevelopment projects and infrastructure modernization initiatives further strengthen demand for steel products and associated metallurgical processing equipment across construction, transportation, and industrial applications.

Market Dynamics:

Growth Drivers:

Why is the Japan Metallurgical Equipment Market Growing?

Government Support for Green Transformation and Carbon Neutrality Initiatives

The Japanese government's commitment to achieving carbon neutrality by 2050 is driving substantial investments in metallurgical equipment modernization. The Green Transformation Promotion Act provides financial incentives for steel manufacturers transitioning from traditional blast furnace processes to lower-emission electric arc furnace technology. Subsidies and supportive policies encourage equipment upgrades across integrated steel facilities nationwide. These policy measures create favorable conditions for metallurgical equipment manufacturers by stimulating demand for next-generation steelmaking machinery, continuous casting systems, and associated infrastructure supporting sustainable production methods.

Automotive Industry Electrification and Advanced Manufacturing Requirements

The transition toward electric vehicle manufacturing is transforming metallurgical equipment requirements across Japan's automotive supply chain. Electric and hybrid vehicle sales continue to demonstrate strong growth, intensifying demand for specialized production machinery. Electric vehicle manufacturing requires high-precision equipment capable of producing electromagnetic steel sheets for motors, durable battery casings, and lightweight high-strength structural components. The automotive sector's substantial share of Japan's tool steel consumption underscores its significance as an equipment demand driver. Automakers are investing in advanced multi-axis machining centers and specialized forming equipment to meet stringent quality requirements for safety-critical components. This electrification trend necessitates continuous equipment upgrades and creates sustained growth opportunities for metallurgical machinery manufacturers serving automotive applications throughout the production value chain.

Technological Advancement and Industry 4.0 Integration

The integration of digital technologies into metallurgical equipment is accelerating market growth as manufacturers pursue enhanced operational efficiency and product quality. Japanese steel and machinery companies are implementing artificial intelligence, Internet of Things connectivity, and digital twin technology across production facilities. In December 2024, JFE Steel implemented J-astquad, a multi-process quality data analysis system for automotive steel sheet production that analyzes operational impacts on product quality. These technological advancements enable predictive maintenance, optimized process control, and enhanced quality assurance capabilities. Equipment manufacturers incorporating smart features command premium valuations while helping customers reduce downtime, improve yield rates, and meet increasingly stringent quality specifications across demanding industrial applications.

Market Restraints:

What Challenges the Japan Metallurgical Equipment Market is Facing?

Large Capital Expenditures and Long Payback Period

Metal processing equipment installations demand high capital outlay investment, which can discourage smaller companies from embarking on any form of upgrading. The most advanced versions of electric arc furnace technology or multi-axis CNC machining centers have high capital outlay investment requirements, longer implementation project time, and need specialized skill levels in order to effect implementation.

Reducing Domestic Steel Production and Excess Capacity

Japan’s crudes steel production eased due to weakening domestic demand and competition from competitively priced imports. As a consequence, reduced production will impact equipment usage, postponing capital spending decisions for steel producers, with a negative impact on demand for metallurgical equipment.

Skilled Labor Shortages and Workforce Issues

The problem of an aging working population and a declining population in Japan brings difficulties in operating and maintaining metallurgical equipment. The problem of a lack of sufficient workforces with adequate skill levels in Japan’s manufacturing industry, especially in an economy in decline, is a challenge in this context.

Competitive Landscape:

The Japan market for metallurgical equipment operates in an intense competitive environment with established local players with advanced technology and dedicated service support. The players in this market include steel production equipment suppliers with vertical integration capabilities and machine tool suppliers for specific industries. The fast-paced competition in this market takes place primarily in technology and quality, with a focus on energy conservation and excellent service support. Collaborative agreements, acquisitions, and joint research and development activities are common in this market, with an objective of increasing product offerings through expansion and enhancing competitive positions. The level of consolidation for major equipment in this market is moderate, where leading players hold their market positions based on sustained investment in research and development, advanced technology, and excellent solutions in response to increasing demands in automotive, aerospace, energy, and other industries.

Japan Metallurgical Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ironmaking Equipment, Steelmaking Equipment, Metal Rolling Machine |

| Equipments Covered | Milling Machines, Broaching Machines, Grinding Machines, Drilling Machines |

| Applications Covered | Aerospace and Defense, Automotive, Medical and Dental, Oil and Gas, Industrial, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan metallurgical equipment market size was valued at USD 9,089.00 Million in 2025.

The Japan metallurgical equipment market is expected to grow at a compound annual growth rate of 5.04% from 2026-2034 to reach USD 14,147.35 Million by 2034.

Steelmaking equipment dominated the market with a 42% share in 2025, driven by substantial investments in electric arc furnace technology and blast furnace modernization programs supporting Japan's carbon neutrality objectives.

Key factors driving the Japan metallurgical equipment market include government support for green transformation initiatives, automotive industry electrification requiring advanced manufacturing equipment, and integration of digital technologies enabling smart manufacturing capabilities.

Major challenges include high capital investment requirements for advanced equipment, declining domestic steel production creating overcapacity concerns, skilled labor shortages affecting equipment operation and maintenance, and competition from lower-cost foreign imports pressuring domestic manufacturers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)