Japan Mobile Money Market Size, Share, Trends and Forecast by Technology, Business Model, Transaction Type, and Region, 2026-2034

Japan Mobile Money Market Summary:

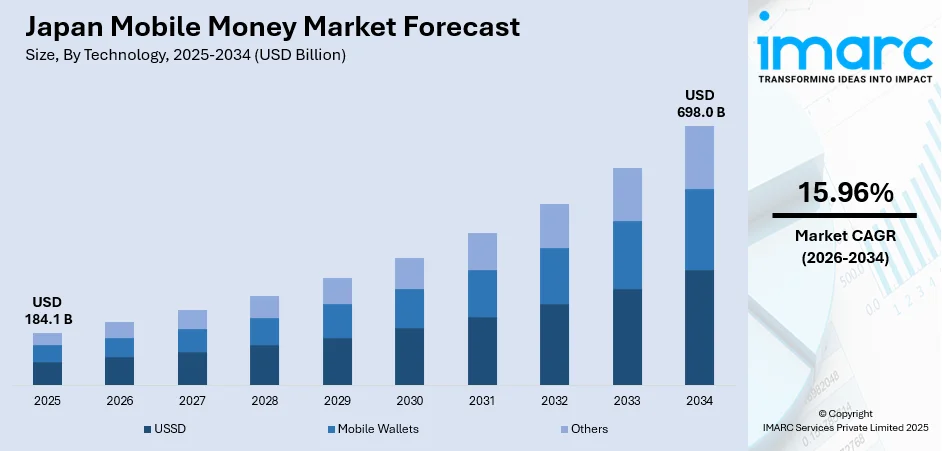

The Japan mobile money market size was valued at USD 184.1 Billion in 2025 and is projected to reach USD 698.0 Billion by 2034, growing at a compound annual growth rate of 15.96% from 2026-2034.

The market is driven by widespread smartphone adoption, government initiatives promoting a cashless society, and the integration of advanced technologies enhancing transaction security and user experience. The proliferation of QR code-based payment platforms and the growing demand for seamless, contactless transactions continue to accelerate market adoption. Rising e-commerce activities and strategic partnerships between financial institutions and technology providers further strengthen the ecosystem, contributing to Japan mobile money market share.

Key Takeaways and Insights:

- By Technology: Mobile wallets dominate the market with a share of 76.5% in 2025, driven by their seamless integration with smartphones, user-friendly interfaces, and widespread acceptance across retail, transportation, and e-commerce platforms throughout Japan.

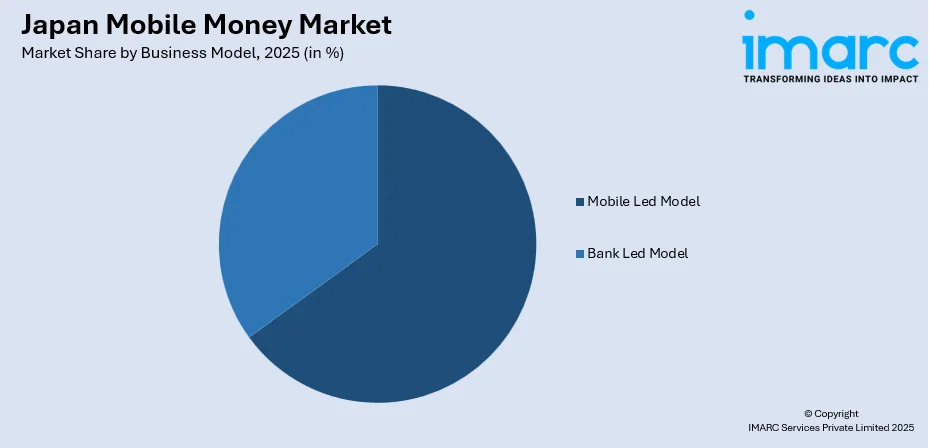

- By Business Model: Mobile led model leads the market with a share of 65.0% in 2025, owing to the proliferation of smartphone-based payment applications that offer comprehensive financial services beyond traditional banking channels and enhanced consumer accessibility.

- By Transaction Type: Peer to peer represents the largest segment with a market share of 35.9% in 2025, driven by the growing demand for instant money transfers between individuals and the convenience of splitting payments among friends and family.

- By Region: Kanto Region dominates the market with a share of 33.9% in 2025, attributed to high population density, well-developed digital infrastructure, concentration of retail establishments, and advanced technological adoption in metropolitan areas including the capital.

- Key Players: The market features strong competition as providers enhance security, expand merchant networks, and integrate advanced technologies to differentiate their platforms. Companies are prioritizing seamless user experiences, strategic partnerships, and faster transaction capabilities to maintain relevance and capture a larger share of Japan’s evolving digital payments ecosystem.

To get more information on this market Request Sample

Japan's mobile money market is experiencing robust expansion driven by the convergence of technological advancement, regulatory support, and evolving consumer preferences. The government's strategic vision for a cashless society has catalyzed widespread infrastructure development, encouraging both merchants and consumers to adopt digital payment solutions. In March 2025, Japan’s mobile payments market surged, fueled by government cashless initiatives, rising digital wallet adoption, and mobile commerce growth, with PayPay, LINE Pay, and Rakuten Pay leading consumer usage nationwide. Moreover, high smartphone penetration rates have created an ecosystem where mobile financial services are readily accessible to a broad demographic. The integration of sophisticated security features, including biometric authentication and tokenization, has enhanced consumer confidence in digital transactions. Additionally, the expansion of e-commerce activities has increased demand for convenient, rapid payment methods. Strategic collaborations between financial institutions and technology providers are accelerating innovation while expanding merchant acceptance networks, creating a virtuous cycle of adoption and usage growth.

Japan Mobile Money Market Trends:

Growing Integration of Biometric Authentication Technologies

The mobile money landscape in Japan is witnessing significant adoption of biometric authentication methods including fingerprint recognition, facial scanning, and iris detection technologies. These advanced security features address consumer concerns regarding transaction safety while streamlining the payment process. In July 2024, PayPay announced that over 30 million users completed identity verification (eKYC), enabling full access to services like bank top-ups and cashouts, boosting security and transaction adoption nationwide. Further, financial service providers are incorporating multiple biometric layers to enhance protection against unauthorized access and fraudulent activities. This technological evolution is particularly appealing to security-conscious consumers who previously hesitated to embrace digital payment solutions, thereby broadening the potential user base significantly.

Expansion of Super App Ecosystems

Japanese mobile money providers are evolving into comprehensive super app platforms that extend far beyond basic payment functionalities. These integrated ecosystems now encompass diverse services including food delivery, ride-hailing, insurance products, investment options, and loyalty programs within unified applications. For instance, in November 2024, PayPay and Alipay+ expanded QR code payment support to over 3 million Japanese merchants, enabling seamless e-wallet transactions for tourists across food, retail, and entertainment sectors. Further, this consolidation strategy enhances user engagement by creating multiple touchpoints for daily interactions while generating valuable consumer behavior insights. The convenience of accessing numerous services through single platforms is driving increased adoption rates and strengthening customer retention across demographic segments.

Rise of Cross-Border Payment Capabilities

Mobile money platforms in Japan are increasingly incorporating cross-border payment functionalities to accommodate the growing international transaction requirements. This expansion addresses the needs of international tourists visiting Japan and Japanese citizens conducting overseas transactions. Enhanced interoperability with regional and global payment networks is facilitating seamless currency conversions and international transfers. In November 2025, over 100 million Suica cards were in use in Japan, while PayPay reached 70 million users, handling 20% of cashless transactions and supporting 26 foreign e-wallets. Further, the development of standardized protocols and partnerships with overseas payment providers is positioning Japanese mobile money platforms as comprehensive solutions for both domestic and international financial needs.

Market Outlook 2026-2034:

The Japan mobile money market is set for strong revenue growth, supported by government-backed cashless initiatives and rapid digital transformation. Rising merchant adoption of mobile payment tools, especially among SMEs shifting from cash, will drive expansion. Advancements in AI and blockchain are improving transaction speed and security, attracting more users. Growing e-commerce activity and wider digital payment acceptance across traditionally cash-focused sectors are creating new opportunities. With digitally native consumers entering peak spending years, the market’s revenue outlook remains robust. The market generated a revenue of USD 184.1 Billion in 2025 and is projected to reach a revenue of USD 698.0 Billion by 2034, growing at a compound annual growth rate of 15.96% from 2026-2034.

Japan Mobile Money Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Mobile Wallets | 76.5% |

| Business Model | Mobile Led Model | 65.0% |

| Transaction Type | Peer to Peer | 35.9% |

| Region | Kanto Region | 33.9% |

Technology Insights:

- USSD

- Mobile Wallets

- Others

The mobile wallets dominate with a market share of 76.5% of the total Japan mobile money market in 2025.

Mobile wallet technology represents the predominant segment within Japan's mobile money market, driven by its seamless integration with consumer smartphones and extensive merchant acceptance networks. The user-friendly interfaces and intuitive navigation features have made mobile wallets accessible to consumers across various age groups and technological proficiency levels. These platforms offer comprehensive functionalities including bill payments, money transfers, and retail purchases within unified applications.

The popularity of mobile wallets is further enhanced by attractive incentive programs including cashback offers, point accumulation, and exclusive discount partnerships with major retailers. The technology enables instant transactions through QR code scanning and near-field communication capabilities, significantly reducing checkout times and enhancing consumer convenience. In January 2024, PayPay expanded its QR code payment integration to eight additional overseas cashless services from six countries, allowing users from 18 services across 10 countries to pay at Japanese merchants. Continuous innovation in security protocols and user experience optimization continues to drive adoption rates and transaction volumes across diverse use cases.

Business Model Insights:

Access the comprehensive market breakdown Request Sample

- Mobile Led Model

- Bank Led Model

The mobile led model leads with a share of 65.0% of the total Japan mobile money market in 2025.

The mobile led business model has established market leadership by leveraging Japan's exceptional smartphone penetration and digital infrastructure. This model operates independently of traditional banking frameworks, offering financial services directly through mobile applications without requiring existing bank account relationships. In April 2025, PayPay launched the “PayPay Bank Balance” payment method, enabling direct QR code payments from PayPay Bank accounts and providing users seamless, bank-independent mobile transactions. The approach has proven particularly effective in reaching underbanked populations and consumers seeking alternatives to conventional financial institutions.

These platforms benefit from operational flexibility and rapid innovation cycles, enabling quick adaptation to evolving consumer preferences and technological advancements. These providers have successfully built comprehensive ecosystems encompassing payments, savings, investments, and insurance products. The lower operational costs associated with digital-only infrastructure allow competitive pricing and attractive promotional campaigns that accelerate customer acquisition and market penetration across urban and suburban regions.

Transaction Type Insights:

- Peer to Peer

- Bill Payments

- Airtime Top-ups

- Others

The peer to peer exhibits a clear dominance with a 35.9% share of the total Japan mobile money market in 2025.

Peer to peer payment transactions have emerged as the dominant transaction category, reflecting the growing consumer preference for instant money transfers between individuals. In April 2024, PayPay increased its peer-to-peer payment limit to ¥300,000, enabling users to send over ¥300 billion in the first three and a half months, highlighting growing P2P adoption. Additionally, the functionality enables seamless splitting of expenses among friends, family remittances, and informal business transactions without the delays associated with traditional banking transfers. The convenience of transferring funds using mobile phone numbers or QR codes has made peer-to-peer payments integral to daily financial interactions.

The segment benefits from strong social dynamics where users encourage adoption among their personal networks to facilitate shared transactions. Mobile money platforms have optimized peer-to-peer interfaces for speed and simplicity, enabling transfers within seconds with minimal authentication steps. The functionality has become particularly popular among younger demographics who frequently engage in group activities requiring expense sharing, creating sustained growth momentum for this transaction category.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region commands with a market share of 33.9% of the total Japan mobile money market in 2025.

The Kanto Region maintains market leadership driven by its concentration of population, economic activity, and technological infrastructure centered around the metropolitan capital area. The region benefits from extensive merchant networks, advanced public transportation systems utilizing contactless payments, and a highly connected consumer base. For instance, in January 2025, Tokyo’s Toei Subway began public demonstrations of tap-and-go mobile and card payments across stations, enhancing convenience for commuters and international travelers using cashless transit solutions. Moreover, the presence of major financial institutions and technology companies has created an innovation hub that drives adoption trends subsequently adopted nationwide.

The regions dense urban environment creates ideal conditions for mobile payment adoption, with numerous daily transaction opportunities across retail, dining, transportation, and entertainment sectors. Consumers in this region demonstrate higher digital literacy and openness to technological innovation compared to other areas. The sophisticated retail ecosystem featuring department stores, convenience chains, and specialty retailers provides comprehensive acceptance networks that reinforce mobile payment usage habits.

Market Dynamics:

Growth Drivers:

Why is the Japan Mobile Money Market Growing?

Strategic Government Initiatives Promoting Cashless Society

The Japanese government has implemented comprehensive policies aimed at transforming the nation into a cashless society, creating favorable conditions for mobile money expansion. According to sources, in March 2025, Japan’s cashless payment ratio reached 42.8%, surpassing the government’s 40% target, reflecting successful adoption of digital payments across retail, services, and electronic money channels. These initiatives include subsidy programs for merchants installing digital payment terminals, consumer incentive campaigns offering cashback rewards, and regulatory frameworks facilitating fintech innovation. The establishment of standardized interoperability protocols has reduced fragmentation across payment platforms. Government agencies have partnered with private sector stakeholders to develop unified infrastructure supporting seamless digital transactions. Educational campaigns targeting various demographic segments have addressed misconceptions about digital payment security while highlighting convenience benefits. The regulatory environment has evolved to accommodate digital salary payments through mobile wallets, expanding use cases beyond retail transactions.

Accelerating E-Commerce Expansion and Digital Retail Transformation

Japan's rapidly expanding e-commerce sector is creating sustained demand for efficient mobile payment solutions that streamline online purchasing experiences. The growth of digital retail channels across diverse product categories including electronics, fashion, groceries, and services requires seamless payment integration. Mobile money platforms offer superior convenience for online transactions compared to traditional payment methods requiring manual card entry. According to sources, in March 2025, PayPay Corporation reported that total 2024 transactions exceeded 7.46 Billion, representing around 20% of all domestic cashless transactions in Japan. Moreover, the convergence of mobile shopping applications with integrated payment functionalities has created frictionless purchasing journeys. Subscription-based services spanning entertainment, software, and lifestyle products increasingly rely on recurring mobile payment capabilities. The expansion of click-and-collect services and hybrid retail models requires payment flexibility that mobile money platforms readily provide, supporting continued market expansion.

Technological Innovation Enhancing Security and User Experience

Continuous technological advancement in mobile payment platforms is addressing historical barriers to adoption while expanding functionality and use cases. Innovations in biometric authentication including fingerprint sensors and facial recognition have significantly enhanced transaction security. In May 2024, NEC Corporation introduced Japan’s largest face-recognition payment system at Expo 2025 Osaka, Kansai, enabling hands-free payments across approximately 1,000 terminals and 51 entrance gates. Further, artificial intelligence (AI) integration enables personalized user experiences, fraud detection, and spending insights that increase platform engagement. The deployment of advanced encryption protocols and tokenization technologies protects sensitive financial data throughout transaction processes. User interface optimization based on behavioral analysis has reduced friction in payment flows and increased completion rates. The integration of augmented reality features for product visualization and voice-activated payment capabilities represents emerging innovations attracting technology-forward consumers and maintaining competitive differentiation.

Market Restraints:

What Challenges the Japan Mobile Money Market is Facing?

Cultural Preference for Physical Cash Transactions

Japan maintains a deeply rooted cultural affinity for cash transactions, particularly among elderly populations, rural communities, and traditional small businesses. This preference stems from the perceived tangibility, reliability, and control offered by physical currency. Cash-giving customs for ceremonial occasions reinforce the cultural significance of physical money. Many establishments, especially traditional restaurants and small retailers, continue operating as cash-only businesses, limiting mobile payment utility in certain contexts.

Security and Privacy Concerns Among Consumers

Consumer apprehension regarding data security, privacy protection, and potential unauthorized access continues to moderate adoption rates among cautious demographic segments. High-profile security incidents in the digital payment sector have reinforced skepticism toward mobile financial services. Concerns about transaction tracking and personal spending data collection create hesitation among privacy-conscious consumers who prefer the anonymity of cash transactions.

Infrastructure Investment Requirements for Merchants

Small and medium enterprises face significant financial and operational challenges in implementing mobile payment acceptance infrastructure. The costs associated with terminal equipment, integration services, and ongoing transaction fees burden businesses operating on thin margins. Staff training requirements and the complexity of managing multiple payment systems create additional operational challenges that discourage adoption among resource-constrained merchants.

Competitive Landscape:

The Japan mobile money market exhibits a dynamic competitive environment characterized by diverse participants including technology-focused payment providers, traditional financial institutions expanding digital offerings, and telecommunications companies leveraging existing customer relationships. Market competition centers on user acquisition through promotional campaigns, merchant network expansion, and continuous platform enhancement. Differentiation strategies emphasize ecosystem comprehensiveness, reward program attractiveness, and transaction processing speed. Strategic partnerships between payment providers and retailers, transportation operators, and service businesses create exclusive value propositions. Investment in technological capabilities including artificial intelligence, biometric security, and user interface optimization drives competitive positioning. The market structure encourages continuous innovation as participants seek to establish dominant positions in specific transaction categories or demographic segments while building comprehensive service portfolios.

Recent Developments:

-

In April 2025, Stripe launched new payment features in Japan, enabling businesses to accept PayPay, offer card instalments, and utilize 3D Secure and network tokens, enhancing transaction security, faster payouts, and seamless online payment experiences.

Japan Mobile Money Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | USSD, Mobile Wallets, Others |

| Business Models Covered | Mobile Led Model, Bank Led Model |

| Transaction Types Covered | Peer to Peer, Bill Payments, Airtime Top-ups, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan mobile money market size was valued at USD 184.1 Billion in 2025.

The Japan mobile money market is expected to grow at a compound annual growth rate of 15.96% from 2026-2034 to reach USD 698.0 Billion by 2034.

Mobile wallets dominated the market share, driven by seamless smartphone integration, intuitive interfaces, and widespread merchant acceptance. Their strong presence across retail and e-commerce ecosystems continues to reinforce user convenience and sustained transaction growth.

Key factors driving the Japan mobile money market include government cashless society initiatives, rising smartphone penetration, expanding e-commerce activities, technological security enhancements, and strategic partnerships between financial and technology providers.

Major challenges include cultural preferences for cash transactions among elderly populations, security and privacy concerns deterring adoption, infrastructure costs for small merchants, fragmented payment platform ecosystem, interoperability limitations, and consumer trust issues following security incidents.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)