Japan Modular Furniture Market Size, Share, Trends and Forecast by Product Type, Material, End User, and Region, 2026-2034

Japan Modular Furniture Market Summary:

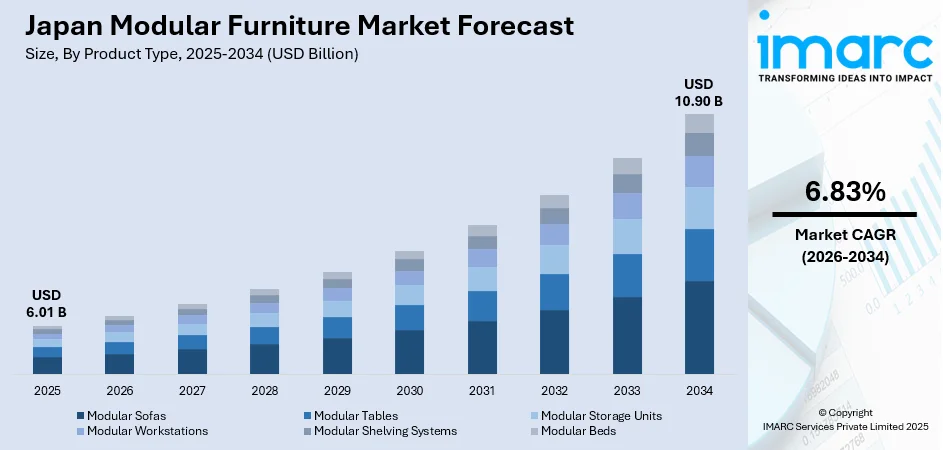

The Japan modular furniture market size was valued at USD 6.01 Billion in 2025 and is projected to reach USD 10.90 Billion by 2034, growing at a compound annual growth rate of 6.83% from 2026-2034.

The Japan modular furniture market is experiencing steady expansion driven by evolving consumer preferences, urban lifestyle transformations, and the nation's distinctive demographic dynamics. Rising demand for space-efficient solutions that maximize functionality within compact living environments is reshaping product development across residential and commercial segments. Growing environmental consciousness among Japanese consumers is accelerating adoption of sustainably sourced materials and eco-certified furnishings. Additionally, the expansion of hybrid work arrangements continues to stimulate investments in adaptable office interiors, reinforcing the Japan modular furniture market share.

Key Takeaways and Insights:

- By Product Type: Modular sofas hold the largest market share at 34% in 2025, establishing themselves as the leading product category in Japan's modular furniture landscape, driven by consumer preference for customizable seating configurations that adapt to diverse room layouts.

- By Material: Wood dominates the market with 40% share in 2025, reflecting Japan's deep cultural appreciation for natural materials, traditional craftsmanship, and growing consumer preference for sustainably sourced timber products.

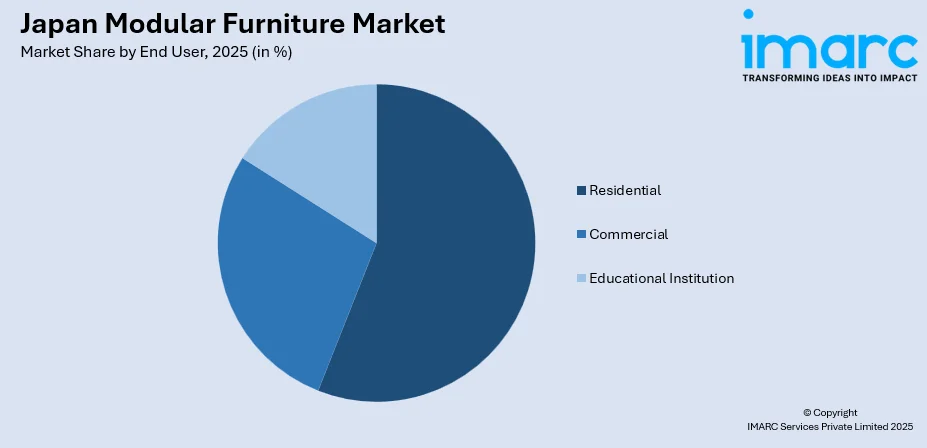

- By End User: Residential leads the market with 56% share in 2025, driven by urban apartment living trends, shrinking household sizes, and increasing consumer investments in functional home furnishings that optimize limited living spaces.

- By Region: Kanto Region holds the biggest market share at 35% in 2025, supported by the concentration of Japan's population in the Tokyo metropolitan area, substantial economic activity, and consistently high consumer spending power.

- Key Players: The Japan modular furniture market exhibits moderate competitive intensity, with established domestic manufacturers competing alongside international retailers across diverse price segments, emphasizing design innovation, sustainability credentials, and customization capabilities.

To get more information on this market Request Sample

The Japan modular furniture market is advancing as manufacturers respond to evolving urban lifestyles and demographic shifts with innovative space-saving solutions. Japanese consumers increasingly prioritize furniture that offers flexibility, aesthetic appeal, and environmental responsibility within compact living environments. The market benefits from robust domestic manufacturing capabilities alongside growing acceptance of international design influences. In June 2025, ITOKI Corporation launched its new office furniture brand "NII" at ORGATEC TOKYO 2025, introducing modular furniture collections designed by international designers, aimed at transforming office spaces into creative and collaborative environments. This development reflects broader industry trends toward design-driven, adaptable workspace solutions that support Japan's evolving hybrid work culture.

Japan Modular Furniture Market Trends:

Expansion of Space-Efficient Living Solutions

Japanese consumers are embracing compact, multifunctional furniture designed for efficient space utilization within urban apartments. Foldable tables, convertible sofas, and storage-integrated beds have become essential household items as metropolitan residents seek to maximize functionality without compromising aesthetics. In 2024, Tokyo's population density reached 6,158 persons per square kilometer, driving substantial demand for transformable furniture solutions that adapt to limited floor spaces while supporting the Japan modular furniture market growth.

Rising Demand for Sustainable and Eco-Certified Furniture

Environmental consciousness is reshaping purchasing decisions as Japanese consumers increasingly favor furniture made from sustainably sourced materials, certified wood, and recycled components. Manufacturers are responding by adopting Forest Stewardship Council certification, low-VOC finishes, and responsible production practices. The Japanese government's Green Purchasing Law requires public institutions to prioritize procurement of eco-friendly products, encouraging furniture companies to develop environmentally responsible lines that meet stringent sustainability standards.

Integration of Smart Technology and Flexible Workspaces

The adoption of hybrid work arrangements continues accelerating demand for adaptable office furniture featuring technology integration and reconfigurable designs. Wireless charging capabilities, built-in connectivity features, and modular workstation systems are gaining traction among corporate clients seeking productive workspace environments. Organizations are increasingly investing in activity-based workplace concepts that prioritize flexibility and employee collaboration. Commercial interior designers are responding with innovative furniture solutions that accommodate diverse working styles and seamless transitions between individual focus work and team collaboration. These evolving workplace requirements are establishing new standards for office furniture functionality, driving manufacturers to develop versatile products supporting modern corporate environments.

Market Outlook 2026-2034:

The Japan modular furniture market growth will be supported by continued urbanization trends, demographic shifts toward smaller household sizes, and expanding hybrid work culture across corporate sectors. Rising consumer awareness of sustainability, coupled with increasing investments in residential renovation and commercial interior redesigns, will sustain market momentum through the forecast horizon. Growing e-commerce penetration and digital retail innovations will further expand market accessibility, enabling manufacturers to reach broader consumer segments seeking functional and aesthetically appealing furniture solutions. The market generated a revenue of USD 6.01 Billion in 2025 and is projected to reach a revenue of USD 10.90 Billion by 2034, growing at a compound annual growth rate of 6.83% from 2026-2034.

Japan Modular Furniture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Modular Sofas | 34% |

| Material | Wood | 40% |

| End User | Residential | 56% |

| Region | Kanto Region | 35% |

Product Type Insights:

- Modular Sofas

- Modular Tables

- Modular Storage Units

- Modular Workstations

- Modular Shelving Systems

- Modular Beds

Modular sofas lead with 34% share in Japan modular furniture market in 2025.

The modular sofas segment commands the largest share, reflecting consumer preferences for versatile seating solutions that offer configuration flexibility within limited floor spaces. Japanese households increasingly favor sectional designs that can be rearranged to accommodate different activities, guest accommodations, and evolving lifestyle needs. The segment benefits from growing acceptance of Western-style furniture combined with traditional Japanese appreciation for functional minimalism. Manufacturers are expanding product portfolios with lightweight, reconfigurable sofa systems featuring premium upholstery options and space-saving mechanisms that appeal to urban apartment dwellers seeking both comfort and adaptability. Rising demand for multi-functional living spaces has accelerated innovation in modular sofa designs incorporating storage compartments, convertible sleeping arrangements, and detachable components. Consumers increasingly seek sofas that transition seamlessly between casual lounging, formal entertaining, and occasional sleeping configurations. The availability of diverse fabric choices, color palettes, and modular configurations enables homeowners to personalize seating arrangements according to individual preferences and room dimensions. Online retail platforms have further expanded consumer access to customizable modular sofa options with detailed visualization tools.

Material Insights:

- Wood

- Metal

- Plastic

- Glass

- Upholstery

Wood dominates with 40% share in Japan modular furniture market in 2025.

Wood maintains market leadership driven by Japan's centuries-old woodworking tradition and deep consumer appreciation for natural aesthetics. Japanese furniture manufacturers have cultivated expertise in precision joinery techniques and sustainable timber sourcing, particularly utilizing domestically grown hardwoods from Hokkaido and other forested regions. The Asahikawa Furniture Industry Cooperative continues promoting local wood utilization through initiatives like the International Furniture Design Competition Asahikawa, which encourages sustainable materials and manufacturing methods while raising international design awareness. Growing environmental consciousness reinforces demand for FSC-certified and responsibly sourced wooden furniture among eco-conscious consumers. The natural warmth and durability of wood align with Japanese design philosophies emphasizing harmony between interior spaces and natural elements. Manufacturers are increasingly incorporating reclaimed and recycled wood materials into product lines, appealing to environmentally aware consumers seeking sustainable alternatives. Advanced finishing techniques and protective treatments extend product longevity while preserving natural wood grain characteristics. The premium positioning of domestically crafted wooden furniture supports higher price points and reinforces quality perceptions among discerning consumers valuing craftsmanship heritage.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Offices

- Hotels

- Retail Spaces

- Restaurants

- Educational Institution

Residential segment holds the largest share at 56% in Japan modular furniture market in 2025.

The residential segment dominates the Japan modular furniture market as urbanization and evolving household structures drive demand for adaptable home furnishings. Japanese consumers prioritize furniture that maximizes utility within small apartments while maintaining aesthetic harmony aligned with minimalist design principles. The segment benefits from rising disposable incomes, growing exposure to global interior trends, and increasing e-commerce accessibility that expands product choices for younger demographics. Ongoing residential construction activity across metropolitan areas continues generating substantial demand for furniture purchases. Sustainability considerations increasingly influence residential purchasing decisions, with many households opting for eco-friendly materials and locally crafted designs that blend modern functionality with traditional sensibilities. The growing prevalence of remote work arrangements has stimulated demand for home office furniture solutions integrated within residential living spaces. Younger consumers demonstrate strong preferences for modular furniture enabling flexible room configurations that adapt to changing lifestyle requirements. Social media platforms and digital interior design resources continue influencing residential furniture purchasing patterns, driving demand for aesthetically distinctive pieces that complement contemporary living environments while offering practical functionality.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region leads the market with 35% share in Japan modular furniture market in 2025.

The Kanto Region commands the largest share of the Japan modular furniture market, anchored by Tokyo's position as the nation's economic and cultural center. The region's exceptionally high population density creates sustained demand for space-saving furniture solutions suited for compact urban apartments. Companies specializing in modular furniture design have established strong market presence through offerings that address metropolitan lifestyle requirements. In January 2024, IKEA opened its tenth store in Japan at Maebashi in Gunma Prefecture, marking the retailer's first location in the North Kanto region and positioning the store to serve over seven million residents in surrounding areas. The Kansai region follows as a significant market, blending traditional Japanese design heritage with contemporary commercial demand centered around Osaka, Kyoto, and Kobe.

Market Dynamics:

Growth Drivers:

Why is the Japan Modular Furniture Market Growing?

Demographic Shifts and Aging Population Requirements

Japan's demographic landscape, characterized by a significant aging population and shrinking household sizes, is fundamentally reshaping residential furniture demand. This demographic shift creates growing demand for furniture that supports accessibility, ergonomic comfort, and independent living arrangements. Modular furniture enables elderly individuals and couples to maximize living space while maintaining convenience and safety. Compact storage units, lightweight seating configurations, and adjustable components offer practical solutions tailored to senior residents. Government-supported housing models and accessibility regulations further reinforce demand for adaptable furnishings designed for aging citizens.

Rapid Urbanization and Limited Living Spaces

Japan's high urbanization rate creates persistent demand for space-efficient furniture solutions. Metropolitan residents living in compact apartments require furnishings that maximize functionality within limited floor spaces without compromising comfort or aesthetic appeal. Shrinking average apartment sizes in metropolitan areas intensify consumer preference for modular, transformable furniture. Foldable tables, convertible sofas, and storage-integrated beds have become essential household items. Manufacturers continue innovating with lightweight materials and minimalist designs aligned with Japanese cultural preferences for simplicity and balance. This sustained urbanization trend shapes purchasing decisions and drives product development across residential furniture categories.

Expansion of Hybrid Work Culture and Office Redesigns

Japan's evolving work culture, marked by increasing adoption of hybrid arrangements and flexible workplace policies, is stimulating significant investments in adaptable office furniture. Organizations are redesigning commercial interiors to foster collaboration, social interaction, and employee well-being through modular workstation systems and reconfigurable meeting spaces. The rise of open-plan workplaces and coworking hubs amplifies demand for furniture enabling easy reconfiguration without structural modifications. Universities, research institutions, and co-working spaces are adopting modular interiors to accommodate multiple users and functions within limited footprints. Industry events continue showcasing cutting-edge workstation designs promoting creative and flexible workplace concepts that reflect market direction toward productivity-enhancing environments.

Market Restraints:

What Challenges the Japan Modular Furniture Market is Facing?

Declining Population and Household Formation

Japan's declining population presents a long-term challenge for the furniture market as household formation slows. With birth rates remaining low and the overall population contracting, domestic demand growth faces structural limitations, particularly in rural and regional areas experiencing population outflows to metropolitan centers.

Intense Competition Among Market Players

The market faces fragmented competition with numerous domestic manufacturers and international retailers vying for market share. This creates pricing pressures and margin compression, particularly in mid-range segments. Established players must continuously invest in product differentiation, brand positioning, and innovation to maintain competitive advantage.

Rising Material Costs and Supply Chain Pressures

Fluctuating raw material prices and supply chain constraints affect production costs and pricing strategies. Limited domestic timber resources necessitate imports, exposing manufacturers to currency fluctuations and international supply disruptions. These factors challenge profitability and require careful cost management across operations.

Competitive Landscape:

The Japan modular furniture market exhibits a semi-consolidated competitive structure with established domestic manufacturers competing alongside international retailers across diverse product segments and price points. Leading domestic players leverage deep understanding of Japanese consumer preferences, traditional craftsmanship heritage, and extensive retail networks to maintain market positions. International competitors contribute global design perspectives, supply chain efficiencies, and digital retail innovations. Competition centers on product differentiation through design excellence, sustainability credentials, customization capabilities, and omnichannel distribution strategies. Strategic partnerships between furniture manufacturers and international designers are emerging as key differentiators for premium market positioning.

Japan Modular Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Modular Sofas, Modular Tables, Modular Storage Units, Modular Workstations, Modular Shelving Systems, Modular Beds |

| Materials Covered | Wood, Metal, Plastic, Glass, Upholstery |

| End Users Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan modular furniture market size was valued at USD 6.01 Billion in 2025.

The Japan modular furniture market is expected to grow at a compound annual growth rate of 6.83% from 2026-2034 to reach USD 10.90 Billion by 2034.

Modular sofas, holding the largest revenue share of 34%, dominate the Japan modular furniture market, driven by consumer demand for customizable seating configurations that adapt to compact living spaces and diverse room layouts.

Key factors driving the Japan modular furniture market include demographic shifts with aging population requirements, rapid urbanization creating demand for space-efficient solutions, expansion of hybrid work culture, growing sustainability awareness, and increasing residential renovation activities.

Major challenges include declining population affecting long-term demand growth, intense competition among domestic and international players, rising raw material costs, supply chain constraints, and evolving consumer preferences requiring continuous product innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)