Japan Motorcycle Tires Market Size, Share, Trends and Forecast by Tire Type, Tire Structure, Tire Category, Tire Size, Sales Channel, Location, and Region, 2026-2034

Japan Motorcycle Tires Market Summary:

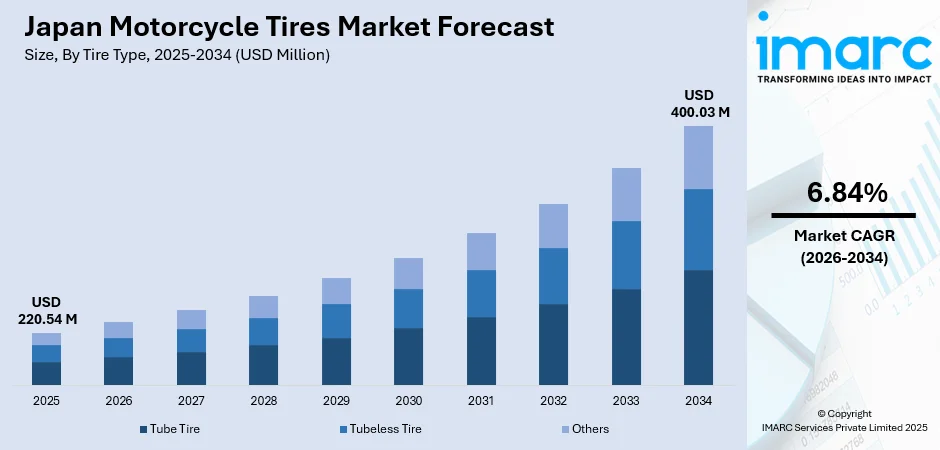

The Japan motorcycle tires market size was valued at USD 220.54 Million in 2025 and is projected to reach USD 400.03 Million by 2034, growing at a compound annual growth rate of 6.84% from 2026-2034.

The Japan motorcycle tires market is experiencing robust growth driven by the country's strong motorcycle culture and rising demand for premium two-wheeler products. Technological advancements in tire manufacturing, including improved rubber compounds and tread designs, are enhancing safety and performance standards across all motorcycle segments. The growing popularity of motorcycle tourism along Japan's scenic routes is stimulating demand for high-quality touring and sport-touring tires. Additionally, the increasing adoption of tubeless and radial tire technologies reflects consumer preference for enhanced safety and riding comfort. The aftermarket segment continues to dominate as Japanese riders prioritize regular tire maintenance and upgrades, contributing significantly to the Japan motorcycle tires market share.

Key Takeaways and Insights:

- By Tire Type: Tubeless tire dominates the market with a share of 73.13% in 2025, owing to its superior safety features that prevent sudden air loss during punctures, enhanced fuel efficiency through reduced rolling resistance, and improved ride quality. Growing consumer awareness about tubeless tire benefits is fueling market expansion.

- By Tire Structure: Radial leads the market with a share of 58.08% in 2025. This dominance is driven by radial tires' exceptional performance characteristics including enhanced grip, superior handling at higher speeds, and longer tread life. Japanese riders increasingly prefer radial construction for its stability and comfort during long-distance touring.

- By Tire Category: Street tires represent the largest segment with a market share of 45.14% in 2025, reflecting Japan's urban commuting patterns and extensive road network that favor on-road tire applications. Rising demand for versatile tires suitable for daily commuting and weekend touring drives segment growth.

- By Tire Size: 12"-15" exhibits a clear dominance in the market with 42.07% share in 2025, owing to the widespread popularity of mid-range motorcycles and scooters in Japan. This size range caters effectively to both urban commuters and touring enthusiasts seeking optimal performance and versatility.

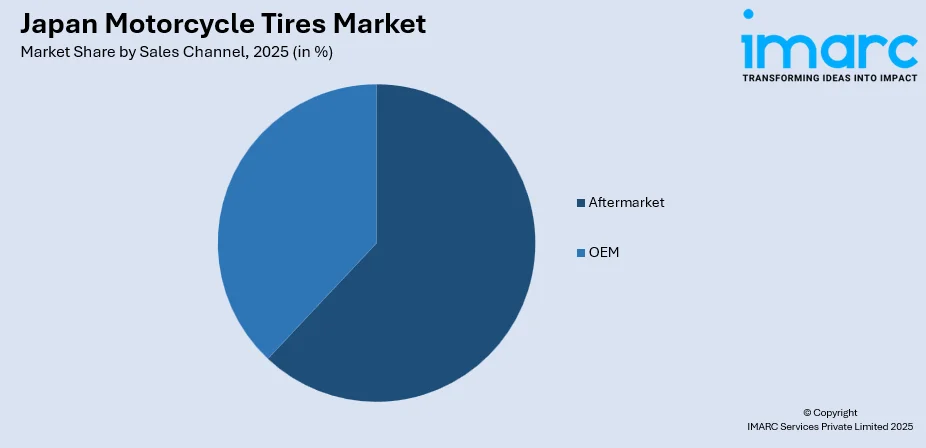

- By Sales Channel: Aftermarket dominates the market with a share of 61.07% in 2025. This dominance is driven by Japanese riders' commitment to regular maintenance and tire upgrades, extensive dealer networks, and the aging motorcycle fleet requiring frequent replacements.

- By Location: Rear dominates the market with a share of 55.14% in 2025, owing to higher wear rates on rear tires due to power transmission and braking forces. Japanese riders prioritize rear tire quality to ensure optimal traction and safety during acceleration and cornering.

- Key Players: Key players drive the Japan motorcycle tires market by expanding product portfolios, improving grip and durability technologies, and strengthening nationwide distribution. Their investments in motorsports sponsorship, premium tire development, and partnerships with motorcycle manufacturers boost brand awareness and ensure consistent product availability.

To get more information on this market Request Sample

The Japan motorcycle tires market continues to evolve as domestic manufacturers leverage advanced rubber technologies and precision engineering to meet diverse rider requirements. Japan's position as a global leader in tire innovation is reinforced by companies investing heavily in research and development to create tires that deliver superior wet and dry grip performance. The market benefits from strong original equipment partnerships, with Bridgestone announcing in January 2025 the supply of BATTLAX RACING STREET RS11 tires as original equipment for Yamaha's new YZF-R9 Supersport model. In order to create application-specific solutions that improve vehicle performance and rider enjoyment across sport, touring, and commuter sectors, Japanese tire producers collaborate closely with motorcycle OEMs, as demonstrated by this partnership.

Japan Motorcycle Tires Market Trends:

Rising Adoption of Tubeless Tire Technology

The Japan motorcycle tires market is witnessing accelerated adoption of tubeless tire technology as riders increasingly prioritize safety and convenience. Tubeless tires offer significant advantages including resistance to sudden deflation during punctures, enhanced fuel efficiency through reduced rolling resistance, and lower maintenance requirements compared to traditional tube-type alternatives. Japanese consumers, known for their quality consciousness, are gravitating toward tubeless options that provide better air retention and improved ride comfort. Manufacturers are responding by expanding tubeless tire portfolios across various motorcycle categories, supporting the Japan motorcycle tires market growth.

Premium Performance Tire Demand Expansion

Demand for premium high-performance motorcycle tires is expanding significantly across Japan as riders seek superior handling, durability, and riding pleasure. Japanese consumers are increasingly discerning in their tire choices, prioritizing products that offer exceptional grip in both wet and dry conditions along with extended tread life. Particular interest in track-capable tires approved for street usage is being driven by the sports and supersport motorbike classes. Manufacturers are incorporating technologies developed through motorsports programs, leveraging insights from racing competitions to enhance commercial tire offerings for enthusiast riders.

Radial Construction Gaining Prominence

Radial tire construction is gaining substantial prominence in the Japan motorcycle tires market as riders recognize its performance benefits over traditional bias-ply designs. Radial tires feature cord plies arranged perpendicular to the direction of travel, providing enhanced flexibility that translates into improved grip, superior handling stability, and better heat dissipation during extended rides. This construction method delivers reduced rolling resistance, contributing to fuel efficiency gains that appeal to cost-conscious and environmentally aware Japanese consumers. The preference for radial tires is particularly strong among sport and touring motorcycle enthusiasts.

Market Outlook 2026-2034:

The Japan motorcycle tires market is positioned for sustained growth as technological innovation and evolving consumer preferences drive demand expansion. Manufacturers are intensifying focus on developing tires that balance performance, safety, and longevity while incorporating sustainable materials and production processes. The market generated a revenue of USD 220.54 Million in 2025 and is projected to reach a revenue of USD 400.03 Million by 2034, growing at a compound annual growth rate of 6.84% from 2026-2034. Rising motorcycle tourism, continued aftermarket replacement demand, and premium tire adoption among performance-oriented riders will contribute to market expansion throughout the forecast period.

Japan Motorcycle Tires Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Tire Type | Tubeless Tire | 73.13% |

| Tire Structure | Radial | 58.08% |

| Tire Category | Street Tires | 45.14% |

| Tire Size | 12"-15" | 42.07% |

| Sales Channel | Aftermarket | 61.07% |

| Location | Rear | 55.14% |

Tire Type Insights:

- Tube Tire

- Tubeless Tire

- Others

Tubeless tire dominates with a market share of 73.13% of the total Japan motorcycle tires market in 2025.

Tubeless tires have become the preferred choice among Japanese motorcycle riders due to their enhanced safety profile and performance characteristics. These tires eliminate the need for inner tubes, reducing the risk of sudden blowouts and enabling controlled deflation during punctures that allows riders to maintain vehicle control. The integrated construction provides better heat dissipation, improving durability during extended riding sessions on Japan's mountainous terrain and highway networks. Tubeless technology also delivers superior air retention compared to traditional tube-type alternatives, ensuring consistent tire pressure that optimizes handling stability and braking performance across diverse riding conditions.

Japanese consumers increasingly recognize the practical benefits of tubeless technology including simplified maintenance, reduced overall weight, and improved fuel efficiency through lower rolling resistance. The regulatory environment in Japan, which emphasizes strict safety standards for motorcycle components, has further accelerated tubeless tire adoption. Additionally, tubeless tires offer greater resistance to damage from road debris and minor punctures, providing riders with enhanced confidence during both urban commuting and long-distance touring. Manufacturers continue expanding tubeless product portfolios to address growing demand across all motorcycle categories and displacement ranges.

Tire Structure Insights:

- Radial

- Bias

- Others

Radial leads with a share of 58.08% of the total Japan motorcycle tires market in 2025.

Radial tire construction has established clear dominance in Japan's motorcycle tire segment through its superior performance attributes compared to traditional bias-ply alternatives. The perpendicular arrangement of cord plies in radial tires provides enhanced flexibility, resulting in improved grip characteristics, more precise handling response, and better stability at higher speeds. Japanese riders, particularly those operating sport and touring motorcycles, value these performance benefits for both daily commuting and recreational riding.

The technological advancement in radial tire manufacturing has enabled reduced rolling resistance, contributing to fuel economy improvements that resonate with environmentally conscious Japanese consumers. Radial tires also demonstrate superior heat dissipation properties, extending service life under demanding riding conditions. In May 2024, Yokohama announced plans to invest ¥3.8 Billion to expand motorsports tire production at its Mishima Plant, increasing capacity by 35 percent to meet growing demand for high-performance radial tires.

Tire Category Insights:

- Street Tires

- Dual Sports or Adv Tires

- Touring Tires

- Sports/Performance Tires

- Sports Touring Tires

- Off-Roads Tires

- Racing Tires/Slicks

Street tires represent the largest segment with a 45.14% share of the total Japan motorcycle tires market in 2025.

Street tires maintain market leadership in Japan due to the country's extensive paved road infrastructure and urban-centric motorcycle usage patterns. These tires are engineered to deliver balanced performance across varied on-road conditions, offering reliable grip on both dry and wet surfaces while maintaining comfortable ride characteristics. Japanese commuters favor street tires for their versatility, enabling confident riding during daily transportation and occasional weekend touring excursions.

The street tire segment benefits from Japan's well-maintained road networks and the popularity of mid-displacement motorcycles and scooters for urban mobility. Tire manufacturers continue developing street-focused products with improved wet weather performance and extended tread life to address consumer priorities. In January 2024, Michelin Japan launched the Anakee Road tire specifically designed for adventure touring motorcycles, offering stable handling performance for on-road applications with enhanced wet grip capabilities.

Tire Size Insights:

- Less than 12"

- 12"-15"

- 15"-17"

- Above 17"

12"-15" exhibits a clear dominance with a 42.07% share of the total Japan motorcycle tires market in 2025.

The 12-inch to 15-inch tire size category commands the largest market share in Japan, reflecting the popularity of mid-range motorcycles, scooters, and small-displacement commuter bikes that utilize wheels within this diameter range. This size category offers optimal balance between maneuverability for urban navigation and stability for highway cruising, addressing the diverse requirements of Japanese riders who use motorcycles for both practical transportation and recreational purposes.

Japanese motorcycle ownership patterns show strong preference for versatile mid-sized vehicles that are easy to handle in congested city traffic while capable of comfortable longer-distance travel. Tire manufacturers focus significant development resources on this size segment, ensuring availability of diverse tread patterns and compound formulations. The robust aftermarket demand within this category is supported by Japan's aging motorcycle fleet.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

Aftermarket dominates with a market share of 61.07% of the total Japan motorcycle tires market in 2025.

The aftermarket sales channel maintains clear leadership in Japan's motorcycle tire distribution, driven by the country's maintenance-conscious riding culture and extensive dealer network infrastructure. Japanese motorcycle owners demonstrate strong commitment to regular tire inspection and timely replacement, understanding the critical role quality tires play in vehicle safety and performance. This proactive maintenance approach ensures consistent aftermarket demand throughout the year.

Japan's aftermarket tire segment benefits from well-established retail channels including specialized motorcycle shops, automotive service centers, and e-commerce platforms that provide convenient access to diverse product selections. The aging motorcycle fleet in Japan, combined with riders' preference for upgrading to premium replacement tires with enhanced performance characteristics, sustains strong aftermarket volumes. Manufacturers invest in aftermarket-focused marketing and dealer support programs to capitalize on this dominant distribution channel.

Location Insights:

- Front

- Rear

Rear holds 55.14% share of the total Japan motorcycle tires market in 2025.

Rear tires account for the majority of Japan's motorcycle tire market due to inherently higher wear rates resulting from power transmission, acceleration forces, and braking loads concentrated on the rear wheel. Japanese riders recognize that rear tire condition directly impacts vehicle traction, stability during cornering, and overall riding safety, prompting more frequent replacement compared to front tires that experience comparatively lighter wear under normal riding conditions.

The performance-oriented nature of Japan's motorcycle enthusiast community drives demand for high-quality rear tires capable of delivering optimal grip during acceleration and secure traction through corners. Manufacturers develop rear-specific tire compounds and tread designs optimized for the unique stress patterns experienced at this position. The emphasis on rear tire performance is particularly pronounced among sport bike riders who prioritize maximum traction for spirited riding on Japan's winding mountain roads.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region, encompassing Tokyo and surrounding prefectures, represents a significant motorcycle tire consumption hub driven by the metropolitan area's large motorcycle population, extensive dealer networks, and concentration of major tire retailers. Urban commuting patterns and recreational riding along coastal routes sustain consistent replacement tire demand.

The Kansai/Kinki Region, including Osaka, Kyoto, and Kobe, demonstrates strong motorcycle tire demand supported by its substantial manufacturing sector and dense urban population. The region's well-maintained road infrastructure and popular touring destinations attract riders requiring quality tires for diverse riding conditions and applications.

The Central/ Chubu Region serves as a critical motorcycle tire market supported by its automotive manufacturing heritage and scenic mountain roads popular among touring enthusiasts. The region's proximity to major tire production facilities ensures efficient distribution, while mountainous terrain drives demand for high-performance grip-oriented products.

The Kyushu-Okinawa Region contributes to motorcycle tire demand through its subtropical climate enabling year-round riding and growing motorcycle tourism industry. The region's diverse terrain from volcanic mountains to coastal roads requires versatile tire solutions that deliver reliable performance across varying conditions.

The Tohoku Region presents seasonal motorcycle tire demand patterns influenced by harsh winter conditions that concentrate riding activity during warmer months. Riders in this region prioritize durable tires with excellent wet grip capabilities to navigate frequently variable weather conditions encountered during spring and autumn touring.

The Chugoku Region supports steady motorcycle tire consumption driven by its scenic Seto Inland Sea coastline and mountain passes attractive to touring riders. The region's moderate climate extends riding seasons, sustaining consistent aftermarket demand for replacement tires among commuters and recreational motorcyclists alike.

The Hokkaido Region exhibits distinct seasonal demand characteristics with motorcycle activity concentrated during summer months due to severe winters. The region's expansive landscapes and scenic touring routes attract domestic and international riders seeking quality tires capable of handling long-distance travel across varied terrain.

The Shikoku Region maintains stable motorcycle tire demand supported by its famous pilgrimage routes and scenic coastal highways attracting touring enthusiasts. The island's compact geography and well-connected road network facilitate motorcycle usage for both practical transportation and recreational purposes throughout the riding season.

Market Dynamics:

Growth Drivers:

Why is the Japan Motorcycle Tires Market Growing?

Rising Motorcycle Tourism and Recreational Riding

The Japan motorcycle tires market is experiencing significant growth stimulus from rising motorcycle tourism and recreational riding activities across the country. Japan's diverse landscapes, scenic coastal highways, and mountainous touring routes attract both domestic and international riders seeking memorable two-wheeled adventures. This tourism trend generates sustained demand for high-quality touring and sport-touring tires that deliver reliable performance over extended distances. Regional governments actively promote motorcycle-friendly tourism initiatives, developing dedicated parking facilities and rider rest areas that encourage longer touring excursions. The increasing popularity of motorcycle rental services among tourists further expands the addressable market for replacement tires as rental fleet operators prioritize quality tire maintenance for customer safety and satisfaction.

Technological Innovation in Tire Manufacturing

Continuous technological innovation in tire manufacturing represents a fundamental driver of market growth as Japanese manufacturers introduce products with enhanced performance characteristics. Advancements in rubber compound formulations, tread pattern engineering, and structural design enable tires that deliver superior grip, extended service life, and improved fuel efficiency. Smart tire technologies featuring embedded sensors for real-time pressure and temperature monitoring are gaining traction among technology-conscious Japanese consumers who prioritize safety and performance optimization. Japanese tire manufacturers leverage expertise developed through motorsports programs to transfer racing-derived technologies into commercial products, delivering track-proven performance for street applications. Research and development investments focus on creating compounds that maintain consistent grip across varying temperature ranges and road conditions encountered throughout Japan's diverse climate zones. Innovations in carcass construction enhance stability during high-speed riding while improving comfort for long-distance touring applications. These continuous technological improvements stimulate replacement tire purchases as riders upgrade to benefit from latest advancements in grip performance, durability, and riding comfort that enhance overall motorcycle ownership experience.

Strong Aftermarket Replacement Demand

Robust aftermarket replacement demand provides sustained growth momentum for the Japan motorcycle tires market, driven by the country's substantial motorcycle population and maintenance-focused riding culture. Japan's aging motorcycle fleet, comprising over ten million registered units, generates consistent replacement tire requirements as vehicles accumulate mileage and tires reach service life limits. Japanese riders demonstrate high awareness regarding tire safety and performance degradation, typically replacing tires proactively rather than waiting for excessive wear. The extensive network of authorized dealers, specialized motorcycle shops, and online retailers ensures convenient access to replacement products, supporting purchase decisions. Manufacturers strengthen aftermarket presence through dealer training programs, competitive pricing strategies, and promotional campaigns that reinforce brand loyalty among repeat purchasers.

Market Restraints:

What Challenges is the Japan Motorcycle Tires Market Facing?

Declining Motorcycle Sales in Certain Segments

The Japan motorcycle tires market faces headwinds from declining motorcycle sales in certain vehicle segments, particularly small-displacement scooters and mopeds. Japan's aging population and shifting urban mobility preferences toward bicycles and public transportation are reducing demand for entry-level two-wheelers. This demographic shift constrains OEM tire demand and eventually impacts aftermarket volumes as the fleet of smaller motorcycles contracts over time.

Raw Material Price Volatility

Fluctuations in raw material prices, particularly natural rubber and petroleum-derived synthetic rubber compounds, create cost pressures that challenge market participants. Supply chain disruptions, currency exchange rate movements, and global commodity market volatility impact production costs and potentially constrain manufacturer margins. These cost pressures may ultimately translate to higher retail prices that could moderate consumer purchasing decisions.

Competition from Imported Products

Increasing competition from imported motorcycle tires, particularly from manufacturers in Southeast Asia offering lower-priced alternatives, presents challenges for domestic market participants. Price-sensitive consumers may opt for imported products despite potential quality differentials, pressuring premium-positioned domestic brands. Manufacturers must continuously demonstrate value through performance advantages and brand reputation to maintain market position against import competition.

Competitive Landscape:

The Japan motorcycle tires market features intense competition among established domestic manufacturers and international brands seeking market share expansion. Leading companies leverage extensive research and development capabilities to introduce innovative products addressing evolving rider requirements for performance, safety, and durability. Competition is driven by product differentiation through advanced tire technologies, OEM partnership agreements with major motorcycle manufacturers, and aftermarket distribution network strength. Motorsports involvement serves as both a technology development platform and brand visibility mechanism, with companies sponsoring racing teams and supplying tires for premier motorcycle racing series. Strategic investments in production capacity expansion and manufacturing automation enhance cost competitiveness while maintaining quality standards expected by discerning Japanese consumers.

Japan Motorcycle Tires Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tire Types Covered | Tube Tire, Tubeless Tire, Others |

| Tire Structures Covered | Radial, Bias, Others |

| Tire Categories Covered | Street Tires, Dual Sports or Adv Tires, Touring Tires, Sports/Performance Tires, Sports Touring Tires, Off-Roads Tires, Racing Tires/Slicks |

| Tire Sizes Covered | Less than 12”, 12”-15”, 15”-17”, More Than 17” |

| Sales Channels Covered | OEM, Aftermarket |

| Locations Covered | Front, Rear |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan motorcycle tires market size was valued at USD 220.54 Million in 2025.

The Japan motorcycle tires market is expected to grow at a compound annual growth rate of 6.84% from 2026-2034 to reach USD 400.03 Million by 2034.

Tubeless tire dominated the market with a share of 73.13%, owing to superior safety features including resistance to sudden deflation during punctures, enhanced fuel efficiency through reduced rolling resistance, and improved ride quality that appeals to safety-conscious Japanese riders.

Key factors driving the Japan motorcycle tires market include rising motorcycle tourism and recreational riding, technological innovation in tire manufacturing, strong aftermarket replacement demand, growing adoption of tubeless and radial tire technologies, and increasing consumer preference for premium high-performance products.

Major challenges include declining motorcycle sales in certain segments particularly small-displacement vehicles, raw material price volatility affecting production costs, competition from lower-priced imported products, Japan's aging population reducing new rider numbers, and shifting urban mobility preferences toward alternative transportation modes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)