Japan Natural Gas Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Japan Natural Gas Market Overview:

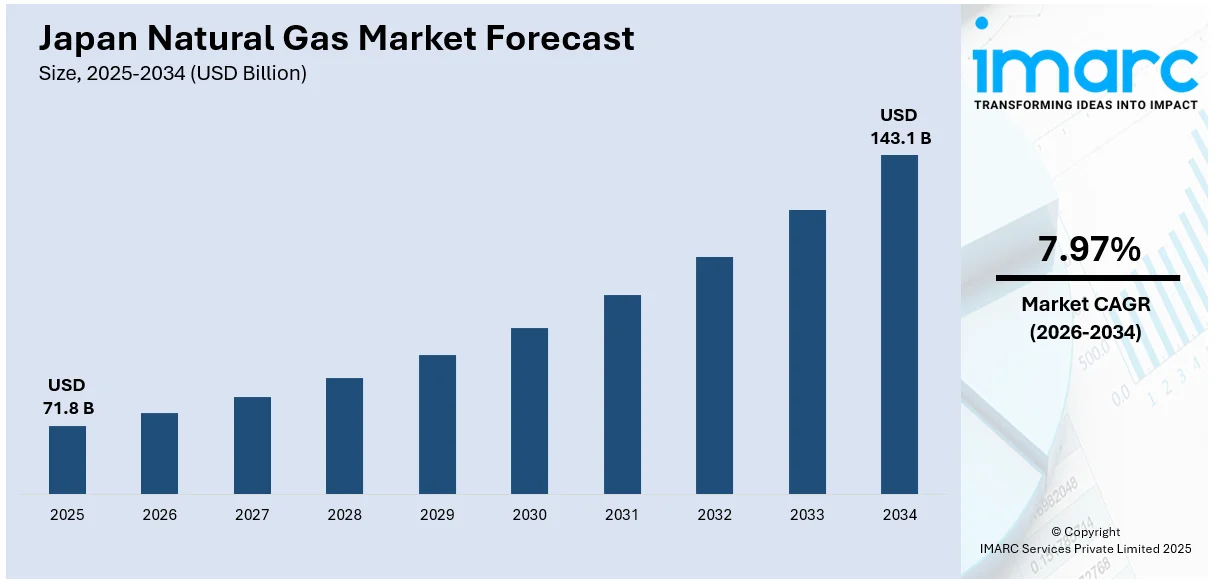

The Japan natural gas market size reached USD 71.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 143.1 Billion by 2034, exhibiting a growth rate (CAGR) of 7.97% during 2026-2034. At present, Japan is shifting towards natural gas as part of the decarbonization of its energy mix while ensuring energy security and economic stability. The country is also proactively improving its energy security by expanding the sources of its liquefied natural gas (LNG) imports and its gas storage capacity in light of unstable global energy trends. Moreover, the heightened focus on industrial and technological innovation through gas integration is expanding the Japan natural gas market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 71.8 Billion |

| Market Forecast in 2034 | USD 143.1 Billion |

| Market Growth Rate 2026-2034 | 7.97% |

Japan Natural Gas Market Trends:

Shifting Towards Low-Carbon Energy to Achieve Climate Targets

Japan is shifting towards natural gas as part of the decarbonization of its energy mix, ensuring energy security and economic stability. The government is engaging actively in the reduction of dependence on nuclear power and coal in the wake of the Fukushima accident, thus ensuring liquefied natural gas (LNG) is a cleaner substitute. This shift is being facilitated by long-term policy strategies like the Sixth Strategic Energy Plan, which is laying out ambitious carbon neutrality goals by 2050. Utilities and industries are making investments in the refurbishment of infrastructure to support increased percentages of LNG and combined-cycle gas turbines, which are highly efficient and less emissions-intensive. In addition, Japan is persistently entering into long-term LNG supply agreements and researching carbon-neutral LNG solutions in accordance with sustainability directives. These are being integrated with carbon capture and storage (CCS) studies, so natural gas continues to be a pillar of Japan's transitional energy plan and moving forward toward environmental goals. Between 2013 and 2024, public financial institutions in Japan invested $93 billion (€82 billion) in oil and gas initiatives, according to a report by Solutions for Our Climate (SFOC), based in South Korea. International liquefied natural gas (LNG) development initiatives totaled $56 billion in this funding.

To get more information on this market Request Sample

Energy Security Improvement During Geopolitical Volatility

Japan is proactively improving its energy security by expanding the sources of its LNG imports as well as its gas storage capacity in light of unstable global energy trends. As a resource-scarce nation, Japan relies enormously on energy imports, especially LNG, to power its industries and power plants. Against a backdrop of heightened geopolitical tensions, Japan is shifting its dependence on stable allies for reliable LNG supplies. As per InHEdge, in April 2025, LNG imports in Japan increased to 271.99 million cubic meters per day (Mcm/d), rising from 257.5 Mcm/d the week before. The rise indicates a consistent recovery that started in late March and suggests a managed modification. The government of Japan and private sector firms are also negotiating long-term agreements and taking stakes in foreign upstream gas assets to secure stable procurement. At the same time, Japan is constructing new floating storage and regasification units (FSRUs) and expanding existing facilities to create domestic buffers against supply shocks. Such strategic steps are reaffirming natural gas as a safe and flexible energy resource, thereby contributing to the Japan natural gas market growth.

Facilitating Industrial and Technological Innovation through Gas Integration

Japan is progressively backing its industrial development and technological advancement through the use of natural gas in sophisticated manufacturing techniques and clean energy technology. The technologically advanced sectors of the nation, such as electronics, steel production, and chemical manufacturing, are becoming dependent on natural gas due to its stable heat energy, efficiency, and lower carbon intensity than coal and oil. Natural gas is also being utilized as a feedstock in hydrogen production, a central pillar in the long-term energy and mobility strategies of Japan. Businesses are developing gas-to-hydrogen conversion technologies, for example, steam methane reforming integrated with carbon capture, to create cleaner value chains for energy. Industrial parks and smart cities are also being constructed with natural gas-fueled cogeneration units that supply electricity as well as heat effectively. By locating natural gas at the center of its more extensive innovation system, Japan is not only cultivating industrial competitiveness but also making sure that natural gas is at the center of supporting a modern, low-emission economy.

Japan Natural Gas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type.

Type Insights:

Access the comprehensive market breakdown Request Sample

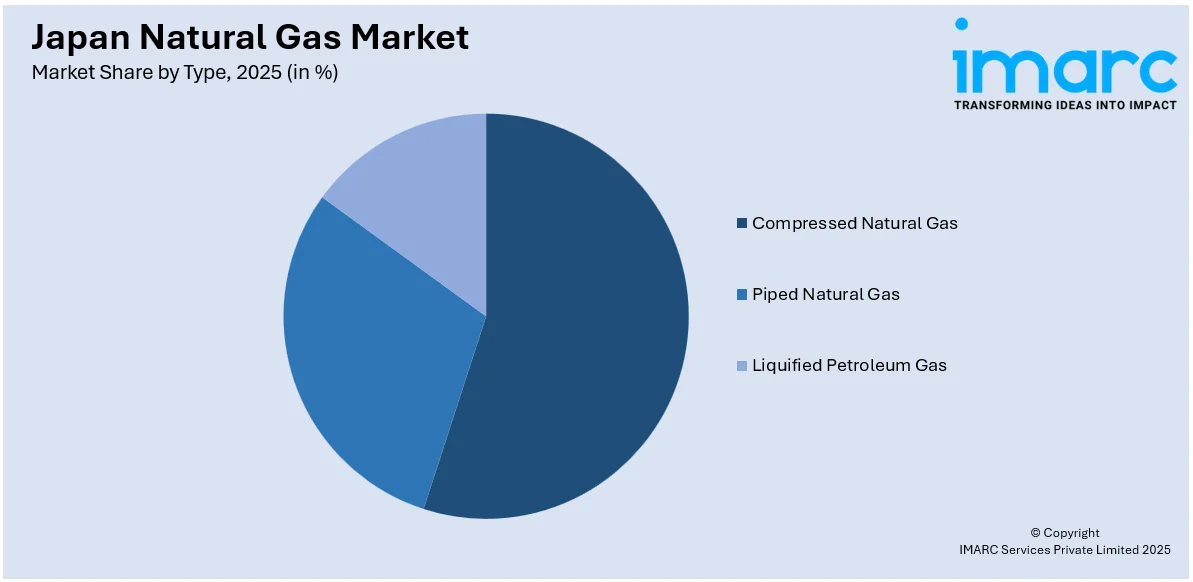

- Compressed Natural Gas

- Piped Natural Gas

- Liquified Petroleum Gas

The report has provided a detailed breakup and analysis of the market based on the type. This includes compressed natural gas, piped natural gas, and liquified petroleum gas.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Natural Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Compressed Natural Gas, Piped Natural Gas, Liquefied Petroleum Gas |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan natural gas market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan natural gas market on the basis of type?

- What is the breakup of the Japan natural gas market on the basis of region?

- What are the various stages in the value chain of the Japan natural gas market?

- What are the key driving factors and challenges in the Japan natural gas market?

- What is the structure of the Japan natural gas market and who are the key players?

- What is the degree of competition in the Japan natural gas market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan natural gas market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan natural gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan natural gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)