Japan Natural Sweeteners Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Natural Sweeteners Market Overview:

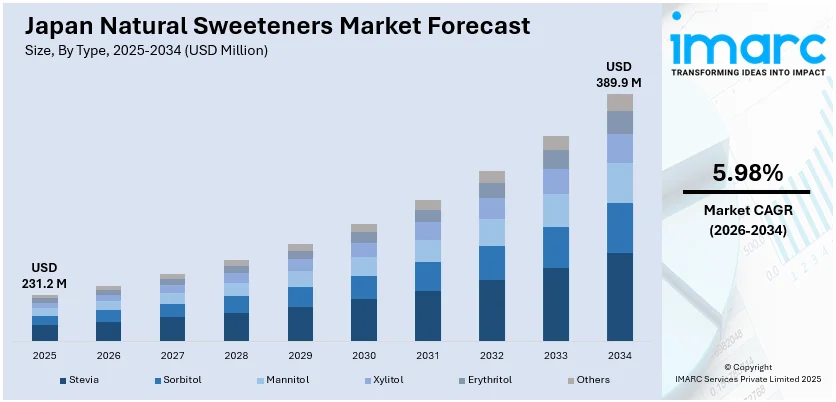

The Japan natural sweeteners market size reached USD 231.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 389.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.98% during 2026-2034. The market is fueled by the growing demand from consumers for healthier options to conventional sugar as there is a growing awareness about negative consequences of high sugar intake. Also, the rising trend towards clean-label products and the increased usage of plant-based diets also sustain the growth in the market. In addition to this, the transition towards naturally occurring low-calorie sweeteners like stevia and monk fruit and the high demand for health-oriented consumers is further expanding the Japan natural sweeteners market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 231.2 Million |

| Market Forecast in 2034 | USD 389.9 Million |

| Market Growth Rate 2026-2034 | 5.98% |

Japan Natural Sweeteners Market Trends:

Rising Consumer Demand for Healthier Sweetener Alternatives

Growing health concerns about the ill effects of excessive sugar consumption have contributed to a dramatic change in consumer preferences towards more healthy, natural sweeteners. Being renowned for its health-aware culture, Japan has experienced growing demand for lower-sugar products or those sweetened using natural alternatives. These sweeteners, such as stevia, monk fruit, and yacon, provide consumers with the means to indulge their sweet tooth without the detrimental health effects associated with refined sugars. With lifestyle diseases like obesity, diabetes, and heart disease still on the rise across the world, consumers are becoming wiser and choosier about what they consume. As per industry reports, the incidence of diabetes in Japan was 8.1% in 2024, which translates to an estimated 8,970,500 cases among adults. This increasing health issue has led consumers to look for healthier options, which has fueled the demand for natural sweeteners. These options, particularly those with lower caloric content and less deleterious to general health, have gained great popularity in Japan as a means to control lifestyle-related health issues. Besides this, these changes are also backed by government policies, which are driving the Japan natural sweeteners market growth.

To get more information on this market Request Sample

Growing Popularity of Functional Foods and Beverages

The rising interest in functional food and beverages is a dominant trend driving the natural sweeteners market. Functional foods that provide more than mere basic nutrition have become increasingly popular as people look for more out of their food and beverages. In this respect, natural sweeteners, which are associated with a range of potential health benefits like blood sugar control, weight control, and anti-inflammatory activity, are being deployed in growing volumes as leading ingredients in functional foods. For example, stevia enjoys popularity not just for its sweetness but also for its ability to contribute to diabetes management and better metabolic health. The demand for functional foods in Japan is being driven by the country's aging population, which is increasingly focused on maintaining health through diet. Industry reports indicate that the country’s older adult’s population has reached a record 36.25 million, with individuals aged 65 and older now accounting for nearly 30% of the total population. As older consumers seek ways to manage conditions such as diabetes and obesity, the market for healthier food and beverage options, including those sweetened with natural alternatives, is expanding. Manufacturers are responding by using natural sweeteners in applications such as fortified drinks, snack foods, and dietary supplements that target special health requirements. This health-oriented, functional consumption trend is anticipated to continue to fuel the uptake of natural sweeteners within the Japanese market.

Japan Natural Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Stevia

- Sorbitol

- Mannitol

- Xylitol

- Erythritol

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes stevia, sorbitol, mannitol, xylitol, erythritol, and others.

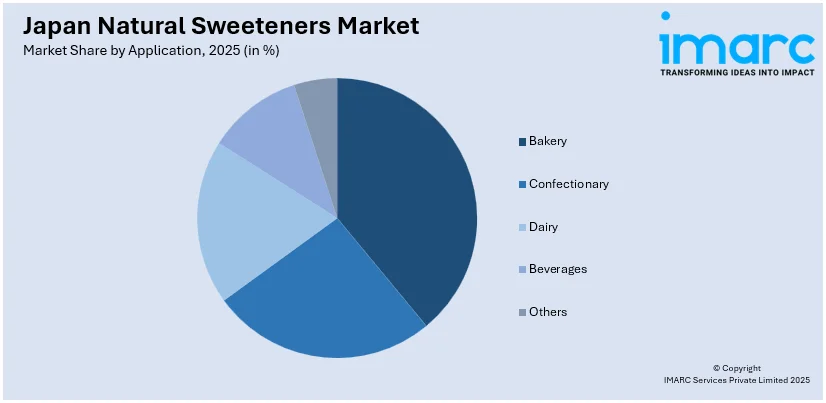

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery

- Confectionary

- Dairy

- Beverages

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery, confectionery, dairy, beverages, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Natural Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stevia, Sorbitol, Mannitol, Xylitol, Erythritol, Others |

| Applications Covered | Bakery, Confectionary, Dairy, Beverages, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan natural sweeteners market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan natural sweeteners market on the basis of type?

- What is the breakup of the Japan natural sweeteners market on the basis of application?

- What is the breakup of the Japan natural sweeteners market on the basis of region?

- What are the various stages in the value chain of the Japan natural sweeteners market?

- What are the key driving factors and challenges in the Japan natural sweeteners market?

- What is the structure of the Japan natural sweeteners market and who are the key players?

- What is the degree of competition in the Japan natural sweeteners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan natural sweeteners market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan natural sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan natural sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)