Japan Off-Grid Solar Power Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Off-Grid Solar Power Market Overview:

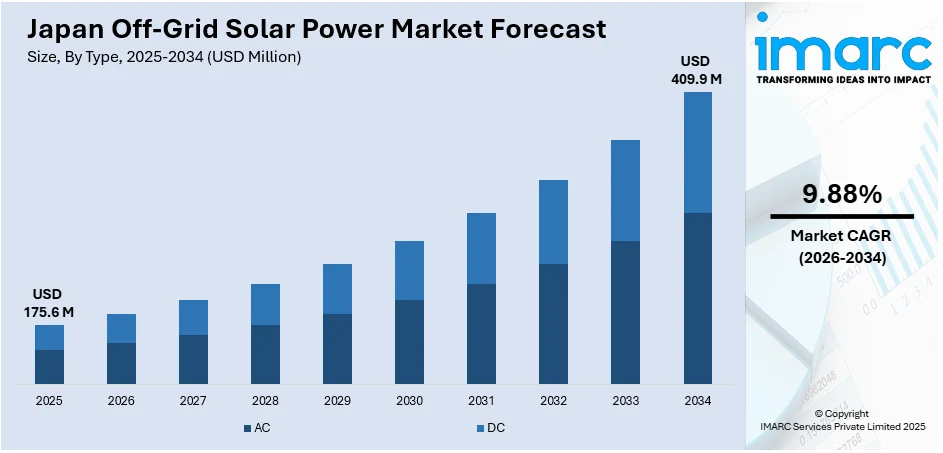

The Japan off-grid solar power market size reached USD 175.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 409.9 Million by 2034, exhibiting a growth rate (CAGR) of 9.88% during 2026-2034. At present, with the increasing power utilization due to modern lifestyles and high technology adoption, people are seeking to control costs through self-sufficient energy sources, thereby driving the demand for off-grid solar power. Besides this, the broadening of 5G services is contributing to the expansion of the Japan off-grid solar power market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 175.6 Million |

| Market Forecast in 2034 | USD 409.9 Million |

| Market Growth Rate 2026-2034 | 9.88% |

Japan Off-Grid Solar Power Market Trends:

Increasing electricity costs

The growing electricity costs are positively influencing the market. As per industry reports, 80% of significant power providers in Japan were set to increase their electricity and gas prices in March 2025. As conventional power prices continue to rise, both households and businesses are looking for affordable and sustainable energy alternatives. Off-grid solar systems offer a long-term solution by reducing dependency on the national grid and lowering monthly electricity bills. People find the initial investment in solar panels and storage systems worthwhile, as they provide reliable power with minimal operating costs. In a country like Japan, where electricity tariffs are relatively high compared to worldwide standards, the economic advantage of generating one’s own power is becoming attractive. Additionally, with energy utilization increasing due to modern lifestyles and technology adoption, people are seeking to control costs through self-sufficient energy sources. Off-grid solar power is becoming appealing in rural and disaster-prone regions, where grid supply can be unstable and disrupted. The combination of cost pressure and the need for reliability is rendering solar a practical choice. Businesses are benefiting from the operational savings and predictable energy costs, which enhance long-term planning and profitability. As battery technology is improving and prices are falling, more users can store solar energy efficiently, further reducing grid reliance. Thus, high electricity costs act as a powerful catalyst in shifting user preferences towards off-grid solar power in Japan.

To get more information on this market Request Sample

Growing adoption of renewable energy

The rising adoption of renewable energy is impelling the Japan off-grid solar power market growth. As the country is committing to lowering carbon emissions and encouraging sustainability, both the government and private sectors are wagering on clean energy solutions. Solar power is emerging as a key option due to Japan’s adequate sunlight availability and technological readiness. Off-grid solar systems allow users to generate and employ their own electricity without depending on traditional power grids, aligning well with Japan’s green energy goals. Individuals, businesses, and communities are installing off-grid systems to decrease their environmental impact and improve energy independence. Government policies and incentives are further supporting this transition by promoting decentralized energy production. As renewable energy is becoming more mainstream, off-grid solar power is gaining traction as a practical, eco-friendly, and efficient choice for diverse energy needs across Japan. In January 2025, the Tokyo Metropolitan Government introduced the mandate that new standalone houses with a total floor area of under 2,000 square meters would incorporate rooftop solar panels to boost the share of renewable energy production.

Increasing demand from telecom industry

Telecom towers and base stations require continuous power to maintain communication services, especially during emergencies. Off-grid solar systems offer a dependable and sustainable solution by providing consistent energy without relying on the central power grid. As telecom companies are expanding network coverage, particularly for 5G and rural connectivity, they are installing solar-powered systems to ensure uptime and reduce operational costs. As per the IMARC Group, the Japan 5G infrastructure market size reached USD 4.3 Billion in 2024. Solar power also helps these companies meet environmental targets by lowering carbon emissions. The ability of off-grid systems to function independently makes them ideal for telecom infrastructure spread across geographically challenging regions. Consequently, the growing energy needs of the telecom sector are supporting the wider adoption of off-grid solar solutions in Japan.

Japan Off-Grid Solar Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- AC

- DC

The report has provided a detailed breakup and analysis of the market based on the type. This includes AC and DC.

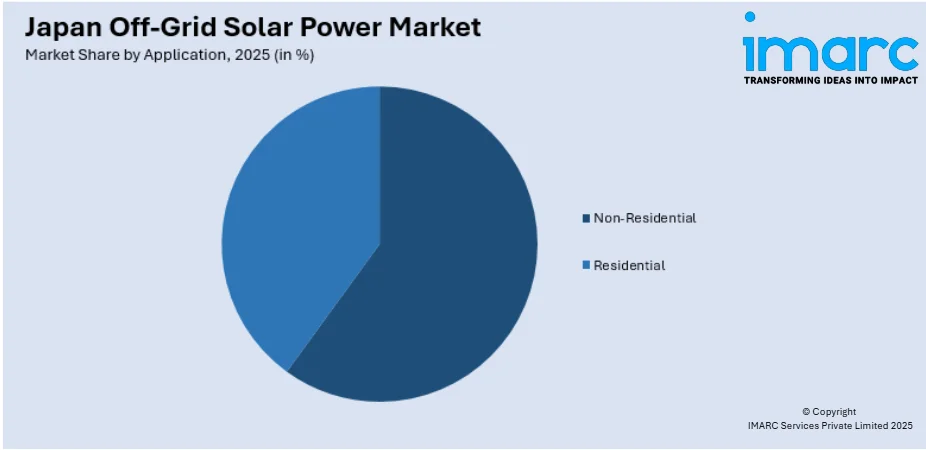

Application Insights:

Access the comprehensive market breakdown Request Sample

- Non-Residential

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes non-residential and residential.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Off-Grid Solar Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | AC, DC |

| Applications Covered | Non-Residential, Residential |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan off-grid solar power market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan off-grid solar power market on the basis of type?

- What is the breakup of the Japan off-grid solar power market on the basis of application?

- What is the breakup of the Japan off-grid solar power market on the basis of region?

- What are the various stages in the value chain of the Japan off-grid solar power market?

- What are the key driving factors and challenges in the Japan off-grid solar power market?

- What is the structure of the Japan off-grid solar power market and who are the key players?

- What is the degree of competition in the Japan off-grid solar power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan off-grid solar power market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan off-grid solar power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan off-grid solar power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)