Japan Off-Road Vehicles Market Size, Share, Trends and Forecast by Product and Region, 2026-2034

Japan Off-Road Vehicles Market Summary:

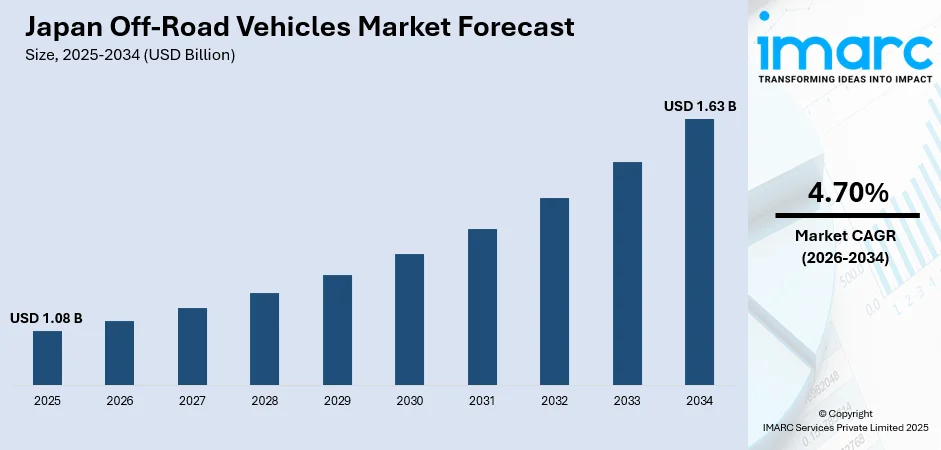

The Japan off-road vehicles market size was valued at USD 1.08 Billion in 2025 and is projected to reach USD 1.63 Billion by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

Japan's off-road vehicles market is witnessing steady growth driven by increasing recreational outdoor activities and expanding agricultural mechanization requirements. The nation's diverse terrain, ranging from mountainous regions to rural farmlands, creates sustained demand for versatile off-road mobility solutions across both leisure and commercial applications.

Key Takeaways and Insights:

-

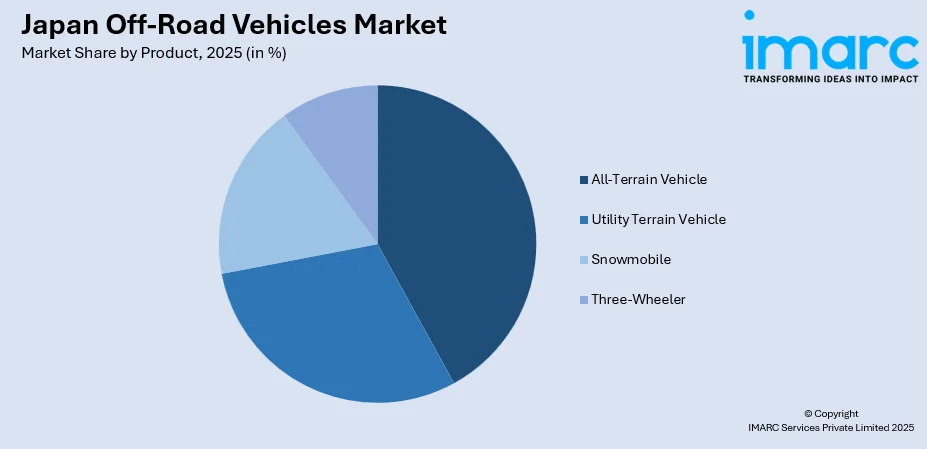

By Product: All-Terrain Vehicle dominates the market with a share of 42% in 2025, driven by its versatility across recreational activities, agricultural operations, and utility applications in Japan's varied geographical landscapes.

-

By Region: Kanto Region represents the largest segment with a market share of 28% in 2025, attributed to its substantial population base, proximity to recreational areas, and concentration of dealership networks supporting off-road vehicle sales.

-

Key Players: The Japan off-road vehicles market exhibits a competitive landscape featuring established domestic manufacturers alongside international brands. Market participants focus on technological innovation, product diversification, and dealer network expansion to strengthen their market positioning.

To get more information on this market Request Sample

Japan's off-road vehicles market is propelled by growing interest in outdoor recreational pursuits and the expanding utilization of utility vehicles in agricultural and forestry sectors. For example, Kawasaki Motors Japan recently announced plans to introduce a new lineup of all‑terrain vehicles (ATVs) targeting both recreational and utility users in the domestic market, enhancing options for off‑road riding and work applications. The nation's mountainous topography and extensive rural areas create natural demand for capable off-road transportation solutions. Japanese consumers increasingly embrace outdoor lifestyles including camping, trail riding, and adventure tourism, driving recreational vehicle adoption. Additionally, the agricultural sector relies on all-terrain and utility vehicles for farm operations, livestock management, and property maintenance. Manufacturers respond to market demands through continuous product development incorporating advanced features, improved fuel efficiency, and enhanced safety systems tailored to Japanese consumer preferences and regulatory requirements.

Japan Off-Road Vehicles Market Trends:

Growing Adoption of Electric and Hybrid Powertrains

Japanese off-road vehicle manufacturers are increasingly developing electric and hybrid powertrain options responding to environmental consciousness and regulatory evolution. According to reports, Mitsubishi Motors emphasized its hybrid legacy at the Japan Mobility Show 2025, reaffirming its goal to electrify its entire lineup, including hybrids and EVs, by 2035. These alternative propulsion systems offer reduced emissions, quieter operation beneficial for residential and wildlife-sensitive areas, and lower operating costs. The trend reflects broader automotive industry electrification patterns while addressing specific off-road application requirements including torque delivery and range considerations.

Integration of Advanced Safety and Connectivity Features

Modern off-road vehicles in Japan increasingly incorporate sophisticated safety systems and digital connectivity features enhancing operator protection and vehicle management. In 2024, Subaru’s new Forester enhanced its driver monitoring and added pulse brake warnings, showcasing advanced safety tech that could shape future off‑road vehicle development trends. Roll-over protection improvements, electronic stability controls, and GPS navigation systems address safety concerns while smartphone integration and fleet management capabilities support commercial applications. These technological enhancements attract safety-conscious consumers and professional users requiring advanced vehicle monitoring.

Expansion of Recreational Tourism and Outdoor Activities

Japan's growing outdoor recreation and adventure tourism sector drives demand for off-road vehicles supporting trail experiences and wilderness exploration. For example, Toyota City’s Sanage Adventure Field offers multipurpose off‑road runs where visitors can test drive four‑wheel‑drive vehicles and learn handling techniques, helping introduce consumers to off‑road capabilities outside of ownership contexts. Designated riding areas, guided tour operations, and rental services expand consumer access to off-road activities without ownership requirements. This trend broadens market reach while introducing potential future purchasers to vehicle capabilities and brands through experiential engagement.

Market Outlook 2026-2034:

The Japan off-road vehicles market demonstrates favorable growth prospects throughout the forecast period, supported by recreational activity expansion, agricultural sector requirements, and technological advancement integration. Continued development of electric powertrains, enhanced safety features, and connectivity solutions will drive product evolution and consumer adoption. The market generated a revenue of USD 1.08 Billion in 2025 and is projected to reach a revenue of USD 1.63 Billion by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

Japan Off-Road Vehicles Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

All-Terrain Vehicle |

42% |

|

Region |

Kanto Region |

28% |

Product Insights:

Access the comprehensive market breakdown Request Sample

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

The all-terrain vehicle dominates with a market share of 42% of the total Japan off-road vehicles market in 2025.

All-Terrain Vehicles represent the leading product segment in Japan's off-road vehicles market, valued for their exceptional versatility across recreational and utility applications. These compact four-wheeled vehicles navigate diverse terrains including mountain trails, agricultural fields, and forested areas with remarkable agility. For instance, Kawasaki Motors recently confirmed the domestic introduction of its ATV lineup, including models like the KFX90/50 and BRUTE FORCE 300, expanding Japanese consumers’ access to versatile off‑road options. Japanese consumers appreciate ATVs for outdoor recreational pursuits including trail riding and adventure tourism, while agricultural operators rely on their capability for farm management, property maintenance, and livestock operations across challenging rural landscapes.

The segment's dominance reflects ATVs' balanced combination of maneuverability, payload capacity, and terrain capability suited to Japan's geographical characteristics. Manufacturers offer diverse model ranges addressing varied consumer requirements from entry-level recreational units to professional-grade utility configurations. Continuous product development incorporating improved suspension systems, enhanced safety features, and fuel-efficient powertrains sustains consumer interest. The growing availability of designated riding areas and organized recreational activities further supports ATV adoption among Japanese outdoor enthusiasts.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 28% share of the total Japan off-road vehicles market in 2025.

The Kanto Region dominates Japan's off-road vehicles market, anchored by Tokyo and surrounding prefectures comprising the nation's largest population concentration. This economic powerhouse benefits from extensive dealership networks, proximity to recreational destinations in neighboring mountainous areas, and substantial consumer purchasing power. The region's diverse landscape, ranging from coastal plains to highland areas in prefectures like Gunma and Tochigi, provides natural terrain for off-road vehicle utilization across both recreational and commercial applications.

Kanto's market leadership reflects the concentration of outdoor recreation facilities, designated riding areas, and adventure tourism operations within accessible distance of major urban centers. Agricultural operations in peripheral prefectures contribute utility vehicle demand, while the region's robust transportation infrastructure supports efficient vehicle distribution and after-sales service networks. Strong consumer awareness and established brand presence through marketing activities centered in Tokyo further reinforce Kanto's dominant position in Japan's off-road vehicles market.

Market Dynamics:

Growth Drivers:

Why is the Japan Off-Road Vehicles Market Growing?

Expanding Outdoor Recreation and Adventure Tourism

Japanese consumers increasingly embrace outdoor recreational activities including trail riding, camping, and wilderness exploration, driving demand for capable off-road vehicles. For example, visitors to Japan’s APPI Adventure Field in Hachimantai can enjoy off‑road driving adventures through forest trails using prepared action vehicles, offering experiential tourism that showcases off‑road capabilities in a scenic, accessible setting. The growing adventure tourism sector creates opportunities for rental operations and guided experiences introducing consumers to off-road vehicle capabilities. Designated riding areas and organized events foster community engagement while expanding market accessibility beyond traditional ownership models. This lifestyle trend aligns with wellness-oriented pursuits and nature appreciation, supporting sustained recreational vehicle demand across demographic segments.

Agricultural and Commercial Utility Requirements

Japan's agricultural sector relies extensively on off-road vehicles for farm operations, livestock management, and property maintenance across challenging rural terrain. The Ministry of Agriculture, Forestry and Fisheries (MAFF) has been promoting “smart agriculture” and mechanization programs that include demonstrations of advanced farm machinery such as utility terrain vehicles and automated equipment across hundreds of districts nationwide to tackle labor shortages and improve operational efficiency. Utility vehicles provide essential transportation and cargo capabilities supporting efficient agricultural practices and forestry operations. Commercial applications extend to construction sites, resort properties, and industrial facilities requiring versatile mobility solutions. The aging agricultural workforce increasingly values mechanized assistance, driving adoption of user-friendly utility vehicles enhancing productivity while reducing physical demands on operators.

Technological Advancements and Product Innovation

Continuous technological development in off-road vehicles enhances consumer appeal through improved performance, safety, and convenience features. Electric and hybrid powertrain introductions address environmental concerns while offering operational advantages including reduced noise and lower running costs. In 2025, Toyota launched the latest RAV4 in Japan featuring a hybrid powertrain and enhanced off‑road capability tailored for outdoor adventure usage, combining improved traction control and software integration for better terrain handling. Advanced suspension systems, electronic stability controls, and connectivity features elevate driving experiences and operator confidence. Japanese manufacturers leverage domestic engineering expertise to develop products specifically suited to local terrain conditions, regulatory requirements, and consumer preferences, maintaining competitive market positioning.

Market Restraints:

What Challenges the Japan Off-Road Vehicles Market is Facing?

Limited Designated Riding Areas and Access Restrictions

Japan's densely populated landscape and strict land use regulations constrain available areas for off-road vehicle operation. Limited designated riding locations and access restrictions on public lands reduce recreational utilization opportunities, potentially dampening consumer interest. Environmental protection regulations in sensitive areas further restrict off-road activities, requiring careful navigation of permitted use zones.

High Initial Purchase and Ownership Costs

Off-road vehicles represent substantial investments encompassing vehicle purchase, registration, insurance, maintenance, and storage expenses. These cumulative costs may deter potential consumers, particularly in urban areas where storage challenges compound ownership burdens. Economic considerations influence purchasing decisions, with some consumers preferring rental options over vehicle ownership commitments.

Regulatory Compliance and Safety Concerns

Evolving safety regulations and environmental standards require manufacturers to continuously adapt product specifications, potentially increasing development costs and consumer prices. Safety concerns regarding off-road vehicle operation, particularly among inexperienced users, necessitate comprehensive training and protective equipment investments. Regulatory requirements regarding vehicle registration and operational permits add complexity to ownership experiences.

Competitive Landscape:

The Japan off-road vehicles market exhibits a competitive structure featuring established domestic manufacturers alongside prominent international brands. Market participants compete through product innovation, dealer network development, after-sales service quality, and brand marketing initiatives. Japanese manufacturers leverage local engineering expertise and consumer understanding to develop products suited to domestic requirements, while international brands contribute global technology platforms and diverse model portfolios. Strategic activities including new product introductions, technology partnerships, and distribution network expansion characterize competitive dynamics. Manufacturers increasingly emphasize electric powertrain development, advanced safety features, and connected vehicle capabilities to differentiate offerings and address evolving consumer expectations.

Recent Developments:

-

In October 2025, Toyota unveiled the new Land Cruiser “FJ” at the Japan Mobility Show 2025, a compact rugged off‑road SUV blending classic Land Cruiser heritage with modern design. Japan launch is planned for mid‑2026.

Japan Off-Road Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | All-Terrain Vehicle, Utility Terrain Vehicle, Snowmobile, Three-Wheeler |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan off-road vehicles market size was valued at USD 1.08 Billion in 2025.

The Japan off-road vehicles market is expected to grow at a compound annual growth rate of 4.70% from 2026-2034 to reach USD 1.63 Billion by 2034.

All-Terrain Vehicle dominated the market with a 42% share, driven by its versatility across recreational activities, agricultural operations, and utility applications in Japan's varied geographical landscapes.

Key factors driving the Japan off-road vehicles market include expanding outdoor recreation and adventure tourism, agricultural and commercial utility requirements, and continuous technological advancements in product innovation.

Major challenges include limited designated riding areas and access restrictions, high initial purchase and ownership costs, regulatory compliance requirements, and safety concerns regarding vehicle operation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)