Japan Off-The-Road Tire Market Size, Share, Trends and Forecast by Vehicle Type, Tire Type, Distribution Channel, Rim Size, End-Use, and Region, 2026-2034

Japan Off-The-Road Tire Market Overview:

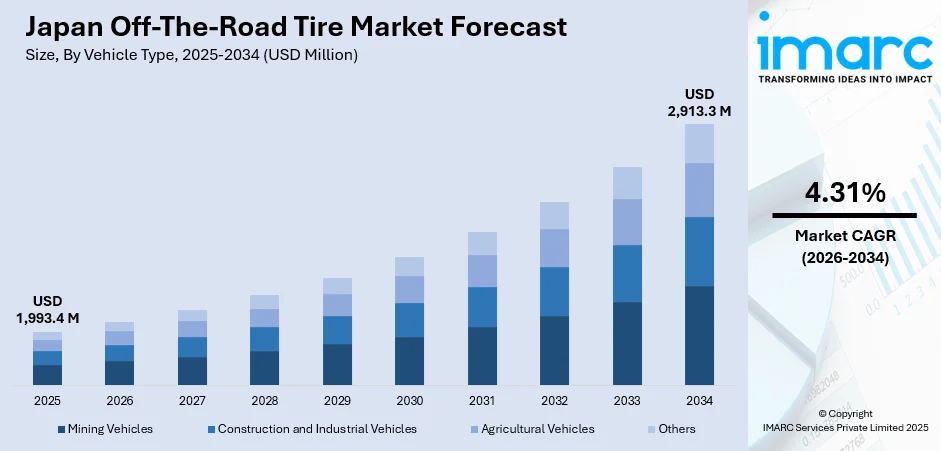

The Japan off-the-road tire market size reached USD 1,993.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,913.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.31% during 2026-2034. The market is expanding due to rising demand in mining, construction, and heavy-duty logistics. Investment in plant upgrades, capacity expansion, and tire innovations are driving performance improvements, durability, and supply stability across domestic and export markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,993.4 Million |

| Market Forecast in 2034 | USD 2,913.3 Million |

| Market Growth Rate 2026-2034 | 4.31% |

Japan Off-The-Road Tire Market Trends:

Ongoing Upgrades in Domestic Plants

Japan’s OTR tire market is responding to increased demand from construction and resource-heavy sectors by upgrading production capabilities. Companies are prioritizing durable, high-performance tires suited for mining trucks, earthmovers, and industrial vehicles. This has led to fresh investments in manufacturing automation, design innovation, and long-term capacity expansion. Tire makers are focusing on plant modernization to meet performance expectations across various terrains while maintaining quality and durability. These efforts are also in line with improving productivity and ensuring just-in-time deliveries for OEM and aftermarket clients. In April 2024, Bridgestone committed USD 166 Million to modernize its Kitakyushu plant over 3.5 years, focusing on earthmover and mining tire output. This upgrade supports global demand and strengthens Japan’s role in high-spec tire supply. In another notable step, Sumitomo Rubber Industries expanded production capacity at multiple Japan-based facilities, investing USD 27.5 Million as part of a broader plan. These enhancements aimed to boost annual output by 12%, addressing regional needs. Such developments underline a consistent trend: Japanese manufacturers are investing in their domestic base to improve manufacturing resilience and cater to high-performance off-road applications across industrial and construction sectors.

To get more information on this market Request Sample

Innovation Driving Tire Performance Shift

The Japanese OTR tire market is evolving with a strong emphasis on technological advancements aimed at improving traction, longevity, and all-weather reliability. This is especially relevant as equipment used in mining and heavy construction faces harsher workloads, demanding tire solutions that are not only durable but also fuel-efficient and environmentally conscious. Manufacturers are enhancing tread design, material composition, and structural integrity to withstand varied terrain and maximize service life. In May 2024, Yokohama Rubber launched the GEOLANDAR A/T4 as a new-generation all-terrain tire for SUVs and pickups, emphasizing off-road performance, wet traction, and snow capability. The tire was certified with the Three-Peak Mountain Snowflake Symbol, reinforcing its utility in severe conditions. Although targeted at light commercial vehicles, the technology and design insights developed through this product are feeding into broader OTR innovations. Tire producers are now integrating performance features such as chip-resistant compounds and optimized contact patches into medium and heavy-duty models. These trends are also supported by Japan’s broader industrial strategy of promoting energy efficiency and product quality across transport components. As demand grows for high-endurance OTR tires, innovation remains a critical factor in securing long-term competitiveness in both local and export markets.

Japan Off-The-Road Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on vehicle type, tire type, distribution channel, rim size, and end-use.

Vehicle Type Insights:

- Mining Vehicles

- Construction and Industrial Vehicles

- Agricultural Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes mining vehicles, construction and industrial vehicles, agricultural vehicles, and others.

Tire Type Insights:

- Radial Tire

- Bias Tire

A detailed breakup and analysis of the market based on the tire type have also been provided in the report. This includes radial tire and bias tire.

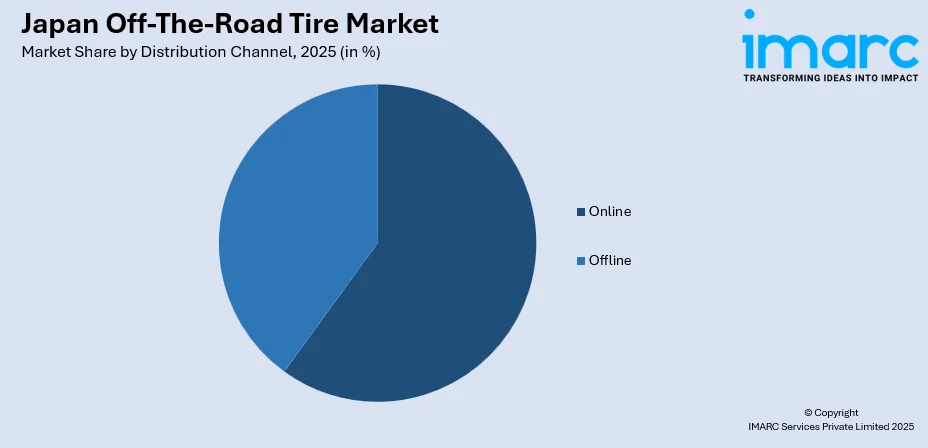

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Rim Size Insights:

- Below 29 Inches

- 29-45 Inches

- Above 45 Inches

A detailed breakup and analysis of the market based on the rim size have also been provided in the report. This includes below 29 inches, 29-45 inches, and above 45 inches.

End-Use Insights:

- OEM

- Replacement

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes OEM and replacement.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Off-The-Road Tire Market News:

- May 2024: Yokohama Rubber launched the GEOLANDAR A/T4 in Japan, a next-generation all-terrain tire for SUVs and pickups. Featuring enhanced off-road performance, snow certification, and aggressive design, it strengthened Japan’s off-the-road tire market by expanding options for rugged and seasonal driving demands.

- April 2024: Bridgestone announced a USD 166 Million investment to upgrade its Kitakyushu plant in Japan over 3.5 years. Focused on earthmover and mining tires, the move strengthened Japan’s off-the-road tire manufacturing capacity and supported advanced production for heavy-duty industrial applications.

Japan Off-The-Road Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Mining Vehicles, Construction and Industrial Vehicles, Agricultural Vehicles, Others |

| Tire Types Covered | Radial Tire, Bias Tire |

| Distribution Channels Covered | Online, Offline |

| Rim Sizes Covered | Below 29 Inches, 29-45 Inches, Above 45 Inches |

| End-Uses Covered | OEM, Replacement |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan off-the-road tire market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan off-the-road tire market on the basis of vehicle type?

- What is the breakup of the Japan off-the-road tire market on the basis tire type?

- What is the breakup of the Japan off-the-road tire market on the basis distribution channel?

- What is the breakup of the Japan off-the-road tire market on the basis rim size?

- What is the breakup of the Japan off-the-road tire market on the basis end-use?

- What is the breakup of the Japan off-the-road tire market on the basis of region?

- What are the various stages in the value chain of the Japan off-the-road tire market?

- What are the key driving factors and challenges in the Japan off-the-road tire market?

- What is the structure of the Japan off-the-road tire market and who are the key players?

- What is the degree of competition in the Japan off-the-road tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan off-the-road tire market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan off-the-road tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan off-the-road tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)