Japan Offshore Wind Power Market Size, Share, Trends and Forecast by Installation, Water Depth, Capacity, and Region, 2026-2034

Japan Offshore Wind Power Market Overview:

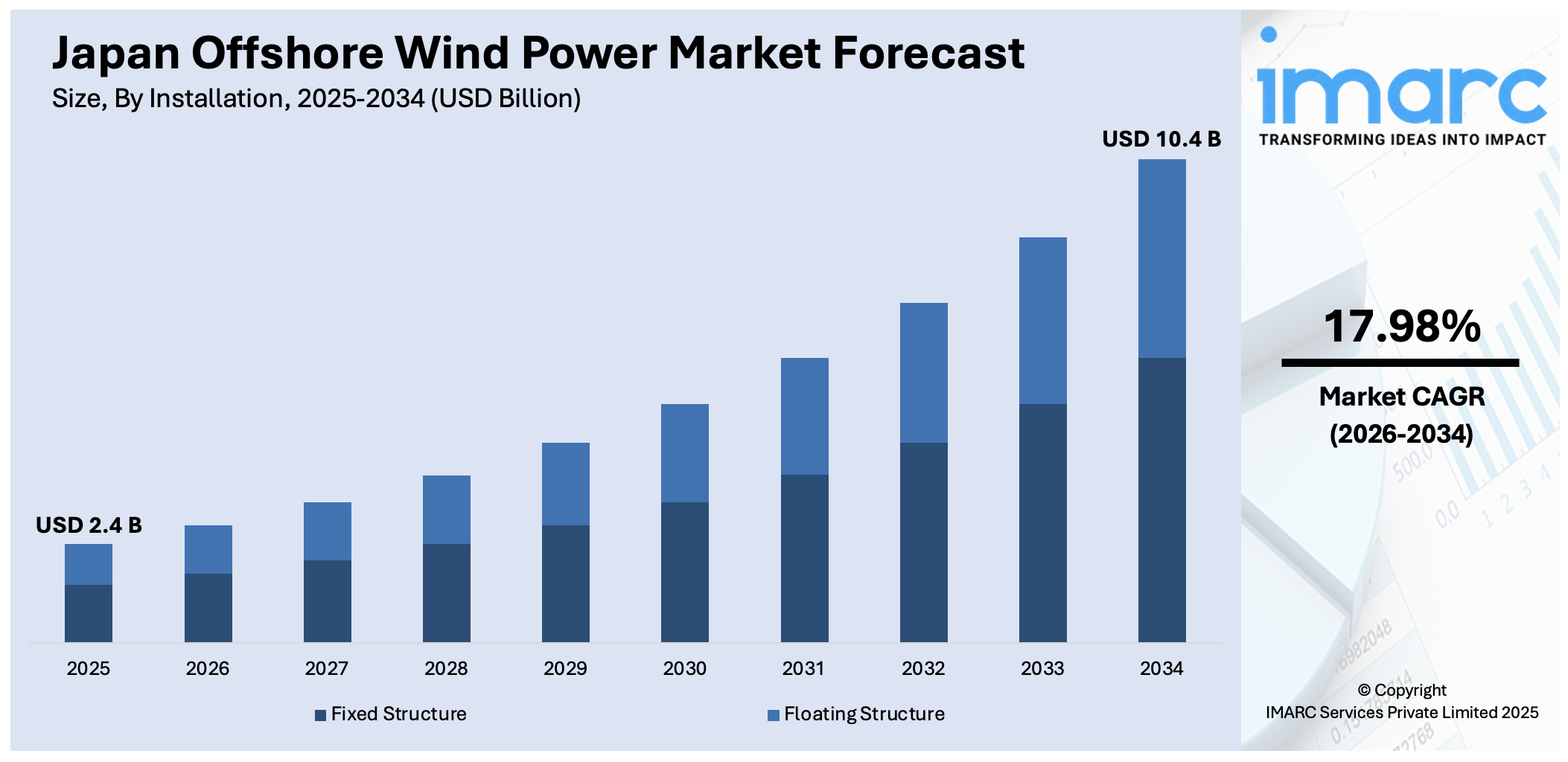

The Japan offshore wind power market size reached USD 2.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.4 Billion by 2034, exhibiting a growth rate (CAGR) of 17.98% during 2026-2034. Government targets for carbon neutrality, favorable wind conditions, declining technology costs, energy security concerns, and policy support through feed-in tariffs and auctions are some of the factors contributing to Japan offshore wind power market share. Coastal geography and industrial innovation also encourage offshore wind energy expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.4 Billion |

| Market Forecast in 2034 | USD 10.4 Billion |

| Market Growth Rate 2026-2034 | 17.98% |

Japan Offshore Wind Power Market Trends:

Macroeconomic Pressures Prompting Project Reassessment

Offshore wind initiatives in Japan are undergoing strategic realignment due to rising inflation, a weaker yen, elevated interest rates, and ongoing supply chain disruptions. Development plans are being re-evaluated in response to these financial and logistical challenges. Despite these pressures, progress continues, reflecting the sector’s vital role in supporting the country’s energy security and decarbonization goals. Stakeholders are adjusting business frameworks and investment approaches to navigate the current environment while maintaining momentum in clean energy expansion. Offshore wind remains a priority in the national agenda, and current efforts aim to balance immediate economic realities with long-term renewable power ambitions. This period marks a recalibration phase rather than a retreat from development. These factors are intensifying the Japan offshore wind power market growth. For example, in February 2025, Mitsubishi Corporation reviewed its offshore wind power projects in Akita and Chiba due to macroeconomic shifts, including inflation, yen depreciation, supply chain constraints, and rising interest rates. Selected in 2021, the projects span Noshiro, Mitane, Oga, Yurihonjo, and Choshi. Mitsubishi continues development efforts while reassessing business plans to determine next steps. Offshore wind remains central to Japan’s energy stability and carbon neutrality goals.

To get more information on this market Request Sample

Scaling Up Floating Wind Innovation

Japan is advancing its floating offshore wind capabilities through a new initiative off the southern coast of Akita. Supported by government funding, the project focuses on installing high-capacity turbines using modular semisubmersible platforms. It incorporates optimized mooring systems, synchronized vessel operations, and digital twin technology for continuous performance monitoring. The initiative serves as a demonstration effort aimed at reducing costs and building a foundation for broader deployment of floating wind infrastructure. By combining engineering innovation with real-time digital oversight, the project is designed to strengthen Japan’s ability to utilize deeper offshore areas for renewable energy. This move reflects the country’s ongoing efforts to expand clean power sources and increase energy resilience. For instance, in October 2024, Japan launched a major offshore wind initiative near southern Akita. Led by Marubeni and Japan Marine United, the project would install two 15+ MW floating turbines by 2029. Backed by government funding, it emphasizes cost reduction via modular semisubmersible structures, optimized mooring, digital twin monitoring, and synchronized vessel operations. The demonstration will run until March 2031, aiming to scale Japan’s floating wind capabilities efficiently.

Japan Offshore Wind Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on installation, water depth, and capacity.

Installation Insights:

- Fixed Structure

- Floating Structure

The report has provided a detailed breakup and analysis of the market based on the installation. This includes fixed structure and floating structure.

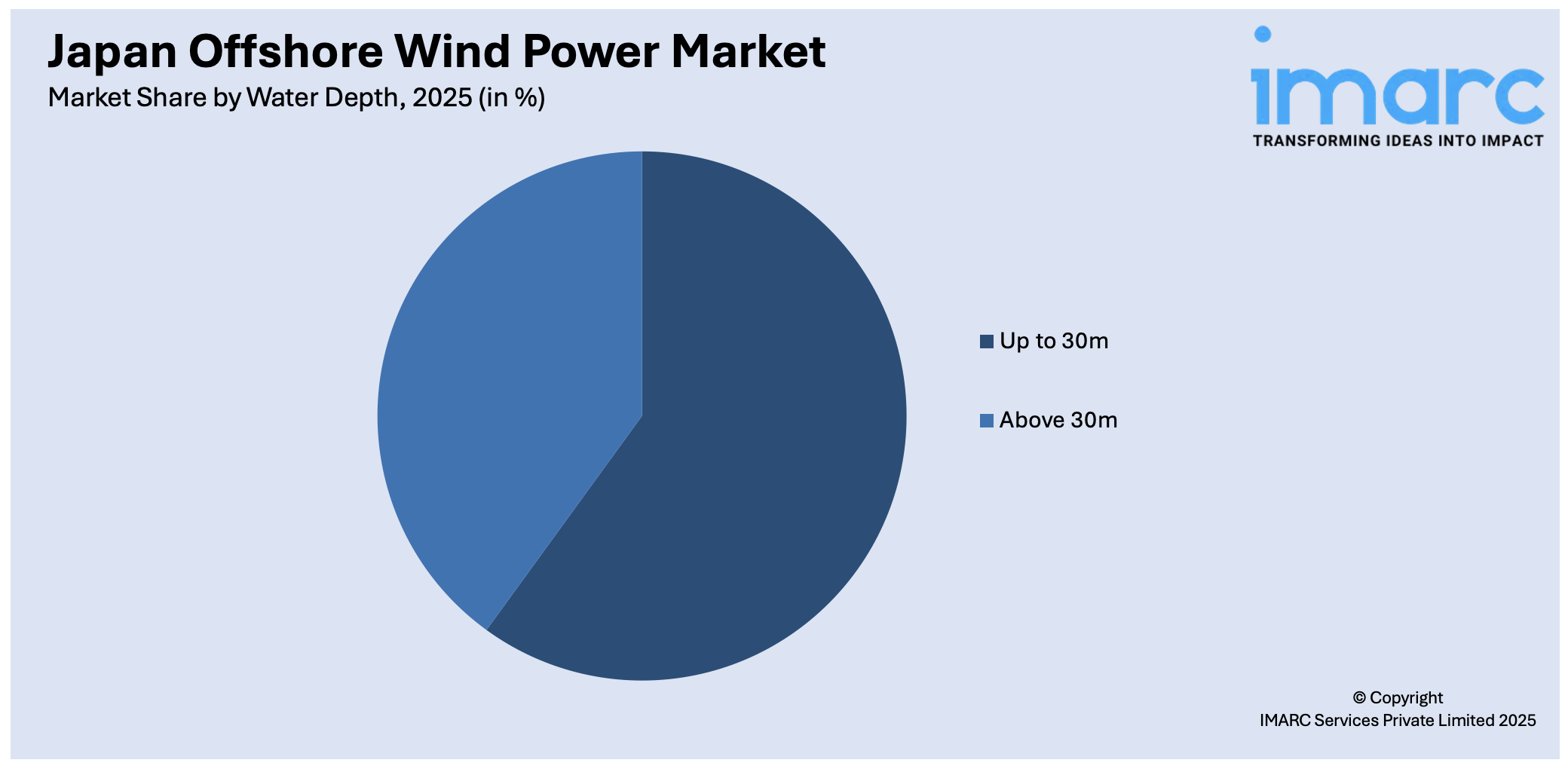

Water Depth Insights:

Access the comprehensive market breakdown Request Sample

- Up to 30m

- Above 30m

A detailed breakup and analysis of the market based on the water depth have also been provided in the report. This includes up to 30m and above 30m.

Capacity Insights:

- Up to 3MW

- 3MW to 5MW

- Above 5MW

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 3MW, 3MW to 5MW, and above 5MW.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Offshore Wind Power Market News:

- In May 2025, Renew Risk introduced Japan-specific catastrophe models for offshore wind farms, addressing earthquake and typhoon threats. These models incorporate local data, including wave height, wind speed, and seismic activity, offering detailed risk assessments. As Japan expands its offshore wind capacity, these tools aim to enhance risk management and support the industry's growth.

- In December 2024, Japan awarded operatorship for two major offshore wind projects set to begin by June 2030. A JERA-led consortium would develop a 615 MW farm off Aomori Prefecture using 41 Siemens Gamesa turbines. Separately, BP and partners would build a 450 MW facility near Yuza Town. Both projects strengthen Japan’s offshore wind capacity under dedicated business entities and highlight growing private sector involvement in the country’s clean energy transition.

Japan Offshore Wind Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Fixed Structure, Floating Structure |

| Water Depths Covered | Up to 30m, Above 30m |

| Capacities Covered | Up to 3MW, 3MW to 5MW, Above 5MW |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan offshore wind power market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan offshore wind power market on the basis of installation?

- What is the breakup of the Japan offshore wind power market on the basis of water depth?

- What is the breakup of the Japan offshore wind power market on the basis of capacity?

- What is the breakup of the Japan offshore wind power market on the basis of region?

- What are the various stages in the value chain of the Japan offshore wind power market?

- What are the key driving factors and challenges in the Japan offshore wind power market?

- What is the structure of the Japan offshore wind power market and who are the key players?

- What is the degree of competition in the Japan offshore wind power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan offshore wind power market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan offshore wind power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan offshore wind power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)