Japan Online Alcohol Delivery Market Size, Share, Trends and Forecast by Type, Delivery Place, and Region, 2026-2034

Japan Online Alcohol Delivery Market Summary:

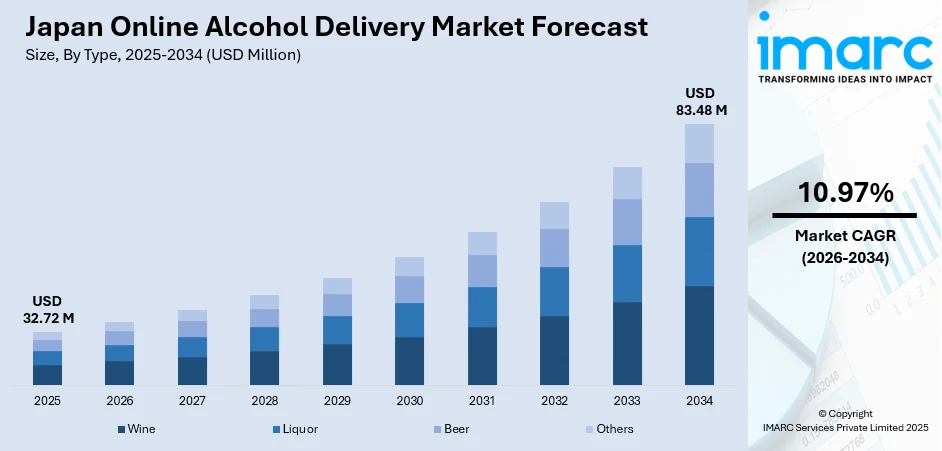

The Japan online alcohol delivery market size was valued at USD 32.72 Million in 2025 and is projected to reach USD 83.48 Million by 2034, growing at a compound annual growth rate of 10.97% from 2026-2034.

The Japan online alcohol delivery market growth is primarily driven by highly developed e-commerce infrastructure, evolving consumer preferences toward convenience-driven purchasing, and increasing digital adoption among urban populations. The convergence of premium beverage culture, sophisticated logistics networks, and the growing acceptance of online alcohol purchasing is fundamentally reshaping how consumers in Japan discover, select, and receive alcoholic beverages, creating substantial opportunities for market participants across.

Key Takeaways and Insights:

- By Type: Liquor dominates the market with a share of 40% in 2025, driven by the cultural significance of traditional spirits like shochu and sake, the growing international recognition of Japanese whisky, and strong consumer preference for premium distilled beverages across both domestic consumption and gifting occasions.

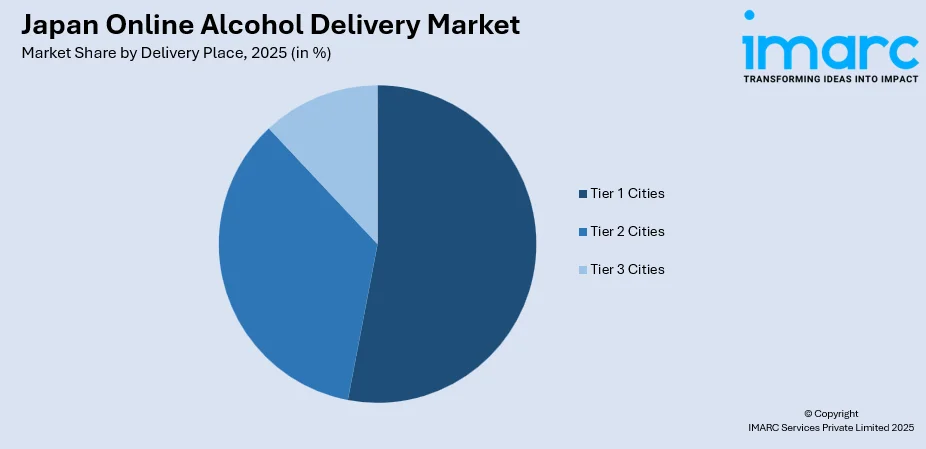

- By Delivery Place: Tier 1 cities lead the market with a share of 53% in 2025, owing to concentrated population density in metropolitan areas including Tokyo, Osaka, and Yokohama, superior logistics infrastructure enabling rapid delivery, higher disposable incomes supporting premium purchases, and advanced digital payment adoption.

- Key Players: The Japan online alcohol delivery market shows moderate competitive intensity, with established e-commerce platforms competing alongside specialized alcohol retailers and direct-to-consumer (DTC) channels. These players target various beverage categories and price segments, offering a wide range of options to meet diverse consumer preferences.

To get more information on this market Request Sample

The Japan online alcohol delivery market is strongly driven by the accelerating consumer demand for convenience and the widespread adoption of digital purchasing platforms. Modern busy lifestyles have made efficient home delivery an essential service particularly for consumers seeking alcohol without visiting physical retail locations. The desire for a diverse range of premium and niche products further necessitates convenient access. The unveiling of exclusive high-end spirits confirms the growing market for specialized products. In 2025 The House of Suntory unveiled its oldest Mizunara-aged whisky to date Yamazaki 25 Years Old Mizunara. This exceptional single malt aged entirely in Mizunara oak casks highlights the market's demand for unique and high-value alcoholic beverages. Online delivery platforms are critical for efficiently distributing such premium and niche products directly to consumers, thereby impelling the market growth.

Japan Online Alcohol Delivery Market Trends:

Changes in Consumer Drinking Habits

Younger generations, particularly millennials and Gen Z, are more inclined to consume alcohol at home rather than in bars or restaurants. As of October 1, 2024, the population aged 15 to 64 was 73,728 thousand, accounting for 59.6% of the total population, highlighting a large demographic of potential consumers. With a growing preference for convenience, these groups are driving the need for delivery services. Additionally, the rising popularity of craft beers, premium spirits, and unique alcoholic beverages is catalyzing the demand for specialized online platforms offering curated product selections.

Rise in Disposable Income and Affluent Consumers

The rise in disposable income, particularly among affluent consumers in urban areas, is contributing to the growth of the market. As economic conditions improve, more people are willing to invest in premium and luxury alcoholic beverages. According to the Statistics Bureau of Japan, the average monthly income per household reached 599,845 yen in 2025, reflecting the growing purchasing power of middle and upper-income consumers. This shift is encouraging the development of high-end alcohol offerings and specialized delivery services. The preference for convenience and quality is further catalyzing the demand for premium alcohol through online channels.

Expansion of Online Payment Options

As consumers demand more secure, fast, and varied payment options, including credit cards, mobile wallets, and digital payment systems, alcohol delivery platforms are increasingly integrating these methods. The ease of transaction and the convenience of contactless payments contribute to higher conversion rates and increased market demand. In 2025, Stripe launched several new features for businesses in Japan, including the ability to accept PayPay for online transactions and faster payouts. These updates aim to improve the payment experience, allowing businesses to offer card installment options and comply with Japan's new 3D Secure mandate, further enhancing customer satisfaction and driving growth in the online alcohol market.

Market Outlook 2026-2034:

The Japan online alcohol delivery market shows significant growth potential during the forecast period, driven by technological innovations and shifting consumer preferences towards convenience. The market generated a revenue of USD 32.72 Million in 2025 and is projected to reach a revenue of USD 83.48 Million by 2034, growing at a compound annual growth rate of 10.97% from 2026-2034. This expansion is driven by the rising demand for online platforms offering quick and easy access to alcohol in response to changing lifestyles.

Japan Online Alcohol Delivery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Liquor | 40% |

| Delivery Place | Tier 1 Cities | 53% |

Type Insights:

- Wine

- Liquor

- Beer

- Others

Liquor leads with a market share of 40% of the total Japan online alcohol delivery market in 2025.

Liquor holds the biggest market share due to its longstanding cultural preference and widespread consumption across various social occasions. It remains a staple in the country's alcohol market, driving the demand for convenient delivery services that cater to both personal and commercial needs.

Additionally, the availability of a wide range of liquor brands and products through online platforms is contributing to the market dominance. Consumers are opting for online orders to access premium and niche liquor selections that are often unavailable in local stores.

Delivery Place Insights:

Access the comprehensive market breakdown Request Sample

- Tier 1 Cities

- Tier 2 Cities

- Tier 3 Cities

Tier 1 cities dominate with a market share of 53% of the total Japan online alcohol delivery market in 2025.

Tier 1 cities represent the largest segment owing to their high population density, advanced infrastructure, and greater disposable income. These urban areas offer consumers a wide variety of alcohol options, making them prime locations for the growth of online delivery services.

Tier 1 cities also benefit from more efficient logistics networks and faster delivery times, enhancing the overall client experience. The demand for convenience and a wide selection of alcohol products in these cities further drives the prominence of online alcohol delivery services.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region is a crucial segment in the market, with its large urban population and well-established infrastructure. The region's high demand for convenience and variety, combined with its economic strength, offers significant growth potential for alcohol delivery services.

The Kansai/Kinki Region benefits from its vibrant tourism industry and cultural affinity for social drinking, creating a strong demand for online alcohol delivery. The region's metropolitan areas, including Osaka and Kyoto, are prime markets for diverse alcohol selections and quick delivery services.

Central/Chubu Region is witnessing increasing interest in online alcohol delivery, influenced by its manufacturing hubs. The region’s expanding middle-class population and increasing preference for convenient shopping options make it an attractive market for alcohol delivery services.

Kyushu-Okinawa Region shows strong local culture and affinity for alcohol consumption, which is contributing to the growth of online delivery services. The region's rising internet penetration, combined with its appeal as a popular travel destination, provides opportunities for tailored alcohol delivery services to meet diverse consumer needs.

In the Tohoku Region, there is rise in the demand for online alcohol delivery due to the increasing trend of home consumption and the increase of younger, tech-savvy consumers. The region's expansion of e-commerce platforms further supports the growth of this sector.

Chugoku Region presents untapped potential in the online alcohol delivery market. Its increasing number of young professionals and a rising preference for convenient alcohol purchasing options are encouraging trends, while local breweries also enhance the appeal of region-specific alcoholic products.

Hokkaido Region offers a unique advantage for online alcohol delivery, with its booming tourism industry and the growing interest in local craft beverages. The region’s wide range of distinct alcoholic products, paired with increasing consumer demand for convenience, creates strong market growth opportunities.

Shikoku Region is witnessing higher adoption of online alcohol delivery services, driven by its strong local food culture and a growing preference for convenience. As more consumers seek easy access to premium alcoholic beverages, the market potential in this region continues to grow.

Market Dynamics:

Growth Drivers:

Why is the Japan Online Alcohol Delivery Market Growing?

Integration of Mobile Technology

With widespread smartphone usage, people are increasingly turning to mobile apps to place alcohol orders, benefiting from user-friendly interfaces, personalized recommendations, and fast payment systems. In 2025, according to the Ministry of Internal Affairs and Communications' Reiwa 6 Communication Usage Trend Survey, 90.5% of households owned smartphones. This widespread smartphone adoption makes it easier for consumers to place on-demand orders, track deliveries, and access exclusive deals, further contributing to the market growth. The trend is particularly evident among tech-savvy consumers who prefer using smartphones over desktop platforms for their purchases.

Increasing E-commerce Adoption

The rise in e-commerce adoption across Japan is significantly driving the adoption of online alcohol delivery. As more individuals embrace online shopping, the alcohol sector is increasingly shifting towards online channels, with platforms offering convenience, ease of payment, and door-to-door delivery. According to the Ministry of Economy, Trade and Industry (METI), Japan's B2C e-commerce market reached 26.1 trillion yen in 2024, highlighting the growing shift to online platforms. This trend aligns with the broader increase in e-commerce activity, prompting more alcohol retailers to enter the online market to meet evolving consumer preferences.

Influence of Social Media and Online Marketing

The influence of social media and advanced online marketing is a crucial factor impelling the Japan online alcohol delivery market growth. Platforms like Instagram, YouTube, and X allow alcohol brands and retailers to effectively reach a wider audience through targeted advertising and influencer content. This increased online visibility raises awareness of digital delivery services and promotes the exploration of new products. Social media's widespread usage in Japan further enhances the impact of digital marketing strategies. According to the Ministry of Internal Affairs and Communications' Reiwa 6 Communication Usage Trend Survey released in 2025, 81.9% of internet users engage with SNS, confirming the effectiveness of social media in influencing individual behavior.

Market Restraints:

What Challenges the Japan Online Alcohol Delivery Market is Facing?

Strict Regulatory Requirements and Licensing Obligations

Online alcohol sales in Japan are subject to rigorous regulatory requirements, including the need for an online alcohol retail license from local tax offices. The application process is thorough and can take several months for approval. Additionally, the Liquor Tax Law imposes specific conditions on the qualifications of operators, retail locations, and product offerings, limiting the flexibility of market participants and creating barriers to entry.

Age Verification Challenges in Digital Transaction Environments

Japan’s legal drinking age necessitates strict age verification for online alcohol purchases. E-commerce platforms face technical challenges in implementing digital verification systems that ensure compliance while maintaining a seamless user experience. Any violations of age requirements could lead to significant penalties, including fines and potential license revocation, making it essential for online retailers to invest in efficient and secure verification technologies.

Distribution Infrastructure Limitations in Non-Metropolitan Areas

The growth of online alcohol sales is constrained by the lack of advanced delivery infrastructure in rural and remote areas. Limited cold-chain logistics capabilities outside major metropolitan centers make it difficult to expand distribution networks effectively. As a result, access to online alcohol sales remains concentrated in urban areas, leaving smaller communities dependent on traditional retail channels and limiting the market's reach beyond larger cities.

Competitive Landscape:

The Japan online alcohol delivery market exhibits moderate competitive intensity characterized by the presence of major e-commerce platforms alongside specialized alcohol retailers and manufacturer direct channels. Market dynamics reflect strategic positioning across diverse business models, ranging from comprehensive marketplaces offering extensive product ranges to curated specialty retailers emphasizing premium selections and expertise. Competition is driven by factors, including delivery speed and reliability, product assortment breadth, pricing competitiveness, and the ability to provide personalized recommendations. In addition, established platforms leverage existing logistics infrastructure and client relationships while newer entrants differentiate through specialized curation and authentic beverage expertise.

Japan Online Alcohol Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wine, Liquor, Beer, Others |

| Delivery Places Covered | Tier 1 Cities, Tier 2 Cities, Tier 3 Cities |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan online alcohol delivery market size was valued at USD 32.72 Million in 2025.

The Japan online alcohol delivery market is expected to grow at a compound annual growth rate of 10.97% from 2026-2034 to reach USD 83.48 Million by 2034.

Liquor dominates the Japan online alcohol delivery market with 40% share in 2025, driven by strong consumer preference for traditional spirits including shochu, sake, and Japanese whisky.

Key factors driving the Japan online alcohol delivery market include the rise in disposable income, particularly among affluent consumers. In 2025, the average monthly household income reached 599,845 yen, driving the demand for premium alcohol. This economic growth encourages investment in high-end alcoholic beverages and specialized delivery services, further strengthening the market growth.

Major challenges include the strict regulatory requirements for online alcohol retail licensing, age verification complexities for online alcohol purchases, distribution infrastructure limitations in non-metropolitan areas, and compliance obligations under the Liquor Tax Law.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)