Japan Online Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, Payment Mode, Service Type, and Region, 2026-2034

Japan Online Car Rental Market Overview:

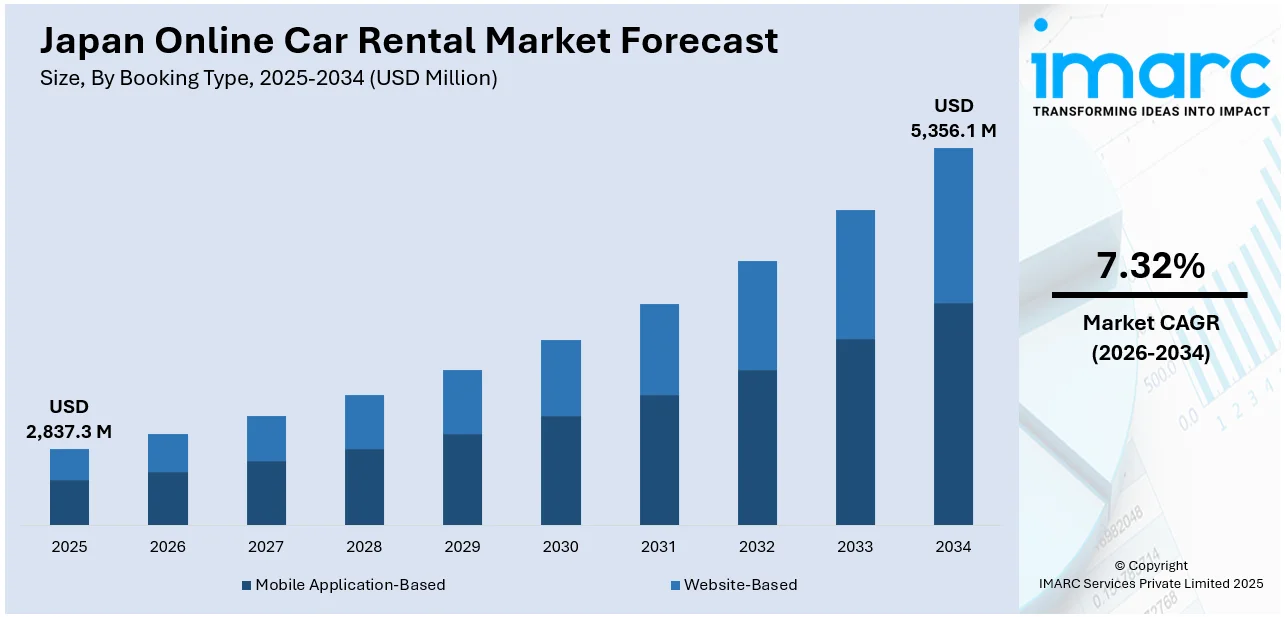

The Japan online car rental market size reached USD 2,837.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,356.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.32% during 2026-2034. At present, domestic tourists are proactively looking for hassle-free and customized travel. Moreover, car rental firms across Japan are aggressively shifting towards digital platforms to serve their increasingly technology-savvy customer base. Apart from this, the increasing number of individuals preferring short-term, flexible transportation means over car ownership is expanding the Japan online car rental market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2,837.3 Million |

|

Market Forecast in 2034

|

USD 5,356.1 Million |

| Market Growth Rate 2026-2034 | 7.32% |

Japan Online Car Rental Market Trends:

Growing Demand for Convenient Travel Solutions Among Domestic Travelers

The Japanese online automobile rental market is experiencing strong growth as domestic tourists are proactively looking for hassle-free and customized travel. With Japan's long network of railways becoming crowded in peak travel periods, tourists are opting for rented cars to visit off-the-beaten-path locations with more flexibility. Couples, families, and individual tourists are using online renting websites to reserve cars that meet their traveling schedules. These websites are providing real-time car availability, route proposals, and electronic payment processing, making traveling hassle-free. Since individuals living in urban areas are moving towards digital-first solutions, inclusion of easy-to-use mobile applications is also increasing accessibility. Online car rentals are also facilitating rural tourism by promoting easier travel to rural areas with few public means of transport. This rising trend is complementing the government's attempts to increase regional tourism, hence driving the use of app-based car rentals by local tourists in Japan. In 2024, Rakuten Group Inc. announced that its travel booking service Rakuten Travel, a premier online travel agency in Japan, launched its car rental reservation service for visitors to Japan in several languages. The service accommodated customers speaking English, Korean, and Traditional Chinese (Taiwan), along with Japanese.

To get more information on this market Request Sample

Increasing Use of Online Platforms by Car Rental Operators

Car rental firms across Japan are aggressively shifting towards digital platforms to serve their increasingly technology-savvy customer base. The firms are now investing in the development of apps, artificial intelligence (AI)-based fleet management, and contactless customer support systems to simplify processes and enhance the efficiency of services. With the push towards online reservations, businesses are risingly updating their reservation systems and visibility to vehicle inventories. This digital revolution is enabling customers to choose cars based on their actual availability, prices, and location choice. Companies are also integrating dynamic pricing mechanisms and customer feedback interfaces to drive personalization. Through collaborations with travel aggregators and digital wallets, car hire companies are making it larger and more secure. With the need for convenience increasing, companies are adopting omnichannel approaches that combine web-based interfaces and mobile apps. This digital strategic shift is taking center stage in making car rentals online more accessible, scalable, and attractive to a wider group of people. In 2024, PARK24 CO., LTD. declared its decision to launch a pilot ride-hailing service in collaboration with Uber Japan Co., Ltd. The rise-haling service is made by employing vehicles of the Times CAR car sharing service managed by the PARK24 GROUP. The pilot program began functioning with the assistance of Royal Limousine Co., Ltd., a corporate taxi service operator that is a partner of Uber.

Rising Shifts in Mobility Habits

Urban developments in Japan are bringing a significant change in mobility needs, as an increasing number of individuals prefer short-term, flexible transportation means over car ownership. In highly developed cities such as Tokyo, Osaka, and Yokohama, city dwellers are using online car rental services to use cars only when necessary. The trend is picking up pace due to the high cost of maintaining vehicles, lack of parking areas, and heightened environmental consciousness. The younger generation, in turn, is indicating a strong preference for shared mobility rather than ownership, driving the demand for online car rentals. The industry is reacting by providing small, fuel-sipping, and hybrid cars to fit the needs of urban driving. Mobile-based reservation platforms are allowing users to rent and return cars from multiple sites, providing more flexibility and minimizing the need for permanent car ownership. With individuals giving more importance to sustainability, cost-effectiveness, and convenience, web-based car renting platforms are becoming a key part of contemporary urban transportation systems.

Japan Online Car Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on booking type, rental length, vehicle type, application, payment mode, and service type.

Booking Type Insights:

- Mobile Application-Based

- Website-Based

The report has provided a detailed breakup and analysis of the market based on the booking type. This includes mobile application-based and website-based.

Rental Length Insights:

- Short Term

- Long Term

The report has provided a detailed breakup and analysis of the market based on the rental length. This includes short term and long term.

Vehicle Type Insights:

- Luxury

- Executive

- Economy

- SUVs

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes luxury, executive, economy, SUVs, and others.

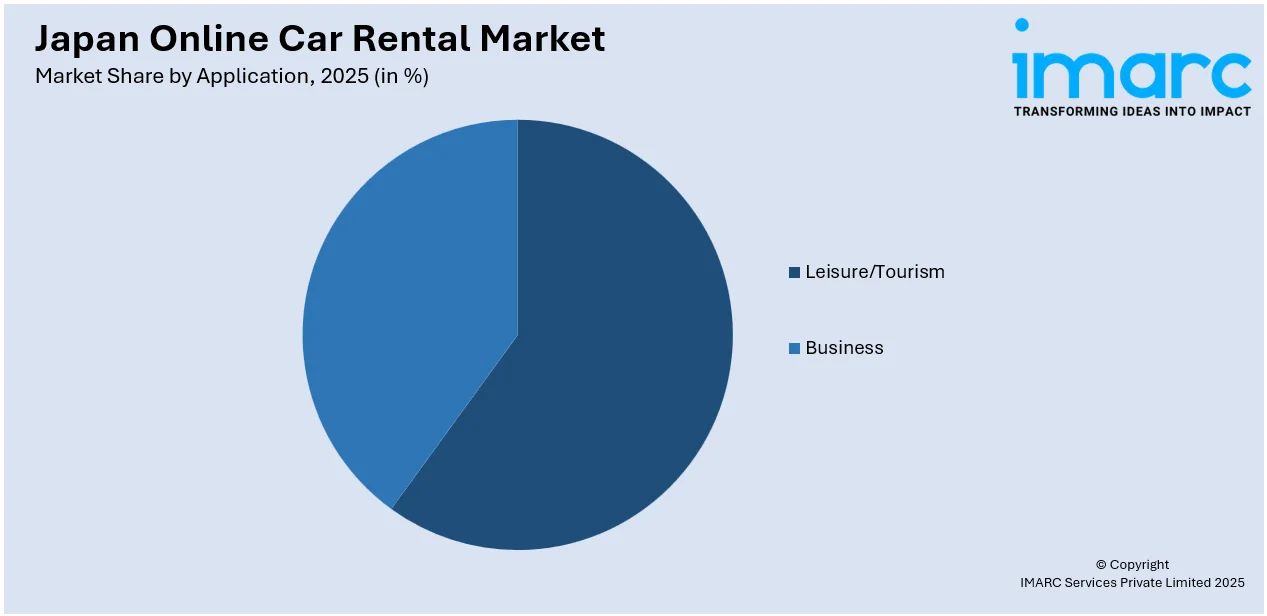

Application Insights:

Access the comprehensive market breakdown Request Sample

- Leisure/Tourism

- Business

The report has provided a detailed breakup and analysis of the market based on the application. This includes leisure/tourism and business.

Payment Mode Insights:

- Online Payment

- Cash on Delivery

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes online payment and cash on delivery.

Service Type Insights:

- Self-Driven

- Chauffeur-Driven

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes self-driven and chauffeur-driven.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Online Car Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Mobile Application-Based, Website-Based |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| Payment Modes Covered | Online Payment, Cash on Delivery |

| Services Types Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan online car rental market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan online car rental market on the basis of booking type?

- What is the breakup of the Japan online car rental market on the basis of rental length?

- What is the breakup of the Japan online car rental market on the basis of vehicle type?

- What is the breakup of the Japan online car rental market on the basis of application?

- What is the breakup of the Japan online car rental market on the basis of payment mode?

- What is the breakup of the Japan online car rental market on the basis of service type?

- What is the breakup of the Japan online car rental market on the basis of region?

- What are the various stages in the value chain of the Japan online car rental market?

- What are the key driving factors and challenges in the Japan online car rental market?

- What is the structure of the Japan online car rental market and who are the key players?

- What is the degree of competition in the Japan online car rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan online car rental market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan online car rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan online car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)