Japan Organic Packaged Foods Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Japan Organic Packaged Foods Market Summary:

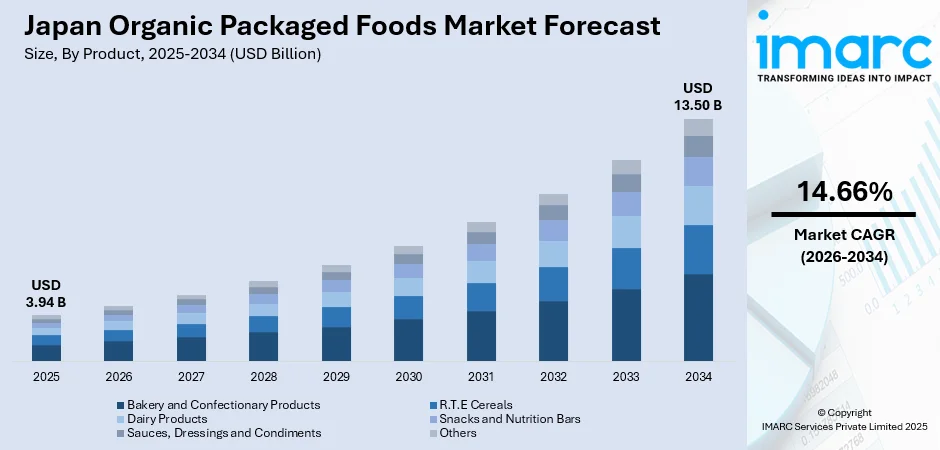

The Japan organic packaged foods market size was valued at USD 3.94 Billion in 2025 and is projected to reach USD 13.50 Billion by 2034, growing at a compound annual growth rate of 14.66% from 2026-2034.

Japan's organic packaged foods market is experiencing robust expansion driven by rising health consciousness among consumers and growing awareness regarding food safety and environmental sustainability. The nation's discerning consumer base increasingly prioritizes organic certification and clean-label products, creating sustained demand for premium organic food offerings across diverse categories.

Key Takeaways and Insights:

-

By Products: Bakery and confectionary products dominate the market with a share of 38.09% in 2025, driven by Japanese consumers' strong preference for organic ingredients in everyday staples and premium treats that align with health-conscious lifestyle choices.

-

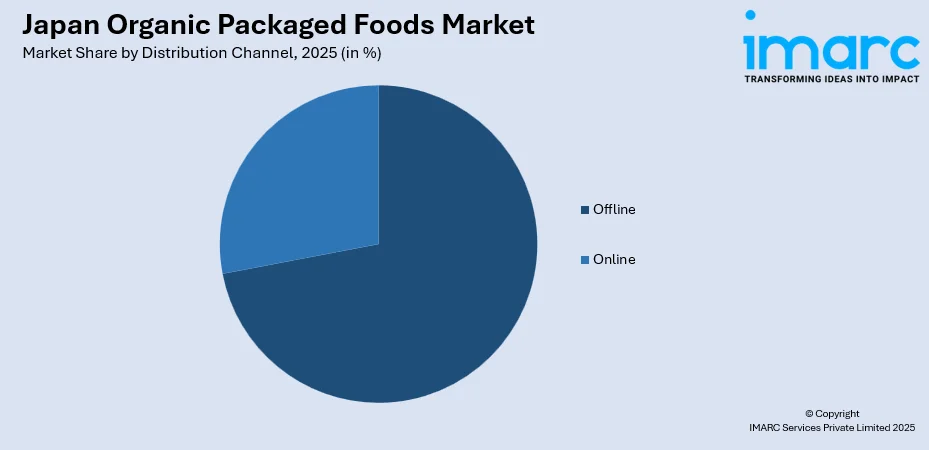

By Distribution Channel: Offline leads the market with a share of 71.06% in 2025, owing to Japanese consumers' preference for in-store product inspection, trust in established retail environments, and the tactile shopping experience offered by supermarkets and specialty stores.

-

By Region: Kanto Region represents the largest segment with a market share of 35% in 2025, attributed to its substantial urban population, higher disposable incomes, and concentration of health-conscious consumers driving organic food adoption.

-

Key Players: The Japan organic packaged foods market exhibits a competitive landscape featuring domestic organic food producers alongside international brands. Market participants focus on product innovation, organic certification, and distribution network expansion to strengthen their market positioning.

To get more information on this market Request Sample

Japan's organic packaged foods market is propelled by evolving consumer preferences toward healthier dietary choices and increasing concerns regarding pesticide residues, artificial additives, and genetically modified ingredients. In March 2024, Kaneka Corporation launched a new JAS‑certified organic milk product under its Pur Natur™ brand, expanding its organic dairy lineup and reinforcing major food companies’ commitments to organic offerings. The nation's aging population demonstrates heightened interest in nutritious food options supporting wellness and longevity, while younger demographics embrace organic products aligned with environmental sustainability values. Japanese Agricultural Standards certification provides consumer confidence in organic product authenticity, strengthening market credibility. Retailers expand organic product offerings responding to consumer demand, with dedicated organic sections becoming standard features in major supermarket chains. Additionally, premiumization trends support willingness to pay higher prices for certified organic products perceived as delivering superior quality, safety, and nutritional benefits compared to conventional alternatives.

Japan Organic Packaged Foods Market Trends:

Rising Demand for Clean-Label and Transparent Products

Japanese consumers increasingly scrutinize product ingredients and sourcing practices, driving demand for organic packaged foods featuring clear labeling and transparent supply chain information. In March 2024, Japan’s Consumer Affairs Agency moved forward with an optional front-of-pack nutrition labeling initiative to make ingredient and nutritional info more visible on packaged foods, reflecting regulatory support for transparency and helping consumers make more informed choices. Manufacturers respond with simplified ingredient lists, detailed origin disclosure, and third-party certification verification. This transparency trend extends beyond organic certification to encompass broader clean-label attributes including additive-free formulations, natural preservatives, and allergen-conscious processing practices.

Expansion of Premium and Specialty Organic Offerings

The Japan organic packaged foods market witnesses growing premiumization with specialty products targeting discerning consumers seeking exceptional quality and unique offerings. At the 2024 Organic Food Expo in Tokyo, nearly 30 organic food companies showcased premium organic breads, artisanal snacks, and specialty processed products, highlighting innovation in high-end organic offerings and increased interest from retailers and distributors. Artisanal organic breads, gourmet confectionery featuring organic ingredients, and specialty dietary products addressing specific health concerns represent expanding market niches. Manufacturers develop innovative formulations combining organic certification with functional benefits, ancient grains, and traditional Japanese ingredients appealing to sophisticated palates.

Integration of Sustainability and Environmental Consciousness

Environmental sustainability considerations increasingly influence organic packaged food purchasing decisions among Japanese consumers. Brands emphasize eco-friendly packaging, carbon footprint reduction, and sustainable agricultural practices beyond organic certification requirements. In November 2023, Neste and Mitsui Chemicals partnered with the Japanese Consumers Co-operative Union (JCCU) to introduce bio-based packaging made from renewable materials for CO-OP’s seaweed snack, the first food packaging in Japan of its kind to receive the Eco Mark certification, highlighting industry action toward lower-impact packaging. This holistic approach to environmental responsibility resonates with consumers seeking alignment between personal health benefits and broader ecological impact, strengthening brand loyalty among environmentally conscious demographics.

Market Outlook 2026-2034:

The Japan organic packaged foods market demonstrates favorable growth prospects throughout the forecast period, supported by sustained health consciousness, expanding retail availability, and continuous product innovation. Growing awareness regarding organic food benefits, coupled with increasing disposable incomes and premiumization willingness, will drive market expansion across product categories and distribution channels. The market generated a revenue of USD 3.94 Billion in 2025 and is projected to reach a revenue of USD 13.50 Billion by 2034, growing at a compound annual growth rate of 14.66% from 2026-2034.

Japan Organic Packaged Foods Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Products | Bakery and Confectionary Products | 38.09% |

| Distribution Channel | Offline | 71.06% |

| Region | Kanto Region | 35% |

Product Insights:

- Bakery and Confectionary Products

- R.T.E. Cereals

- Dairy Products

- Snacks and Nutrition Bars

- Sauces, Dressings and Condiments

- Others

The bakery and confectionary products dominate with a market share of 38.09% of the total Japan organic packaged foods market in 2025.

Bakery and confectionary products represent the leading segment in Japan's organic packaged foods market, reflecting strong consumer demand for organic ingredients in everyday staples and indulgent treats. In August 2025, confectionery maker Endo Seian refreshed its organic strategy with the “en Far East Organic” brand, introducing low-sugar organic anko products that blend traditional flavors with certified organic ingredients to attract increasingly health-conscious consumers. Japanese consumers demonstrate particular sensitivity toward ingredient quality in baked goods and sweets consumed regularly, driving preference for organic flour, sugar, and natural flavorings. The segment encompasses organic breads, pastries, cookies, chocolates, and traditional Japanese confections crafted with certified organic components.

The segment's dominance reflects Japan's established bakery culture and confectionery appreciation combined with health consciousness driving organic product selection. Manufacturers develop diverse offerings ranging from artisanal organic breads to premium confections featuring organic cacao and natural sweeteners. Gift-giving traditions in Japanese culture further support premium organic confectionery demand, as consumers seek high-quality organic treats for special occasions. Continuous product innovation introducing organic versions of popular items sustains segment growth and consumer engagement.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline leads with a share of 71.06% of the total Japan organic packaged foods market in 2025.

Offline distribution channels dominate Japan's organic packaged foods market, encompassing supermarkets, hypermarkets, specialty organic stores, department stores, and convenience outlets. Japanese consumers prefer physical retail environments enabling direct product inspection, freshness verification, and label examination before purchase. The tactile shopping experience proves particularly important for organic food purchases where consumers seek visual confirmation of product quality and authenticity through packaging assessment and certification verification.

The segment's leadership reflects Japan's well-developed retail infrastructure and consumer shopping preferences favoring in-store experiences. Major supermarket chains dedicate expanding floor space to organic product sections, improving accessibility and visibility. Specialty organic stores provide curated selections attracting health-conscious consumers seeking expert guidance. Department store food halls offer premium organic offerings appealing to quality-focused shoppers. The established trust relationship between Japanese consumers and physical retailers reinforces offline channel dominance despite growing e-commerce alternatives.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 35% share of the total Japan organic packaged foods market in 2025.

The Kanto Region dominates Japan's organic packaged foods market, anchored by Tokyo's massive consumer base and concentration of health-conscious urban populations. This economic powerhouse features higher disposable incomes enabling premium organic product purchases and sophisticated retail infrastructure supporting extensive product availability. The region's cosmopolitan demographics include trend-conscious consumers embracing organic lifestyles, international residents familiar with organic food cultures, and wellness-oriented professionals prioritizing dietary quality.

Kanto's market leadership reflects the concentration of premium supermarkets, specialty organic retailers, and department stores offering comprehensive organic product selections. Tokyo serves as the entry point for international organic brands and innovation hub for domestic manufacturers launching new products. Marketing activities centered in the capital region drive consumer awareness and category education. Strong media presence and influencer culture in Tokyo accelerate organic food trend adoption, subsequently spreading to other regions nationwide.

Market Dynamics:

Growth Drivers:

Why is the Japan Organic Packaged Foods Market Growing?

Rising Health Consciousness and Wellness Trends

Japanese consumers demonstrate increasing health consciousness driving preference for organic packaged foods perceived as healthier alternatives to conventional products. In 2025, Japanese organic producer Hikari Miso exhibited seven certified organic miso varieties at ANUGA 2025, one of Europe’s largest food fairs, showcasing products tailored for global markets and reflecting growing international and domestic demand for high-quality organic foods. Growing awareness regarding potential health impacts of pesticide residues, artificial additives, and genetically modified ingredients motivates organic product selection. The aging population emphasizes dietary quality for longevity and wellness maintenance, while younger consumers embrace preventive health approaches through nutritional choices. This broad-based health orientation creates sustained demand growth across demographic segments seeking organic food benefits.

Expanding Retail Availability and Product Accessibility

Major retailers significantly expand organic packaged foods availability, improving consumer access and category visibility throughout Japan. The overall Japan retail market reached USD 1,779.7 Billion in 2024, reflecting the scale and potential of retail channels to support organic product growth, and is expected to reach USD 2,006.9 Billion by 2033, according to IMARC Group. Supermarket chains dedicate growing shelf space to organic products, while convenience stores introduce organic options addressing on-the-go consumption patterns. Specialty organic retailers provide curated selections attracting dedicated organic consumers. This distribution expansion reduces barriers to organic product trial and regular purchase, converting interested consumers into habitual organic buyers. Enhanced accessibility across retail formats supports market growth by meeting consumers wherever they prefer shopping.

Environmental Sustainability and Ethical Consumption Values

Growing environmental consciousness among Japanese consumers extends purchasing decisions beyond personal health to broader ecological considerations. According to sources, Japan’s Ministry of Agriculture, Forestry and Fisheries expanded the Japanese Agricultural Standards (JAS) for organic certification and tightened import and labelling regulations to enhance consumer trust and ensure authenticity of certified organic products domestically and abroad. Organic agriculture's reduced environmental impact through prohibition of synthetic pesticides and emphasis on soil health resonates with sustainability-minded consumers. Younger demographics particularly embrace values-based consumption connecting food choices with environmental responsibility. Brands effectively communicate sustainability credentials alongside organic certification, strengthening consumer connections. This alignment of personal health benefits with environmental values creates compelling motivation for organic product adoption among ethically oriented consumer segments.

Market Restraints:

What Challenges the Japan Organic Packaged Foods Market is Facing?

Premium Pricing and Value Perception Concerns

Organic packaged foods typically command significant price premiums over conventional alternatives, potentially limiting adoption among price-sensitive consumers. Economic pressures and household budget constraints may prioritize affordability over organic certification benefits. Some consumers question whether organic premiums deliver proportionate value, particularly for processed products where ingredient differences may seem less impactful than fresh produce categories.

Limited Domestic Organic Production Capacity

Japan's organic agricultural production remains relatively limited compared to conventional farming, constraining domestic organic ingredient supply for packaged food manufacturing. Import dependence for organic raw materials introduces supply chain complexities and cost considerations. Geographic and climatic constraints affect organic production scalability, while conversion from conventional farming requires significant time and investment from agricultural producers.

Consumer Education and Certification Awareness Gaps

Despite growing interest, some Japanese consumers lack comprehensive understanding of organic certification standards and benefits. Confusion regarding different organic labels, certification bodies, and what organic designation actually guarantees may create purchase hesitation. Market development requires ongoing consumer education efforts clarifying organic production requirements and differentiating certified products from natural or health-oriented marketing claims.

Competitive Landscape:

The Japan organic packaged foods market exhibits a competitive structure featuring domestic organic food producers, traditional food manufacturers expanding organic lines, and international organic brands. Market participants compete through product quality, organic certification credentials, brand positioning, and distribution network strength. Domestic companies leverage understanding of Japanese consumer preferences and local ingredient sourcing, while international brands contribute global organic expertise and established product portfolios. Strategic activities including new product development, organic certification expansion, and retail partnership building characterize competitive dynamics. Manufacturers increasingly emphasize transparency, sustainability credentials, and premium positioning to differentiate offerings and justify price premiums in the expanding organic category.

Recent Developments:

-

In Oct 2025, Fair‑trade & organic brand People Tree launched a new seasonal organic chocolate collection with refreshed packaging in Japan, featuring board chocolate, mini packs, and gift‑ready tins with FSC‑certified materials.

Japan Organic Packaged Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bakery and Confectionary Products, R.T.E. Cereals, Dairy Products, Snacks and Nutrition Bars, Sauces, Dressings and Condiments, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan organic packaged foods market size was valued at USD 3.94 Billion in 2025.

The Japan organic packaged foods market is expected to grow at a compound annual growth rate of 14.66% from 2026-2034 to reach USD 13.50 Billion by 2034.

Bakery and confectionary products dominated the market with a 38.09% share, driven by Japanese consumers' strong preference for organic ingredients in everyday staples and premium treats aligned with health-conscious lifestyle choices.

Key factors driving the Japan organic packaged foods market include rising health consciousness and wellness trends, expanding retail availability and product accessibility, and growing environmental sustainability and ethical consumption values among consumers.

Major challenges include premium pricing and value perception concerns, limited domestic organic production capacity, consumer education and certification awareness gaps, and supply chain complexities for organic raw material sourcing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)