Japan Organic Snack Foods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Flavor, and Region, 2026-2034

Japan Organic Snack Foods Market Overview:

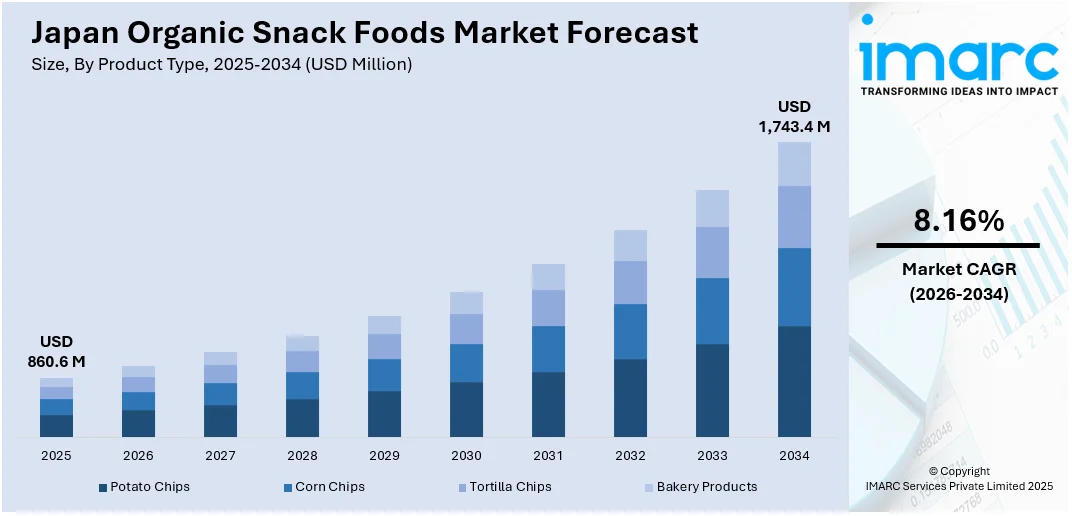

The Japan organic snack foods market size reached USD 860.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,743.4 Million by 2034, exhibiting a growth rate (CAGR) of 8.16% during 2026-2034. The market is fueled by consumer preference for functional nutrition, cultural heritage, and convenient availability. Growing demand for snacks with health-promoting ingredients and the rediscovery of classic Japanese flavors indicate a move toward sustainable eating. At the same time, growth in e-commerce and high-end retail distribution networks is extending market accessibility to different age groups. These overall trends are reinforcing product innovation and customer engagement, positively impacting Japan organic snack foods market share growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 860.6 Million |

| Market Forecast in 2034 | USD 1,743.4 Million |

| Market Growth Rate 2026-2034 | 8.16% |

Japan Organic Snack Foods Market Trends:

Increased Demand for Healthy Organic Snack Foods

Functional organic snacking foods are highly in demand among Japanese consumers, with customers preferring food products offering health benefits alongside convenient packaging. This is particularly strong among health-oriented consumers across all age groups, including middle-aged and older populations, looking to enhance immunity, intestinal health, and energy through daily nutrition. Functional organic snacks with added probiotics, plant fibers, and antioxidants are increasingly popular. The appeal of such products is that they are satisfying hunger but also targeting particular health objectives, like enhanced digestion or alleviated fatigue. Companies have adapted by infusing such ingredients as fermented grains, superfruits, and vegetable proteins, thus accelerating nutritional content without sacrificing flavor. For instance, in September 2024, Nissin Kako introduced four JAS-certified "Organic Joy Chocolate" products in Japan, which are made with organic ingredients and contain no emulsifiers or fragrances, encouraging sustainable and ethical snacking. Moreover, the growing culture for health and wellness in Japan, together with discerning dietary habits, continues to reshape consumer expectations of snack food. This change is a key driver of Japan organic snack foods market growth, affirming the need for new, nutrient-rich offerings within the organic product category.

To get more information on this market Request Sample

Cultural Rebirth Through Heritage Japanese Ingredients

Japan's organic snack market is increasingly adopting traditional ingredients like matcha, kinako, azuki beans, and umeboshi, relaunching them in contemporary, health-oriented snack forms. These ingredients, traditionally based on Japanese food and culture, are now being redirected to answer the changing needs of organic shoppers who want both flavor and authenticity. Organic senbei, yuzu fruit chips, and matcha granola bars are just a few of many examples of how ancient ingredients are fusing with contemporary nutritional requirements. This trend is not just sought after by older shoppers who enjoy nostalgia but is also visited by younger audiences seeking locally produced, culturally specific superfoods. The snacks honor the nation's culinary history while conforming to modern values of minimal processing and sustainability. The return of indigenous tastes in organic snack foods highlights Japan's potential for innovation while maintaining tradition. As such a trend becomes widespread, it directly impacts Japan organic snack foods market trends, influencing both domestic consumption and global product appeal.

Diversification of Retail and E-Commerce Distribution Channels

A key trend influencing Japan's organic snack market is the diversification of retail and digital distribution channels. Organic snack foods no longer have a limited presence in specialty health food stores; they are more and more prominent in premium supermarkets, lifestyle boutiques, and on-line platforms. This increased availability has improved accessibility, particularly among younger consumers and working professionals who enjoy online shopping. Ease of digital buying, along with niche marketing and subscription box models, has simplified discovery and test-driving new organic snacks for consumers. Additionally, in-store product placement in edited health and wellness sections of large retailers has improved brand visibility and credibility. Firms are investing in both offline activity and shelf placement to reach more consumers and build trust by being transparent. This distribution strategy change is enabling expansion of categories and is directly tied to Japan organic snack foods market growth, as it allows for greater market penetration and loyalty to consumers in a more health-aware society.

Japan Organic Snack Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, distribution channel, and flavor.

Product Type Insights:

- Potato Chips

- Corn Chips

- Tortilla Chips

- Bakery Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes potato chips, corn chips, tortilla chips, and bakery products.

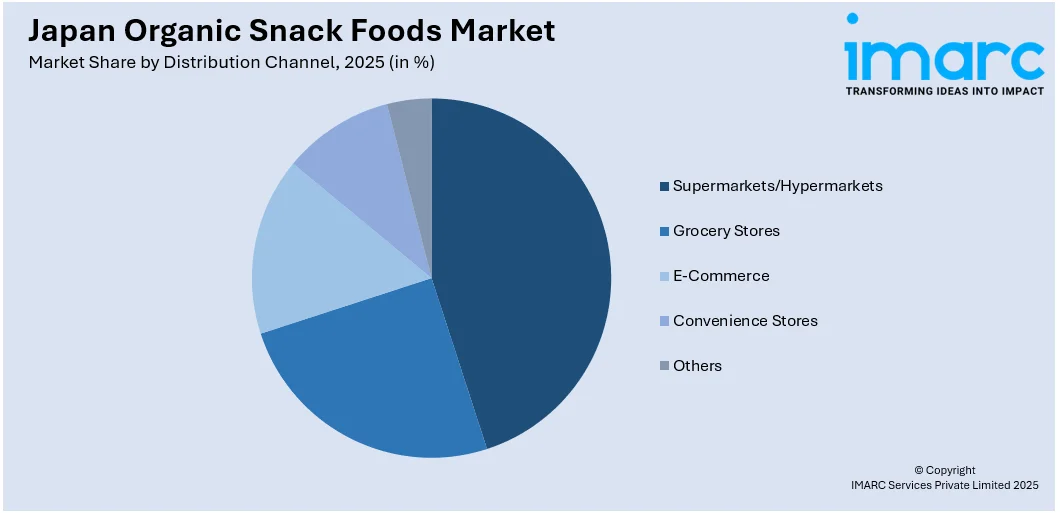

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Grocery Stores

- E-Commerce

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, grocery stores, e-commerce, convenience stores, and others.

Flavor Insights:

- Chocolate

- Vanilla

- Strawberry

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes chocolate, vanilla, strawberry, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Organic Snack Foods Market News:

- In March 2024, maama introduced two new varieties of Almond and Hazelnut for its "Raw Chocolate Nuts Bar." Organic raw cacao, coconut sugar, and nut pastes are used in these bars, which are vegan, gluten-free, and additive-free. They provide a silky, healthy indulgence for the cold season as a conscious, sustainable snacking option.

Japan Organic Snack Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Potato Chips, Corn Chips, Tortilla Chips, Bakery Products |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Grocery Stores, E-Commerce, Convenience Stores, Others |

| Flavors Covered | Chocolate, Vanilla, Strawberry, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan organic snack foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan organic snack foods market on the basis of product type?

- What is the breakup of the Japan organic snack foods market on the basis of distribution channel?

- What is the breakup of the Japan organic snack foods market on the basis of flavor?

- What is the breakup of the Japan organic snack foods market on the basis of region?

- What are the various stages in the value chain of the Japan organic snack foods market?

- What are the key driving factors and challenges in the Japan organic snack foods?

- What is the structure of the Japan organic snack foods market and who are the key players?

- What is the degree of competition in the Japan organic snack foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan organic snack foods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan organic snack foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan organic snack foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)