Japan Organic Spices Market Size, Share, Trends and Forecast by Product, Form, Distribution Channel, and Region, 2026-2034

Japan Organic Spices Market Summary:

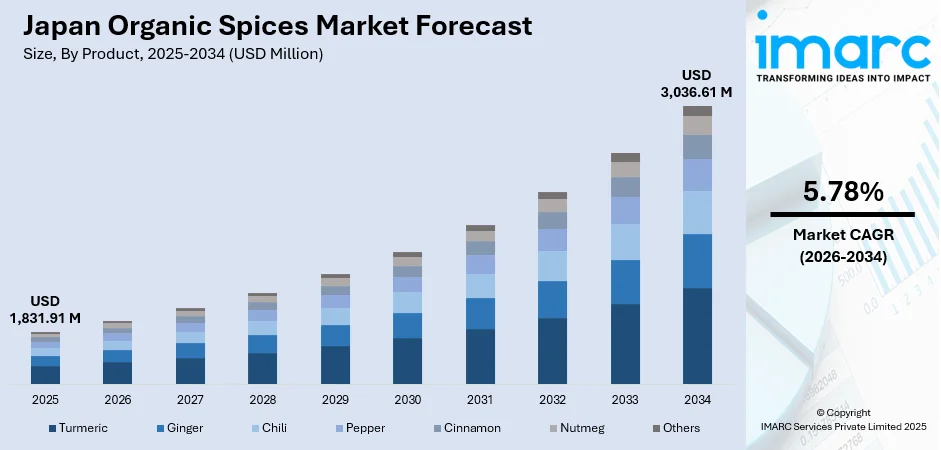

The Japan organic spices market size was valued at USD 1,831.91 Million in 2025 and is projected to reach USD 3,036.61 Million by 2034, growing at a compound annual growth rate of 5.78% from 2026-2034.

Japan's organic spices market is experiencing sustained expansion driven by heightened consumer awareness regarding natural health solutions and clean-label products. The nation's distinct culinary heritage, combined with increasing preference for chemical-free and sustainably sourced ingredients, creates favorable conditions for market development. Growing adoption across household kitchens, foodservice establishments, and functional food manufacturers reflects the deepening integration of organic spices into daily dietary practices throughout the country.

Key Takeaways and Insights:

- By Product: Turmeric dominates the market with a share of 27% in 2025, owing to its well-documented anti-inflammatory and antioxidant properties that resonate strongly with Japan's health-conscious consumers. The ingredient's versatility in functional foods, dietary supplements, and traditional wellness preparations continues to fuel its leading position.

- By Form: Powder leads the market with a share of 58% in 2025, This dominance is driven by the convenience and ease of incorporation into cooking, longer shelf stability, and consistent flavor profiles that appeal to both household consumers and professional food processing applications.

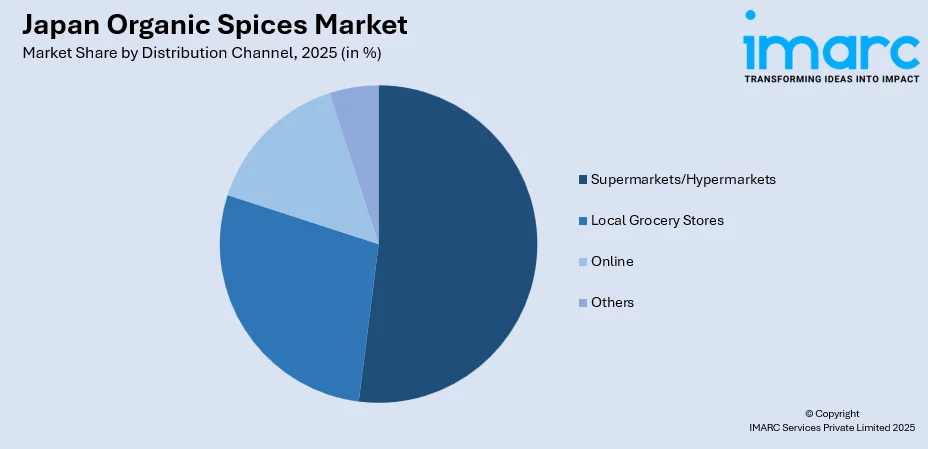

- By Distribution Channel: Supermarkets/hypermarkets represent the largest segment with a market share of 52% in 2025, reflecting the established retail infrastructure and consumer preference for in-store product evaluation, particularly for premium organic offerings where quality verification matters.

- By Region: Kanto Region comprises the largest region with 35% share in 2025, driven by the concentration of Japan's largest metropolitan population in Tokyo and surrounding areas, higher disposable incomes, and strong presence of health-conscious urban consumers seeking premium organic products.

- Key Players: Key players drive the Japan organic spices market by expanding product portfolios, enhancing quality certifications, and strengthening distribution networks. Their investments in sustainable sourcing, premium packaging, and partnerships with retail chains boost consumer awareness and accelerate adoption.

To get more information on this market Request Sample

The Japan organic spices market demonstrates growth potential underpinned by fundamental shifts in consumer dietary preferences and wellness priorities. Japanese consumers increasingly gravitate toward organic alternatives as concerns regarding synthetic additives, pesticide residues, and food transparency intensify across demographic segments. The nation's stringent Japanese Agricultural Standards certification framework ensures product authenticity while building consumer confidence in organic claims. According to government data, Japan's senior citizen demographic reached an unprecedented 36.25 Million individuals in 2024, with those aged 65 and above now representing nearly one-third of the total population. This aging demographic places heightened emphasis on preventative healthcare through natural food consumption, directly benefiting organic spice adoption. Furthermore, the integration of organic spices into functional foods, nutraceuticals, and traditional medicinal preparations continues expanding market opportunities across diverse application segments.

Japan Organic Spices Market Trends:

Rising Health and Wellness Focus Driving Natural Ingredient Adoption

Japanese consumers increasingly prioritize health and well-being in their dietary choices, creating substantial momentum for organic spices positioned as natural wellness enhancers. This trend manifests through growing integration of immune-boosting and anti-inflammatory organic spices into daily cooking routines and herbal therapy preparations. The preference extends beyond mere culinary applications toward therapeutic uses, with consumers recognizing organic turmeric, ginger, and cinnamon as functional ingredients supporting preventative healthcare objectives. Health-oriented individuals across age groups actively seek products cultivated without synthetic fertilizers or pesticides.

Clean-Label Movement and Transparency Demands Reshaping Product Standards

The clean-label movement has transitioned from niche health food segments into mainstream packaged food categories throughout Japan. Consumers demonstrate strong preference for products with recognizable, natural ingredients and transparent sourcing information. Manufacturers respond by reformulating products, eliminating synthetic additives, and pursuing Japanese Agricultural Standards certification to validate organic authenticity. This regulatory framework ensures quality standards while enabling export preparedness for domestic producers. The trend influences both ingredient selection and marketing communications emphasizing purity and natural cultivation methods.

Digital Commerce Expansion Enhancing Market Accessibility

E-commerce platforms and online grocery services significantly accelerate organic spice accessibility across Japan's urban and rural markets. Digital channels provide consumers convenient access to diverse organic product portfolios previously limited to specialty stores and premium supermarket sections. The surge in online grocery adoption, particularly in metropolitan centers including Tokyo, Osaka, and Yokohama, enables efficient distribution of premium organic spices. Retailers increasingly optimize digital presence while maintaining physical store expansion, creating omnichannel accessibility that broadens consumer reach.

Market Outlook 2026-2034:

The Japan organic spices market outlook remains positive through the forecast period, supported by enduring consumer demand for natural health solutions and clean-label products. Market expansion will be sustained by continued integration of organic spices into functional foods, dietary supplements, and culinary applications across household and foodservice segments. The market generated a revenue of USD 1,831.91 Million in 2025 and is projected to reach a revenue of USD 3,036.61 Million by 2034, growing at a compound annual growth rate of 5.78% from 2026-2034. Retail channel diversification, enhanced certification frameworks, and increasing domestic organic cultivation capacity will collectively drive sustained market development.

Japan Organic Spices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Turmeric | 27% |

| Form | Powder | 58% |

| Distribution Channel | Supermarkets/Hypermarkets | 52% |

| Region | Kanto Region | 35% |

Product Insights:

- Turmeric

- Ginger

- Chili

- Pepper

- Cinnamon

- Nutmeg

- Others

Turmeric dominates with a market share of 27% of the total Japan organic spices market in 2025.

Turmeric maintains its leading position in the Japan organic spices market owing to the widespread recognition of its health-promoting properties, particularly curcumin's anti-inflammatory and antioxidant benefits. Japanese consumers increasingly incorporate organic turmeric into daily wellness routines, functional beverages, and traditional medicinal preparations. The strong functional food culture and nutraceutical industries drive consistent demand for high-quality organic turmeric extracts with enhanced bioavailability formulations. Consumer awareness regarding turmeric's therapeutic applications continues expanding through educational initiatives and healthcare practitioner recommendations supporting natural dietary interventions.

The demand trajectory for organic turmeric in Japan demonstrates steady growth driven primarily by rising consumer preference for natural health and wellness products. Japan's aging population seeking natural health solutions further reinforces turmeric's dominant market position through continued integration into dietary supplements, immunity-boosting formulations, and culinary applications. The ingredient's versatility enables seamless incorporation across diverse product categories ranging from ready-to-drink beverages and functional snacks to traditional herbal remedies and premium cooking ingredients, sustaining broad-based consumer appeal across demographic segments.

Form Insights:

- Powder

- Whole

- Chopped/Crushed

Powder leads with a share of 58% of the total Japan organic spices market in 2025.

Powdered organic spices maintain substantial market dominance due to their convenience, uniformity, and extended shelf stability that appeals to both household consumers and food processing industries. The powder format facilitates easy incorporation into diverse culinary preparations, ready-to-cook meal solutions, and industrial food manufacturing processes. Japanese consumers favor powdered formulations for their consistent flavor profiles and efficient storage characteristics. The fine texture enables precise portion control and even distribution throughout dishes, ensuring balanced seasoning across various cooking applications. Manufacturers benefit from streamlined handling, packaging efficiency, and reduced transportation costs associated with powdered formats.

The preference for powdered organic spices reflects broader convenience-oriented consumption patterns prevalent across Japan's food market. Advanced processing technologies including precision grinding and low-moisture drying methods enhance product quality while preserving nutritional compounds and aromatic profiles. Modern processing facilities employ temperature-controlled environments that maintain the integrity of volatile oils and active ingredients throughout manufacturing stages. This technological sophistication supports premium product positioning while meeting stringent quality expectations from discerning Japanese consumers seeking authentic flavors and maximum health benefits.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Local Grocery Stores

- Online

- Others

The supermarkets/hypermarkets exhibit a clear dominance with a 52% share of the total Japan organic spices market in 2025.

Supermarkets and hypermarkets serve as primary distribution channels for organic spices in Japan, offering consumers convenient access to diverse product portfolios under one roof. Major retail chains have substantially expanded their organic product offerings, dedicating prominent shelf space to certified organic seasonings and spice blends. These retail formats enable consumers to evaluate product quality, verify certifications, and compare options before purchase. The in-store shopping experience allows customers to examine packaging details, read ingredient labels, and assess freshness indicators that influence purchasing decisions for premium organic products.

The supermarket channel's dominance reflects Japan's well-established retail infrastructure and consumer preference for physical product evaluation when purchasing premium organic items. Retailers continue expanding dedicated organic sections while integrating digital capabilities for enhanced customer engagement through loyalty programs and promotional activities. Private label organic offerings alongside branded products provide consumers with diverse price-point options, supporting broader market penetration across demographic segments seeking organic alternatives. Store personnel increasingly receive training on organic certification standards to assist customer inquiries and build purchasing confidence.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region represent the leading segment with a 35% share of the total Japan organic spices market in 2025.

The Kanto Region, encompassing Tokyo and surrounding prefectures, maintains its position as Japan's largest organic spices market driven by the highest concentration of health-conscious urban consumers and premium retail infrastructure. The region benefits from elevated disposable income levels, strong presence of specialty organic retailers, and sophisticated e-commerce logistics enabling efficient product distribution. Urban millennials, Gen Z consumers, and health-focused professionals lead organic adoption trends.

Tokyo's metropolitan area demonstrates particularly strong demand for organic spices, supported by diverse retail formats ranging from premium supermarkets to specialty health food stores and farmers markets. The surge in online grocery platforms has especially accelerated access to organic produce in cities like Tokyo, Osaka, Kyoto, Nagoya, and Yokohama. The region's robust foodservice sector further amplifies demand as restaurants increasingly incorporate organic ingredients to meet consumer preferences for clean-label dining experiences.

Market Dynamics:

Growth Drivers:

Why is the Japan Organic Spices Market Growing?

Aging Population Emphasizing Preventative Healthcare Through Natural Foods

Japan's demographic transformation significantly influences organic spice market expansion as the nation's aging population increasingly prioritizes preventative healthcare through dietary modifications. Senior consumers actively seek natural food products with recognized health benefits, driving sustained demand for organic spices known for anti-inflammatory, antioxidant, and immune-supporting properties. This demographic shift creates enduring market opportunities as elderly consumers demonstrate strong brand loyalty and willingness to pay premium prices for certified organic products. The integration of organic spices into daily cooking routines, herbal preparations, and wellness supplements reflects broader lifestyle changes among health-conscious seniors. Healthcare practitioners increasingly recommend natural dietary interventions, further reinforcing organic spice adoption. This preventative healthcare orientation among Japan's substantial senior population establishes stable long-term demand fundamentals.

Japanese Agricultural Standards Certification Framework Building Consumer Trust

The Japanese Agricultural Standards certification system provides critical market infrastructure by ensuring product authenticity and quality verification for organic spices. JAS certification establishes rigorous standards covering cultivation practices, processing methods, and supply chain integrity that build consumer confidence in organic claims. This regulatory framework enables domestic producers to differentiate products while facilitating export preparedness through international recognition. The certification process requires compliance with stringent requirements prohibiting synthetic fertilizers, pesticides, and genetically modified organisms throughout production and processing stages. Growing producer adoption of JAS certification reflects recognition that verified organic credentials command premium pricing and consumer preference.

Expansion of Modern Retail Infrastructure and E-Commerce Platforms

The rapid development of retail channels specializing in organic products substantially enhances market accessibility across Japan's urban and regional markets. Major supermarket chains continue expanding organic product portfolios and dedicated shelf space, making premium organic spices available to broader consumer segments. E-commerce platforms complement physical retail by providing convenient access to diverse organic offerings with detailed product information and certification verification. Online grocery adoption accelerated substantially, with digital platforms enabling efficient distribution of specialty organic products previously limited to metropolitan specialty stores. Retailers optimize omnichannel strategies combining physical store presence with digital engagement capabilities. This distribution infrastructure development reduces accessibility barriers while supporting market education through enhanced product information availability.

Market Restraints:

What Challenges the Japan Organic Spices Market is Facing?

Premium Price Points Limiting Mass Market Penetration

Organic spices command significantly higher prices compared to conventional alternatives, creating affordability barriers that constrain market expansion beyond premium consumer segments. The price differential reflects elevated production costs, certification expenses, and supply chain complexities associated with organic cultivation and processing standards. Price-sensitive consumers may defer organic purchases during economic uncertainties.

Limited Domestic Organic Farmland and Import Dependence

Japan's organic agricultural sector remains constrained by limited farmland conversion, with organic cultivation comprising a small percentage of total agricultural area. This domestic production shortfall necessitates substantial import reliance from international suppliers, creating supply chain vulnerabilities and cost pressures. Geographic and climatic limitations further restrict domestic organic spice cultivation capacity.

Consumer Awareness Gaps in Rural and Suburban Markets

Despite growing urban awareness, consumer understanding of organic certification standards and benefits remains uneven across regional markets. Information asymmetry between metropolitan and rural areas limits market penetration in suburban and provincial locations. Educational initiatives require sustained investment to expand organic literacy beyond core urban consumer segments.

Competitive Landscape:

The Japan organic spices market features a moderately fragmented competitive landscape with participation from established domestic spice manufacturers, international organic brands, and specialty food importers. Market participants differentiate through product quality certifications, sourcing transparency, and portfolio breadth across spice varieties. Strategic investments in sustainable sourcing relationships, premium packaging innovations, and retail distribution partnerships characterize competitive positioning. Companies emphasize Japanese Agricultural Standards certification as foundational credibility markers while expanding product lines to address evolving consumer preferences for functional and traditional spice varieties. Private label offerings from major retailers introduce additional competitive dynamics, challenging branded manufacturers on price competitiveness while expanding overall category visibility.

Recent Developments:

- In November 2025, S&B Foods, Japan's leading spice manufacturer, announced the launch of new paste products including Umeboshi Paste, Mentaiko Paste, and Yuzu Miso Paste, expanding its portfolio of authentic Japanese seasonings for domestic and international markets.

Japan Organic Spices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Turmeric, Ginger, Chili, Pepper, Cinnamon, Nutmeg, Others |

| Forms Covered | Powder, Whole, Chopped/ Crushed |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Local Grocery Stores, Online, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan organic spices market size was valued at USD 1,831.91 Million in 2025.

The Japan organic spices market is expected to grow at a compound annual growth rate of 5.78% from 2026-2034 to reach USD 3,036.61 Million by 2034.

Turmeric dominated the market with a share of 27%, driven by widespread recognition of its anti-inflammatory and antioxidant health benefits that resonate with Japan's health-conscious consumer base.

Key factors driving the Japan organic spices market include aging population emphasizing preventative healthcare, Japanese Agricultural Standards certification building consumer trust, expansion of modern retail and e-commerce channels, and growing clean-label product preferences.

Major challenges include premium price points limiting mass market penetration, limited domestic organic farmland requiring import dependence, supply chain complexities, and uneven consumer awareness between urban and rural markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)