Japan Organic Tea Market Size, Share, Trends and Forecast by Product, Taste, Form, Distribution Channel, and Region, 2026-2034

Japan Organic Tea Market Overview:

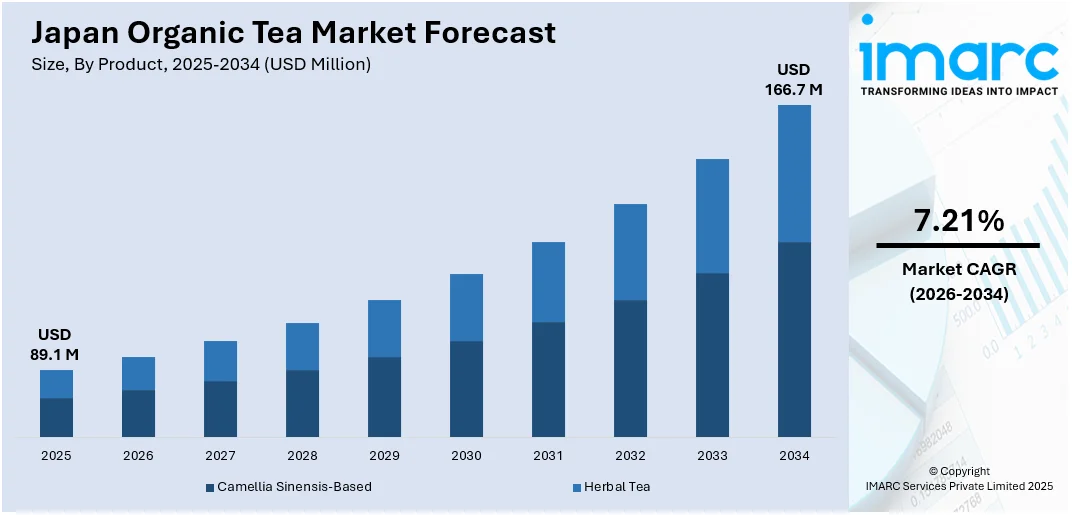

The Japan organic tea market size reached USD 89.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 166.7 Million by 2034, exhibiting a growth rate (CAGR) of 7.21% during 2026-2034. At present, the Japanese government is playing an active role in encouraging the organic farming industry, which, in turn, is strengthening the market growth. Moreover, the rising emphasis on wellness and health among the masses is impelling the market growth. Apart from this, the increasing product diversification and premiumization are expanding the Japan organic tea market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 89.1 Million |

| Market Forecast in 2034 | USD 166.7 Million |

| Market Growth Rate 2026-2034 | 7.21% |

Japan Organic Tea Market Trends:

Increase in Consumer Health and Wellness Awareness

The Japanese organic tea market is witnessing significant growth as end-consumers are placing greater emphasis on wellness and health. Consumers are now learning about the value of chemical-free, organically cultivated products, especially in the wake of heightened risk awareness about lifestyle diseases like high blood pressure, obesity, and diabetes. Consequently, consumers are actively converting to food and beverage choices that assist with long-term health objectives. Organic tea, which is free from pesticides and synthetic fertilizers, is being marketed as a natural source supporting detoxification, immunity, and metabolic well-being. Wellness trends in Japan are also creating mindfulness among the masses, with tea drinking becoming a central aspect of these regimens. Marketing campaigns and packaging are also highlighting antioxidant levels, functional health benefits, and eco-friendliness, thus rising the value proposition of organic teas. This emerging awareness is catalyzing the demand for organic tea products. Moreover, the IMARC Group predicts that the Japan health and wellness market is anticipated to attain USD 287.50 Billion by 2033. This will further drive the need for healthy consumables like organic tea.

To get more information on this market Request Sample

Increasing Product Diversification and Premiumization

The industry is now seeing an explosion of product innovation and premiumization trends to appeal to a sophisticated consumer base. Japanese organic tea companies are launching vast portfolios of specialty teas such as matcha, sencha, genmaicha, and hojicha with organic certification and distinctive processing techniques, thereby impelling the Japan organic tea market growth. The innovations are improving product appeal by providing diversified flavor profiles, brewing styles, and health benefits. Firms are also introducing ready-to-drink (RTD) organic teas, cold brews, and tea-infused drinks that keep up with convenience trends while allowing the organic purity of their ingredients. In addition, premium packaging, tea origin storytelling, and limited harvest releases are being utilized to heighten brand identity and justify premium prices. For instance, in May 2025, Marumatsu, a historical tea company with more than 120 years of heritage, revealed the revitalization of its "san grams Sangram" brand. Situated in one of Japan's most famous tea-producing areas, Marumatsu is committed to enhancing everyday life with tea. The revitalized brand presents a new perspective on savoring tea that links tradition with the pace of contemporary life. Central to the brand revitalization is the reopening of San Grams Kikugawa, the main store. The space combines a café for leisurely tea enjoyment, a section for richer cultural experiences, and a store featuring high-quality teas and thoughtfully chosen tools. With top-notch quality control measures and certifications like JAS Organic, FSSC 22000, Rainforest Alliance, Kosher, and Halal, Marumatsu continues to be a reputable brand in tea.

Government Support and Organic Certification Standards

The Japanese government is playing an active role in encouraging the organic farming industry, which, in turn, is strengthening the market growth. The authorities are enforcing stricter regulations for organic certification like the Japanese Agricultural Standards (JAS), which provide high-quality production and establish consumer confidence. These certifications are offering traceability and transparency, both of which are becoming a prerequisite purchasing point in the contemporary market. Subsidies and programs by the government are also being implemented to induce tea planters to shift to organic farming, typically requiring greater up-front expenditure and more labor-intensive methods. These efforts are contributing to organic land increases in domestic agricultural land and increasing efficiencies in production. Efforts are also being made to develop Japanese organic tea markets overseas with assistance from export commissions and trade missions. Consequently, the local industry is enhancing its international competitiveness as it bolsters the legitimacy of organic certification for domestic consumers, thus driving long-term market momentum.

Japan Organic Tea Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, taste, form, and distribution channel.

Product Insights:

- Camellia Sinensis-Based

- Black Tea

- Green Tea

- White Tea

- Oolong Tea

- Others

- Herbal Tea

The report has provided a detailed breakup and analysis of the market based on the product. This includes camellia sinensis-based (black tea, green tea, white tea, oolong tea, and others) and herbal tea.

Taste Insights:

- Flavored

- Plain

The report has provided a detailed breakup and analysis of the market based on the taste. This includes flavored and plain.

Form Insights:

- Tea Bag

- Leaf and Powder Tea

- Liquid

The report has provided a detailed breakup and analysis of the market based on the form. This includes tea bag, leaf and powder tea, and liquid.

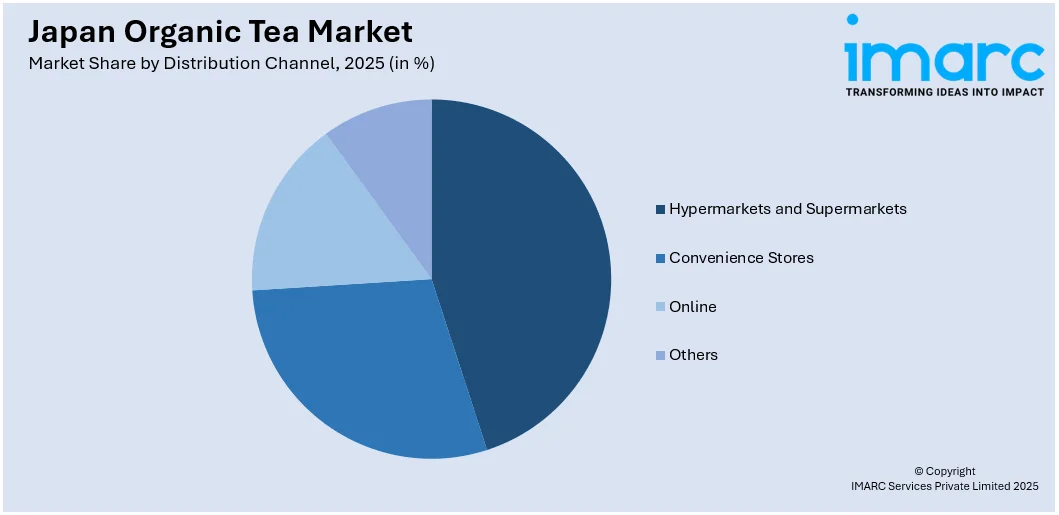

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, online, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Organic Tea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Tastes Covered | Flavored, Plain |

| Forms Covered | Tea Bag, Leaf and Powder Tea, Liquid |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan organic tea market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan organic tea market on the basis of product?

- What is the breakup of the Japan organic tea market on the basis of taste?

- What is the breakup of the Japan organic tea market on the basis of form?

- What is the breakup of the Japan organic tea market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia organic tea market on the basis of region?

- What are the various stages in the value chain of the Japan organic tea market?

- What are the key driving factors and challenges in the Japan organic tea market?

- What is the structure of the Japan organic tea market and who are the key players?

- What is the degree of competition in the Japan organic tea market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan organic tea market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan organic tea market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan organic tea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)