Japan Over-the-Counter Pharmaceutical Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Formulation, and Region, 2026-2034

Japan Over-the-Counter Pharmaceutical Market Summary:

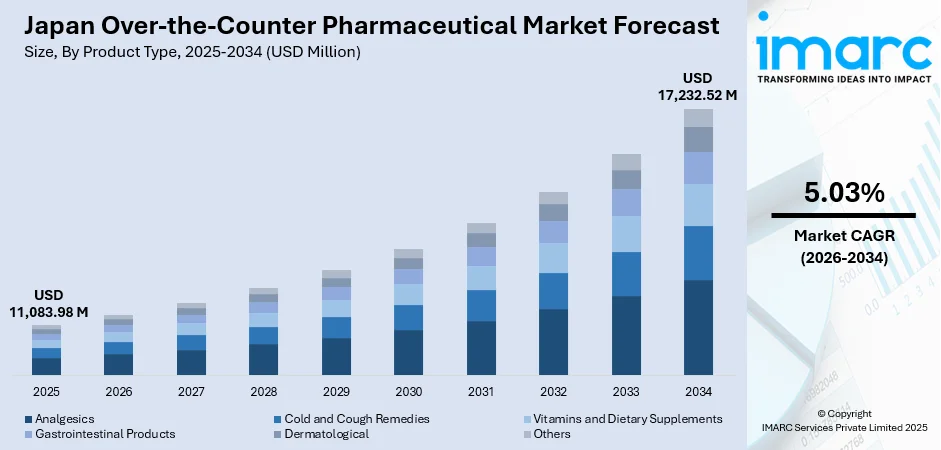

The Japan over-the-counter pharmaceutical market size was valued at USD 11,083.98 Million in 2025 and is projected to reach USD 17,232.52 Million by 2034, growing at a compound annual growth rate of 5.03% from 2026-2034.

The Japan over-the-counter pharmaceutical market is experiencing sustained expansion driven by the nation's aging population seeking accessible self-medication options and growing consumer preference for preventive healthcare solutions. Rising health consciousness among Japanese consumers, coupled with the well-established pharmacy infrastructure and cultural acceptance of traditional medicine alongside modern formulations, continues to bolster market development across diverse therapeutic categories.

Key Takeaways and Insights:

- By Product Type: Analgesics dominated the market with approximately 26% revenue share in 2025, driven by the high prevalence of musculoskeletal conditions among Japan's elderly population, widespread availability across retail channels, and strong consumer familiarity with established pain relief formulations.

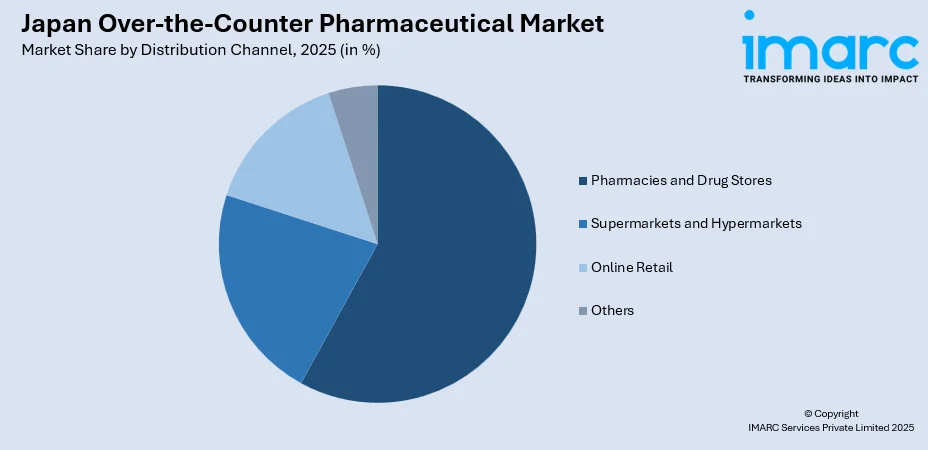

- By Distribution Channel: Pharmacies and drug stores led the market with a share of approximately 58% in 2025, owing to the extensive network of licensed pharmacies across urban and rural areas, professional pharmacist consultations that enhance consumer trust, and regulatory frameworks favoring pharmacy-based OTC distribution.

- By Formulation: Tablets and capsules represented the largest segment with a market share of 54% in 2025, attributed to their convenience in dosing and storage, extended shelf life compared to liquid formulations, and strong consumer preference for familiar oral delivery formats.

- By Region: Kanto Region dominated the market with approximately 37% revenue share in 2025, driven by the concentration of Japan's population in Tokyo and surrounding prefectures, higher disposable incomes enabling premium OTC product purchases, and dense retail infrastructure supporting widespread product accessibility.

- Key Players: The Japan over-the-counter pharmaceutical market exhibits moderate to high competitive intensity, characterized by established domestic pharmaceutical corporations competing alongside multinational healthcare companies. Market participants differentiate through product innovation, brand heritage, extensive distribution networks, and strategic partnerships with retail pharmacy chains.

To get more information on this market Request Sample

The Japan over-the-counter pharmaceutical market benefits from a mature healthcare ecosystem where self-medication practices are deeply embedded in consumer behavior. In October 2025, Japan’s health ministry approved the over-the-counter sale of the emergency contraceptive pill Norlevo by Aska Pharmaceutical, marking the first time such a pill can be sold without a prescription in the country. The regulatory environment, overseen by the Pharmaceuticals and Medical Devices Agency, maintains stringent quality standards while facilitating appropriate consumer access to non-prescription medications. Japan's unique demographic profile, characterized by one of the world's highest proportions of elderly citizens, generates consistent demand for OTC products addressing age-related health concerns including pain management, digestive wellness, and nutritional supplementation. Additionally, the integration of traditional Kampo medicine within mainstream OTC offerings reflects cultural health preferences and expands product diversity within the market landscape.

Japan Over-the-Counter Pharmaceutical Market Trends:

Expansion of Digital Health Integration

The Japanese OTC pharmaceutical sector is witnessing increasing integration of digital health technologies with traditional medication offerings. Manufacturers are developing smartphone applications that complement OTC products, providing symptom tracking, dosage reminders, and personalized wellness recommendations. In May 2025, three major Japanese pharmaceutical companies including Shionogi, Astellas, and NTT Data signed a basic agreement to develop a digital therapeutic (DTx) distribution platform, marking a collaborative push toward digital health services that could support OTC and related patient engagement tools. This technological convergence addresses the tech-savvy consumer segments while supporting medication adherence among elderly populations through simplified digital interfaces.

Rising Demand for Immunity-Boosting Formulations

Consumer interest in immune health support continues strengthening across Japan, driving innovation in vitamin, mineral, and herbal supplement categories. For example, Kirin Holdings’ proprietary Plasma Lactobacillus series, which includes immune-supporting beverages and functional foods, recorded roughly a 20% year-on-year increase in sales value in 2025, reflecting growing consumer uptake of immune-focused products. Manufacturers are introducing advanced formulations incorporating traditional Japanese ingredients alongside scientifically-validated compounds, appealing to consumers seeking holistic wellness solutions. This trend reflects broader shifts toward preventive healthcare approaches within the Japanese population.

Premiumization of Skincare and Dermatological Products

The OTC dermatological segment is experiencing premiumization as consumers increasingly prioritize high-efficacy skincare solutions. Japanese manufacturers are leveraging advanced formulation technologies to develop products addressing specific skin concerns including anti-aging, moisturization, and sensitivity management. For example, in November 2025, Nivea Kao (a joint venture of Kao and Beiersdorf) launched a premium Eucerin anti-aging skincare series tailored to Japanese consumers, highlighting dermatological science and high-quality actives to meet sophisticated local demand. The emphasis on quality ingredients and clinically-proven effectiveness resonates strongly with discerning Japanese consumers.

Market Outlook 2026-2034:

The Japan over-the-counter pharmaceutical market is positioned for continued growth throughout the forecast period, underpinned by demographic trends favoring self-medication, evolving regulatory frameworks facilitating OTC switches from prescription medications, and sustained consumer emphasis on preventive healthcare. The expansion of e-commerce channels is expected to complement traditional pharmacy distribution, enhancing product accessibility particularly in rural regions. Innovation in formulation technologies and the integration of functional food concepts within OTC offerings will likely create new growth avenues, while the ongoing convergence of traditional. The market generated a revenue of USD 11,083.98 Million in 2025 and is projected to reach a revenue of USD 17,232.52 Million by 2034, growing at a compound annual growth rate of 5.03% from 2026-2034.

Japan Over-the-Counter Pharmaceutical Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Analgesics | 26% |

| Distribution Channel | Pharmacies and Drug Stores | 58% |

| Formulation | Tablets and Capsules | 54% |

| Region | Kanto Region | 37% |

Product Type Insights:

- Analgesics

- Cold and Cough Remedies

- Vitamins and Dietary Supplements

- Gastrointestinal Products

- Dermatological

- Others

The analgesics dominates with a market share of 26% of the total Japan over-the-counter pharmaceutical market in 2025.

The analgesics category maintains leadership position driven by Japan's aging demographic profile, where musculoskeletal conditions and chronic pain management represent significant healthcare concerns. The segment benefits from strong brand loyalty among Japanese consumers who demonstrate preference for established formulations with proven efficacy profiles. Manufacturers continue investing in product differentiation through advanced delivery mechanisms and combination formulations addressing multiple pain-related symptoms simultaneously. For example, in November 2025, SSP Co., Ltd. presented new research on applying novel formulation technologies to combined ibuprofen and acetaminophen OTC analgesics at a medical conference, underscoring ongoing innovation in high-performance pain relief products.

Consumer accessibility remains a key strength of the analgesics segment, with products available across diverse retail channels including pharmacies, convenience stores, and online platforms. The regulatory framework in Japan permits certain analgesic formulations for general sale, expanding market reach beyond traditional pharmacy settings. Additionally, marketing strategies emphasizing fast-acting relief and minimal side effects resonate effectively with health-conscious Japanese consumers seeking immediate symptomatic relief.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retail

- Others

The pharmacies and drug stores lead with a share of 58% of the total Japan over-the-counter pharmaceutical market in 2025.

Pharmacies and drug stores maintain dominant market position through their established infrastructure spanning urban centers and rural communities across Japan. The presence of licensed pharmacists provides valuable consultation services that enhance consumer confidence in product selection and appropriate usage. Japanese regulatory requirements mandating pharmacist oversight for certain OTC categories further reinforce the channel's significance within the distribution landscape. In December 2025, Tsuruha Holdings Inc. and Welcia Holdings Co. completed a business integration to form one of Japan’s largest drugstore chains, a strategic move expected to strengthen pharmacy and OTC product distribution and expand service offerings nationwide.

The pharmacy channel benefits from consumer trust established through decades of professional healthcare service delivery in Japan. Drug store chains have evolved into comprehensive health and wellness destinations, offering expanded product assortments alongside traditional pharmaceutical offerings. Strategic store locations, extended operating hours, and loyalty programs contribute to sustained channel preference among Japanese consumers seeking convenient access to OTC medications.

Formulation Insights:

- Tablets and Capsules

- Liquids and Syrups

- Topicals

- Creams

- Ointments

- Others

The tablets and capsules dominate with a market share of 54% of the total Japan over-the-counter pharmaceutical market in 2025.

Tablets and capsules maintain market leadership through inherent advantages including precise dosing accuracy, extended product stability, and convenient portability that aligns with busy Japanese consumer lifestyles. The formulation type benefits from manufacturing efficiencies enabling competitive pricing while maintaining quality standards expected by discerning consumers. Continuous innovation in coating technologies and modified-release mechanisms enhances product performance and consumer compliance. According to reports, in December 2025, Sawai Pharmaceutical Co., Ltd. announced the listing of five additional generic tablet and capsule products with nine strengths in Japan’s National Health Insurance drug price list, expanding its solid oral dosage portfolio and reinforcing the strategic importance of tablet and capsule formulations in the domestic pharmaceutical supply.

Consumer preference for solid oral dosage forms reflects cultural familiarity and ease of administration without requiring measuring devices or refrigeration. The segment accommodates diverse therapeutic applications from pain relief to nutritional supplementation, providing manufacturers flexibility in product development. Advances in formulation science enable incorporation of multiple active ingredients within single tablet or capsule formats, addressing consumer demand for comprehensive wellness solutions.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 37% share of the total Japan over-the-counter pharmaceutical market in 2025.

The Kanto Region market leadership stems from its position as Japan's most populous area, encompassing the Tokyo metropolitan region and surrounding prefectures including Kanagawa, Saitama, and Chiba. The concentration of economic activity generates higher disposable incomes supporting premium OTC product purchases. Dense retail infrastructure, including extensive pharmacy networks and convenience store chains, ensures comprehensive product availability across the region.

Consumer behavior in the Kanto region reflects sophisticated health awareness and openness to innovative product offerings. The presence of corporate headquarters for major pharmaceutical companies facilitates early market introduction of new formulations within the region. Additionally, the diverse demographic composition including working professionals, families, and elderly populations creates broad demand across OTC therapeutic categories and formulation types.

Market Dynamics:

Growth Drivers:

Why is the Japan Over-the-Counter Pharmaceutical Market Growing?

Aging Population and Rising Self-Medication Practices

Japan's demographic structure, characterized by one of the world's highest proportions of elderly citizens, fundamentally drives OTC pharmaceutical market expansion. The aging population generates sustained demand for medications addressing age-related health concerns including pain management, cardiovascular support, and cognitive wellness. Self-medication practices have become increasingly prevalent as older consumers seek convenient alternatives to physician consultations for minor ailments. To support responsible self‑care among Japan’s aging population, the Ministry of Health, Labour and Welfare and the OTC Drug Association have been promoting the Self‑Care Promotion Policy in 2025, encouraging greater use of OTC medicines and self‑medication practices to help alleviate pressure on the healthcare system and better cater to older adults’ needs. The cultural acceptance of responsible self-care, combined with high health literacy among Japanese citizens, supports informed OTC product selection. Healthcare cost considerations further encourage self-medication approaches, as consumers recognize the economic advantages of treating minor conditions independently.

Regulatory Framework Supporting OTC Switches

The Japanese regulatory environment has progressively facilitated the transition of prescription medications to OTC status through systematic switch programs. The Pharmaceuticals and Medical Devices Agency evaluates established prescription compounds for potential reclassification based on safety profiles and appropriate self-medication applicability. Successful switches expand therapeutic options available to consumers without prescription requirements, broadening the OTC market scope. This regulatory evolution reflects government recognition of self-medication benefits in reducing healthcare system burden while maintaining appropriate consumer safety standards. Manufacturers actively pursue switch opportunities, developing consumer-oriented formulations and educational materials supporting safe OTC usage.

E-Commerce Channel Expansion and Digital Health Integration

The expansion of online retail channels has transformed OTC pharmaceutical accessibility across Japan, particularly benefiting consumers in rural areas with limited pharmacy access. Regulatory modifications permitting online sales of certain OTC categories have catalyzed e-commerce growth within the sector. The Japan e-commerce market size reached USD 258.0 Billion in 2024, and looking forward, IMARC Group expects it to reach USD 692.8 Billion by 2033, highlighting the rapid expansion of online retail channels that OTC companies can leverage. Digital platforms offer comprehensive product information, consumer reviews, and price comparison capabilities enhancing purchase decision-making. The integration of digital health technologies with OTC offerings, including companion applications for symptom tracking and medication reminders, adds value beyond traditional product delivery. Manufacturers and retailers are investing in omnichannel strategies connecting physical pharmacy services with digital conveniences to capture evolving consumer preferences.

Market Restraints:

What Challenges the Japan Over-the-Counter Pharmaceutical Market is Facing?

Stringent Regulatory Requirements

The Japanese pharmaceutical regulatory framework imposes rigorous requirements for OTC product development, approval, and marketing that can extend time-to-market timelines and increase compliance costs. Manufacturers must navigate complex classification systems determining product distribution channels and marketing restrictions. Post-market surveillance obligations and adverse event reporting requirements add operational complexity for market participants.

Market Saturation in Mature Categories

Certain OTC pharmaceutical categories in Japan have reached maturity stages characterized by limited differentiation opportunities and intensified price competition. Established brands face challenges maintaining market share against generic alternatives and private label offerings. Consumer switching behavior and promotional sensitivity in saturated categories pressure manufacturer margins and require sustained marketing investment.

Competition from Alternative Health Products

The OTC pharmaceutical sector faces growing competition from functional foods, dietary supplements, and wellness products that address similar consumer health concerns. Japanese consumers demonstrate openness to diverse health product formats, potentially diverting spending from traditional OTC medications. The regulatory distinction between pharmaceutical and food categories influences product positioning strategies and competitive dynamics.

Competitive Landscape:

The Japan over-the-counter pharmaceutical market features a competitive environment characterized by the presence of established domestic pharmaceutical corporations alongside multinational healthcare enterprises. Market participants compete across multiple dimensions including product innovation, brand equity, distribution network strength, and marketing effectiveness. Domestic manufacturers leverage deep understanding of Japanese consumer preferences and established relationships with pharmacy channels, while international competitors bring global research capabilities and diverse product portfolios. Strategic differentiation increasingly emphasizes value-added services including consumer education programs, digital health integration, and personalized wellness solutions. Mergers and acquisitions activity reflects industry consolidation trends as companies seek scale advantages and complementary capabilities. The competitive landscape continues evolving as market participants adapt to changing consumer behaviors, regulatory developments, and technological advancements shaping the future of self-medication in Japan.

Recent Developments:

- In June 2025, Eisai Co., Ltd. announced the launch of Pariet® S, marking the first proton pump inhibitor (PPI) to be approved for over-the-counter sale in Japan to relieve severe heartburn and acid reflux, with the same rabeprazole sodium dosage as the prescription version.

Japan Over-the-Counter Pharmaceutical Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Analgesics, Cold and Cough Remedies, Vitamins and Dietary Supplements, Gastrointestinal Products, Dermatological, Others |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retail, Others |

| Formulations Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan over-the-counter pharmaceutical market size was valued at USD 11,083.98 Million in 2025.

The Japan over-the-counter pharmaceutical market is expected to grow at a compound annual growth rate of 5.03% from 2026-2034 to reach USD 17,232.52 Million by 2034.

Analgesics dominated the market with approximately 26% share, driven by Japan's aging population requiring pain management solutions and strong consumer familiarity with established formulations.

Key factors driving the Japan over-the-counter pharmaceutical market include aging demographics increasing self-medication demand, regulatory frameworks supporting OTC switches, and e-commerce channel expansion enhancing product accessibility.

Major challenges include stringent regulatory requirements extending product development timelines, market saturation in mature therapeutic categories, and competition from alternative health products including functional foods and dietary supplements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)