Japan Packaged Beverages Market Size, Share, Trends and Forecast by Type, Packaging Type, Distribution Channel, and Region, 2026-2034

Japan Packaged Beverages Market Overview:

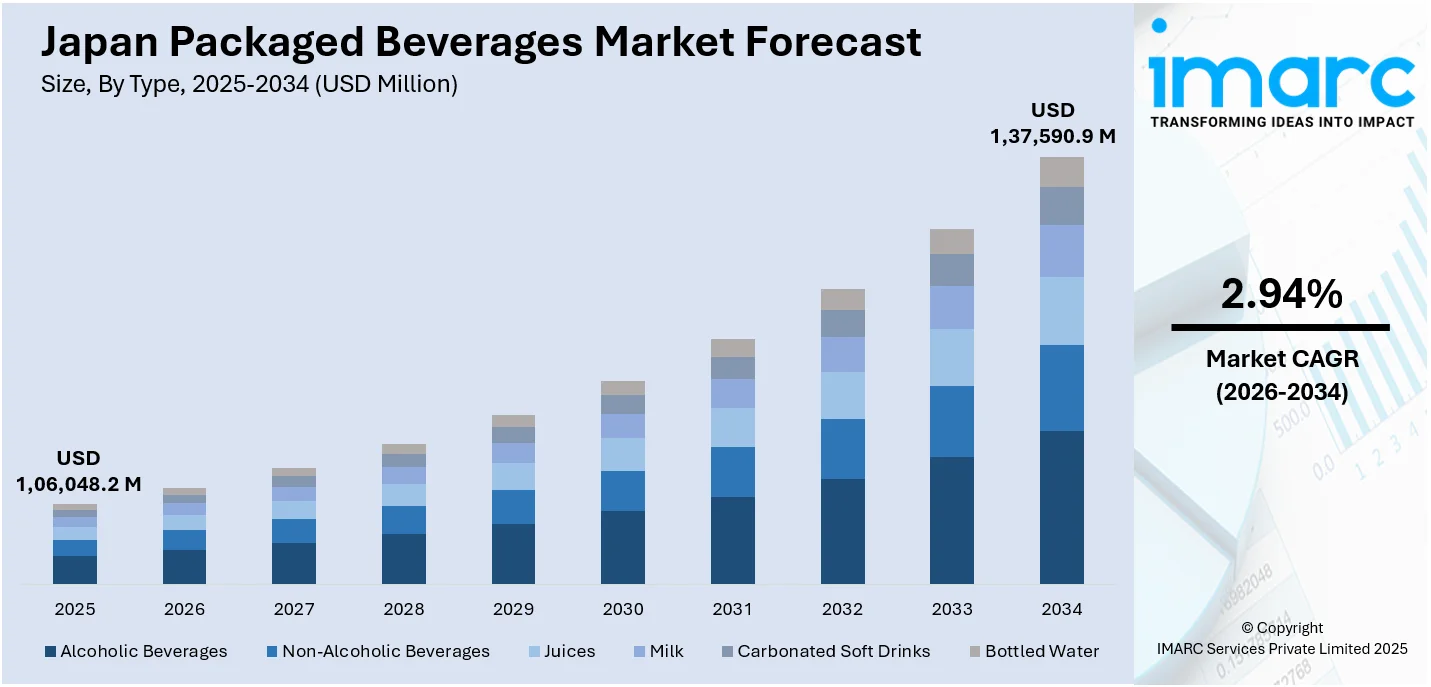

The Japan packaged beverages market size reached USD 1,06,048.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,37,590.9 Million by 2034, exhibiting a growth rate (CAGR) of 2.94% during 2026-2034. Japanese cultural ties to traditional beverages are influencing the packaged drink market, as consumers seek convenience without sacrificing familiar flavors. Additionally, social media trends, such as influencer collaborations and visually appealing drinks, significantly influence consumer behavior and product popularity in a competitive market, further contributing to the expansion of the Japan packaged beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,06,048.2 Million |

| Market Forecast in 2034 | USD 1,37,590.9 Million |

| Market Growth Rate 2026-2034 | 2.94% |

Japan Packaged Beverages Market Trends:

Cultural Influence and Traditional Beverage Popularity

Japanese culture has historically been closely tied to drinks, such as green tea, sake, and traditional herbal infusions, and this cultural connection is now influencing the packaged beverage industry. With health-focused buyers wanting recognizable tastes paired with convenience, classic beverages are being transformed into ready-to-drink (RTD) options. Green tea, in particular, is experiencing a rise in popularity both in Japan and worldwide due to its health benefits, including antioxidants and digestive support. To meet this demand, beverage companies are offering traditional drinks in convenient packaging while also entering international markets. For example, in 2024, Kirin Beverage introduced the exclusive "JAPAN BLEND & CRAFT Grape Tea" for a limited period. This innovative product blended homegrown tea leaves with Nagano Purple grapes and emphasized classic Japanese artisanal skills. Methods like "hiire" roasting and incorporating sansho pepper produced a unique taste, merging traditional techniques with contemporary tastes. Kirin's action showcased the trend of using local, high-quality ingredients in drinks while appealing to regional preferences and global demand. By launching products like these, drink manufacturers are capitalizing on the growing interest in classic tastes while appealing to a younger audience seeking convenience without compromising on quality. The fusion of classic ingredients with modern packaging is strengthening the Japan packaged beverages market growth, demonstrating a significant cultural influence that transcends borders worldwide.

To get more information on this market Request Sample

Strong Influence of Social Media and Marketing Trends

Social media is becoming a powerful tool in shaping consumer behavior and trends in packaged beverage market, particularly among younger generations. Brands are progressively utilizing social media platforms to develop viral marketing strategies that engage a large audience, particularly via partnerships with influencers. These collaborations enhance brand awareness and increase interaction, facilitating the creation of enthusiasm for new products. The rise in demand for visually striking, picture-friendly drinks, like vibrant smoothies or creatively crafted packaging, is driving interest in products that not only taste delicious but also provide a pleasing visual experience. Social media is aiding in the promotion of unique beverages, including seasonal or limited-edition items, that generate a feeling of exclusivity and urgency for consumers. A prominent instance of this trend is the 2024 partnership between Suntory and Netflix Japan, which introduced the Horoyoi Netflix Cola Sour. This canned drink, containing a light 3% alcohol, was a new release that captured Netflix's cultural impact, showcasing designs linked to series such as Squid Game and Love Village. The debut of these visually and culturally significant drinks, enhanced via social media, illustrates how beverage companies are harnessing consumer enthusiasm and influencing trends. With social media influencing consumer choices, beverage companies are discovering innovative methods to leverage it as a robust marketing instrument, providing them with a notable advantage in a progressively competitive landscape.

Japan Packaged Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, packaging type, and distribution channel.

Type Insights:

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Juices

- Milk

- Carbonated Soft Drinks

- Bottled Water

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes alcoholic beverages, non-alcoholic beverages, juices, milk, carbonated soft drinks, and bottled water.

Packaging Type Insights:

- Cartons

- Cans

- Bottles

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes cartons, cans, bottles, and others.

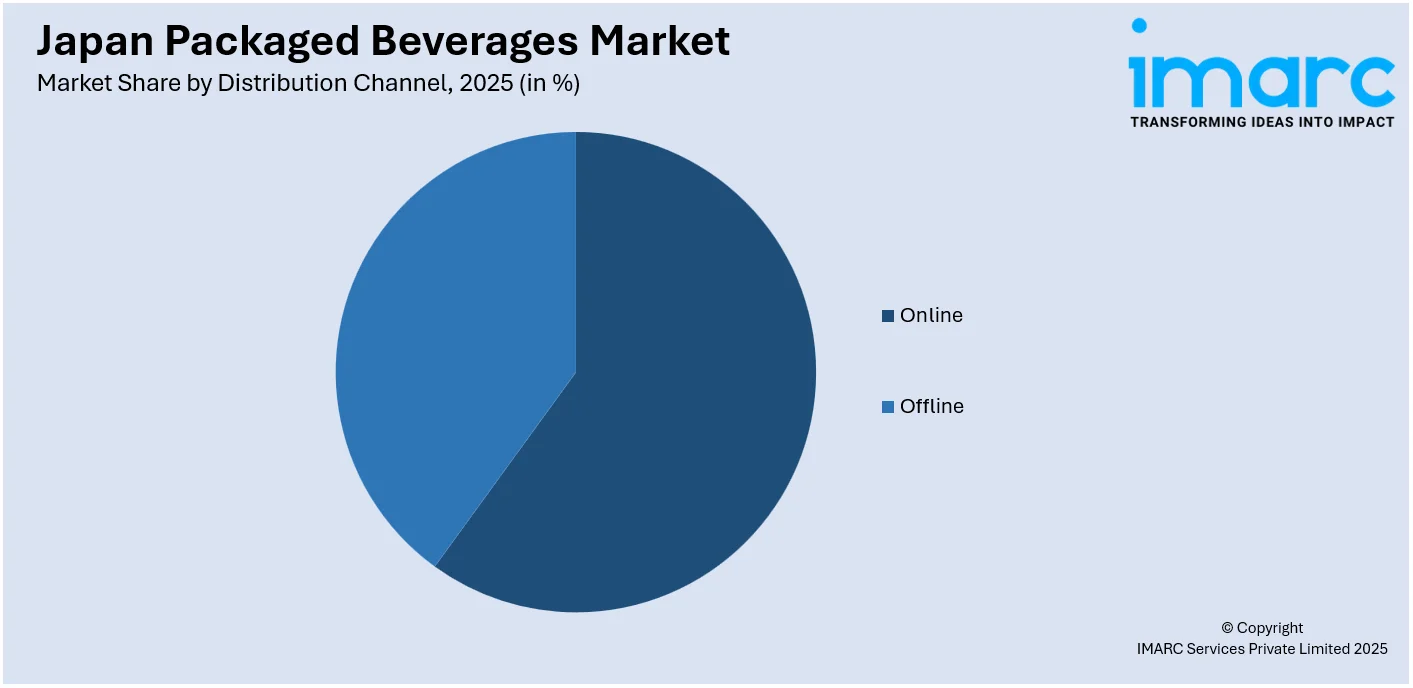

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Packaged Beverages Market News:

- In October 2024, Suntory announced it will release the Suntory Premium Highball Yamazaki, featuring unblended whisky from its Yamazaki Distillery. Priced at 660 yen per can, this was the second installment in its premium canned highball series. The release targeted younger consumers amid rising whisky demand in Japan.

- In June 2024, ITO EN launched two premium beverages in Japan Crunchy Smoothie (with carrot pieces) and Crispy Potage (with onion bits) using SIG’s SmileSmall carton packs and Drinksplus technology. These drinks offered a unique texture with real vegetable bits for an enhanced, on-the-go experience. The packaging was sustainable, FSC-certified, and fully recyclable.

Japan Packaged Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alcoholic Beverages, Non-Alcoholic Beverages, Juices, Milk, Carbonated Soft Drinks, Bottled Water |

| Packaging Types Covered | Cartons, Cans, Bottles, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan packaged beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan packaged beverages market on the basis of type?

- What is the breakup of the Japan packaged beverages market on the basis of packaging type?

- What is the breakup of the Japan packaged beverages market on the basis of distribution channel?

- What is the breakup of the Japan packaged beverages market on the basis of region?

- What are the various stages in the value chain of the Japan packaged beverages market?

- What are the key driving factors and challenges in the Japan packaged beverages market?

- What is the structure of the Japan packaged beverages market and who are the key players?

- What is the degree of competition in the Japan packaged beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan packaged beverages market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan packaged beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan packaged beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)