Japan Palletized Cargo Market Size, Share, Trends and Forecast by Pallet Type, Cargo Type, Mode of Transportation, End Use Industry, and Region, 2026-2034

Japan Palletized Cargo Market Summary:

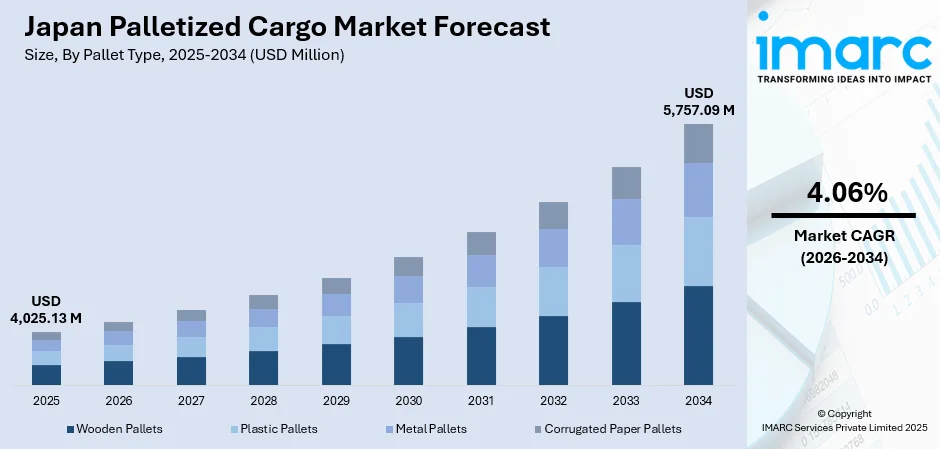

The Japan palletized cargo market size was valued at USD 4,025.13 Million in 2025 and is projected to reach USD 5,757.09 Million by 2034, growing at a compound annual growth rate of 4.06% from 2026-2034.

The Japan palletized cargo market is experiencing robust expansion driven by the nation's stringent environmental regulations and corporate sustainability initiatives. A paradigm shift is occurring in the logistics industry as companies are increasingly focusing on effective cargo management systems to solve labor inefficiencies and to balance the increased pressure of fulfilling e-commerce demands. The adoption of eco-friendly pallet materials and circular economy practices has been brought forward by the fact that Japan has made it its goal to be carbon neutral by 2050, and automation technologies are still radically transforming warehouse operations in significant industrial centres.

Key Takeaways and Insights:

-

By Pallet Type: Wooden pallets dominate the market with a share of 45% in 2025, owing to their cost-effectiveness, widespread availability, and compatibility with established logistics infrastructure across Japan's manufacturing and distribution networks.

-

By Cargo Type: Dry cargo leads the market with a share of 51% in 2025, driven by the extensive movement of manufactured goods, consumer products, and industrial materials through Japan's robust supply chain ecosystem.

-

By Mode of Transportation: Road transport represents the largest segment with a market share of 49% in 2025, reflecting the dominance of trucking networks in connecting manufacturing facilities, distribution centers, and retail destinations across the archipelago.

-

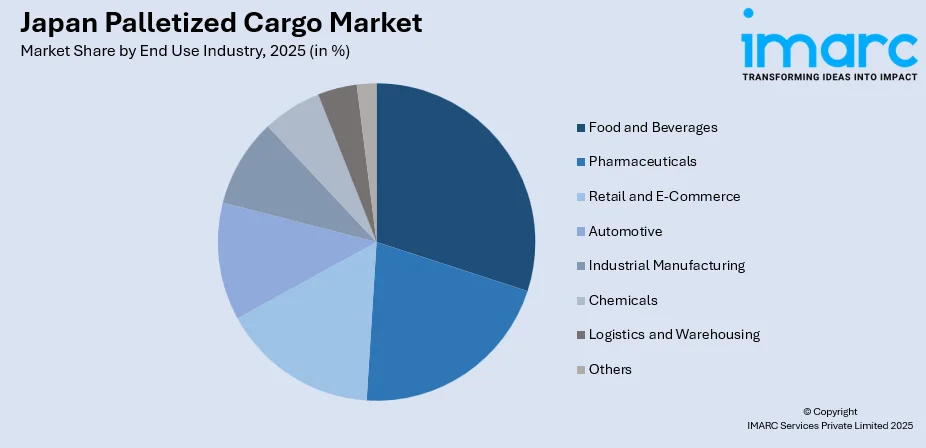

By End Use Industry: Food and beverages accounts for the largest revenue share of approximately 26% in 2025, underpinned by Japan's sophisticated cold chain infrastructure and stringent food safety requirements that necessitate efficient palletized handling.

-

By Region: Kanto region dominates with approximately 32% market share in 2025, benefiting from the concentration of major logistics hubs, ports, and manufacturing centers in the greater Tokyo metropolitan area.

-

Key Players: The Japan palletized cargo market exhibits a moderately fragmented competitive landscape, characterized by the presence of established logistics conglomerates, specialized pallet manufacturers, and innovative pooling service providers competing across diverse industry verticals.

To get more information on this market Request Sample

Japan's palletized cargo sector stands at the intersection of technological innovation and regulatory evolution. The industry is undergoing significant transformation as companies navigate the challenges posed by the country's demographic shifts and the implementation of new overtime regulations for truck drivers, commonly referred to as the "2024 problem." This regulatory change has catalyzed investments in automation and efficiency-enhancing technologies across the logistics value chain. The Sustainable Shared Transport and Fujitsu partnership, launched in February 2025, exemplifies this trend by creating an open logistics platform that optimizes trunk transportation using standardized pallet units, connecting shippers and carriers to reduce empty mileage and improve driver working conditions. Furthermore, Japan's Green Transformation program, supported by substantial government funding, continues to drive the adoption of sustainable pallet solutions and energy-efficient logistics practices, positioning the market for sustained growth through the forecast period.

Japan Palletized Cargo Market Trends:

Accelerated Adoption of Automated Pallet Handling Systems

The integration of robotic palletizing systems, automated guided vehicles, and AI-driven warehouse management solutions is rapidly transforming Japan's logistics infrastructure. For instance, in July 2024, Dexterity and Sumitomo Corporation announced the establishment of Dexterity-SC Japan, a new partnership dedicated to accelerating the adoption of AI-powered robotics in warehouse, supply chain, and logistics operations. The joint venture will deliver solutions for truck loading/unloading and pallet handling, enabling companies to better leverage human resources and streamline industrial processes. Companies are deploying collaborative robots and autonomous mobile forklifts to address chronic labor shortages while enhancing operational precision. The emergence of good-to-person systems in urban warehouses is optimizing picking cycles and reducing manual travel distances. Notably, the International Federation of Robotics has highlighted that mobile robot solutions can save truck drivers up to twenty-five percent of their working time by automating loading and unloading tasks, making automation a strategic priority for logistics operators.

Expansion of Pallet Pooling and Rental Services

Japan's circular economy policies are driving the proliferation of pallet pooling services as businesses seek cost-effective and environmentally responsible logistics solutions. The pooling model allows companies to share standardized pallets across supply chains, reducing capital expenditure and material consumption. Industry leaders have demonstrated that pallet rental services can achieve a seventy-six percent reduction in carbon dioxide emissions compared to disposable alternatives. The standardized palletizing system established by Japanese Industrial Standards continues to provide a foundation for efficient pooling operations across industries.

Integration of IoT and Digital Tracking Technologies

The deployment of IoT-enabled pallets and blockchain-based tracking systems is revolutionizing cargo visibility and inventory management across Japan's logistics networks. The Japan internet of things market size reached USD 60,477.6 Million in 2024. Looking forward, the market is expected to reach USD 1,86,064.6 Million by 2033, exhibiting a growth rate (CAGR) of 13.30% during 2025-2033. Real-time monitoring solutions enable precise temperature tracking for temperature-sensitive goods while optimizing asset utilization throughout the supply chain. The government's Physical Internet roadmap is promoting data integration using IoT and AI technologies, with goals to standardize logistics materials and create interconnected transportation networks. These digital innovations are enhancing operational transparency and enabling predictive maintenance capabilities.

Market Outlook 2026-2034:

The Japan palletized cargo market is poised for steady expansion as the logistics sector continues its digital transformation journey. Industry stakeholders are increasingly adopting automation technologies and sustainable practices to navigate regulatory changes and address workforce constraints. The convergence of e-commerce growth, manufacturing sector recovery, and infrastructure investments will sustain demand for efficient palletized cargo solutions. Strategic partnerships between technology providers and logistics operators are expected to accelerate innovation adoption, while government initiatives supporting decarbonization and circular economy practices will reshape competitive dynamics. The market generated a revenue of USD 4,025.13 Million in 2025 and is projected to reach a revenue of USD 5,757.09 Million by 2034, growing at a compound annual growth rate of 4.06% from 2026-2034.

Japan Palletized Cargo Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Pallet Type |

Wooden Pallets |

45% |

|

Cargo Type |

Dry Cargo |

51% |

|

Mode of Transportation |

Road Transport |

49% |

|

End Use Industry |

Food and Beverages |

26% |

|

Region |

Kanto Region |

32% |

Pallet Type Insights:

- Wooden Pallets

- Plastic Pallets

- Metal Pallets

- Corrugated Paper Pallets

The wooden pallets segment dominates with a market share of 45% of the total Japan palletized cargo market in 2025.

Wooden pallets dominate Japan’s palletized cargo market due to their affordability and practicality for domestic logistics operations. They are easy to repair and maintain, ensuring extended service life, while their compatibility with existing forklifts, racking systems, and warehouse layouts makes them highly convenient for manufacturers and distributors. Established timber supply chains and well-developed refurbishment networks further enhance their reliability, allowing businesses to manage costs effectively while maintaining operational efficiency across a wide range of cargo types and weights.

The structural versatility of wooden pallets allows them to accommodate diverse goods, from light consumer products to heavy industrial shipments, making them suitable for various supply chain applications. They are favored for domestic transportation where international phytosanitary requirements are not a constraint. Coupled with a mature ecosystem for repair, recycling, and refurbishment, wooden pallets continue to offer a sustainable and cost-effective solution for Japan’s logistics sector, reinforcing their dominant market position over alternative pallet materials such as plastic or metal.

Cargo Type Insights:

- Dry Cargo

- Perishable Cargo

- Hazardous Cargo

- Heavy Equipment and Machinery

The dry cargo segment leads with a share of 51% of the total Japan palletized cargo market in 2025.

Dry cargo encompasses the majority of palletized shipments in Japan, reflecting the nation's diverse manufacturing base and extensive consumer goods distribution networks. This segment includes manufactured products, automotive components, electronics, textiles, and general merchandise that require efficient handling but do not necessitate temperature control. The expansion of e-commerce has significantly amplified dry cargo volumes as online retailers rely on palletized systems for warehouse operations and last-mile distribution efficiency.

Japan's robust industrial sector generates substantial demand for dry cargo palletization across automotive manufacturing, electronics assembly, and consumer goods production. The standardization of pallet dimensions under Japanese Industrial Standards facilitates seamless cargo transfer between road, rail, and maritime transportation modes, enhancing supply chain efficiency for dry goods movement throughout the archipelago.

Mode of Transportation Insights:

- Road Transport

- Rail Transport

- Air Transport

- Sea Transport

The road transport segment exhibits clear dominance with a 49% share of the total Japan palletized cargo market in 2025.

Road transport remains the backbone of Japan's palletized cargo movement, offering unmatched flexibility for point-to-point deliveries across the country's extensive highway network. The Japan road freight transport market size reached USD 173.9 Billion in 2025. Looking forward, the market is expected to reach USD 214.3 Billion by 2034, exhibiting a growth rate (CAGR) of 2.35% during 2026-2034. The trucking industry handles the critical first-mile and last-mile segments of supply chains, connecting manufacturing facilities to distribution centers and retail destinations. The implementation of driver overtime regulations has prompted logistics operators to optimize route planning and adopt relay transportation models that maintain service levels while complying with labor requirements.

The road transport segment is experiencing a significant transformation through the adoption of automated loading systems and standardized pallet configurations that reduce manual handling time. Logistics providers are investing in fleet management technologies and collaborative platforms that match cargo with available trucking capacity, improving asset utilization rates and reducing empty mileage across transportation networks.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Pharmaceuticals

- Retail and E-Commerce

- Automotive

- Industrial Manufacturing

- Chemicals

- Logistics and Warehousing

- Others

The food and beverages segment dominates with a market share of 26% of the total Japan palletized cargo market in 2025.

The food and beverages industry represents the largest end-use segment for palletized cargo in Japan, reflecting the nation's sophisticated cold chain infrastructure and stringent food safety requirements. The sector demands specialized pallet handling for temperature-sensitive products, including dairy, seafood, frozen foods, and fresh produce. Japan's high consumer expectations for product freshness and quality necessitate efficient palletized logistics that minimize handling time and maintain temperature integrity throughout distribution networks.

Several collaborations among major frozen food and seafood companies demonstrate the industry's commitment to developing innovative logistics systems that address capacity constraints. The integration of multi-temperature logistics capabilities enables food processors to consolidate shipments across product categories, optimizing transportation efficiency while maintaining distinct temperature zones for diverse product requirements.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region dominates with approximately 32% market share of the total Japan palletized cargo market in 2025.

The Kanto region's market leadership stems from its position as Japan's economic and population center, encompassing the greater Tokyo metropolitan area along with surrounding prefectures. The region hosts the nation's largest port facilities at Tokyo Bay and Yokohama, serving as primary gateways for international trade and domestic distribution. The concentration of major logistics hubs, distribution centers, and manufacturing facilities creates substantial demand for palletized cargo handling services across diverse industry sectors.

The Kanto region benefits from advanced logistics infrastructure including automated warehouses, intermodal transportation facilities, and sophisticated cold chain networks that support complex supply chain operations. The area's high population density and consumer purchasing power generate significant e-commerce volumes that require efficient palletized fulfillment operations, while the presence of corporate headquarters drives demand for premium logistics services.

Market Dynamics:

Growth Drivers:

Why is the Japan Palletized Cargo Market Growing?

Regulatory Push Toward Logistics Efficiency and Labor Reform

The implementation of overtime regulations limiting truck driver working hours has fundamentally altered Japan's logistics landscape, creating compelling incentives for efficiency improvements in cargo handling operations. Companies are compelled to maximize productivity during constrained operating windows, driving investments in palletization systems that accelerate loading and unloading processes. The regulatory environment has catalyzed collaborative initiatives among shippers and carriers to optimize transportation networks through standardized pallet configurations and shared logistics platforms. This regulatory framework aligns with broader government objectives to improve working conditions in the transportation sector while maintaining supply chain reliability, positioning palletized cargo solutions as essential enablers of compliant and efficient logistics operations.

Sustained E-Commerce Expansion and Fulfillment Modernization

Japan's e-commerce sector continues experiencing robust growth as consumer preferences shift toward online purchasing across product categories ranging from groceries to consumer electronics. The Japan e-commerce market size reached USD 258.0 Billion in 2024. Looking forward, the market is expected to reach USD 692.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025-2033. This expansion generates substantial demand for efficient warehouse operations and rapid order fulfillment capabilities that rely on sophisticated palletized storage and retrieval systems. E-commerce operators are investing in automated fulfillment centers featuring robotic palletizing systems, goods-to-person technologies, and intelligent inventory management solutions that maximize space utilization and throughput. The requirement for same-day and next-day delivery services intensifies pressure on logistics networks to optimize palletized cargo handling throughout the distribution chain, from inbound receiving to outbound shipping operations.

Circular Economy Adoption and Sustainability Imperatives

Japan's national commitment to carbon neutrality by 2050 and the advancement of circular economy policies are reshaping demand patterns in the palletized cargo market. Companies are increasingly adopting reusable pallet systems and pooling services that reduce material consumption while lowering lifecycle environmental impacts. Government initiatives supporting green transformation provide financial incentives and regulatory frameworks that encourage sustainable logistics practices across industries. The growing emphasis on environmental, social, and governance considerations among corporate stakeholders reinforces demand for eco-friendly pallet solutions that demonstrate measurable sustainability benefits. This convergence of regulatory requirements and corporate responsibility objectives positions sustainable palletization as a strategic priority for logistics operators and their customers.

Market Restraints:

What Challenges is the Japan Palletized Cargo Market Facing?

Acute Labor Shortages in Logistics Operations

Japan's demographic challenges, characterized by an aging population and declining birth rates, create persistent workforce shortages that constrain logistics capacity. The trucking and warehousing sectors struggle to attract younger workers to physically demanding positions, limiting the operational expansion of palletized cargo services despite growing market demand.

High Capital Requirements for Automation Investments

The transition to automated palletized cargo handling systems requires substantial capital investments that may challenge smaller logistics operators and regional carriers. Implementation costs for robotic palletizing equipment, automated guided vehicles, and warehouse management systems create barriers to modernization for companies with limited financial resources.

Infrastructure Constraints in Urban Distribution

Dense urban environments in major Japanese cities present logistical challenges for palletized cargo delivery operations. Limited loading dock access, restricted vehicle maneuvering space, and congested transportation corridors complicate last-mile distribution efficiency, requiring specialized handling solutions that may increase operational complexity and costs.

Competitive Landscape:

The Japan palletized cargo market features a competitive landscape characterized by diverse participant categories including established logistics conglomerates, specialized pallet manufacturers, innovative pooling service providers, and technology-focused automation suppliers. Market participants are differentiating through technology investments, service integration capabilities, and sustainability credentials. Strategic partnerships between logistics operators and technology companies are accelerating the deployment of automated handling solutions, while collaborations among shippers and carriers are creating shared logistics platforms that optimize network efficiency. The competitive environment favors organizations capable of delivering comprehensive palletized cargo solutions that address customer requirements for efficiency, reliability, and environmental responsibility across increasingly complex supply chain networks.

Recent Developments:

-

November 2025: AiTEN Robotics opened a Japan subsidiary to strengthen its presence in intralogistics automation, offering autonomous mobile forklifts and material-handling robots designed for narrow aisles and complex operational environments across automotive, food and beverage, and manufacturing sectors.

-

April 2025: Rakuten Group Inc. introduced autonomous robots to deliver groceries and e-commerce items in Tokyo's Harumi district, marking advancement in automated guided vehicle technology extending from warehouse operations to urban last-mile logistics.

Japan Palletized Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pallet Types Covered | Wooden Pallets, Plastic Pallets, Metal Pallets, Corrugated Paper Pallets |

| Cargo Types Covered | Dry Cargo, Perishable Cargo, Hazardous Cargo, Heavy Equipment and Machinery |

| Mode of Transportations Covered | Road Transport, Rail Transport, Air Transport, Sea Transport |

| End Use Industries Covered | Food and Beverages, Pharmaceuticals, Retail and E-Commerce, Automotive, Industrial Manufacturing, Chemicals, Logistics and Warehousing, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan palletized cargo market size was valued at USD 4,025.13 Million in 2025.

The Japan palletized cargo market is expected to grow at a compound annual growth rate of 4.06% from 2026-2034 to reach USD 5,757.09 Million by 2034.

Wooden pallets dominated the market with approximately 45% share in 2025, driven by their cost-effectiveness, widespread availability, and compatibility with existing logistics infrastructure throughout Japan's supply chains.

Key factors driving the Japan palletized cargo market include regulatory reforms promoting logistics efficiency, sustained e-commerce expansion requiring advanced fulfillment capabilities, circular economy adoption encouraging sustainable pallet solutions, and automation investments addressing chronic labor shortages.

Major challenges include acute labor shortages driven by demographic changes, high capital requirements for automation system deployment, infrastructure constraints in dense urban distribution environments, and the complexity of coordinating standardization across diverse industry stakeholders.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)