Japan Paper Chemicals Market Size, Share, Trends and Forecast by Type, Form, and Region, 2026-2034

Japan Paper Chemicals Market Summary:

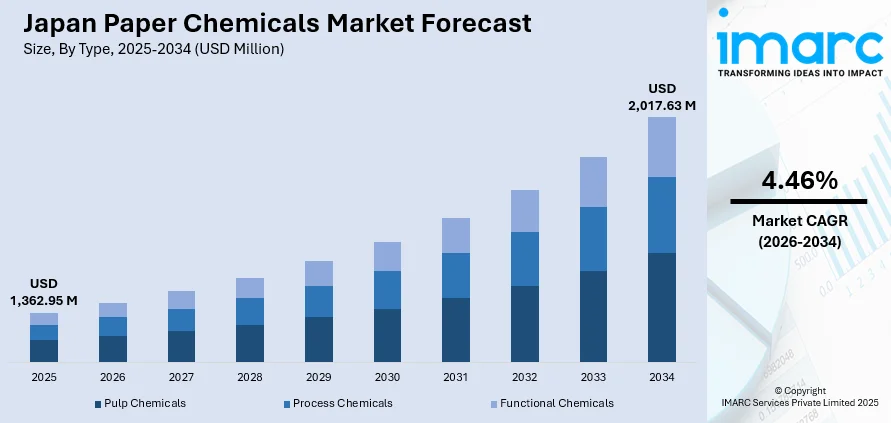

The Japan paper chemicals market size was valued at USD 1,362.95 Million in 2025 and is projected to reach USD 2,017.63 Million by 2034, growing at a compound annual growth rate of 4.46% from 2026-2034.

The Japan paper chemicals market is experiencing robust growth driven by the expanding demand for high-quality paper products used in packaging, printing, and publishing applications. The market benefits from technological advancements in paper production processes and increasing emphasis on environmentally sustainable manufacturing practices. Rising e-commerce activities and Japan's strong industrial base continue to fuel demand for specialty paper chemicals across diverse applications.

Key Takeaways and Insights:

-

By Type: Pulp chemicals dominate the market with a share of 42% in 2025, driven by substantial demand from bleaching, delignification, and fiber treatment processes essential for producing high-quality paper grades across Japan's established pulp and paper manufacturing facilities.

-

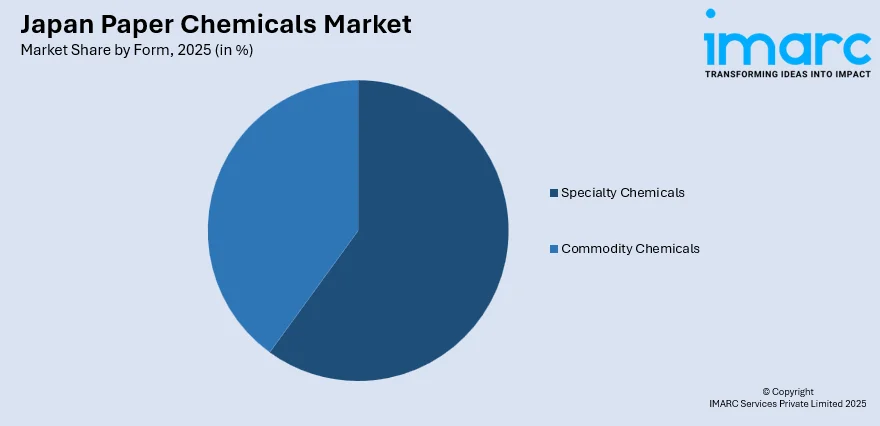

By Form: Specialty chemicals lead the market with a share of 60% in 2025, owing to their superior performance characteristics in enhancing paper strength, printability, water resistance, and surface properties demanded by premium packaging and specialty paper applications.

-

By Region: Kanto Region represents the largest segment with a market share of 28% in 2025, attributed to the concentration of major paper manufacturing facilities, extensive packaging industry presence, and proximity to Japan's largest consumer markets in the Tokyo metropolitan area.

-

Key Players: The Japan paper chemicals market exhibits a competitive landscape characterized by the presence of established domestic chemical manufacturers and global specialty chemical suppliers. Market participants compete through product innovation, sustainability-focused solutions, and strategic partnerships with paper mills to deliver customized chemical formulations.

To get more information on this market Request Sample

The Japan paper chemicals market continues to evolve in response to shifting industry dynamics and environmental imperatives. The country maintains its position as the third-largest paper producer globally, supporting substantial demand for diverse paper chemical categories. Market growth is underpinned by the accelerating transition toward sustainable packaging solutions, driven by regulatory restrictions on single-use plastics and growing consumer preference for eco-friendly alternatives. The Japanese government's policy framework targeting significant reductions in plastic waste by 2030 has positioned paper-based packaging as a preferred material choice, consequently elevating demand for specialty paper chemicals that enhance functionality while maintaining environmental compliance. Additionally, the expansion of mobile commerce and e-commerce platforms has catalyzed increased consumption of corrugated packaging and folding cartons, creating sustained demand for chemicals that improve paper strength, durability, and printability.

Japan Paper Chemicals Market Trends:

Transition Toward Sustainable and Bio-Based Chemical Formulations

Japanese paper chemical manufacturers are increasingly prioritizing the development and adoption of environmentally sustainable formulations aligned with national carbon neutrality targets for 2050. This transition encompasses bio-based sizing agents, enzyme-assisted processing chemicals, and recyclable coating materials that minimize environmental impact while maintaining performance standards. The Ministry of Economy, Trade and Industry (METI) and Japan Paper Association (JPA) continue to establish industry guidelines promoting eco-friendly chemical practices. For instance, in March 2025, chemical leader SNF and Japan's Mitsubishi Chemical Corporation announced a partnership to produce N-vinylformamide (NVF), an advanced monomer essential for sustainable polymers used in paper applications.

Growing Adoption of Advanced Functional Additives

The market is witnessing accelerated adoption of advanced functional additives including nanocellulose-based chemicals, enzyme treatments, and specialty coatings that enhance paper properties while reducing chemical consumption. These innovations support the production of lightweight yet durable paper grades suitable for premium packaging applications and digital printing compatibility. Japanese manufacturers are investing in mill-specific chemical customization to optimize wet-end processing, retention efficiency, and fiber bonding characteristics. Additionally, biodegradable coatings for food-contact packaging applications are gaining prominence as the food and beverage industry seeks sustainable packaging solutions.

Integration of Forest Biomass and Circular Economy Principles

Leading paper manufacturers in Japan are advancing circular economy initiatives by developing forest biomass applications and integrating renewable resource utilization into chemical production processes. This includes the development of wood-derived chemicals and by-product utilization from pulp manufacturing operations. Oji Holdings Corporation launched Japan's largest pilot plant for wood-derived sugar solution at their Yonago Mill, followed by a wood-derived ethanol pilot plant in March 2025, demonstrating the industry's commitment to sustainable material innovation.

Market Outlook 2026-2034:

The Japan paper chemicals market outlook remains positive, supported by structural demand from packaging applications and ongoing investments in sustainable manufacturing technologies. The expanding e-commerce sector continues to drive packaging material consumption, while stringent environmental regulations incentivize adoption of eco-friendly chemical solutions. Paper mills across Japan are increasingly investing in additives that improve operational efficiency, water usage optimization, and fiber bonding characteristics. In November 2024, Mitsubishi Heavy Industries and Hokuetsu Corporation launched a CO2 capture demonstration test at Hokuetsu's Niigata Mill, marking the first application of carbon capture technology in the pulp and paper sector and reflecting industry commitment to sustainability. The market generated a revenue of USD 1,362.95 Million in 2025 and is projected to reach a revenue of USD 2,017.63 Million by 2034, growing at a compound annual growth rate of 4.46% from 2026-2034.

Japan Paper Chemicals Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Pulp Chemicals |

42% |

|

Form |

Specialty Chemicals |

60% |

|

Region |

Kanto Region |

28% |

Type Insights:

- Pulp Chemicals

- Process Chemicals

- Functional Chemicals

The pulp chemicals dominate with a market share of 42% of the total Japan paper chemicals market in 2025.

Pulp chemicals constitute the foundation of paper manufacturing operations in Japan, encompassing bleaching agents, cooking chemicals, and delignification additives essential for converting raw wood materials into high-quality pulp suitable for diverse paper applications. These chemicals enable manufacturers to achieve desired brightness levels, fiber characteristics, and processing efficiency across both virgin and recycled pulp streams. The segment benefits from Japan's substantial paper production capacity and established infrastructure for chemical pulping operations.

The demand for pulp chemicals is sustained by Japan's well-established position as a leading global paper producer and the increasing emphasis on sustainable pulping processes across the industry. Japanese manufacturers continue investing in oxygen-based and chlorine-free bleaching technologies that minimize environmental impact while preserving pulp quality and brightness standards required for premium paper grades. The integration of enzyme-assisted pulping processes and advanced chemical recovery systems further optimizes resource utilization and supports circular economy objectives within the industry. Additionally, the growing adoption of recycled fiber processing has created demand for specialized deinking agents and contaminant control chemicals that enable effective utilization of recovered paper streams while maintaining finished product quality.

Form Insights:

Access the comprehensive market breakdown Request Sample

- Specialty Chemicals

- Commodity Chemicals

The specialty chemicals lead with a share of 60% of the total Japan paper chemicals market in 2025.

Specialty chemicals have emerged as the dominant form category due to their critical role in enhancing paper performance characteristics demanded by premium packaging, printing, and specialty paper applications. These formulations include advanced sizing agents, retention polymers, coating binders, and surface treatment chemicals that deliver targeted functionality including water resistance, printability enhancement, and barrier properties. The segment benefits from increasing demand for high-performance paper grades suitable for digital printing, food-contact packaging, and sustainable labeling applications.

The specialty chemicals segment continues to expand as manufacturers seek differentiated solutions that optimize production efficiency while meeting stringent quality and environmental compliance requirements. Investment in bio-based and low-VOC specialty formulations is accelerating, driven by corporate sustainability commitments and evolving regulatory frameworks. Paper mills increasingly prioritize specialty chemicals that enhance sheet characteristics, improve machine runnability, and reduce water consumption during manufacturing processes. The shift toward recyclable and compostable packaging applications further supports demand for innovative specialty chemical solutions.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 28% share of the total Japan paper chemicals market in 2025.

The Kanto Region maintains market leadership driven by its strategic economic position as Japan's primary manufacturing and consumption hub. The region encompasses the Tokyo metropolitan area alongside major industrial centers in Saitama, Chiba, and Kanagawa prefectures, housing significant paper manufacturing capacity and extensive packaging industry operations. The concentration of consumer goods companies, printing facilities, and packaging converters creates consistent demand for diverse paper chemical categories supporting both commodity and specialty paper production applications.

The region's paper chemicals demand is supported by robust e-commerce logistics infrastructure, premium packaging requirements for consumer goods distribution, and proximity to major brand owners seeking customized paper packaging solutions. Continued urbanization and the concentration of retail and distribution networks in the Greater Tokyo area sustain elevated demand for specialty paper chemicals that enhance packaging functionality, printability, and sustainability credentials. Advanced manufacturing facilities in the region increasingly adopt innovative chemical formulations.

Market Dynamics:

Growth Drivers:

Why is the Japan Paper Chemicals Market Growing?

Accelerating Demand for Sustainable Packaging Solutions

The Japan paper chemicals market is experiencing substantial growth driven by the accelerating shift toward sustainable packaging alternatives across multiple industries. Growing environmental awareness among consumers and regulatory pressure to reduce plastic waste have positioned paper-based packaging as a preferred material choice for food and beverage, personal care, and consumer goods applications. The Japanese government's comprehensive policy framework targeting significant reductions in single-use plastic generation and enhanced recycling rates has catalyzed industry-wide adoption of paper packaging solutions. This structural transition creates sustained demand for specialty paper chemicals that enhance barrier properties, moisture resistance, and mechanical strength while maintaining recyclability and biodegradability credentials. Paper chemical manufacturers are responding with innovative formulations including water-based coatings, bio-based sizing agents, and functional additives specifically designed to optimize paper packaging performance without compromising environmental sustainability objectives.

E-Commerce Expansion Driving Packaging Material Consumption

The continued expansion of electronic commerce and mobile commerce platforms in Japan is generating sustained demand for paper-based packaging materials including corrugated boxes, folding cartons, and protective packaging solutions. Japan maintains one of the world's highest rates of internet penetration and digital commerce adoption, with e-commerce sales volumes continuing to expand across consumer product categories. This growth trajectory directly translates into increased consumption of paper packaging materials requiring specialty chemicals for strength enhancement, printability optimization, and surface treatment applications. The logistics infrastructure supporting e-commerce fulfillment demands packaging solutions that protect products during shipping while meeting sustainability expectations of environmentally conscious consumers. Paper chemical suppliers are developing customized formulations that improve package durability, enable high-quality graphics reproduction, and reduce material weight without sacrificing protective performance.

Technological Innovation in Chemical Formulations and Manufacturing Processes

Ongoing technological advancements in paper chemical formulations and manufacturing processes are enabling market expansion by improving product performance while reducing environmental impact. Japanese chemical manufacturers are investing in research and development activities focused on enzyme-assisted processing, nanocellulose-based additives, and bio-based chemical alternatives that deliver superior functionality compared to conventional formulations. These innovations support the production of high-performance specialty papers suitable for demanding applications including digital printing, food-contact packaging, and technical papers requiring specific barrier or functional properties. The integration of advanced process control technologies and predictive maintenance systems in paper mills is optimizing chemical consumption efficiency and enabling real-time formulation adjustments that improve quality consistency while reducing waste generation.

Market Restraints:

What Challenges the Japan Paper Chemicals Market is Facing?

Declining Demand for Printing and Communication Papers

The ongoing digitalization of media consumption and business communications continues to reduce demand for printing and communication papers, constraining growth in associated paper chemical categories. Declining newspaper circulation and reduced corporate paper consumption directly impact demand for bleaching chemicals, optical brighteners, and coating formulations traditionally used in graphic paper applications.

Stringent Environmental Regulations and Compliance Costs

Increasingly stringent environmental regulations governing chemical manufacturing, effluent discharge, and product safety impose substantial compliance costs on paper chemical producers. The requirement to develop and reformulate products meeting evolving regulatory standards creates investment burdens while potentially limiting the availability of certain chemical categories with established performance characteristics.

Raw Material Price Volatility and Supply Chain Disruptions

Fluctuations in petrochemical feedstock prices and disruptions to global supply chains impact production costs and availability of key chemical raw materials. Paper chemical manufacturers face challenges in maintaining competitive pricing while managing input cost variability, potentially affecting market penetration and profitability across product categories.

Competitive Landscape:

The Japan paper chemicals market features a moderately consolidated competitive landscape characterized by the presence of established domestic chemical manufacturers, integrated paper producers with captive chemical operations, and global specialty chemical suppliers serving the Japanese market. Competition centers on product innovation, technical service capabilities, sustainability credentials, and supply chain reliability. Market participants differentiate through development of application-specific formulations, investment in bio-based and environmentally sustainable product portfolios, and establishment of collaborative relationships with paper mills for customized solution development. The industry has witnessed strategic initiatives including partnerships for advanced chemical development, expansion of sustainable product offerings, and integration of digital technologies for process optimization support. Domestic players leverage deep understanding of local market requirements and established distribution networks, while international participants contribute global R&D capabilities and diverse product portfolios addressing specialized applications.

Japan Paper Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pulp Chemicals, Process Chemicals, Functional Chemicals |

| Forms Covered | Specialty Chemicals, Commodity Chemicals |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan paper chemicals market size was valued at USD 1,362.95 Million in 2025.

The Japan paper chemicals market is expected to grow at a compound annual growth rate of 4.46% from 2026-2034 to reach USD 2,017.63 Million by 2034.

Pulp chemicals dominated the market with a 42% share in 2025, driven by substantial demand from bleaching, delignification, and fiber treatment processes essential for producing high-quality paper grades across Japan's established paper manufacturing facilities.

Key factors driving the Japan paper chemicals market include accelerating demand for sustainable packaging solutions, expanding e-commerce activities generating packaging material consumption, technological innovations in chemical formulations, and regulatory frameworks promoting eco-friendly paper production practices.

Major challenges include declining demand for printing and communication papers due to digitalization, stringent environmental regulations imposing compliance costs, raw material price volatility affecting production economics, and supply chain disruptions impacting chemical availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)