Japan Paper Packaging Products Market Size, Share, Trends and Forecast by Product Type, Material Type, End-Use Industry, and Region, 2026-2034

Japan Paper Packaging Products Market Summary:

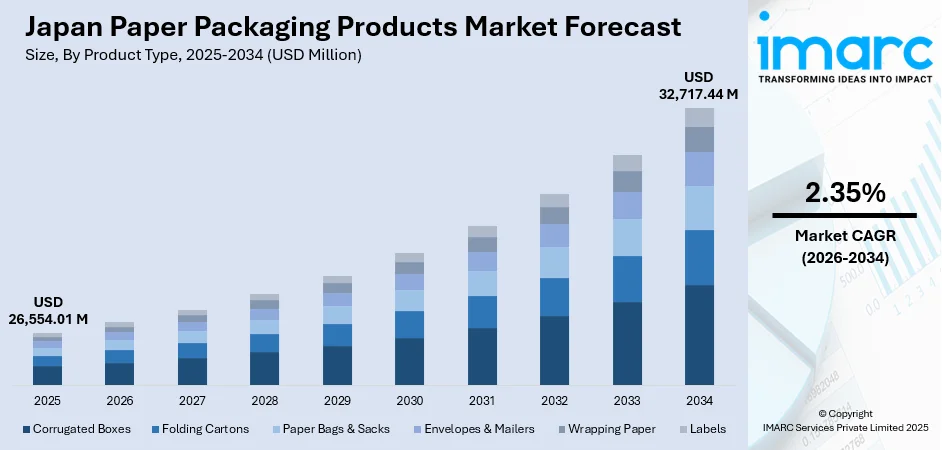

The Japan paper packaging products market size was valued at USD 26,554.01 Million in 2025 and is projected to reach USD 32,717.44 Million by 2034, growing at a compound annual growth rate of 2.35% from 2026-2034.

The market is driven by the country's strong commitment to environmental sustainability and the transition away from single-use plastics. Growing consumer awareness about eco-friendly packaging alternatives, combined with expanding e-commerce activities, is fueling demand for paper-based solutions. Technological advancements in packaging design and increasing adoption by food, retail, and healthcare sectors are further strengthening market momentum, contributing to the expanding Japan paper packaging products market share.

Key Takeaways and Insights:

- By Product Type: Corrugated boxes dominate the market with a share of 45.6% in 2025, driven by their widespread adoption across e-commerce fulfillment operations, food distribution networks, and industrial shipping applications requiring durable yet sustainable packaging solutions.

- By Material Type: Recycled paper leads the market with a share of 45.8% in 2025, owing to stringent environmental regulations promoting circular economy practices, consumer preferences for sustainable materials, and established collection and recycling infrastructure.

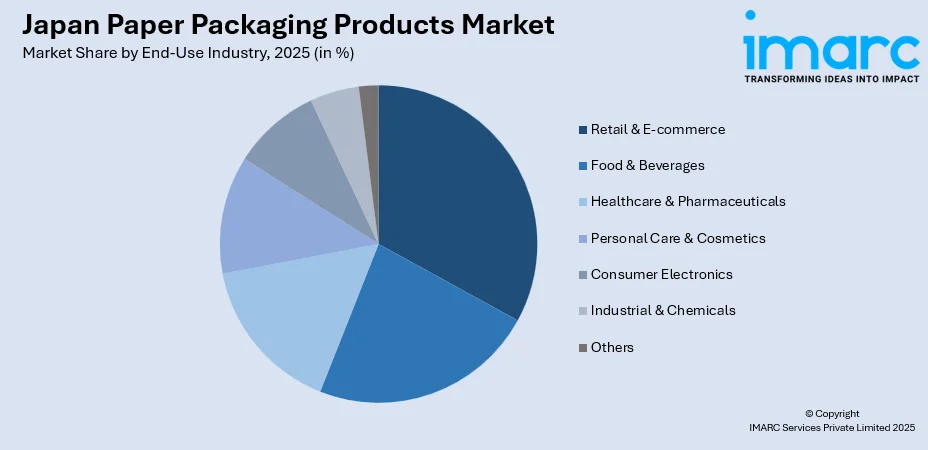

- By End-Use Industry: Retail & e-commerce represents the largest segment with a market share of 33.8% in 2025, attributed by rapid online shopping expansion, increasing demand for protective packaging, and brand emphasis on sustainable unboxing experiences.

- By Region: Kanto region commands the market with a share of 33.2% in 2025, supported by the concentration of manufacturing facilities, distribution centers, major retail headquarters, and the highest population density enabling robust packaging demand.

- Key Players: The Japan paper packaging products market shows moderate to high competitive intensity, with strong domestic manufacturers competing alongside global companies. Competition spans diverse product categories, sustainability-focused innovations, and varied price points, driving continuous product differentiation and technological advancement across the sector.

To get more information on this market Request Sample

The Japan paper packaging products market is advancing as sustainability becomes central to consumer and corporate priorities. Environmental consciousness is driving significant shifts from conventional plastic packaging toward paper-based alternatives across multiple industries. The food and beverage sector remains a key consumer, requiring functional packaging that maintains product integrity while meeting recyclability standards. E-commerce growth continues to generate substantial demand for corrugated solutions that combine protection with presentation quality. In November 2025, Japan’s METI introduced strict packaging certification rules mandating higher recycled content and PVC-free, easily removable components, further reinforcing the national shift toward recyclable, paper-based solutions. Technological innovations are enhancing paper packaging capabilities, enabling moisture resistance, extended shelf life, and interactive features that previously required plastic alternatives. Regional manufacturing hubs, particularly in the Kanto area, benefit from concentrated industrial activity and efficient distribution networks. Government policies supporting plastic reduction and corporate sustainability commitments are accelerating the transition toward paper packaging solutions across the Japanese market.

Japan Paper Packaging Products Market Trends:

Growing Adoption of Digital and Smart Packaging Features

The market is witnessing increased integration of digital technologies into paper packaging solutions. Manufacturers are incorporating QR codes, NFC chips, and smart labels that enable consumer engagement, product authentication, and supply chain traceability. In January 2025, Japanese company TOPPAN Digital introduced paper-substrate NFC smart-packaging solutions at Paris Packaging Week, demonstrating how advanced digital features are increasingly being embedded into paper-based formats to enhance security and consumer interaction. These interactive elements transform packaging from mere protection into communication platforms that provide product information, promotional content, and brand storytelling. Digital printing capabilities allow for greater personalization and shorter production runs without compromising quality, supporting the Japan paper packaging products market growth.

Expansion of Premium and Customized Packaging Solutions

Rising consumer expectations and brand differentiation strategies are driving demand for premium paper packaging with enhanced aesthetic qualities. Embossing, foil stamping, specialty coatings, and unique structural designs are gaining popularity across luxury goods, cosmetics, and specialty food segments. Brands are investing in distinctive packaging experiences that strengthen emotional connections with consumers. This trend reflects the cultural importance of presentation in Japanese society, where packaging quality often signals product value and brand prestige.

Development of High-Performance Barrier Paper Materials

Technological advancements in material science are enabling paper packaging to achieve functional properties previously exclusive to plastics. Manufacturers are developing paperboard with improved water resistance, grease barriers, and structural strength suitable for demanding food packaging applications. Bio-based coatings and laminations maintain recyclability while providing necessary protection. In June 2025, BASF commenced production of a new Acronal® grade at its Rokuromi site in Japan, designed specifically for paper applications, supporting enhanced barrier performance and sustainable growth in the Japanese market. These innovations expand paper packaging applications into categories that traditionally required plastic solutions, supporting broader market adoption across diverse industry verticals.

Market Outlook 2026-2034:

The market is positioned for steady revenue expansion through the forecast period as sustainability imperatives continue shaping industry dynamics. Growing environmental awareness among consumers and businesses will sustain demand for recyclable and biodegradable packaging alternatives. E-commerce sector expansion is expected to drive consistent revenue growth for corrugated packaging solutions optimized for shipping efficiency and product protection. Technological innovations enhancing paper packaging performance characteristics will enable market penetration into new application segments. Government regulations targeting plastic reduction will further accelerate adoption rates across food service, retail, and industrial sectors. The market generated a revenue of USD 26,554.01 Million in 2025 and is projected to reach a revenue of USD 32,717.44 Million by 2034, growing at a compound annual growth rate of 2.35% from 2026-2034.

Japan Paper Packaging Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Corrugated Boxes | 45.6% |

| Material Type | Recycled Paper | 45.8% |

| End-Use Industry | Retail & E-commerce | 33.8% |

| Region | Kanto Region | 33.2% |

Product Type Insights:

- Corrugated Boxes

- Folding Cartons

- Paper Bags & Sacks

- Envelopes & Mailers

- Wrapping Paper

- Labels

The corrugated boxes dominate with a market share of 45.6% of the total Japan paper packaging products market in 2025.

Corrugated boxes form a foundational component of Japan’s paper packaging sector, supporting critical supply-chain functions in e-commerce, retail distribution, electronics logistics, and industrial transport. Their adaptability allows precise tailoring of dimensions, structural profiles, and print formats for varied commercial needs. These boxes combine low weight with robust strength, helping minimize freight expenses while delivering dependable protection against compression, impact, and vibration, ensuring secure product movement throughout domestic and international logistics networks.

Demand for corrugated packaging in Japan continues rising in response to the rapid expansion of online retail channels, where businesses seek reliable and environmentally responsible shipment materials. In 2024, production volumes in Japan’s corrugated box industry reached 98.9% of the previous year’s level, highlighting stable demand despite market fluctuations. Modern production technologies now offer greater operational efficiency, faster turnaround, and improved design flexibility for specialized applications. Strong recyclability performance strengthens corporate sustainability commitments and supports circular economy practices, solidifying the segment’s position as a preferred choice for brands aiming to enhance packaging performance and reduce environmental impact.

Material Type Insights:

- Virgin Paper

- Recycled Paper

- Kraft Paper

- Coated Paper

The recycled paper leads with a share of 45.8% of the total Japan paper packaging products market in 2025.

Recycled paper has become a leading material in Japan’s packaging sector due to the country’s advanced waste collection systems and mature recycling networks. Strong regulatory emphasis on circular economy models, combined with corporate procurement shifts toward sustainable inputs, drives steady adoption. Competitive cost structures compared with virgin fiber production strengthen market viability, while continuous improvements in material strength, printability, and consistency have reduced prior performance limitations across a wide range of packaging uses. In May 2025, Oji Holdings, Nihon Tetra Pak, and Gold Pack introduced Japan’s first system to recycle aseptic carton packages into corrugated containers, debuting at Expo 2025 Osaka, exemplifying industry efforts to expand circular paper usage.

Growing consumer preference for environmentally responsible products encourages manufacturers to expand recycled paper processing capacity and strengthen supporting supply chains. The material’s adaptability across formats such as corrugated containers, folding cartons, and protective inserts supports widespread utilization among retailers and industrial users. Ongoing government initiatives promoting waste reduction and resource conservation further reinforce long-term demand, ensuring the segment remains a central component of Japan’s sustainable packaging landscape throughout the forecast period.

End-Use Industry Insights:

Access the Comprehensive Market Breakdown Request Sample

- Food & Beverages

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Consumer Electronics

- Retail & E-commerce

- Industrial & Chemicals

- Others

The retail & e-commerce exhibits a clear dominance with a 33.8% share of the total Japan paper packaging products market in 2025.

The retail and e-commerce sector generates significant demand for paper packaging as online purchasing continues reshaping consumer expectations in Japan. Requirements include durable corrugated shippers, visually appealing presentation boxes, and eco-friendly substitutes for plastic wrapping. Brands increasingly view packaging as a marketing asset, using texture, print quality, and structural design to enhance customer engagement. As home delivery volumes rise, packaging must balance protection, aesthetics, and sustainability across a broad spectrum of product categories.

Physical retail channels maintain consistent use of paper packaging for merchandise display, product organization, and carryout applications. The nationwide shift away from single-use plastics has accelerated the adoption of paper bags and recyclable protective materials across supermarkets, fashion outlets, and specialty stores. For instance, in October 2023, Aeon began replacing plastic shopping bags with eco-friendly paper bags at its supermarkets, aiming to cut approximately 66 million plastic bags annually across Japan. Moreover, growth in omnichannel retail, combining in-store purchases with online fulfillment, reinforces steady demand for adaptable, sustainable packaging formats. This environment supports ongoing innovation in material performance, print customization, and operational efficiency.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region commands with a market share of 33.2% of the total Japan paper packaging products market in 2025.

The Kanto region sustains its leading position in Japan’s paper packaging market due to its concentration of manufacturing hubs, corporate headquarters, and extensive distribution networks supporting the nation’s largest consumer base. The Greater Tokyo area anchors demand through dense retail activity, rapidly expanding e-commerce fulfillment operations, and sizable food processing clusters that rely heavily on consistent packaging supply. This economic scale accounts for roughly one-third of national consumption, reinforcing Kanto’s strategic importance. In April 2024, Lawson began switching to paper chopstick bags in 5,400 stores across Kanto and Tohoku, reducing plastic use and expanding nationwide, reflecting the region’s adoption of sustainable packaging solutions.

Major paper packaging producers operate key manufacturing facilities within the region to support rapid delivery, reduce transportation costs, and meet high-volume commercial requirements. Kanto’s advanced recycling systems ensure stable access to recovered fiber, strengthening sustainable material procurement. Corporate sustainability programs led by companies headquartered in the region promote adoption of innovative, high-performance, and environmentally responsible packaging, further enhancing Kanto’s competitive advantage and solidifying its position as the country’s dominant market.

Market Dynamics:

Growth Drivers:

Why is the Japan Paper Packaging Products Market Growing?

Stringent Environmental Regulations and Plastic Reduction Policies

The Japanese government has implemented comprehensive policies targeting plastic waste reduction and promoting sustainable packaging alternatives throughout the economy. The Plastic Resource Circulation Act established frameworks requiring businesses to minimize single-use plastic consumption and develop recycling systems. According to sources, in March 2024, Kao Corporation became the first manufacturer or retailer in Japan to receive approval for voluntary collection of plastic packaging from consumers under this Act, demonstrating corporate alignment with national recycling goals. Further, these regulations create favorable conditions for paper packaging adoption by establishing compliance requirements that plastic alternatives struggle to meet. Government procurement preferences for eco-friendly materials signal market direction and encourage private sector investment in paper packaging capabilities. The regulatory environment extends beyond domestic requirements to international sustainability commitments, positioning paper packaging as essential for export-oriented businesses meeting global standards.

Expansion of E-commerce and Changing Consumer Shopping Behaviors

The rapid growth of online retail fundamentally transforms packaging requirements across Japanese consumer markets. E-commerce operations demand packaging solutions optimized for shipping durability, warehouse efficiency, and consumer unboxing experiences that paper-based materials effectively address. For instance, in March 2025, Tachibana Sangyo launched Nekopos-compatible cardboard shipping boxes in Japan, designed for online auctions and small-item deliveries, reflecting the need for efficient, sustainable, and customer-friendly packaging. The shift from in-store to doorstep delivery increases per-unit packaging consumption while emphasizing sustainability credentials that influence purchasing decisions. Online retailers recognize packaging as brand communication touchpoints, investing in customized paper solutions that enhance customer experiences. The convenience-driven evolution of Japanese retail continues generating substantial demand growth for corrugated boxes, padded mailers, and protective paper packaging across diverse product categories.

Demographic Shifts and Geriatric Population Packaging Preferences

Japan's demographic profile creates distinct packaging requirements that paper-based solutions address effectively. The substantial elderly population demonstrates preferences for lightweight, easy-to-handle packaging with clear labeling and convenient opening features. Paper packaging materials offer ergonomic advantages including reduced weight for carrying, simpler disposal procedures, and compatibility with home recycling systems familiar to older consumers. Healthcare and pharmaceutical sectors serving aging populations increasingly adopt paper packaging for its perceived safety, natural characteristics, and alignment with consumer preferences. Single-person households, common among both elderly and younger urban demographics, drive demand for smaller portion sizes and packaging formats where paper solutions demonstrate strong market fit. In October 2024, Dai Nippon Printing (DNP) launched an environmentally friendly microwaveable paper pouch, reducing plastic usage and enabling meals to be eaten directly from the package, enhancing convenience for consumers.

Market Restraints:

What Challenges the Japan Paper Packaging Products Market is Facing?

Raw Material Price Volatility and Supply Constraints

The paper packaging industry faces periodic fluctuations in raw material costs driven by pulp pricing, recycled fiber availability, and energy expenses that impact production economics. Global supply chain disruptions and competition for sustainable fiber resources create pricing pressures that challenge manufacturer margins. Currency exchange rate movements affect imported material costs and competitiveness against international suppliers, requiring ongoing adjustment to commercial strategies.

Performance Limitations in Certain Applications

Despite technological advancements, paper packaging materials exhibit inherent limitations in moisture sensitivity, barrier properties, and durability that restrict applicability across specific product categories. Food packaging requiring extended shelf life, liquid containment, and high-humidity resistance continues challenging paper-based alternatives. These functional constraints maintain market segments where plastic packaging remains preferred, limiting total addressable market expansion.

Competition from Alternative Sustainable Packaging Materials

The paper packaging industry faces emerging competition from other sustainable materials including bioplastics, molded fiber alternatives, and innovative composite materials seeking market share. Corporate sustainability initiatives evaluate multiple packaging options, creating competitive dynamics that pressure pricing and innovation requirements. Market participants must continuously invest in performance improvements to maintain competitive positioning against evolving alternative technologies.

Competitive Landscape:

The Japan paper packaging products market demonstrates moderate consolidation with established domestic manufacturers maintaining significant market presence alongside international corporations operating through local subsidiaries. Competition centers on product innovation, manufacturing efficiency, customer service capabilities, and sustainability credentials that differentiate offerings across market segments. Major players invest in production capacity expansion, technology upgrades, and geographic coverage to strengthen competitive positioning. Strategic acquisitions enable market participants to enhance capabilities, enter new segments, and achieve operational synergies. The competitive environment encourages continuous improvement in product quality, design innovation, and environmental performance. Smaller regional manufacturers compete effectively in localized markets through customer relationships and specialized product offerings while larger players pursue scale advantages across national distribution networks.

Recent Developments:

- In October 2025, Okumura Printing Co., Ltd. will launch “beakx” at JAPAN PACK 2025, Makuhari Messe. The innovative paper packaging transforms into a durable, water- and oil-resistant plate, offering sustainable, recyclable, and disaster-ready solutions. Utilizing patented origami technology, beakx combines functionality, hygiene, and environmental responsibility for diverse food packaging applications.

Japan Paper Packaging Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Cartons, Paper Bags & Sacks, Envelopes & Mailers, Wrapping Paper, Labels |

| Material Types Covered | Virgin Paper, Recycled Paper, Kraft Paper, Coated Paper |

| End-Use Industries Covered | Food & Beverages, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Consumer Electronics, Retail & E-commerce, Industrial & Chemicals, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan paper packaging products market size was valued at USD 26,554.01 Million in 2025.

The Japan paper packaging products market is expected to grow at a compound annual growth rate of 2.35% from 2026-2034 to reach USD 32,717.44 Million by 2034.

Corrugated boxes held the largest market share due to widespread use in e-commerce fulfillment, food distribution, and industrial logistics, supported by strong demand for sustainable, protective, and customizable packaging solutions that ensure durability, efficiency, and versatility across diverse commercial and operational environments.

Key factors driving the Japan paper packaging products market include stringent government plastic reduction policies, expanding e-commerce activities, aging population preferences for lightweight packaging, growing environmental consciousness, and technological innovations improving paper packaging performance.

Major challenges include raw material price volatility and supply constraints, performance limitations in moisture-sensitive and barrier applications, competition from alternative sustainable materials, and manufacturing cost pressures requiring continuous efficiency improvements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)