Japan Pasta Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, and Region, 2026-2034

Japan Pasta Market Size and Share:

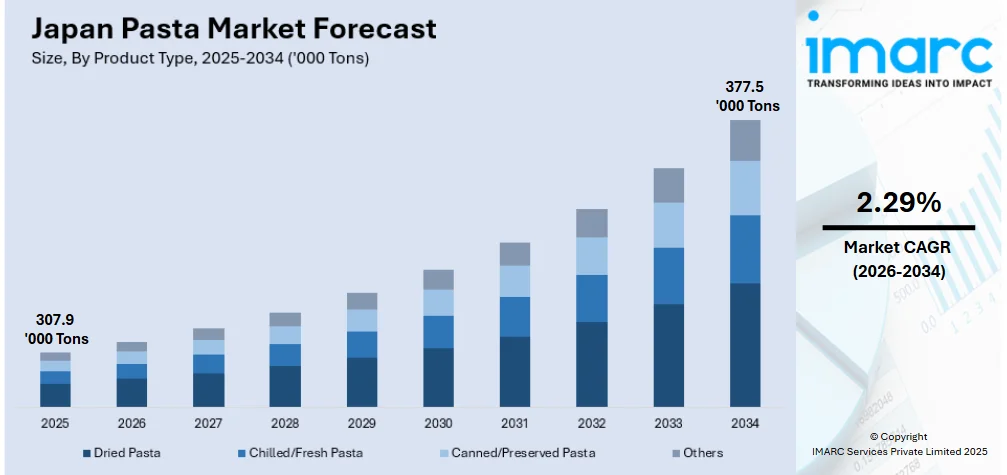

The Japan pasta market size reached 307.9 Thousand Tons in 2025. Looking forward, IMARC Group estimates the market to reach 377.5 Thousand Tons by 2034, exhibiting a CAGR of 2.29% from 2026-2034. The Japanese pasta market is fueled by factors such as the increasing demand for convenience foods, as consumers look for quick and easy meal options. The popularity of fusion dishes combining Japanese and Italian flavors also fuels revenue. In line with this, the increasing preference for healthier, sustainable pasta alternatives like gluten-free options supports market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 307.9 Thousand Tons |

| Market Forecast in 2034 | 377.5 Thousand Tons |

| Market Growth Rate (2026-2034) | 2.29% |

Demand for ready-to-eat (RTE) and quick-to-prepare meals is increasing in Japan, thereby boosting the pasta market. Consumers have been adopting fast food, as a large number of people are working, and the lifestyle has become very hectic. Convenience foods that are quick to prepare yet offer great taste are in high demand. Pasta is easy to cook and is versatile; thus, it matches this trend. The pre-packaged, instant, and microwavable products increase its appeal. This makes instant noodle cups the one with the biggest demand in terms of sales achieved in 2023, having reached USD 4.3 billion and contributing to 48.0 % of the share. Furthermore, the new product flavors that include miso- or soy-sauce-flavored pasta are an adaptation to specific Japanese tastes in order to allow for a culturally relevant meal alternative that is readily available and consumable.

To get more information on this market Request Sample

Increased health consciousness among Japanese consumers has driven demand for healthier options of pasta, thereby covering whole-grain, gluten-free, and high-protein varieties. Following the lead of healthy diets, companies have prepared fortified and organic pasta to match their tastes. Low-carb and low-calorie diets have also inspired products such as shirataki pasta, in line with Japanese tradition in diet. This change towards better options promotes the growth in the pasta market as it attracts consumers looking for healthier options still serving tasty dishes and has an appeal to more youthful and middle-aged generations, which are more mindful of their diet hence creating a favorable pasta market outlook in Japan.

Japan Pasta Market Trends:

Fusion of Japanese and Italian Cuisines

The blending of Japanese and Italian flavors has become a prominent trend in Japan’s pasta market. Dishes featuring Japanese ingredients such as seaweed, soy sauce, miso, and mentaiko (spicy cod roe) combined with traditional pasta recipes attract consumers seeking unique taste experiences. This fusion aligns with Japan's culinary tradition of adopting foreign cuisines and adapting them to local preferences. Restaurants and packaged pasta brands actively promote these innovations, making fusion pasta widely accessible. This trend not only broadens the market but also strengthens pasta’s presence as a versatile dish that complements Japanese palates while maintaining its identity as a global food staple.

Premiumization and Gourmet Offerings

The growing interest in high-quality food experiences has led to increased demand for premium pasta products in Japan. Consumers are willing to pay more for artisanal, handmade, or imported pasta made from durum wheat or other superior ingredients. The rise of gourmet pasta sauces featuring truffles, lobster, and other luxury components complements this trend, creating an upscale dining experience at home. Besides this, brands are focusing on limited-edition and region-specific offerings to attract affluent consumers. This trend aligns with Japan’s preference for exclusivity and quality, transforming pasta from a convenience meal into an indulgent culinary option. This growth is further evidenced by the increasing importation of pasta, with Japan importing about 50% of its pasta consumption, contributing to a total annual consumption of approximately 285 thousand tons further aiding the Japan pasta market growth.

Sustainability and Eco-Friendly Packaging

Sustainability has become a significant focus in Japan’s pasta market, driven by environmentally conscious consumers. Brands are increasingly adopting eco-friendly packaging, such as biodegradable or recyclable materials, in line with Japan's waste reduction efforts. At the same time, there is a growing trend in pasta made from alternative, sustainable ingredients like lentils, chickpeas, and edamame, which cater to health-conscious consumers while supporting sustainable farming practices. These efforts resonate with Japanese shoppers who prioritize environmental responsibility, particularly among younger generations. This trend has encouraged brands to innovate while reinforcing their commitment to environmental preservation, giving them a competitive edge in a socially conscious market.

Japan Pasta Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan pasta market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, raw material, and distribution channel.

Analysis by Product Type:

- Dried Pasta

- Chilled/Fresh Pasta

- Canned/Preserved Pasta

- Others

Dried pasta remains the most popular segment holding significant Japan pasta market share due to its long shelf life, convenience, and affordability. It is widely used in households and foodservice industries, offering ease of storage and preparation. Consumers value the variety of shapes and flavors available, contributing to its continued dominance in the market.

Moreover, the chilled or fresh pasta is gaining traction, especially among consumers seeking premium products. Its shorter cooking time and superior texture make it attractive to those desiring a fresher, more authentic dining experience. This segment appeals to health-conscious individuals, as it often contains fewer preservatives compared to dried pasta.

Also, the canned or preserved pasta is typically popular for its convenience and long shelf life, often used in RTE meals or for quick snacks. While less common than dried or fresh pasta, it attracts busy consumers looking for affordable, time-saving meal solutions, particularly in urban areas with fast-paced lifestyles.

Meanwhile, the others category encompasses niche pasta products such as gluten-free, high-protein, or organic varieties. These products cater to specific dietary needs and preferences, fueling growth in the health-conscious and specialty food markets. Their increasing availability and consumer awareness contribute to this segment’s expanding share within the broader pasta market.

Analysis by Raw Material:

- Durum Wheat Semolina

- Wheat

- Mix

- Barley

- Rice

- Maize

- Others

Durum wheat semolina is the primary raw material used in pasta production, prized for its high protein content and firmness, which contribute to its desirable texture. It produces pasta with a firm bite and excellent cooking quality, making it the preferred choice for traditional pasta products.

Additionally, the wheat, often in the form of refined flour, is used for making various types of pasta, especially in lower-cost products. It offers a soft texture and is a common choice for mass-produced pasta, catering to the large-scale market. Wheat pasta is favored for its affordability and versatility.

Along with this, the mix category involves a blend of different grains such as wheat and rice or other ingredients. This combination is often used to cater to niche markets, such as gluten-free or high-protein pasta. It offers a balance of texture and nutritional benefits, appealing to a wide range of consumer preferences.

Additionally, barley-based pasta is becoming increasingly popular among health-conscious consumers for its high fiber content and lower glycemic index. Barley is often used in specialty pasta products, promoting digestive health and offering a unique, slightly nutty flavor. This type appeals to individuals seeking nutritious and functional food options.

In addition, rice pasta is used in gluten-free products, making it a suitable alternative for those with gluten sensitivities. It has a delicate texture and is popular in Asian-inspired pasta dishes. Rice-based pasta is expanding in markets where consumers prioritize gluten-free, allergen-friendly, or vegan diets.

Additionally, maize is increasingly being found as a viable gluten-free diet alternative, especially given the light weight and slightly sweet taste of its pasta. Most of its applications combine it with other grains because the texture complements its gluten intolerant nature by still being well priced and quite healthy.

Besides, the category others comprises pasta of alternative grains or ingredients, which are quinoa, lentil, or chickpea pasta. These types of products align with specific diet requirements, for example, vegan, high protein, or low-carb. The segment is growing as people look for innovative, healthier pasta options that provide flavors and nutritional differences.

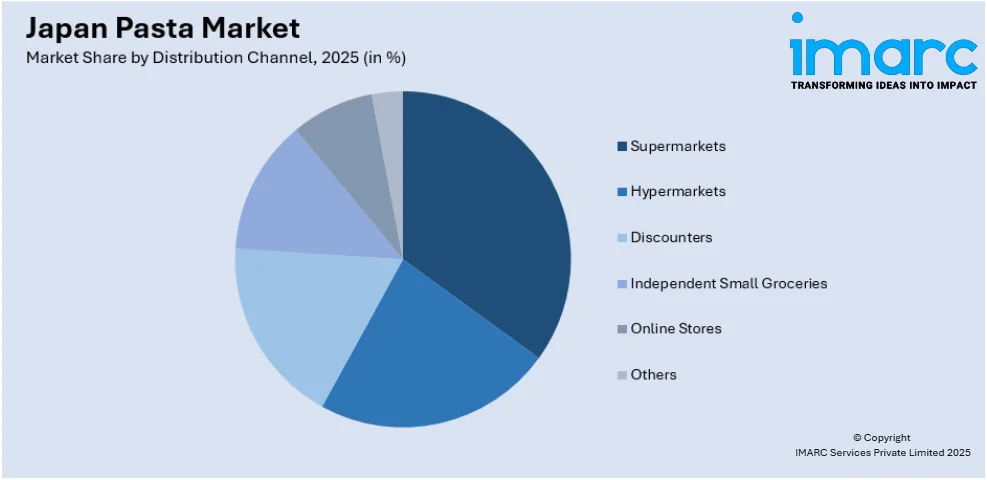

Analysis by Distribution Channel:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets

- Hypermarkets

- Discounters

- Independent Small Groceries

- Online Stores

- Others

Supermarkets are a key distribution channel for the pasta market, providing a wide range of pasta products in various price segments. Shoppers typically look for convenience, variety, and quality, with supermarkets offering both local and international pasta brands. The convenience of one-stop shopping continues to drive consumer preference for this channel.

In line with this, the hypermarkets cater to a broader customer base and often offer larger quantities or bulk packages, making them appealing for families or restaurants. The extensive product range, including value packs and premium options, attracts price-sensitive consumers. Competitive pricing and frequent promotions contribute to the popularity of hypermarkets as a distribution channel for pasta.

Also, the discounters are growing in popularity for price-conscious consumers. These stores offer affordable pasta options, often with limited variety and private-label products. While the focus is on value, discounters appeal to budget shoppers seeking cost-effective alternatives without sacrificing basic product quality, driving their role in the pasta market.

Moreover, the independent small groceries provide localized distribution, often catering to specific communities or regional preferences. While the selection of pasta may be more limited, this channel appeals to consumers seeking quick, convenient purchases. Personalized customer service and tailored product assortments help maintain a loyal customer base in these stores.

Additionally, online stores have experienced significant growth, fueled by the convenience of home delivery and the increasing demand for e-commerce. Consumers now have access to a wide variety of pasta brands, including specialty and niche products. The ease of browsing, discounts, and subscription models enhance online shopping’s appeal, especially among younger, tech-savvy buyers.

The others category includes alternative distribution channels like foodservice providers, direct-to-consumer platforms, and specialty retailers. This includes pasta sold in bulk to restaurants, catering services, and online direct-sales models. These channels help reach niche markets, such as restaurants or health-conscious consumers, expanding the variety and availability of pasta products.

Regional Analysis:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, encompassing Tokyo and surrounding areas, is expected to hold a significant revenue in the market due to its large population and urban lifestyle. High demand for convenience foods and diverse dining options drives pasta consumption. The region is a hub for international cuisine, with premium and innovative pasta offerings thriving in its vibrant food culture.

Also, the Kansai region, including Osaka and Kyoto, showcases a strong preference for fusion cuisines, blending local flavors with international dishes like pasta. Known for its rich culinary heritage, this region drives the demand for premium and fresh pasta varieties. Localized flavors and innovative recipes resonate with consumers seeking unique dining experiences.

Concurrently, the Chubu region, with cities like Nagoya, reflects a growing interest in pasta due to increasing urbanization and exposure to global cuisines. The market here favors both affordable dried pasta and premium products, supported by the region’s balanced mix of metropolitan and rural areas. Convenience and variety are key growth drivers.

Meanwhile, the Kyushu-Okinawa’s pasta market is influenced by its distinct culinary traditions and growing tourism. The region also shows a growing interest in fusion dishes and health-conscious options, such as gluten-free pasta. Local demand is driven by younger demographics and urban areas, with rising preferences for premium and unique pasta flavors aligning with evolving food trends.

Besides this, in Tohoku, pasta consumption is steadily growing, supported by increasing urbanization and evolving dietary habits. This region’s market primarily focuses on affordable and convenient options like dried pasta, catering to households. Rising interest in healthier alternatives and fusion dishes is gradually shaping consumer preferences in this traditionally rice-dominated area.

However, the Chugoku region experiences moderate pasta demand, with a stronger emphasis on convenience and affordability. Smaller cities and rural areas drive the market for dried pasta, while urban centers show growing interest in premium and fresh pasta. The region's evolving culinary preferences are shaped by greater exposure to global food trends.

Furthermore, the Hokkaido’s pasta market benefits from its focus on high-quality ingredients, as the region is renowned for its agricultural produce. Local demand for pasta aligns with its culinary innovation and fusion dishes. Urban areas, particularly Sapporo, drive consumption of premium and fresh pasta, appealing to health-conscious and adventurous consumers.

Along with this, the Shikoku’s smaller population limits its pasta market size, but there is steady demand for affordable and convenient options like dried pasta. Urban centers in the region show growing interest in premium and fresh pasta products. Exposure to global culinary trends is gradually shaping consumer preferences in this region.

Competitive Landscape:

The competitive landscape of Japan's pasta market is one where both domestic and international players vie for market share of this increasing demand for traditional as well as innovative pasta products. Companies are now competing to differentiate themselves through product innovation, such as offering pasta that caters to local tastes or health-conscious preferences, like gluten-free or high-protein variants. Premium and gourmet offerings are also gaining traction, emphasizing high-quality ingredients and distinctive flavors. Sustainability is playing a role; businesses are becoming more eco-friendly in their packaging and encouraging consumers to use organic or sustainably sourced ingredients. Intense competition has led to continuous innovation within packaging, flavor profiles, and product types to push brands quickly to adapt with changing consumer preference while maintaining powerful distribution networks.

The report provides a comprehensive analysis of the competitive landscape in the Japan pasta market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Japanese restaurant chain Pepper Lunch announced plans to open its first store in Mongolia next year, marking the country as its 17th market. The brand entered into a master franchise agreement with local distributor Bluemon Group to accelerate its global expansion. Known for its DIY casual dining concept, Pepper Lunch operates over 400 locations in Japan, Asia, and Australia, offering premium steaks, pasta, and cheese curry rice.

- In January 2024, Nagatani-en launched its innovative pasta product, "Pakitto," designed for time efficiency in 2023. This product splits pasta and microwaves it with sauce, offering a quick meal solution. The company received the prestigious “36th New Technology and Food Development Award” in December 2022 for this innovation. Known for easy-to-prepare products, Nagatani-en was founded in 1953 by Yoshio Nagatani, a descendant of a renowned tea merchant family.

- In January 2024, Seviroli Foods, a US-based frozen pasta manufacturer, acquired Italian food assets from Japan's Ajinomoto Group, including the Bernardi, Rotanelli's, and Mona's brands. The deal, which also includes related intellectual property and equipment, aims to expand Seviroli’s product range in foodservice and retail markets. CEO Paul Vertullo stated that the acquisition accelerates the company’s growth and aligns with its strategic vision. The financial details of the deal were not disclosed.

Japan Pasta Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dried Pasta, Chilled/Fresh Pasta, Canned/Preserved Pasta, Others |

| Raw Materials Covered | Durum Wheat Semolina, Wheat, Mix, Barley, Rice, Maize, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Discounters, Independent Small Groceries, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan pasta market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan pasta market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan pasta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pasta market in Japan reached 307.9 Thousand Tons in 2025.

The Japan pasta market is projected to exhibit a CAGR of 2.29% during 2026-2034, reaching a volume of 377.5 Thousand Tons by 2034.

The market is driven by transforming consumer lifestyles, growing demand for convenience foods, and rising Westernization of diets. Increased demand for ready-to-eat and ready-to-cook pasta, growth in foodservice channels, and impact of global culinary trends drive expansion. Nutritional options, including fortified and whole-grain pasta, also drive market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)