Japan Pathology Lab Services Market Size, Share, Trends and Forecast by Type, Testing Service, End Use, and Region, 2026-2034

Japan Pathology Lab Services Market Overview:

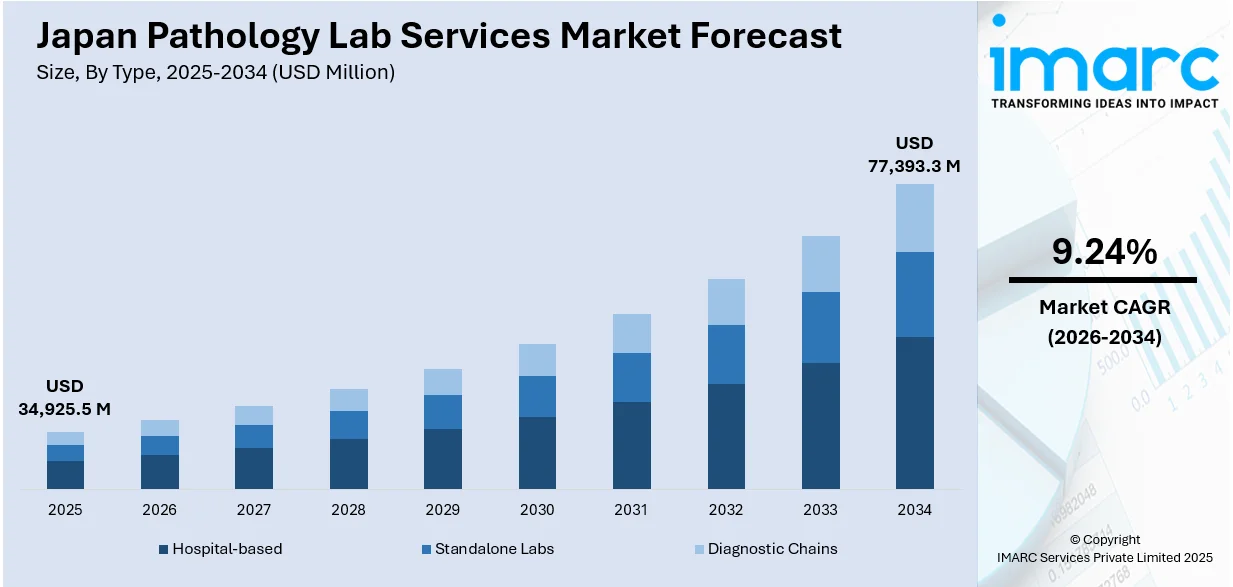

The Japan pathology lab services market size reached USD 34,925.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 77,393.3 Million by 2034, exhibiting a growth rate (CAGR) of 9.24% during 2026-2034. The market is driven by the rapid adoption of digital pathology and AI, supported by government initiatives promoting digital healthcare transformation and precision medicine. The increasing number of elderly individuals and the prevalence of chronic illnesses are driving the need for genomic testing and personalized diagnostics, prompting laboratories to enhance their capabilities in next-generation sequencing (NGS) and biomarker analysis. Strategic collaborations between pathology providers, AI startups, and pharmaceutical firms are accelerating innovations, further augmenting the Japan pathology lab services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 34,925.5 Million |

| Market Forecast in 2034 | USD 77,393.3 Million |

| Market Growth Rate 2026-2034 | 9.24% |

Japan Pathology Lab Services Market Trends:

Increasing Adoption of Digital Pathology and AI Integration

The market is witnessing a significant shift toward digital pathology and artificial intelligence (AI) integration. With advancements in whole-slide imaging (WSI) and cloud-based data storage, labs are transitioning from traditional microscopy to digital platforms for faster and more accurate diagnostics. AI-powered tools are being increasingly adopted to assist pathologists in detecting anomalies, reducing human error, and improving workflow efficiency. The Japanese government’s push for digital healthcare transformation, along with rising demand for precision medicine, is accelerating this trend. Japan's fiscal year 2024 budget for digital health has risen substantially to JPY 61.7 billion (approximately USD 400 Million), with an emphasis on AI diagnostics and the inclusion of electronic medical records (EMRs) to meet the increased need for pathology services resulting from an aging population. Government estimates predict a shortage of 960,000 healthcare professionals by 2040, which underscores the need for swift implementation of digital technologies in the laboratory and diagnostic sectors. United States-Japan collaborations are now focused on EMR standardization, AI development in pathology, and cross-border data exchange to digitally revamp laboratory infrastructure. Additionally, collaborations between pathology labs and AI startups are fostering innovation in automated diagnosis, particularly in cancer detection. However, challenges such as high implementation costs and data security concerns remain. Despite these barriers, the growing need for scalable and remote diagnostic solutions, especially in rural areas, is expected to drive further adoption of digital pathology in Japan over the next decade.

To get more information on this market Request Sample

Rising Demand for Genomic Testing and Personalized Medicine

The accelerating demand for genomic testing and personalized medicine is significantly supporting the Japan pathology lab services market growth. As the nation confronts an increasing elderly population and a higher incidence of chronic illnesses, there is an intensifying emphasis on customized treatment strategies informed by genetic profiling. The incidences of inflammatory bowel disease (IBD) in Japan are projected to be 645.8 per 100,000 by 2032, up from 368.3 in 2022. It will increase at an annual rate of 5.78%, with the highest rise reported in patients under 18 years of age. Ulcerative colitis is also projected to continue being the major subtype in Japan with an estimated prevalence of 545.9 per 100,000 in 2032, higher than Crohn's disease at 101.9. The rising epidemic of chronic illness shows the pressing necessity of upgrading pathology laboratory facilities and upgrading pediatric diagnostic capacity in Japan's IBD care system. Pathology labs are expanding their capabilities to include next-generation sequencing (NGS) and biomarker analysis to support precision oncology and rare disease diagnosis. Government initiatives, such as the "Healthcare Policy for All Citizens," are promoting genomic medicine, further propelling market growth. Private labs are also partnering with pharmaceutical companies to develop companion diagnostics for targeted therapies. Despite the high costs and regulatory complexities, the shift toward personalized healthcare is expected to sustain long-term growth in Japan’s pathology sector, with labs playing a crucial role in advancing precision medicine.

Japan Pathology Lab Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, testing service, and end use.

Type Insights:

- Hospital-based

- Standalone Labs

- Diagnostic Chains

The report has provided a detailed breakup and analysis of the market based on the type. This includes hospital-based, standalone labs, and diagnostic chains.

Testing Service Insights:

- General Physiological and Clinical Tests

- Imaging and Radiology Tests

- Esoteric Tests

- COVID-19 Tests

A detailed breakup and analysis of the market based on the testing service have also been provided in the report. This includes general physiological and clinical tests, imaging and radiology tests, esoteric tests, and COVID-19 tests.

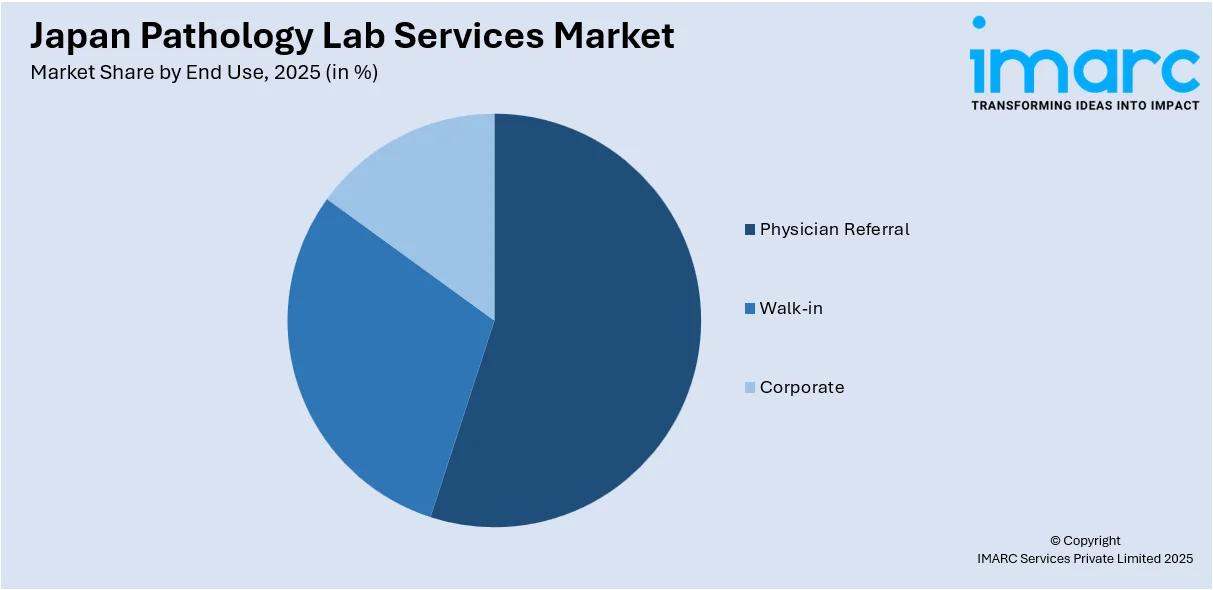

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Physician Referral

- Walk-in

- Corporate

The report has provided a detailed breakup and analysis of the market based on the end use. This includes physician referral, walk-in, and corporate.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Pathology Lab Services Market News:

- August 29, 2024: Hitachi High-Tech and Gencurix of Korea announced the inaugural launch of a cancer molecular diagnostics service in Japan, following the successful conclusion of a feasibility study conducted in June 2024. This partnership combines Gencurix’s expertise in biomarker-driven assay development with Hitachi’s proficiency in digital diagnostics and laboratory automation, aiming to enhance clinical oncology workflows. This initiative aligns with Hitachi’s healthcare integration strategy, established in April 2024, and represents a significant advancement toward digitized pathology lab services within Japan’s precision cancer care sector.

Japan Pathology Lab Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hospital-based, Standalone Labs, Diagnostic Chains |

| Testing Services Covered | General Physiological and Clinical Tests, Imaging and Radiology Tests, Esoteric Tests, COVID-19 Tests |

| End Uses Covered | Physician Referral, Walk-in, Corporate |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan pathology lab services market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan pathology lab services market on the basis of type?

- What is the breakup of the Japan pathology lab services market on the basis of testing service?

- What is the breakup of the Japan pathology lab services market on the basis of end use?

- What is the breakup of the Japan pathology lab services market on the basis of region?

- What are the various stages in the value chain of the Japan pathology lab services market?

- What are the key driving factors and challenges in the Japan pathology lab services market?

- What is the structure of the Japan pathology lab services market and who are the key players?

- What is the degree of competition in the Japan pathology lab services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan pathology lab services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan pathology lab services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan pathology lab services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)