Japan PCB Components Market Size, Share, Trends and Forecast by Component Type, PCB Type, End Use Industry, and Region, 2026-2034

Japan PCB Components Market Overview:

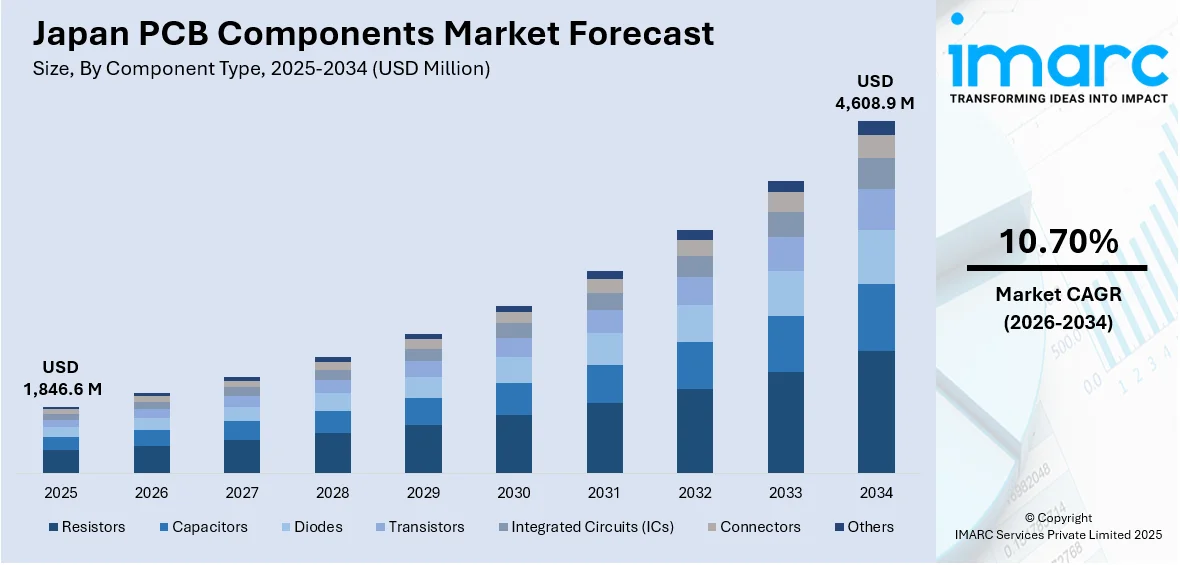

The Japan PCB components market size reached USD 1,846.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,608.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.70% during 2026-2034. The market is driven by Japan’s innovations in compact, high-precision consumer electronics and integration with advanced semiconductors. Automotive transformation toward electric and connected vehicles is accelerating the use of reliable and thermally robust PCB systems. Industrial automation and robotics adoption, particularly in high-tech manufacturing, are reinforcing component demand, further augmenting the Japan PCB components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,846.6 Million |

| Market Forecast in 2034 | USD 4,608.9 Million |

| Market Growth Rate 2026-2034 | 10.70% |

Japan PCB Components Market Trends:

Advanced Consumer Electronics and Semiconductor Ecosystem

Japan’s long-established reputation for innovations in consumer electronics continues to support domestic demand for high-performance PCB components. Leading companies in imaging, audio systems, gaming consoles, and personal computing devices utilize dense, multi-layered PCBs equipped with precision-engineered capacitors, ICs, and microcontrollers. On September 16, 2024, the ICAPE Group announced its acquisition of Japanese PCB distributor NTW, gaining direct access to Japan’s industrial customer base and expanding its strategic footprint across Asia. NTW operates 7 subsidiaries across Japan, China, and Southeast Asia, and is projected to generate over USD 20 million in revenue in 2024. This acquisition positions ICAPE as a leading player in Japan’s PCB distribution market and is expected to contribute to ICAPE's cumulative €45 million external growth since 2023. Additionally, Japan’s robust semiconductor infrastructure facilitates seamless integration between chip design and board-level assembly. PCB suppliers benefit from close technical collaboration with OEMs in Tokyo, Osaka, and Aichi, leading to optimized layout designs and miniaturization. As electronics become increasingly multifunctional and compact, demand is shifting toward rigid-flex PCBs, HDI boards, and specialized dielectric materials. Japan’s role in developing advanced packaging solutions further enhances this ecosystem, where PCB components are engineered for high signal integrity and low thermal stress. The proliferation of 5G devices, AR/VR headsets, and connected home products is reinforcing the relevance of compact and high-frequency-compatible PCB layouts. These developments are setting new performance benchmarks and improving the overall competitiveness of domestic suppliers. Such trends directly contribute to the Japan PCB components market growth.

To get more information on this market Request Sample

Electric Mobility and Automotive Electronics Integration

Japan's automotive sector remains one of the largest globally and is undergoing rapid transformation with the adoption of electric vehicles, autonomous systems, and connected technologies. From battery control units to motor inverters, advanced driver assistance systems (ADAS), and infotainment modules, modern vehicle systems increasingly rely on high-reliability PCB components. Japanese automotive manufacturers are integrating multi-layer PCBs with high-temperature and vibration resistance to ensure safety and longevity. On April 25, 2025, OKI Circuit Technology announced the development of a 124-layer PCB, marking a 15% increase from the conventional 108-layer limit, with thickness maintained at 7.6 mm. This advancement targets next-generation AI semiconductor testing equipment, particularly for high-bandwidth memory (HBM) systems, and aims to enter mass production by October 2025 at OKI’s Joetsu Plant in Niigata, Japan. The innovation supports the growing demand for ultra-high-density, high-frequency PCBs in sectors like AI, aerospace, robotics, and advanced communications. PCB makers are also innovating with thermal management substrates and EMI shielding solutions to meet the evolving needs of EV platforms. Furthermore, Japan’s regulatory push for carbon neutrality by 2050 is spurring investment in green automotive technologies, accelerating the shift toward electronics-intensive vehicle design. Collaborative R&D between automakers and PCB manufacturers supports the development of automotive-grade standards and test protocols. These trends are also reinforced by government support for sustainable transport initiatives and infrastructure, which expand the use cases for PCB assemblies in charging equipment and battery systems. As EV architectures become increasingly intricate, the sophistication and volume of PCB requirements are rising across the value chain.

Japan PCB Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component type, PCB type, and end use industry.

Component Type Insights:

- Resistors

- Capacitors

- Diodes

- Transistors

- Integrated Circuits (ICs)

- Connectors

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes resistors, capacitors, diodes, transistors, integrated circuits (ICs), connectors, and others.

PCB Type Insights:

- Rigid PCBs

- Flexible PCBs

- Rigid-Flex PCBs

The report has provided a detailed breakup and analysis of the market based on the PCB type. This includes rigid PCBs, flexible PCBs, and rigid-flex PCBs.

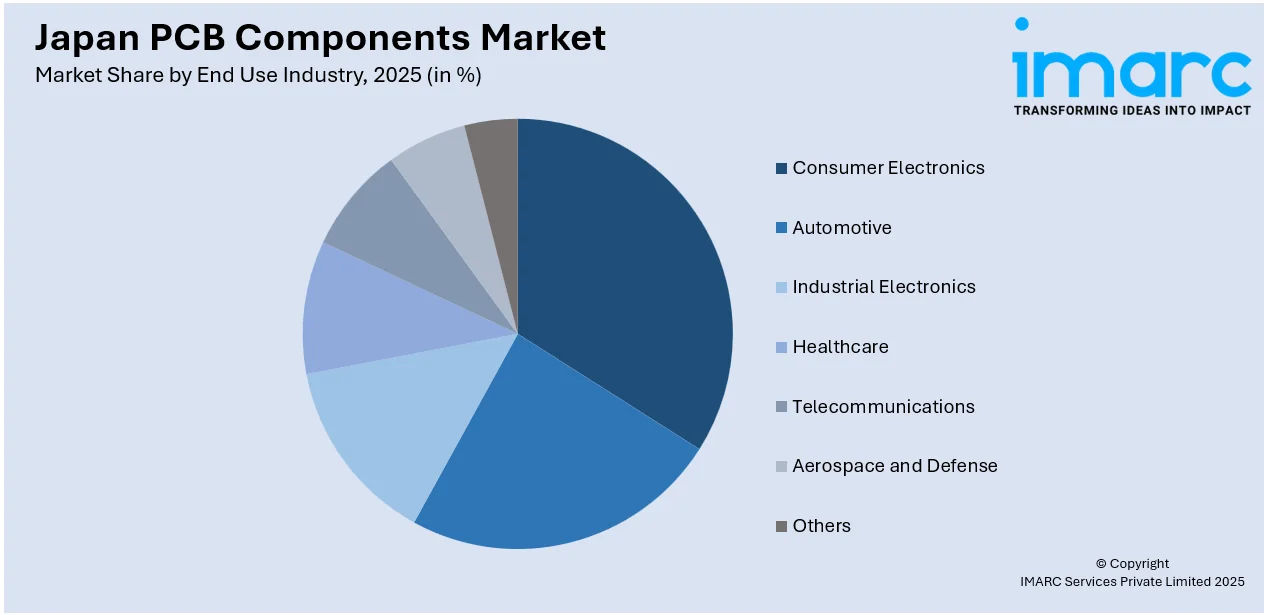

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Automotive

- Industrial Electronics

- Healthcare

- Telecommunications

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes consumer electronics, automotive, industrial electronics, healthcare, telecommunications, aerospace and defense, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan PCB Components Market News:

- On January 17, 2025, Mitsubishi Materials and Panasonic announced the successful operation of a sustainable PMP (Product-Material-Product) loop that has recycled 1.1 tons of gold, 33 tons of silver, and 8,100 tons of copper from waste printed circuit boards (PCBs) of discarded Panasonic appliances. This closed-loop initiative, active since 2011, also contributed to a cumulative CO₂ reduction of approximately 33,000 tons by avoiding smelting from raw ore. The recovered metals are reused within Panasonic’s production, including copper wiring for Expo 2025 Osaka, supporting Japan’s circular economy goals.

- On May 15, 2023, Panasonic Industry unveiled the R-2400, a high-thermal conductive film with a conductivity of 2.7 W/m·K, the highest in the industry for multilayer PCB applications. The film supports multilayer circuit board construction while withstanding temperatures up to 150°C, enabling thermal management in compact, high-output systems like EVs, rail power supplies, and industrial converters.

Japan PCB Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Resistors, Capacitors, Diodes, Transistors, Integrated Circuits (ICs), Connectors, Others |

| PCB Types Covered | Rigid PCBs, Flexible PCBs, Rigid-Flex PCBs |

| End Use Industries Covered | Consumer Electronics, Automotive, Industrial Electronics, Healthcare, Telecommunications, Aerospace and Defense, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan PCB components market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan PCB components market on the basis of component type?

- What is the breakup of the Japan PCB components market on the basis of PCB type?

- What is the breakup of the Japan PCB components market on the basis of end use industry?

- What is the breakup of the Japan PCB components market on the basis of region?

- What are the various stages in the value chain of the Japan PCB components market?

- What are the key driving factors and challenges in the Japan PCB components market?

- What is the structure of the Japan PCB components market and who are the key players?

- What is the degree of competition in the Japan PCB components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan PCB components market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan PCB components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan PCB components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)