Japan Personal Hygiene Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034

Japan Personal Hygiene Market Overview:

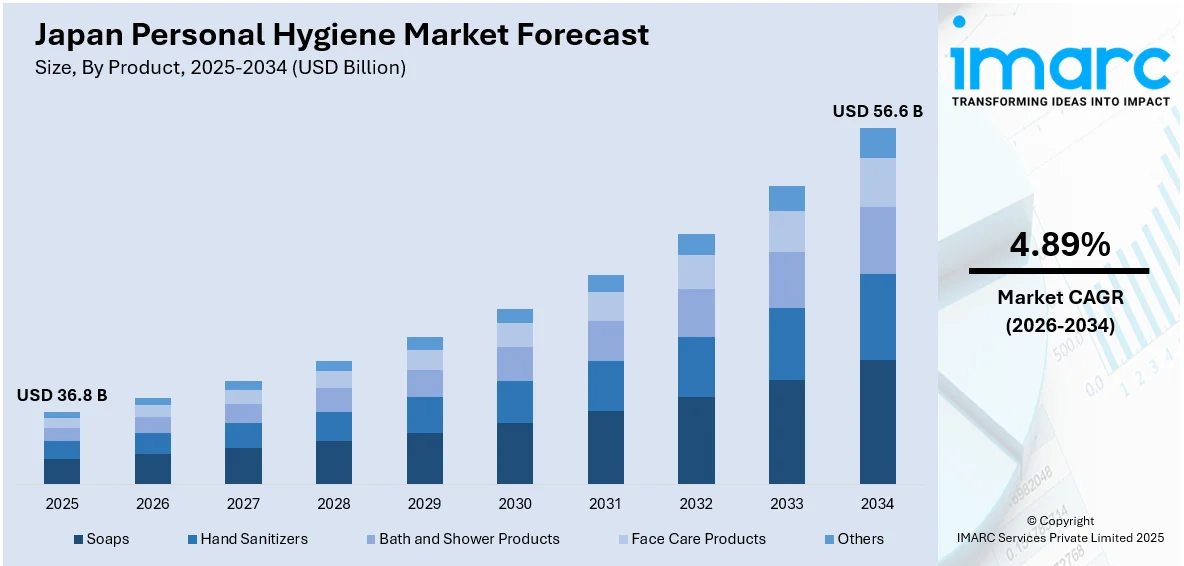

The Japan personal hygiene market size reached USD 36.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 56.6 Billion by 2034, exhibiting a growth rate (CAGR) of 4.89% during 2026-2034. The market is driven by growing consumer preference for natural and organic hygiene products, fueled by health and environmental concerns, along with demand for plant-based alternatives free from synthetic additives. Post-pandemic hygiene consciousness continues to drive sales of antibacterial solutions, while innovations in self-care, including probiotic skincare and touch-free dispensers, cater to changing wellness needs. Additionally, sustainability initiatives and hybrid work lifestyles are further augmenting the Japan personal hygiene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 36.8 Billion |

| Market Forecast in 2034 | USD 56.6 Billion |

| Market Growth Rate 2026-2034 | 4.89% |

Japan Personal Hygiene Market Trends:

Rising Demand for Natural and Organic Personal Hygiene Products

The market is undergoing a notable transition towards natural and organic products, propelled by a growing consumer consciousness regarding health and environmental issues. Shoppers increasingly seek organic components for body care products. As organic demand increases, personal care companies in Japan are likely to follow suit by offering more organic and environmentally friendly options to cater to changing consumer preferences. Japanese consumers are increasingly demanding organic, chemical-free plant-based products, as they avoid synthetic ingredients, parabens, and artificial fragrances commonly found in mass-market hygiene products. Consumers are driving brands to introduce organic soaps, shampoos, and feminine care products made with natural extracts, such as yuzu, green tea, and camellia oil. Eco-friendly features and sustainable sourcing are also gaining traction. With Japan's broader embrace of sustainability, these are the driving forces behind the trend. The momentum for the trend is fueled by younger age groups, particularly millennials and Gen Z, who bring to sustainability why they yearn for transparency in product labels and want to know products' production processes. As a result, retailers are expanding their natural hygiene product lines, and e-commerce platforms are dedicating more shelf space to these items, further propelling the Japan personal hygiene market growth.

To get more information on this market Request Sample

Growth in Antibacterial and Self-Care Hygiene Products Post-Pandemic

In the Japanese personal hygiene market, the COVID-19 pandemic has created an unstoppable momentum that continues to grow. The emphasis on hygiene, however, shall persist beyond the pandemic. To date, sales of hand sanitizers, antibacterial soaps, disinfectant wipes, and other hygiene products have been significantly driven by the pandemic, and customers remain conscious of hygiene for the future. Consumers are also more aware of personal wellness than ever before, and brands are continually introducing new and enhanced products to the market, including probiotic deodorants, pH-balanced intimate washes, and UV-protecting (anti-aging) skincare products. The personal hygiene market is also innovating extended germ protection, such as silver-ion fabrics, and introducing new and enhanced touchless dispensing formats. Furthermore, the rise of hybrid work models has accelerated demand for portable and travel-friendly hygiene solutions. According to a recent survey, 51.2% of workers in Japan reported that their companies allow telecommuting, and 41.5% would like to adopt a hybrid work arrangement where employees work partially from home and partially from the office. As Japan adopts more flexible work patterns, over 60% of professionals are embracing remote work in various formats, a trend that mirrors the growing demand for personal hygiene solutions for home-office environments. This shift presents the personal hygiene sector with the opportunity to develop products, including sanitizers, ergonomic furniture, and housekeeping systems to meet the needs of remote workers. Companies are leveraging advanced formulations and smart packaging to cater to these changing needs. With health consciousness remaining high, the antibacterial and self-care segment is expected to maintain steady growth, supported by both domestic consumption and inbound tourism recovery.

Japan Personal Hygiene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Soaps

- Hand Sanitizers

- Bath and Shower Products

- Face Care Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes soaps, hand sanitizers, bath and shower products, face care products, and others.

Gender Insights:

- Unisex

- Male

- Female

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes unisex, male, and female.

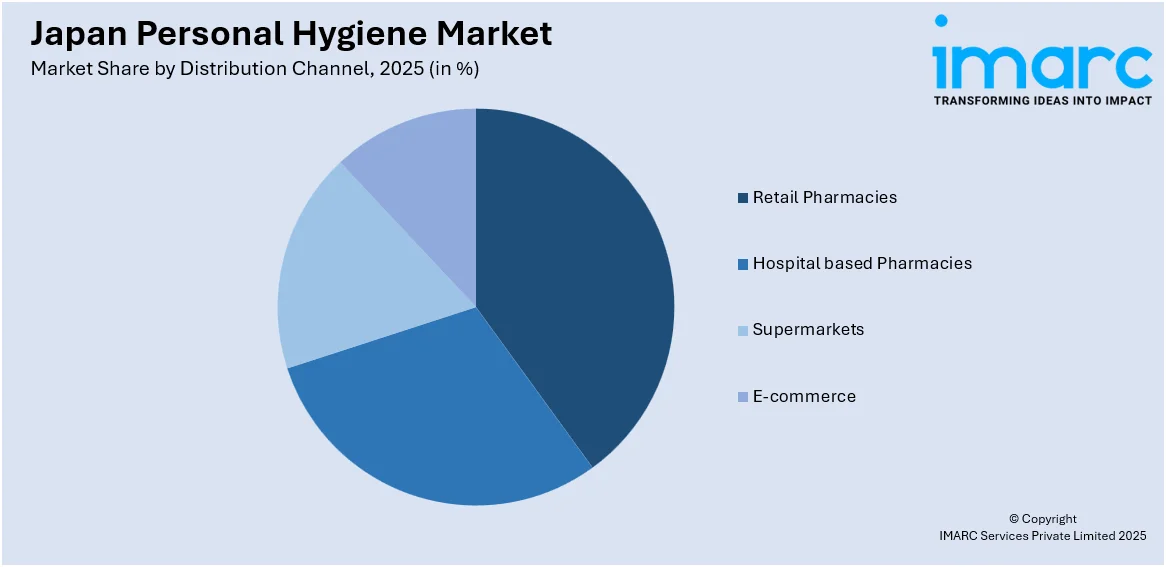

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail Pharmacies

- Hospital based Pharmacies

- Supermarkets

- E-commerce

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies, hospital based pharmacies, supermarkets, and e-commerce.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Personal Hygiene Market News:

- December 09, 2024: Japan's Science Co. unveiled the Mirai Ningen Sentakuk, a cutting-edge human washing machine that utilizes AI-driven, high-pressure water jets and minute air bubbles to clean and dry the body in just 15 minutes. Scheduled to debut at the Osaka Expo 2025, this innovative machine offers a personalized hygiene experience, adjusting wash cycles based on skin type and physical measurements, a revolutionary leap forward for Japan's personal care market. While it is currently still in trials, this sophisticated machine can transform daily hygiene routines, delivering a rapid and efficient solution to busy working individuals in Japan's hectic lifestyle.

Japan Personal Hygiene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Soaps, Hand Sanitizers, Bath and Shower Products, Face Care Products, Others |

| Genders Covered | Unisex, Male, Female |

| Distribution Channels Covered | Retail Pharmacies, Hospital based Pharmacies, Supermarkets, E-commerce |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan personal hygiene market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan personal hygiene market on the basis of product?

- What is the breakup of the Japan personal hygiene market on the basis of gender?

- What is the breakup of the Japan personal hygiene market on the basis of distribution channel?

- What is the breakup of the Japan personal hygiene market on the basis of region?

- What are the various stages in the value chain of the Japan personal hygiene market?

- What are the key driving factors and challenges in the Japan personal hygiene market?

- What is the structure of the Japan personal hygiene market and who are the key players?

- What is the degree of competition in the Japan personal hygiene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan personal hygiene market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan personal hygiene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan personal hygiene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)