Japan Personal Luxury Goods Market Size, Share, Trends and Forecast by Type, Gender, Distribution Channel, and Region, 2026-2034

Japan Personal Luxury Goods Market Overview:

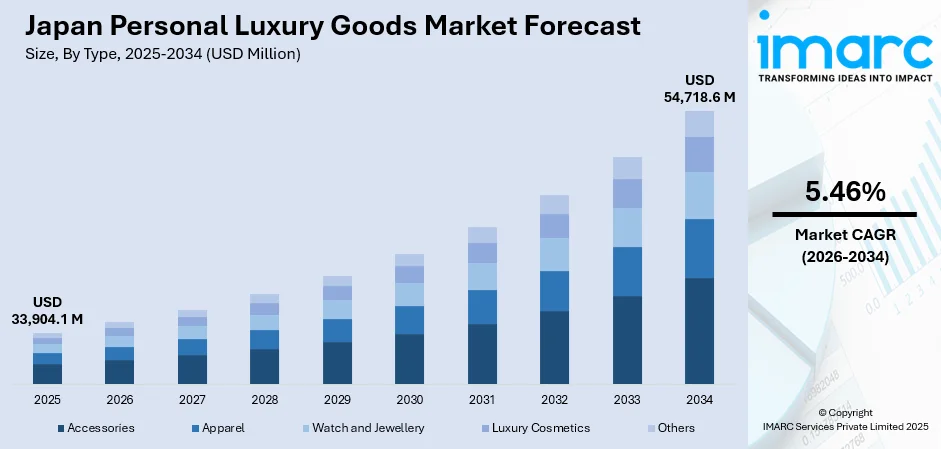

The Japan personal luxury goods market size reached USD 33,904.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 54,718.6 Million by 2034, exhibiting a growth rate (CAGR) of 5.46% during 2026-2034. Japan’s personal luxury goods market is driven by a deep cultural appreciation for craftsmanship and heritage, alongside rapid digital transformation and the rise of e-commerce, which together foster strong demand from both traditional consumers valuing quality and younger, tech-savvy buyers seeking exclusive, immersive brand experiences online and offline.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 33,904.1 Million |

| Market Forecast in 2034 | USD 54,718.6 Million |

| Market Growth Rate 2026-2034 | 5.46% |

Japan Personal Luxury Goods Market Trends:

Cultural Emphasis on Craftsmanship and Quality

Japan's cultural appreciation of craftsmanship frequently defined by the term "monozukuri", is a key driver of demand for individual luxury goods. In Japan, there is a deeply rooted appreciation for higher artistry, precision, and materials, which is highly aligned with luxury brands. Consumers do not merely purchase products due to brand status; they carefully scrutinize the quality, finish, and heritage of each product. Luxury handbags, timepieces, jewellery, and clothing that reflect exemplary craftsmanship are viewed not just as status symbols but investments in art and heritage. This cultural characteristic establishes a distinct climate in which global luxury names such as Hermès, Rolex, and Chanel coexist with Japanese luxury names such as Issey Miyake or Comme des Garçons. As opposed to most markets, which seek trendiness or conspicuous expenditure, the Japanese consumer appreciates timeless values and genuineness. They will pay top dollar for products that will last a couple of decades and can even be handed down as family heirlooms. This behavior supports steady demand during economic downturns because the mindset of luxury products as long-term investments is solid.

To get more information on this market Request Sample

Digital Transformation and E-commerce Expansion

Another key driver is Japan's swift digital revolution permeating the luxury retail market. Traditionally, Japanese consumers were fond of physical shopping experiences, and department stores such as Isetan, Mitsukoshi, and Takashimaya were the go-to locations due to their reputation, level of service, and trustworthiness. Nevertheless, in the last few years, driven forward by the COVID-19 crisis digitalization among brands as well as consumers has picked up pace. Now, luxury retail in Japan is dominated by advanced e-commerce platforms, tailored online experiences, and virtual consultations. Luxury houses have made significant investments in online strategies that are specific to Japan, such as product launches on digital platforms on an exclusive basis, collaborations with local influencers, and virtual flagship stores with engaging features such as AR (Augmented Reality) fitting rooms. Japanese consumers, who are keen on authenticity and detail, have welcomed these advancements. In contrast to mass-market e-commerce, luxury e-commerce sites in Japan focus on digital storytelling, so that brand history, product craftsmanship, and service quality are presented as compellingly online as in a boutique.

Japan Personal Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, gender, and distribution channel.

Type Insights:

- Accessories

- Apparel

- Watch and Jewellery

- Luxury Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes accessories, apparel, watch and jewellery, luxury cosmetics, and others.

Gender Insights:

- Female

- Male

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes female and male.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Mono-brand Stores

- Specialty Stores

- Departmental Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mono-brand stores, specialty stores, departmental stores, online stores, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Personal Luxury Goods Market News:

- February 2025: Japanese contemporary artist Takashi Murakami collaborated with Major League Baseball and Complex to launch an exclusive merchandise collection celebrating the 2025 MLB Tokyo Series between the Dodgers and Cubs. The collection features Nike apparel, New Era caps, Rawlings baseballs, Victus bats, and Topps trading cards adorned with Murakami's iconic artwork. This collaboration underscores the fusion of art and sports, offering fans unique, collectible luxury items that highlight the cultural significance of the event.

- November 2024: Matsuya Ginza launched a new online shopping hub, becoming Japan's first department store to offer global customers a "click and collect" service with tax refunds. The platform features luxury brands like MIU MIU, Prada, and Tom Ford Beauty, allowing shoppers to reserve items online and pick them up in-store. This digital initiative enhances convenience and personalizes the luxury shopping experience for international tourists.

- July 2024: Estée Lauder announced that it would launch Aqua Charge, a personal luxury skincare line developed in Japan. The range includes three products: Medicated Serum Essence, Medicated Milky Cream, and Medicated Treatment Lotion. These products feature the proprietary Self-Hydro Technology, incorporating Rice Power, a fermented rice extract, to enhance skin hydration and elasticity.

Japan Personal Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Accessories, Apparel, Watch and Jewellery, Luxury Cosmetics, Others |

| Genders Covered | Female, Male |

| Distribution Channels Covered | Mono-brand Stores, Specialty Stores, Departmental Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan personal luxury goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan personal luxury goods market on the basis of type?

- What is the breakup of the Japan personal luxury goods market on the basis of gender?

- What is the breakup of the Japan personal luxury goods market on the basis of distribution channel?

- What is the breakup of the Japan personal luxury goods market on the basis of region?

- What are the various stages in the value chain of the Japan personal luxury goods market?

- What are the key driving factors and challenges in the Japan personal luxury goods market?

- What is the structure of the Japan personal luxury goods market and who are the key players?

- What is the degree of competition in the Japan personal luxury goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan personal luxury goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan personal luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan personal luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)